Virtuals Protocol Price’s 105% Rally Could Be Facing A Reversal Soon

VIRTUAL’s 105% surge pushed it to a two-month high, but overbought conditions point to a near-term reversal. Holding above $1.37 is key, while a breakout past $1.54 could extend the rally.

Virtuals Protocol (VIRTUAL) has seen a sharp rally over the past few days, climbing to a two-month high. The token has surged on strong investor demand, doubling in value in less than a week.

While the bullish momentum remains solid, technical indicators suggest that a short-term correction could emerge soon.

Virtuals Protocol Could See Reversal

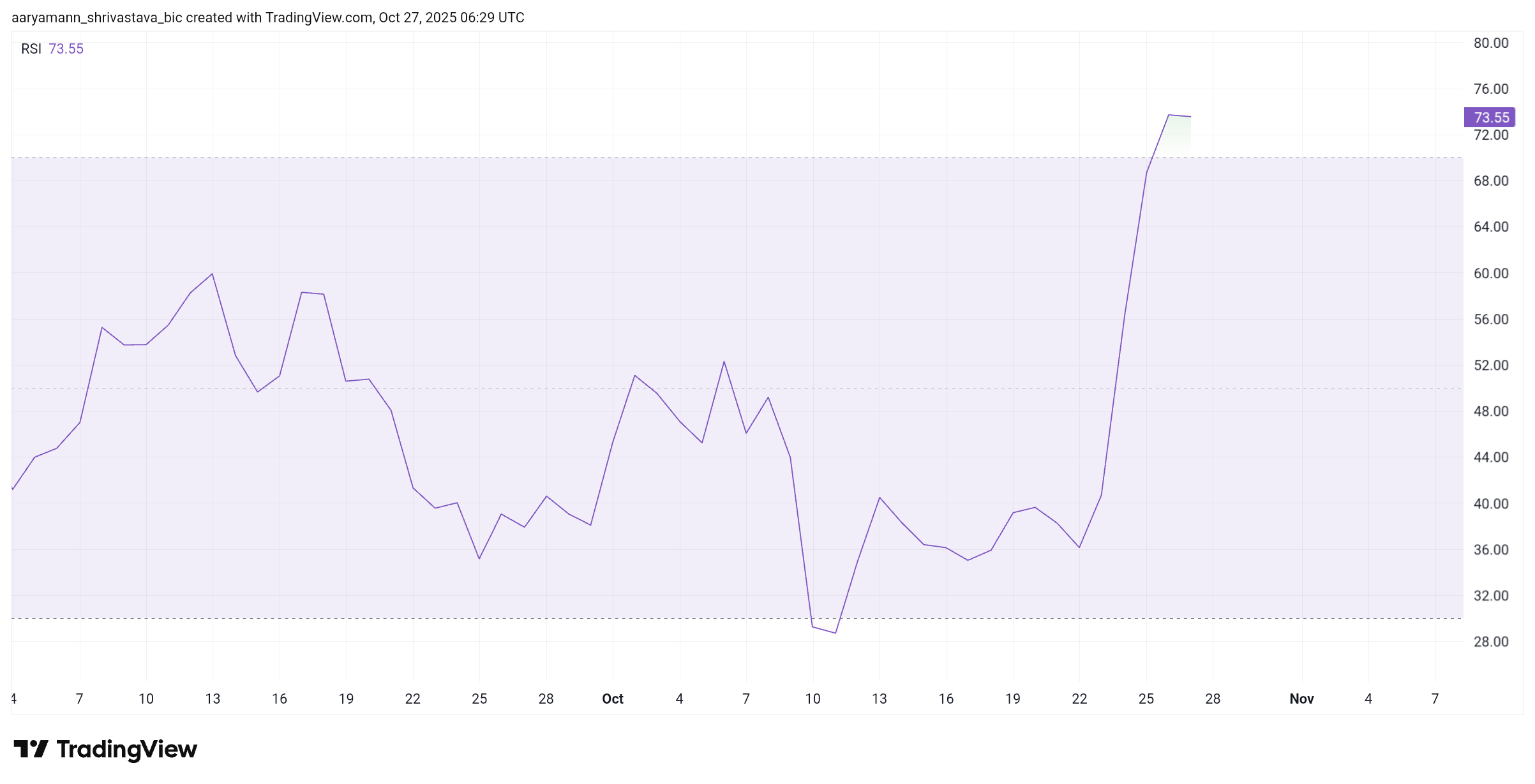

The Relative Strength Index (RSI) currently sits above 70, placing VIRTUAL in the overbought zone. This indicates that profits among holders are peaking, often a precursor to short-term pullbacks. Traders may begin securing gains, especially after such a steep rise, potentially leading to mild selling pressure in the near term.

Historically, when RSI remains extended for long periods, it signals that price momentum has outpaced sustainable growth. If investors start locking in profits, the VIRTUAL price could temporarily stabilize or retrace before resuming its uptrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

VIRTUAL RSI. Source:

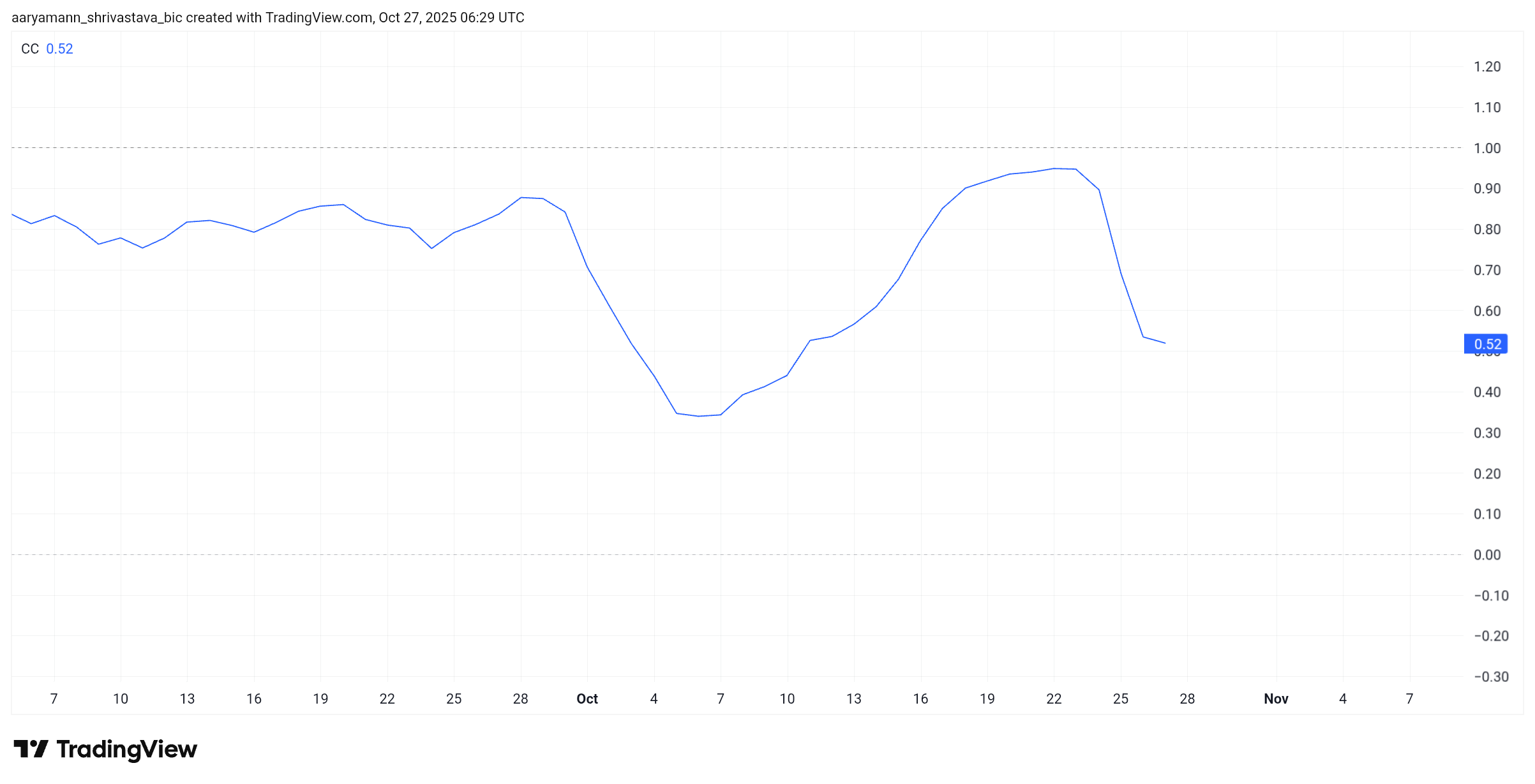

VIRTUAL’s correlation with Bitcoin is currently at 0.52, indicating a moderate relationship between the two assets. However, with Bitcoin recovering toward $115,000, this correlation could work against VIRTUAL if it fails to mirror BTC’s strength.

VIRTUAL RSI. Source:

VIRTUAL’s correlation with Bitcoin is currently at 0.52, indicating a moderate relationship between the two assets. However, with Bitcoin recovering toward $115,000, this correlation could work against VIRTUAL if it fails to mirror BTC’s strength.

If Bitcoin’s momentum remains positive while VIRTUAL lags, traders could rotate capital back into the leading cryptocurrency. This shift would increase selling pressure on the altcoin.

VIRTUAL Correlation To Bitcoin. Source:

VIRTUAL Correlation To Bitcoin. Source:

VIRTUAL Price Jumps

At the time of writing, VIRTUAL trades at $1.50 after a 105% rise in just four days. The token has received notable support from investors. Strong on-chain activity and trading volume continue to support its current valuation.

However, based on market conditions, VIRTUAL could soon face a short-term pullback. If selling pressure intensifies, the token might fall below the $1.37 support level, extending losses toward $1.14 or even lower.

VIRTUAL Price Analysis. Source:

VIRTUAL Price Analysis. Source:

If investors choose to hold their positions, VIRTUAL could maintain its momentum. A sustained rally above $1.54 may push the token toward $1.65 or even $2.00. Breaking this barrier would invalidate the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.

Pi Network Gains Momentum as New Features Energize the Market

In Brief Pi Network shows significant momentum with community revival and AI applications. Increased OTC volumes and key technical indicators support PI's 50% price rise. Liquidity issues and upcoming token unlocks pose potential risks to price stability.

Shiba Inu Struggles to Reach $0.0001 as Market Pressure Mounts

PENGU is on Fire: What’s Fueling the Explosive On-Chain Growth?