Crypto Trader Says NFT Altcoin Primed To Surge More Than 15%, Outlines Path Forward for XRP and Sei

A popular crypto analyst thinks chart patterns suggest one non-fungible token (NFT)-related altcoin is primed to surge in price.

The digital asset trader Ali Martinez tells his 161,200 X followers that PENGU , the native token of the Pudgy Penguins NFT collection, just broke out of a falling wedge pattern.

A falling wedge breakout is a technical analysis pattern that is used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When the price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

Martinez says PENGU could surge to $0.026. With the asset trading at $0.0224 at time of writing, that would represent an increase of more than 16%.

The analyst also notes that “key support is holding” for the decentralized finance (DeFi) layer-1 blockchain Sei ( SEI ).

“If buyers step in, the next targets are $0.31 and $0.44.”

SEI is trading at $0.206 at time of writing.

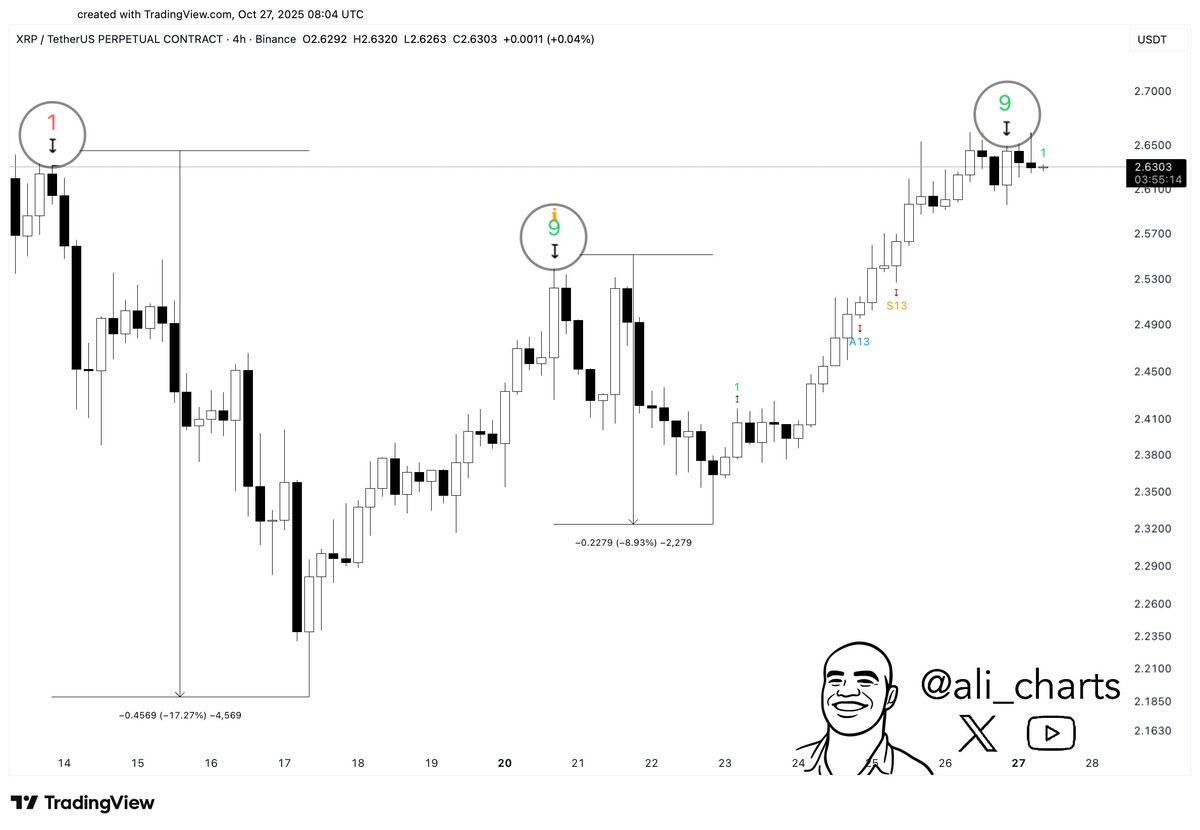

Conversely, Martinez notes that the TD Sequential Indicator, a tool that identifies potential trend exhaustion and price reversal points by counting a sequence of price bars, flashed a sell signal for the payments altcoin XRP .

XRP is trading at $2.68 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces Instability: Yei's Suspension Highlights Underlying Systemic Threats

- Yei Finance paused its Sei-based protocol after a fastUSD market anomaly, citing "unusual conditions" and pledging 24-hour updates. - Stream Finance's $93M loss from XUSD depeg and Yei's fastUSD issues highlight systemic risks in leveraged DeFi models. - DeFi's decentralized governance gaps exposed by rehypothecation risks and opaque fund management, prompting calls for stricter oversight. - Market turbulence underscores need for transparent audits and contingency plans to prevent cascading failures in v

Bitcoin Updates: Major Investors Place $20 Million Wagers on Bitcoin's Short-Term Recovery

- Bitcoin faces critical support at $108,000 as whale accounts open $20M+ leveraged longs, signaling near-term rebound bets. - Technical analysis shows bearish momentum below $110,000 but potential for $114,000+ rally if key support holds. - Aggressive on-chain accumulation by top traders contrasts with FOMC-driven volatility, highlighting macroeconomic uncertainty. - Institutional alignment with current bullish positioning could determine November's outcome amid high-risk market dynamics.

Ethereum Updates: DeFi Faces Widespread Threats as Gauntlet Recommends Urgent Market Suspension

- DeFi firm Gauntlet proposes emergency pause of USDC/USDS/USDT borrowing on Ethereum's Compound v3 to prevent losses from Elixir's deUSD/sdeUSD collapse. - Stream Finance's $93M loss and xUSD's $0.24 plunge exposed systemic risks as Elixir tokens lost 70% value, triggering cross-protocol failures. - Critics warn the pause erodes trust, while Gauntlet stresses updated risk parameters are needed to stabilize artificially inflated oracle prices. - Recent Balancer's $100M exploit highlights compounding DeFi v

Interoperability Becomes a Key Strategic Benefit as Tokenization Evolves

- Tokenization's growth depends on interoperability, enabling seamless cross-chain interactions for institutional and onchain asset scaling. - Chainlink's Runtime Environment (RTE) lets institutions tokenize real-world assets across EVM chains while maintaining compliance and data security. - Bitget integrates Morph Chain to allow direct USDT trading of Layer 2 assets, bridging CeDeFi and enhancing cross-chain liquidity for users. - These advancements highlight interoperability as a strategic advantage, en