SHIB’s Utility Deficit: Shibarium TVL Exposes Structural Flaw

The Shiba Inu (SHIB) token is struggling to recover its price, a failure analysts attribute to fundamental structural challenges rather than simple market volatility. This assessment follows new analyses declaring that SHIB’s goal of reaching the $0.0001 price level is a “dead end road” given the token’s core deficiencies. The Structural Challenge: Supply Overhang vs.

The Shiba Inu (SHIB) token is struggling to recover its price, a failure analysts attribute to fundamental structural challenges rather than simple market volatility.

This assessment follows new analyses declaring that SHIB’s goal of reaching the $0.0001 price level is a “dead end road” given the token’s core deficiencies.

The Structural Challenge: Supply Overhang vs. Delayed Deflation

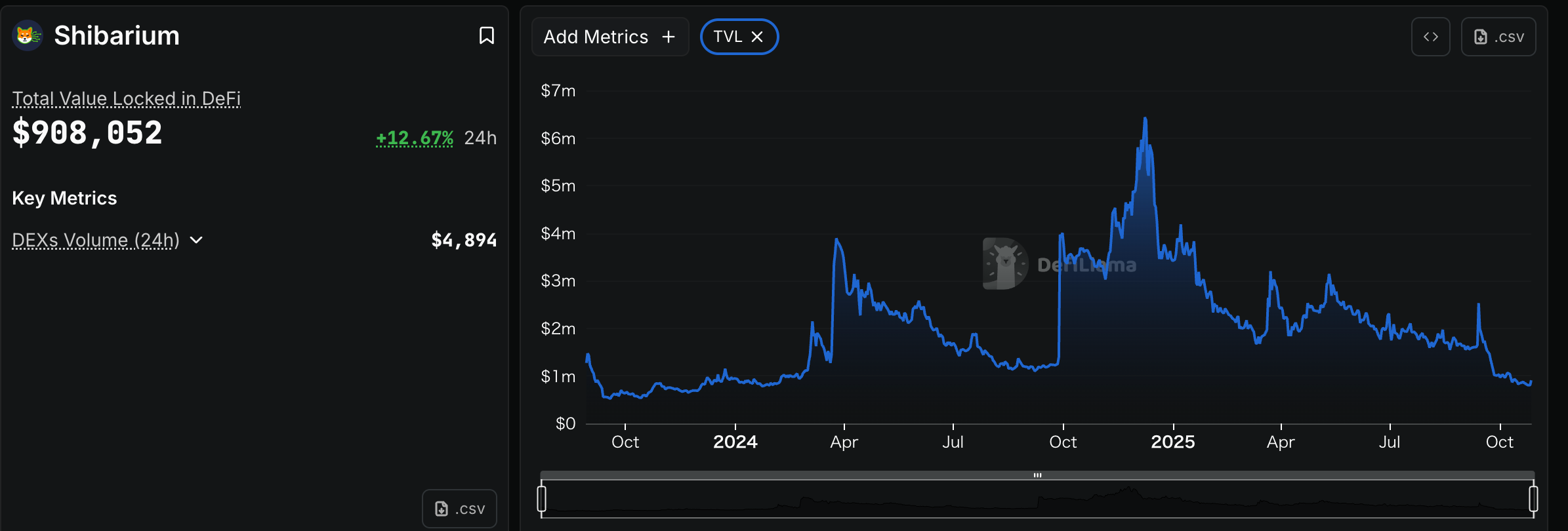

This harsh outlook is underscored by cold on-chain data: the Total Value Locked (TVL) on its layer-2 solution, Shibarium, has fallen and remained consistently below $1 million since early October, exposing a critical lack of ecosystem utility and adoption.

Shibarium TVL Throughout 2025. Source:

Shibarium TVL Throughout 2025. Source:

SHIB faces the core conflict: a mismatch between its massive circulating supply and the slow pace of its deflationary mechanism. SHIB’s ecosystem was designed to utilize its layer-2 network, Shibarium, to burn tokens and reduce the total supply of approximately 589 trillion tokens.

Let’s clear the smoke$SHIB is fully decentralized no one holds the “keys.” Nothing was “destroyed” because no one ever had control to begin with.At launch, half the supply was sent to Vitalik. He burned 410T+ SHIB and donated the rest to charity. The other half was locked in…

— The Dark Shib (@TheDarkShib) October 26, 2025

However, the low TVL on Shibarium continues. This is a fraction of the network’s theoretical potential. Therefore, the token burn rate significantly lags market expectations. This stagnation suggests that development efforts have not translated into meaningful network activity or user adoption.

Given that SHIB’s market capitalization is still in the billions, a TVL below $1 million is a stark indicator that decentralized applications (dApps) and users are not embracing the chain at the scale required.

Analysts interpret this technical failure as the primary structural reason. They increasingly view ambitious price targets like 0.0001 as unrealistic. The sheer scale of the token supply requires a massive, sustained deflationary pressure that the current ecosystem is failing to provide.

The Utility Deficit and Capital Flight to AI/DePIN

A secondary but critical factor that drives SHIB’s struggle is the ongoing rotation of capital within the crypto market. This capital is moving toward sectors that offer tangible utility. As the broader Web3 trend shifts decisively from “meme” to “utility,” SHIB is losing ground to projects that provide real-world value.

In the second half of 2025, capital has favored sectors like AI compute (e.g., Bitfarms’ pivot) and DePIN, projects that generate revenue from data, computation, and enterprise efficiency. These utility-driven tokens offer clear fundamentals beyond speculation.

Conversely, SHIB struggles to shed its “meme coin” image. The lack of TVL confirms that Shibarium has not found a unique, compelling use case. It needs this to attract developers and users away from established Layer-2 networks.

The sustained utility deficit means that whales and savvy money investors opt to divest from SHIB and redirect capital to these higher-growth, utility-focused sectors.

Community Resilience and the Competitive Landscape

Despite the long-term structural issues, community efforts show resilience. Data released yesterday indicates that SHIB token burns surged by over 42,000% in the past 24 hours, leading to a modest price increase to $0.00001062.

HOURLY SHIB UPDATE$SHIB Price: $0.00001062 (1hr 0.13% ▲ | 24hr 4.63% ▲ )Market Cap: $6,253,290,169 (4.61% ▲)Total Supply: 589,247,248,145,084TOKENS BURNTPast 24Hrs: 29,404,116 (42124.85% ▲)Past 7 Days: 54,846,173 (-76.05% ▼)

— Shibburn (@shibburn) October 27, 2025

The capital flight is not limited to utility tokens; it also targets alternative meme projects that promise aggressive tokenomics. One prominent figure noted on X that “the smart ones are rotating to Shib on Base,” citing a 32.6% supply burn and “AI-driven utility” as key drivers.

$Shib on Base Brother! Infinitely deflationary with 32.61% already burned. AI veterinary app releasing soon where 30% of those proceeds also buy and burn tokens. is the real deal. They also just had an AMA with that was very informative. Don’t…

— Keneezie (@CryptoKeneezie) October 26, 2025

This active competition highlights that investors now actively seek faster burn mechanisms and verifiable utility. This forces the original SHIB project to compete with AI tokens and newer, more aggressive meme coin models.

For SHIB to maintain relevance and pursue price recovery, its team must urgently demonstrate measurable and innovative utility. This requires more than just community hype. Instead, it demands attracting significant liquidity and developer engagement to Shibarium. This action ultimately proves that the token functions as a critical piece of Web3 infrastructure

The recovery of Shibarium’s TVL is the necessary first signal that SHIB can break free from its structural constraints.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins: The Foundation for a Decentralized Financial Tomorrow

- Stablecoins are driving DeFi growth, projected to support $2 trillion in tokenized assets by 2028, with $1.5 trillion in tokenized funds and equities expected. - Stripe and Paradigm’s Tempo blockchain, handling 100,000 transactions/second, aims to streamline cross-border payments and integrate on-chain/off-chain systems. - Regulatory challenges around AML compliance and digital dollarization risks persist, but stablecoins are reshaping global finance by reducing costs and expanding inclusion. - Fintechs

Hyperliquid News Update: With HYPE Stumbling, Major Investor Profits Spark Concerns Over Insider Trading

- Hyperliquid whale amasses $3.6M HYPE gains via 5x leverage, with trades aligning suspiciously to major crypto announcements. - Holds $8.22M XPL (10x leverage) and $500K PURR despite 70% losses, raising questions about non-public information use. - HYPE struggles above $50 resistance amid bearish indicators, with $22M long positions at risk if price dips to $46. - Aggressive accumulation contrasts with declining Hyperliquid fees and regulatory scrutiny following MEXC's $3.15M fund freeze case.

BlockDAG's community-focused, institution-level approach emerges as the leading crypto model for 2025

- BlockDAG (BDAG) emerges as a top 2025 crypto contender with a $435M presale and alleged Coinbase/Kraken partnerships, signaling institutional confidence. - Its hybrid DAG + PoW architecture (15,000 TPS) and community-driven model differentiate it from speculative assets like Pudgy Penguins (PENGU) and Near Protocol (NEAR). - PENGU and NEAR face bearish trends and volatility, highlighting risks for projects reliant on VC funding or speculative demand. - BDAG's retail-focused presale (312K holders) and tra