Venezuela is deepening its reliance on stablecoins amid a fresh war threat, continuing U.S. sanctions, and triple-digit bolívar inflation.

Earlier this week, the U.S. Department of Defense moved its most advanced aircraft carrier to the Caribbean near Venezuela, after Donald Trump signaled potential strikes against drug cartels.

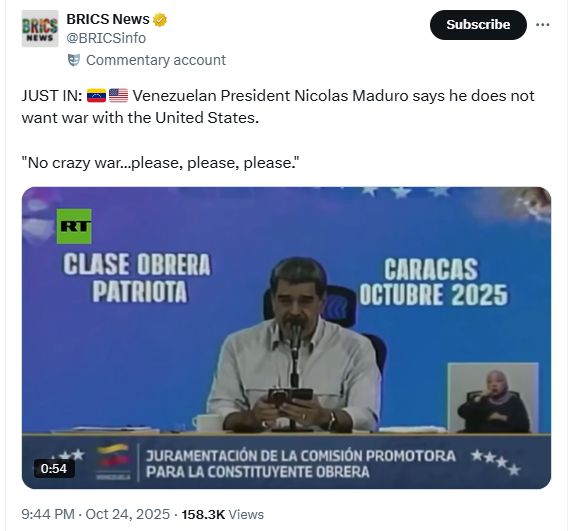

Nicolás Maduro rejected the claims and urged Washington to avoid war. Meanwhile, The New York Times reported efforts to “rewire Venezuela’s economy to stablecoins,” and Chainalysis estimated $44.6 billion in crypto value received from July 2024 to June 2025, ranking the country fourth in LATAM.

Nicolás Maduro addressing Venezuelan workers in Caracas. Source: BRICS News (@BRICSinfo) via RT broadcast

Nicolás Maduro addressing Venezuelan workers in Caracas. Source: BRICS News (@BRICSinfo) via RT broadcast

Stablecoins in Venezuela: everyday payments, USDT savings, and “Binance dollars”

Across cities and towns, stablecoins appear at grocery counters, clinics, and small shops. People use USDT to keep purchasing power as the bolívar weakens. Merchants accept tokens because settlement is quick and simple to verify.

Households also park short-term savings in USDT. They aim to reduce day-to-day losses from inflation.

Therefore, small buffers in tokens help families cover rent and essentials between paychecks.

Locals often call these tokens “Binance dollars.” The phrase reflects platform familiarity, not a technical standard. Still, the term shows how stablecoins entered casual speech and daily budgeting.

War threats and sanctions: why USDT demand persists in Venezuela

Heightened war rhetoric adds pressure to fragile household finances. The nearby aircraft carrier deployment raised uncertainty, so residents favored assets mirroring the U.S. dollar. USDT provided that peg without relying on domestic banks.

Sanctions continue to restrict traditional rails. As a result, stablecoins bridge basic transfers, bill splits, and payroll top-ups. People value speed and finality that work across borders and time zones.

Merchants emphasize practicality over theory. They confirm funds on the spot and restock inventory faster. The bolívar’s daily slippage makes predictable settlement more important than small token moves.

Government finances and oil trade: stablecoin rails and Russia partnership

Authorities also use stablecoins in state transactions. Reporting indicates oil trades with allies, including Russia, route through crypto rails.

On Monday, Venezuela formalized a strategic partnership with Russia, underscoring that alignment.

The New York Times described a shift to tokenized dollars for public flows. It reported that stablecoins “now account for up to half of the hard currency that enters the Venezuelan economy legally.” The characterization points to a structural change in settlement.

Therefore, public finances increasingly bypass correspondent banks. Wallets and exchanges handle flows once processed by slower channels. Sanctions shaped these choices more than preference did.

LATAM crypto adoption: Chainalysis ranks Venezuela fourth at $44.6 billion

The scale shows in the numbers. Chainalysis estimated $44.6 billion in crypto value received between July 2024 and June 2025. That placed Venezuela fourth in Latin America, behind Brazil, Argentina, and Mexico.

This rank reflects retail usage and institutional flows. It also mirrors how stablecoins spread where inflation and controls persist. People adopt what keeps pace with prices and settles quickly.

Moreover, remittances shifted toward tokens that avoid delays and rate disputes. Families found USDT reliable for budgeting. That consistency mattered as wages lagged costs.

Bitcoin for protection: María Corina Machado and BTC self-custody

Prominent figures also turn to crypto for asset safety. María Corina Machado, a former presidential candidate, holds Bitcoin (BTC) to prevent seizures, according to local reporting. Self-custody removes exposure to domestic account freezes.

Earlier this month, she received the Nobel Peace Prize for work to restore democracy and maintain non-violent resistance.

The award drew attention to protective uses of BTC. It also highlighted the difference between daily USDT use and long-term holdings.

Her approach underscores a simple split. Citizens often spend in USDT, while high-profile users may store wealth in BTC. Both flows operate outside traditional banking.

Migration and remittances: 8 million Venezuelans and a stablecoin lifeline

Since 2013, nearly 8 million Venezuelans have left the country. Many lost access to home-bank accounts after moving. Stablecoins enabled cross-border transfers when legacy rails stalled.

Families use USDT for rent, groceries, and tuition. Senders convert wages into tokens and deliver funds in minutes. Recipients cash out or spend directly where merchants accept wallets.

Therefore, stablecoins became a daily tool, not a niche instrument. They also created a shared unit of account across borders. That common denominator reduced friction in scattered households.

Retail practice and language: how “Binance dollars” entered Venezuela’s checkout flow

People adopted simple language for complex rails. “Binance dollars” became shorthand for dollar-pegged tokens in daily trade. The term stuck because it maps to an app many already use.

Merchants post prices in dollars and settle in USDT on request. They calculate token amounts at checkout and confirm receipt instantly. The process spread through word of mouth, not formal training.

Service providers followed retail. Clinics, mechanics, and drivers quoted in dollars and accepted USDT. The workflow matched how customers already saved and spent.

State alignment and settlement: oil, Russia, and the stablecoin route

The government’s oil dealings with Russia illustrate settlement under sanctions. Crypto rails connect counterparties when banks hesitate or delay. Stablecoins compress timelines and raise transparency on balances.

Officials formalized the partnership with Russia this week. That step appeared alongside reports on tokenized public flows. Together, they described an operating model built for constraints.

Settlement in stablecoins does not remove macro risk. However, it reduces friction where older paths closed. Consequently, USDT use in Venezuela remains broad across retail and state channels.

Editor at Kriptoworld

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 28, 2025 • 🕓 Last updated: October 28, 2025