Top 3 Highest Gaining Small-Cap Tokens in the x402 Ecosystem This Week

The x402 ecosystem’s explosive growth pushes its market cap above $800 million, driven by massive rallies in AIN, PAYAI, and AURA—three AI-focused small caps capturing traders’ attention with triple- and quadruple-digit gains.

x402, an internet-native payment standard designed for artificial (AI) agents, has gained major traction across the crypto ecosystem and emerged as one of the most talked-about innovations in the space.

It’s not just attention. The ecosystem’s market capitalization has also surged past $800 million. As momentum continues to build, three small-cap tokens have benefited the most, standing out as the top weekly gainers within the x402 ecosystem.

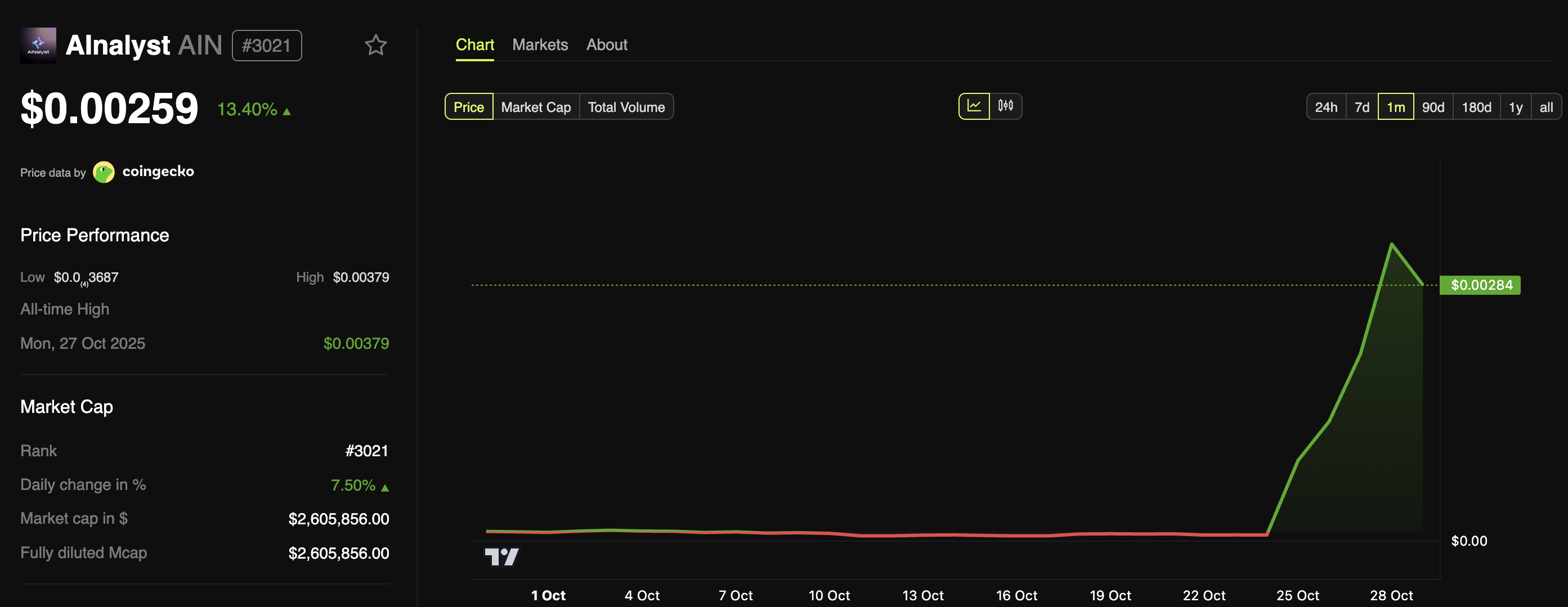

1. AInalyst (AIN)

AInalyst is an AI-driven Web3 analytics platform. It fuses on-chain metrics, social sentiment, and behavioral data to deliver real-time insights for traders and agents.

The project is currently the top agent on x402 and the highest weekly gainer among the ecosystem’s tokens. The altcoin has soared by more than 3,800% this week, reaching a new all-time high yesterday.

AInalyst (AIN) Price Performance. Source:

BeInCrypto Markets

AInalyst (AIN) Price Performance. Source:

BeInCrypto Markets

At the time of writing, AIN traded at $0.00259, up 13.4% in the last 24 hours. Its market cap stands at $2.6 million. Notably, the token recently gained a listing on Binance Wallet, broadening access for new users.

“You can now trade AIN directly on Binance Wallet and find it listed under the x402 category. Real data. Real utility,” the team posted.

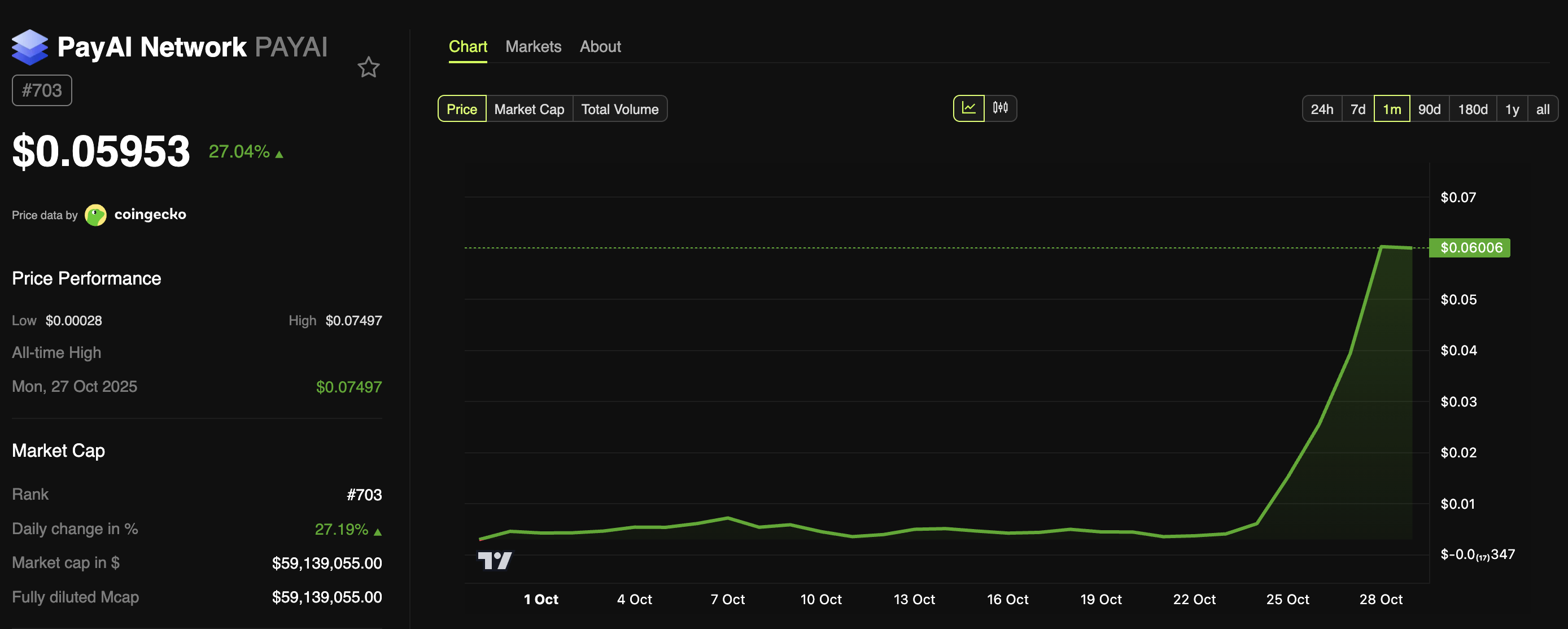

2. PayAI Network (PAYAI)

PayAI Network is an open-source marketplace where AI agents hire, contract, and operate 24/7 autonomously. The network accounts for about 14% of x402’s volume.

With a market capitalization of $59.1 million, PayAI is the third-largest token in the x402 ecosystem. Over the past week, the token jumped over 1,500%, hitting a record high before settling at $0.059. This represented a 27% daily gain.

PayAI Network (PAYAI) Price Performance. Source:

BeInCrypto Markets

PayAI Network (PAYAI) Price Performance. Source:

BeInCrypto Markets

Market analysts suggest the project could soon achieve a $100 million valuation if the current momentum continues.

“PAYAI is dominating on Solana. 100 million is not so far, we will easily break it before the end of this week,” analyst Alex forecasted.

Meanwhile, PayAI’s growth has been accompanied by several notable developments. Crypto exchanges Poloniex and Ju.com announced that they will add trading support for PAYAI today, boosting liquidity and exposure.

At the same time, the network launched an airdrop campaign to reward early supporters and active users, allocating 1 million PAYAI tokens for distribution. This development has further fueled community engagement.

Nonetheless, Talentre DEX’s tool has flagged abnormal capital inflows into PAYAI, raising concerns.

“Our tool detected an unusual inflow into PAYAI and it’s flagged not by wash trading but by real wallets with positive ROI. Once those wallets start selling, it’s time to exit the trade. We warned you!” Talentre posted.

3. Aurra by Virtuals (AURA)

Aurra by Virtuals rounds out this week’s top three. The platform provides AI agent tooling and hosting designed for crypto applications. It enables seamless deployment and monetization of AI agents with zero coding required.

Aurra’s token, AURA, has gained 988.2% over the past week, reaching $0.0078 at press time.

According to data from BeInCrypto Markets, its market capitalization is $7.8 million. The token is also listed on LBank and WEEX, expanding accessibility for traders.

Aurra by Virtuals (AURA) Price Performance. Source:

BeInCrypto Markets

Aurra by Virtuals (AURA) Price Performance. Source:

BeInCrypto Markets

The fast-paced gains of AIN, PAYAI, and AURA reflect both opportunities and risks tied to new technology trends. While exchange listings, airdrops, and broader market participation support the sector’s expansion, volatility could increase if profit-taking accelerates or protocol weaknesses appear.

Future results for x402 small caps hinge on continued development, deeper integrations, and the capacity of AI-powered payments to achieve real-world efficiency. The coming weeks will reveal whether today’s rally signals the start of a long-term trend or another fading meta in the crypto space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tron Network Sees Record Transaction Surge as Retail Adoption Soars

Uniswap Latest Updates: Large Investors and DeFi Movements Drive UNI Closer to $22 Surge

- Uniswap (UNI) faces potential $22 surge by 2025 as technical indicators and whale activity signal bullish momentum. - DeFi's $32B tokenized RWA growth and institutional adoption reinforce UNI's role in bridging TradFi and decentralized ecosystems. - Protocol upgrades like Uniswap V4 and whale-driven liquidity accumulation strengthen its market leadership amid evolving DeFi infrastructure. - Regulatory clarity and Ethereum scalability improvements could further boost UNI's long-term adoption, though compe

Dogecoin News Today: Dogecoin's Recent Decline: Is This a Prolonged Bear Market or the Foundation for a Future Rally?

- Dogecoin faces short-term sell-off as large holders offload 440 million tokens, pushing price to $0.19 with 6% weekly decline. - Whale activity shows $26.8 million moved to exchanges, while technical indicators signal breakdown below key support levels. - Despite bearish trends, historical patterns suggest potential for third bull cycle with unconfirmed $5-$7 price targets. - Upcoming Dogecoin Treasury listing could attract institutional investors, though timing overlaps with recent distribution pressure

Bitcoin Updates: Worldwide Regulatory Battles Intensify Amid Crypto Boom

- Global regulators intensify scrutiny of crypto as stablecoins reshape financial frameworks, prompting regulatory adjustments in Japan, France, and the U.S. - Japan's FSA proposes allowing banks to hold crypto for investment, aiming to position the country as a crypto-friendly hub amid rising onchain activity. - France rejects ECB's digital euro plan, pushing for Bitcoin reserves and relaxed capital rules to counter 1,250% buffers on crypto-collateralized loans. - U.S. sees USDC outpace USDT as Visa expan