Key Market Insights for October 28th, How Much Did You Miss?

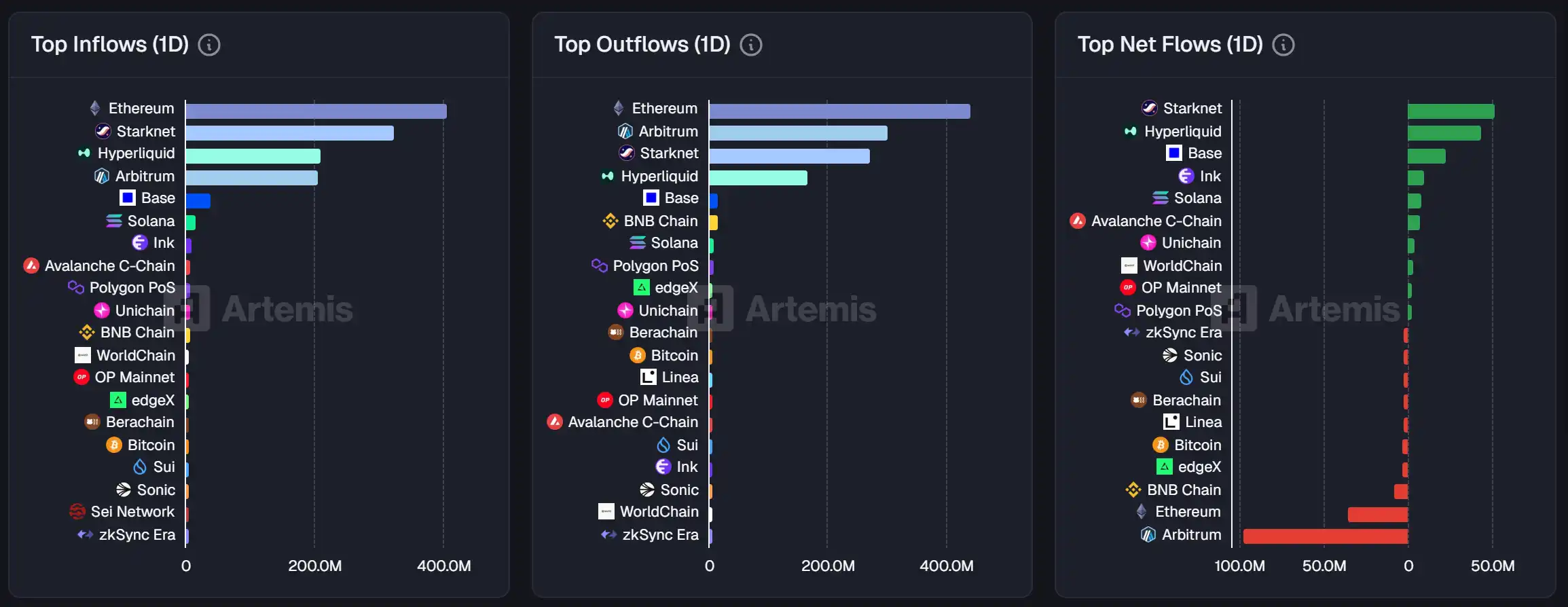

1. On-chain Funds: $146.2M USD inflow to Starknet today; $132.7M USD outflow from Arbitrum 2. Largest Price Swings: $ANYONE, $COMMON 3. Top News: The MegaETH public sale has raised $530M USD to date, with 18,590 participating addresses

精选要闻

1、MegaETH 公售目前已募集 5.3 亿美元,参与地址数达 18,590

2、比特币今年 10 月回报率暂报 0.39%,此前历史平均回报率为 21.89%

3、部分 Solana 生态 meme 币今日涨幅明显,CHILLHOUSE 单日涨超 130%

4、受上线 Upbit 影响,KERNEL 短时拉升超 50%

5、Binance Alpha 将于 10 月 29 日上线 BitcoinOS(BOS)

精选文章

1.《为什么 x402 协议没有昙花一现?》

自 x402 协议因 meme 币 $PING 的爆火点燃市场热情,已经快要过去了一周的时间。目前为止,绝大部分的市场观点是正向的,既有对 x402 协议未来发展的乐观展望,也有对各类项目的细分讨论。但也会有一些声音认为,x402 的爆火太快,有可能无法在短期内承载过热的市场期望,出现后继乏力的情况。那么,在这将近一周的时间里,x402 协议生态发生了哪些变化呢?在一起回顾并分析完接近一周时间内 x402 生态的变化后,我们可以对文章标题的内容给出一个回答。

2.《MSTR 被评 B 级,DAT 公司还值得了解和投资吗?》

DAT 模式连接的是风险,也可能是未来。它代表了一种介于加密与资本市场之间的中间地带——既不完全属于「币圈」,也不完全属于「股市」。Strategy 被评为「垃圾」,但某种意义上,这是数字资产财库第一次获得被评级的资格。未来,传统评级机构如何量化比特币风险、投资者如何看待「加密版伯克希尔·哈撒韦」,将决定 DAT 能否从投机叙事走向金融结构的一部分。

链上数据

10 月 28 日上周链上资金流动情况

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Trump's Wallet Acquires Valor Token—Is This an Endorsement or a Tactical Move?

- Trump's crypto wallet adds 27.37M VALOR tokens, second-largest holding after 800M TRUMP tokens, signaling strategic portfolio shift. - Solana's 6% price drop and institutional selling contrast with Bitwise's $69M inflow into first U.S. Solana ETF, highlighting market volatility. - Trump's TRUMP token integration into debit cards and real estate projects underscores crypto's role in his political branding and financial strategy. - Mixed reactions to VALOR's inclusion question whether tokens were team-tran

SUI News Today: SUI Maintains Steady FFO Growth Amid Unlock Challenges as Market Fluctuations Approach

- Sun Communities (SUI) reported Q3 2025 core FFO of $2.28/share, exceeding guidance, driven by 5.4% NOI growth and 98% occupancy. - Raised 2025 FFO guidance to $6.59–$6.67/share, supported by 3.6x net debt/EBITDA leverage and $500M in stock repurchases at $125.74/share. - Evercore upgraded SUI to "Outperform" with $141 PT, citing strong capital structure, while institutional investments like Econ Financial's $286K stake signal growing confidence. - Upcoming $103M token unlock and 5.1% monthly stock declin

Shutdown Slows Data Releases, Obscuring Fed’s December Rate Decision

- Fed Chair Powell warns December rate cut is "challenging" due to economic uncertainties and delayed data from the government shutdown. - Markets expect a 90% chance of a 25-basis-point cut, but analysts highlight risks from prolonged shutdowns and volatile economic conditions. - Trump's shortlisted Fed chair replacements add political uncertainty, complicating the central bank's policy trajectory amid shifting economic signals. - The four-week shutdown has caused $15-30 billion weekly losses, raising fea

Fed Policy Divide: Logan Opposes Rate Reductions, Emphasizes the Importance of Curbing Inflation

- Dallas Fed President Lorie Logan opposes recent rate cuts, arguing economic conditions don't justify reductions despite the Fed's 3.75%-4.00% policy rate cut. - She highlights a "broadly in equilibrium" labor market and persistently high inflation above 2%, warning preemptive cuts risk undermining inflation control efforts. - Logan advocates patience for inflation progress, contrasting with Chair Powell's caution against labor market slowdowns, reflecting a broader Fed policy divide. - She supports endin