S&P 500 and Bitcoin fell today following Powell's remarks; markets await meeting between Trump and Xi.

- Fed cuts interest rates, but Powell's speech sends the S&P 500 tumbling.

- Bitcoin falls to $109 after Fed statements.

- Investors are awaiting a meeting between Trump and Xi Jinping.

U.S. stocks reversed gains on Wednesday after the Federal Reserve announced its second interest rate cut of the year. The market move came after Fed Chairman Jerome Powell... to indicate that a new cut in December is "far from" guaranteed., which dampened investor optimism.

The S&P 500 retreated below flat, while the Nasdaq Composite, driven by technology companies, held a slight gain of 0,2%. The Dow Jones fell by the same amount. The central bank cut its benchmark interest rate by 0,25 percentage points, but Powell avoided signaling a clear path for future reductions, reinforcing the Fed's cautious stance.

In the cryptocurrency market, Bitcoin (BTC) reacted negatively to Powell's speech, falling from $111 to around $109.200 in the following hours, accumulating a loss of almost 4% for the day. By late afternoon, the leading cryptocurrency was attempting to stabilize near $110.50, with a moderate drop of 3%.

Among individual stocks, Nvidia gained renewed prominence after US President Donald Trump stated that he might mention the company's Blackwell artificial intelligence chips during his highly anticipated meeting with Chinese President Xi Jinping. This statement generated expectations of a possible easing of restrictions impacting the manufacturer's sales in the Chinese market.

Investors are now turning their attention to the summit between Trump and Xi, scheduled for Thursday in South Korea. The meeting could define progress on a possible trade agreement between the world's two largest economies, including issues such as tariffs, semiconductor exports, and trade in rare earth elements.

According to Treasury Secretary Scott Bessent, China is expected to postpone export controls on rare earth elements for a year, while the United States may reduce tariffs on sensitive products. Trump also mentioned the possibility of lowering tariffs on fentanyl, stating: "I hope to lower them because I believe they will help us with the fentanyl situation. They will do what they can."

The market is closely watching the negotiations, which may also include progress on the TikTok deal and adjustments to technology restrictions, factors that directly influence the performance of the S&P 500, Bitcoin, and cryptocurrencies in general.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jensen Huang's fried chicken meal sends Korean "chicken stocks" soaring

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

Will Solana's latest slogan ignite a financial revolution?

Solana is actively transforming "blockchain technology" into foundational infrastructure, emphasizing its financial attributes and capacity to support institutional applications.

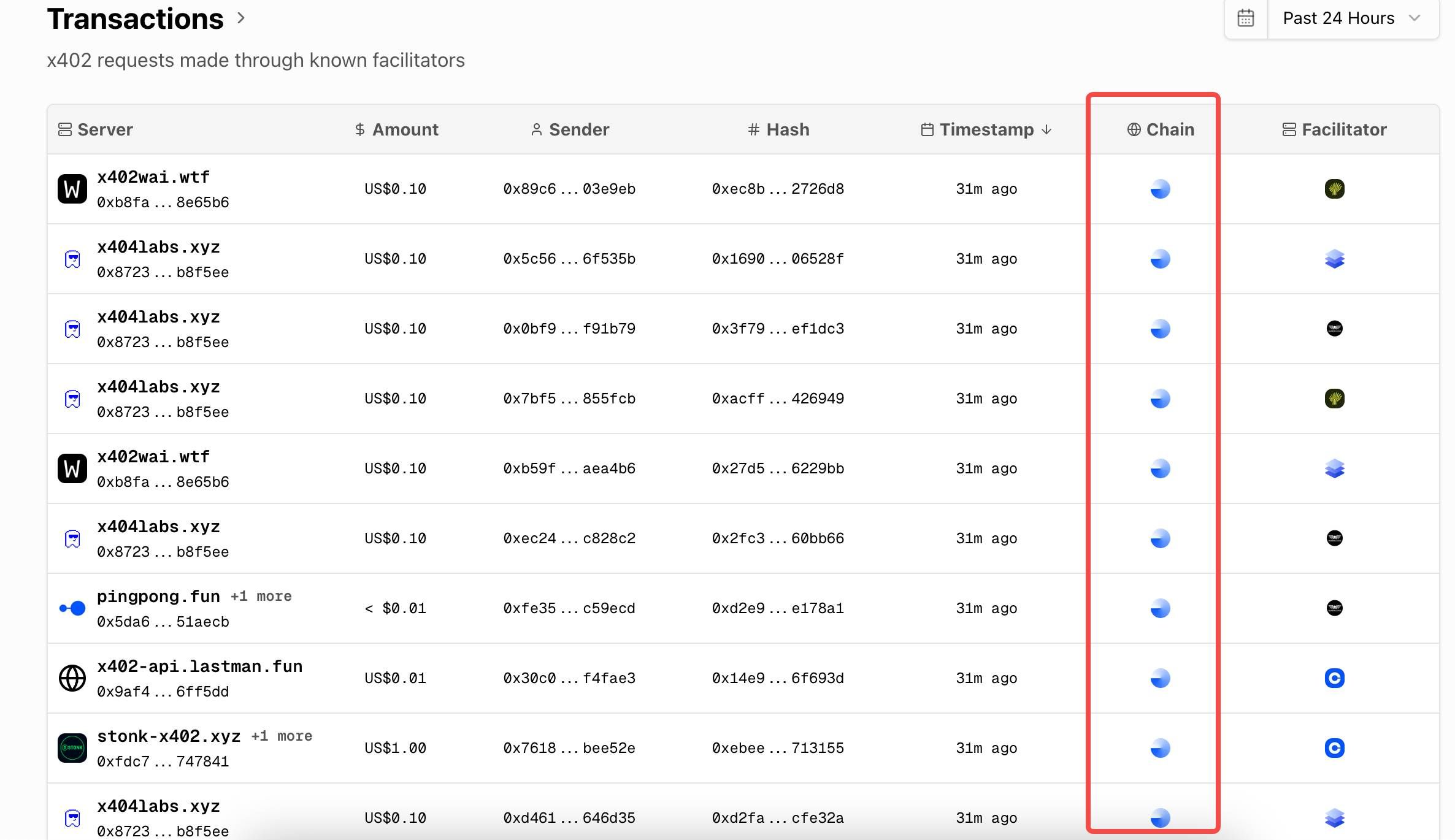

Where are the asset opportunities on BSC and Solana while x402 is booming on BASE?

We have reviewed the BNB Chain and Solana-related x402 projects currently on the market to help everyone better identify assets in this narrative cycle.

Sun Wukong's capital exceeds 100 millions! Innovative gameplay leads DEX resurgence, poised to become the new gateway for decentralized trading

The assets on the Sun Wukong platform have exceeded 100 millions. With its innovative user experience and ecosystem synergy, it is leading a new era of decentralized contract trading. Experts predict that the future will be characterized by the coexistence of DeFi and CeFi, but with decentralization taking the lead.