Ethereum LTH Selling In October Hits 3-Month High — What’s Next for Price?

Ethereum’s long-term holders offloaded major positions in October, triggering selling pressure and stalling price growth as ETH hovers near $4,000 awaiting a breakout signal.

Ethereum closed October with limited price growth as long-term holders (LTHs) significantly reduced their positions, triggering bearish pressure across the market.

As November begins, the market awaits signs of renewed confidence among ETH holders.

Ethereum Holders Show Skepticism

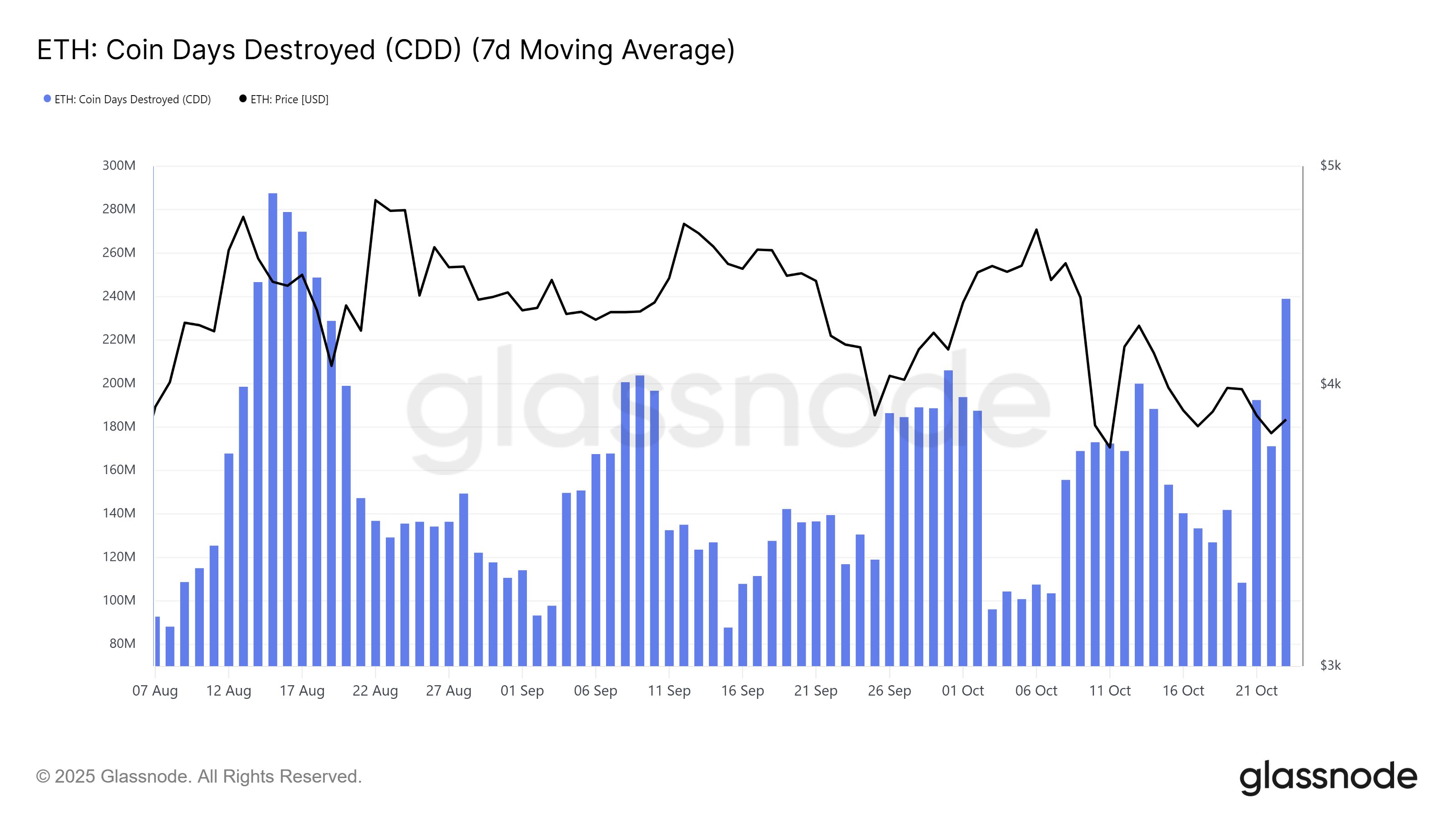

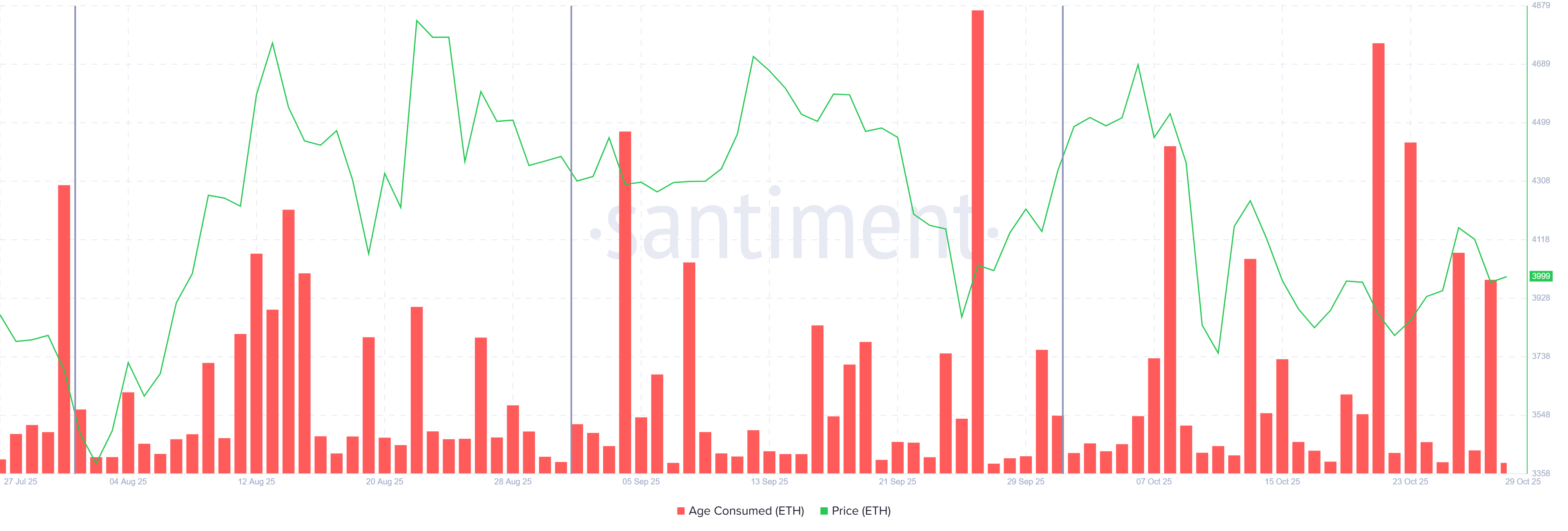

The Age Consumed metric reveals that October witnessed Ethereum’s largest wave of long-term holder activity since July. Spikes in the metric indicate that older coins were moved or sold, often signaling increased selling pressure from experienced investors. The cumulative activity in October far exceeded that of the prior two months, highlighting a notable lack of conviction among LTHs.

This sharp rise in selling reflects growing uncertainty over Ethereum’s near-term performance. Many holders appear to have taken profits amid stagnant price action, likely contributing to the lack of upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum CDD. Source:

Glassnode

Ethereum CDD. Source:

Glassnode

On-chain data shows that Ethereum’s network activity followed a similar pattern. The number of new addresses grew steadily through most of October but dipped sharply during the final week.

This decline suggests that investor interest weakened as prices failed to move decisively higher, highlighting short-term market fatigue. However, this slowdown may prove temporary. If new addresses and network participation rebound in November, Ethereum could see renewed inflows of liquidity.

Ethereum Age Consumed. Source:

Santiment

Ethereum Age Consumed. Source:

Santiment

ETH Price Needs Investor Support

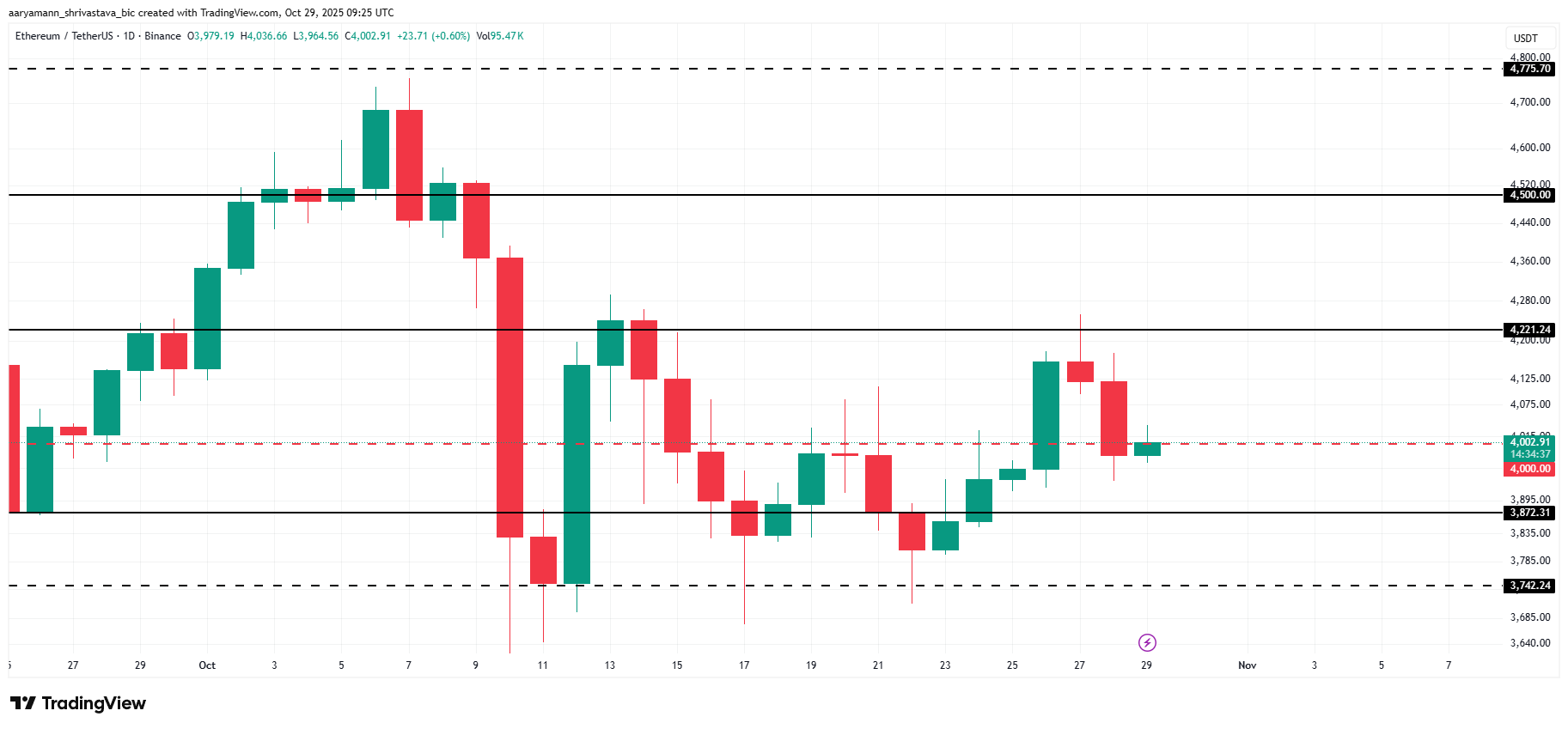

At press time, Ethereum price is at $4,002, maintaining a narrow range around the psychological $4,000 level for nearly three weeks. The inability to reclaim higher levels highlights the impact of ongoing selling and weak investor confidence.

In the near term, ETH could attempt to test the $4,221 resistance level. Yet, without stronger market conditions, it may remain confined between that resistance and the $3,742 support.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Should the broader environment improve, Ethereum could break above $4,221 and target $4,500. A sustained rally toward $4,956—its previous all-time high—would invalidate the bearish outlook and restore market optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From the Grey Area to the Mainstream Track? The Legalization Battle and Future Landscape of Sports Prediction Markets

Prediction market platforms Kalshi and Polymarket are rapidly expanding in the sports sector and have reached a partnership with the NHL. However, they face skepticism from leagues such as the NBA and NFL, as well as strong opposition from the gambling industry, while also becoming embroiled in regulatory and legal disputes. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

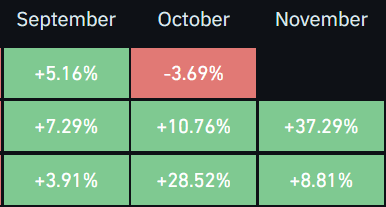

Crypto Market Performance: Why November Could Become the Next Key Month

The crypto market has turned bullish again. Here’s why November 2025 could be another strong month for bitcoin and other cryptocurrencies.

Vitalik Buterin Praises ZKsync’s Atlas Upgrade for Ethereum Scaling

Quick Take Summary is AI generated, newsroom reviewed. Vitalik Buterin praised ZKsync's Atlas upgrade as "underrated and valuable" for Ethereum scaling. The upgrade is cited to enable over 15,000 TPS, one-second finality, and near-zero transaction fees. Atlas fundamentally changes L2s' relationship with L1 by using Ethereum as a real-time, shared liquidity hub. This innovation strengthens Ethereum's backbone for institutional use cases like Real-World Assets (RWA).References ZKsync has been doing a lot of

Bitcoin starts $100K ‘capitulation’ as BTC price metric sees big volatility