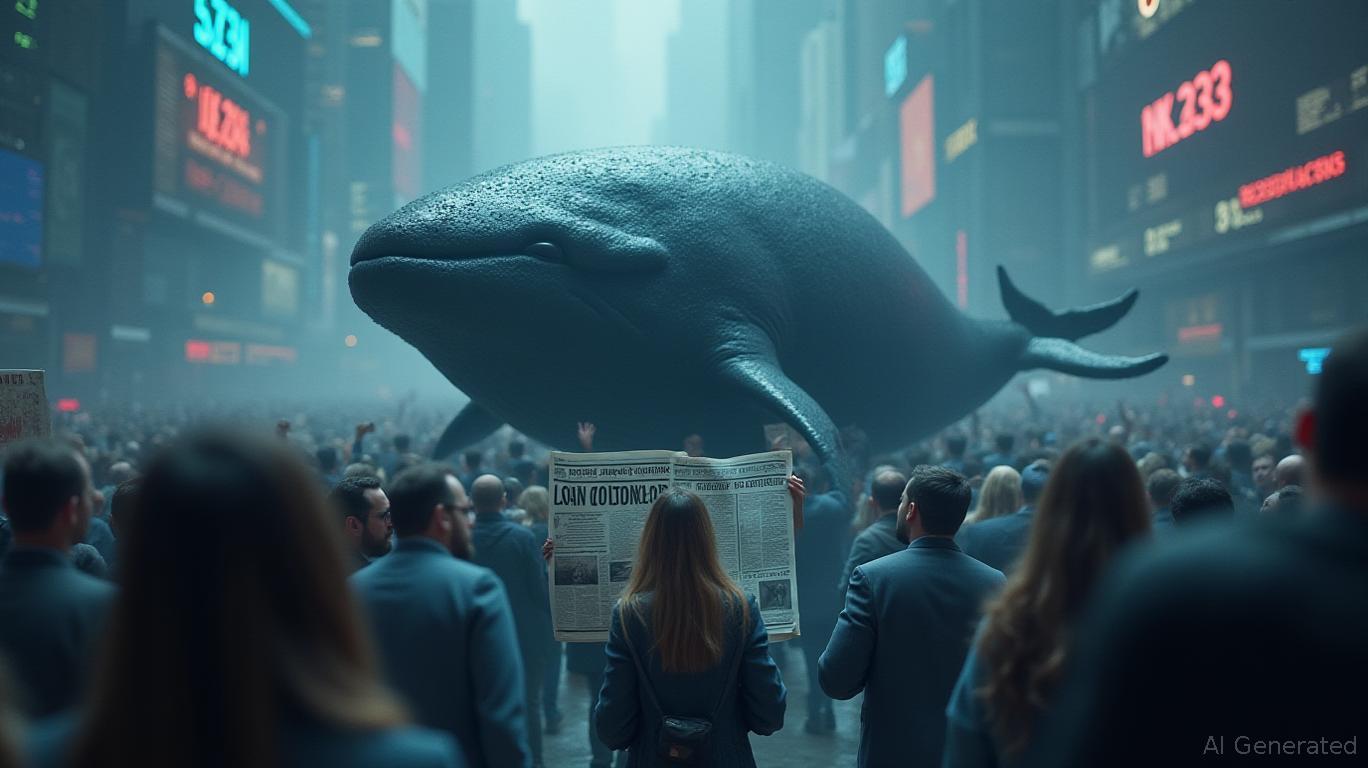

Crypto’s Ideal Whale: Absorb a $7M Deficit or Weather the Turbulence?

- A top crypto whale with 100% historical trade success now faces $7M in losses amid market shifts. - Analysts link the downturn to macroeconomic pressures, regulatory risks, and reduced speculative trading. - The whale's position volatility highlights risks even seasoned traders face in crypto's unpredictable market. - Market observers watch whether this whale will adjust strategies, potentially signaling broader sentiment changes.

An influential crypto whale, previously recognized for an unbroken streak of successful trades, is now facing substantial unrealized losses exceeding $7 million based on the most recent market figures, as reported by

The whale’s long-standing position, once regarded as a model for effective trading, is now being tested as market dynamics evolve. Experts point to several contributing elements, such as global economic challenges, regulatory ambiguity, and a decline in speculative trading, as noted by

Industry watchers are paying close attention to see if this well-known investor will alter their strategy or remain steadfast during the downturn. Should the whale reverse their position, it could indicate a broader change in market sentiment; holding steady, however, may strengthen belief in the long-term prospects of cryptocurrencies. This scenario highlights the difficulties that even veteran traders encounter in a market renowned for its volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deutsche Bank and DWS Support EURAU's Multichain Growth in Line with MiCA Regulations

- AllUnity's EURAU, a MiCA-compliant euro-pegged stablecoin, expanded cross-chain capabilities via Chainlink's CCIP to support Ethereum, Solana, and other major blockchains. - Backed by Deutsche Bank and DWS, EURAU aims to enhance B2B payments and treasury management while complying with EU regulations requiring reserve audits and transparency. - The expansion positions EURAU as a euro-centric alternative to dollar-dominated stablecoins, aligning with EU efforts to reduce reliance on foreign payment system

Selig's Nomination Seeks to Close the Gap Between SEC and CFTC on Crypto Issues

- Smithfield Foods shares rose 6.8% premarket after reporting $3.7B Q3 sales (+12.4% YoY), driven by strong demand across meat segments and $0.58 non-GAAP EPS exceeding estimates. - Indian firms Suraj Estate (+4% net profit) and TTK Prestige (+21.5% net profit) reported mixed Q2 results, with Suraj's pre-sales surging 89% but EBITDA margins declining. - Shenandoah Telecommunications raised annual dividend 10% to $0.11/share, while Trump's nomination of SEC's Selig to CFTC aims to unify crypto regulation be

Tariff Impact Hits Retail: Carter's Shuts 150 Stores, Reduces Staff by 15%

- Carter's Inc. is closing 150 stores and cutting 15% of its office workforce due to tariffs and sourcing shifts, impacting $110M in annual sales. - The restructuring aims to save $35M annually by 2026 through store closures and cost cuts, but Q3 profits fell to $39M from $77M amid rising costs and tariffs. - Despite a 14.5% stock drop, UBS raised its price target to $33, citing strong liquidity, while the company faces Amazon-driven competition and declining Simple Joys sales. - Carter's monitors potentia

Bitcoin News Update: Institutional Endorsement Fuels Bitcoin Cash Surge Beyond $550

- Bitcoin Cash (BCH) surged past $550 in early October 2025, driven by a 328% trading volume spike signaling strong institutional and retail participation. - Technical indicators confirmed an uptrend with consolidation between $553-$556, supported by higher lows and bullish RSI/MACD readings. - T. Rowe Price's BCH ETF inclusion and reduced Mt. Gox liquidation fears validated institutional confidence, while futures open interest rose 13.8% to $382.96M. - A $565.1 breakout could target $651, but a drop below