October 30th Market Key Insights -- How Much Did You Miss?

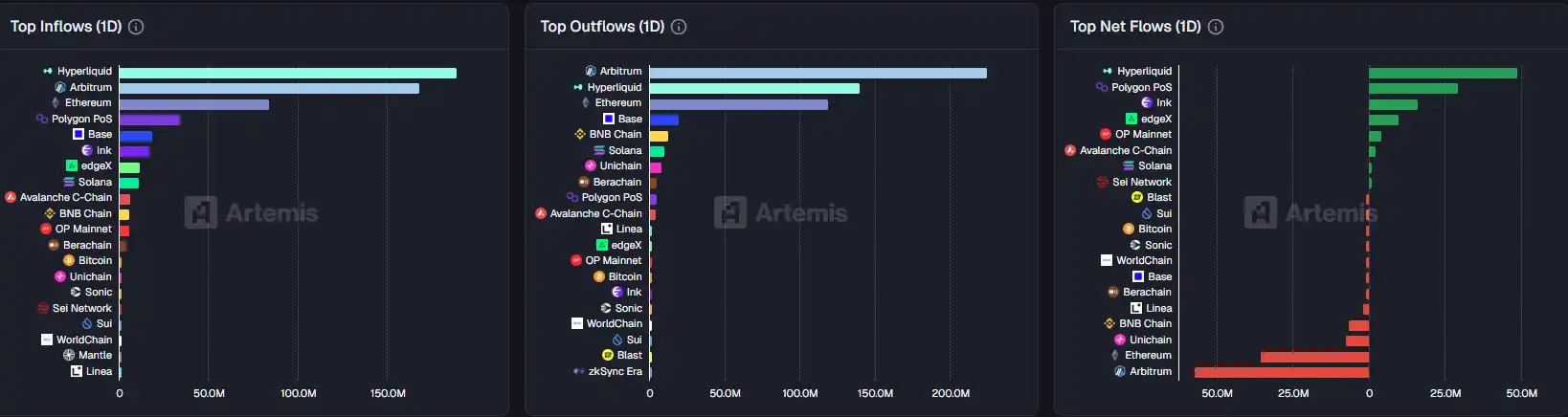

1. On-chain Fund Flows: $48.9M USD has flown into Ethereum today; $57.1M USD has flown out of Arbitrum. 2. Largest Price Swings: $JELLYJELLY, $PEPENODE 3. Top News: MegaETH Public Sale has raised over $1 billion, with oversubscription reaching 20x.

Top News

1. MegaETH Public Sale Fundraising Amount Surpasses $1 Billion, Oversubscribed 20x

2. Pre-market Crypto Concept Stocks in the U.S. Soar, with Strategy Up by 0.96%

3. $590 Million Liquidated Across the Network in the Past 24 Hours, Mainly Long Positions

4. Binance Alpha Airdrop Scheduled for Today at 20:00, Score Threshold at 240 Points

5. Pacifica's Weekly Trading Volume Exceeds $50 Billion, User Balances Receive a 20x Points Bonus

Featured Articles

1. "Earning and Distributing Money at the Same Time: A Look at the Recent Developments of Top Perp DEXes"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXes) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, Lighter ranks second with $86.16 billion, Hyperliquid ranks third with $59.58 billion, while edgeX and ApeX Protocol hold the fourth and fifth positions with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX race, keeping an eye on the dynamics of these top five platforms should provide insights into the overall direction of the race.

2. "CZ Invests in a Chinese College Junior, $11 Million Seed Round, Venture into Education as an Agent"

Chinese third-year student, $11 million seed round, the highest-funded product by a Silicon Valley student entrepreneur. The flagship product is VideoTutor, an educational agent product targeting K12 education, which can generate personalized teaching/explanatory videos with just one sentence. VideoTutor announced today that it has completed a $11 million seed round of financing. The round was led by YZi Labs, with participation from Baidu Ventures, JinQiu Fund, Amino Capital, BridgeOne Capital, and several well-known investors.

On-chain Data

On-chain Fund Flow Last Week on October 30

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: La Culex Takes a Bold Bet: Will Meme-Based Cryptocurrency Surpass Bitcoin’s Reliability?

- La Culex ($CULEX) presale targets 30,683% ROI with $0.00002274 tokens, leveraging meme-driven mechanics and structured tokenomics including burns and staking. - Unlike Bitcoin's $112k stability or TRON's $0.0946 growth, La Culex offers asymmetric risk-reward via community-driven engagement and gamified retail appeal. - Ethereum-based framework with automatic liquidity and transparent governance differentiates it from meme coins, mirroring MoonBull's utility-driven model. - Dynamic pricing increases token

Solana Latest Updates: ARK Makes Major Investment in Crypto Infrastructure Amid ETF Outflows

- ARK Invest's ETFs (ARKK, ARKW, ARKF) now hold $2.15B in crypto assets, reallocating from traditional tech stocks. - The firm increased crypto exposure to 29% in ARKF, investing in Coinbase, Robinhood, and Bullish (CoinDesk's parent). - Despite mixed reactions to Solana ETFs and outflows in Bitcoin/Ethereum ETFs, ARK emphasizes long-term crypto infrastructure bets.

Open-Source AI Movement Faces Resistance from Profit-Oriented Tech Corporations

- Vitalik Buterin advocates open-source autonomous driving to boost innovation and safety, challenging profit-driven tech giants. - AI stocks like C3.ai (-2.96%) underperform as Microsoft and NVIDIA gain traction through proprietary AI hardware and OpenAI partnerships. - OpenAI's potential IPO and $11.6B 2025 revenue projections highlight tensions between non-profit models and commercialization, amid copyright lawsuits. - Market volatility (84% call/79% put implied volatility) reflects uncertainty over AI'

ZEC Climbs Close to $400 While Technical Signals Suggest a Potential Pullback

- Zcash (ZEC) surged near $400, outperforming Bitcoin and Ethereum, but technical indicators signal potential correction due to bearish divergences and weakening momentum. - On-chain data highlights rising retail activity and distribution phase warnings, suggesting short-term profit-taking and waning institutional interest. - ECC’s Q4 2025 privacy upgrades aim to strengthen ZEC’s value proposition, though mixed sentiment persists amid macroeconomic headwinds and Fed rate impacts. - Analysts warn of 10%–12%