Making Money While Giving Away Money: A Look at the Latest Developments of These Leading Perp DEXs

Chainfeeds Guide:

After reading this, who can still say you don't understand Perp DEX.

Source:

Author:

BlockBeats

Opinion:

BlockBeats: Recently, an insider who previously accurately predicted Coinbase's acquisition of Echo and Kalshi's $12 billion valuation, has hinted in a similar riddle-like fashion that Lighter's funding has reached $1.5 billion. This news has sparked widespread attention in the community. Although it has not been officially confirmed, the insider's previous accurate predictions have added credibility to this rumor. From a market perspective, prediction data on Polymarket shows that investors are highly optimistic about Lighter: there is an 88% probability that its FDV will exceed $2 billion on its launch day, and a 55% probability that it will exceed $4 billion. Meanwhile, the OTC market price remains stable at around $80. The latest hints from the Lighter CEO on Twitter have given the community a clearer expectation for the airdrop timing. He explicitly stated that the second season points program will end before the end of the year, but not on December 31, and tweeted that "the holidays will be lit this year." Based on this information, the community generally speculates that the airdrop is most likely to take place during the most important Western holiday—Christmas. Two weeks ago, the Lighter founder held a Russian-language AMA and revealed some key information: Lighter plans to allocate 25-30% of tokens for the first and second season points airdrops, with a total community allocation ratio of 50%. The remaining portion will be used for future airdrops, partner programs, and project funding. In terms of products, spot trading functionality is expected to launch at the end of October or early November, with core assets such as ETH and BTC being the first to go live, followed by selected meme coins and partner projects. The roadmap for the next 6-12 months includes: implementing cross-margin functionality by the end of the year, allowing spot assets to be used as collateral for perpetual contracts; launching EVM sidecar smart contract extensions early next year; RWA derivatives (precious metals and crypto-related stocks) planned to go live by year-end; options and dark pool features are scheduled for next year and the end of next year, respectively. On October 6, Aster seamlessly transitioned to the third phase reward program, Aster Dawn, which will last for 5 weeks until November 9. This program introduces an innovative multidimensional Rh points scoring system, comprehensively considering trading volume, holding duration, ASTER ecosystem assets (such as asBNB, USDF), realized P&L, and team referral contributions. Highlights of the Dawn program include: 4% of the total ASTER supply is dedicated to the third phase airdrop; for the first time, spot trading is included in the points system, no longer limited to perpetual contracts; specific trading pairs (such as AT, AT, AT, ON, etc.) enjoy a 1.2x points bonus; the standard team referral rate is 10%, and large traders can apply for higher levels. Scores are recalculated weekly to ensure fairness, but the specific formula is kept confidential to prevent wash trading. Starting in October, Aster officially launched the third phase (S3) token buyback program. After the buyback is completed, the repurchased tokens will be transferred to the same address as the S2 buyback, and then the S3 airdrop distribution will begin. Based on the platform's estimated daily fee income of $15 million, the market expects the total buyback amount to exceed $200 million. Several community members and analysts believe that if this buyback program continues, it could push the ASTER price to the $10 target.

Source of Content

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

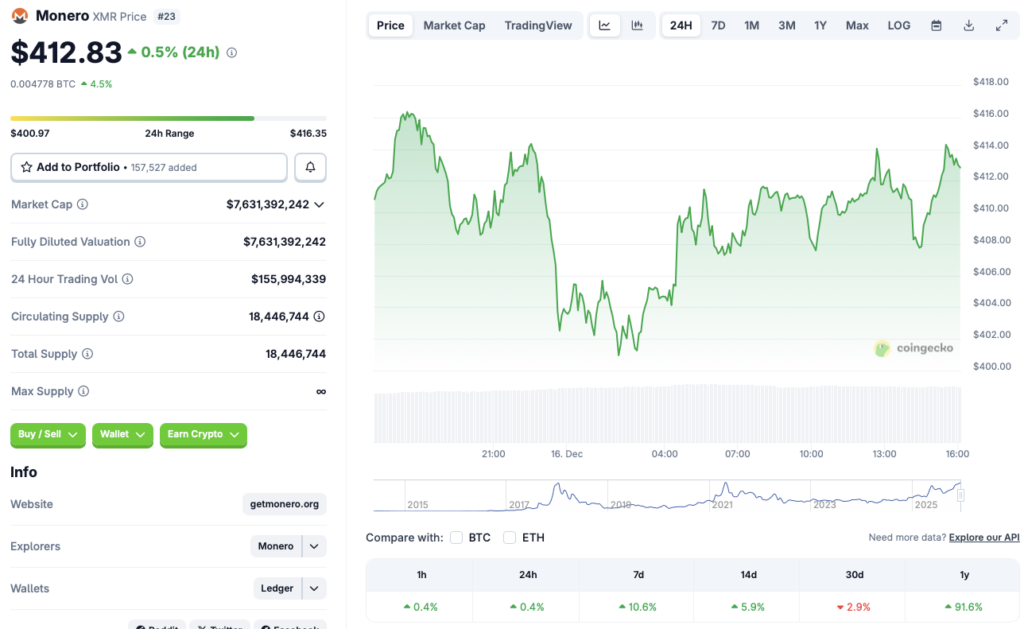

Monero bucks the market trend and continues to strengthen: What are the reasons?

Bank of America Urges Onchain Transition for U.S. Banks

Hong Kong Court Adjourns $206M JPEX Fraud Case Until March: Report