HBAR Price Jumps 26% in a Week — Momentum Is Hot, But Inflows Are Not

Hedera’s 26% surge has fueled optimism after its spot ETF debut, but on-chain data shows limited inflows—hinting that HBAR’s rally may be running hot without solid investor backing.

Hedera (HBAR) has recorded an impressive 26% weekly gain, sparking optimism among traders and investors. The sudden surge has lifted market sentiment and added momentum to portfolios holding the altcoin.

However, on-chain data and technical indicators suggest that the rally might not be as organic as it appears, raising questions about its sustainability in the days ahead.

Hedera Investors Need To Step Up

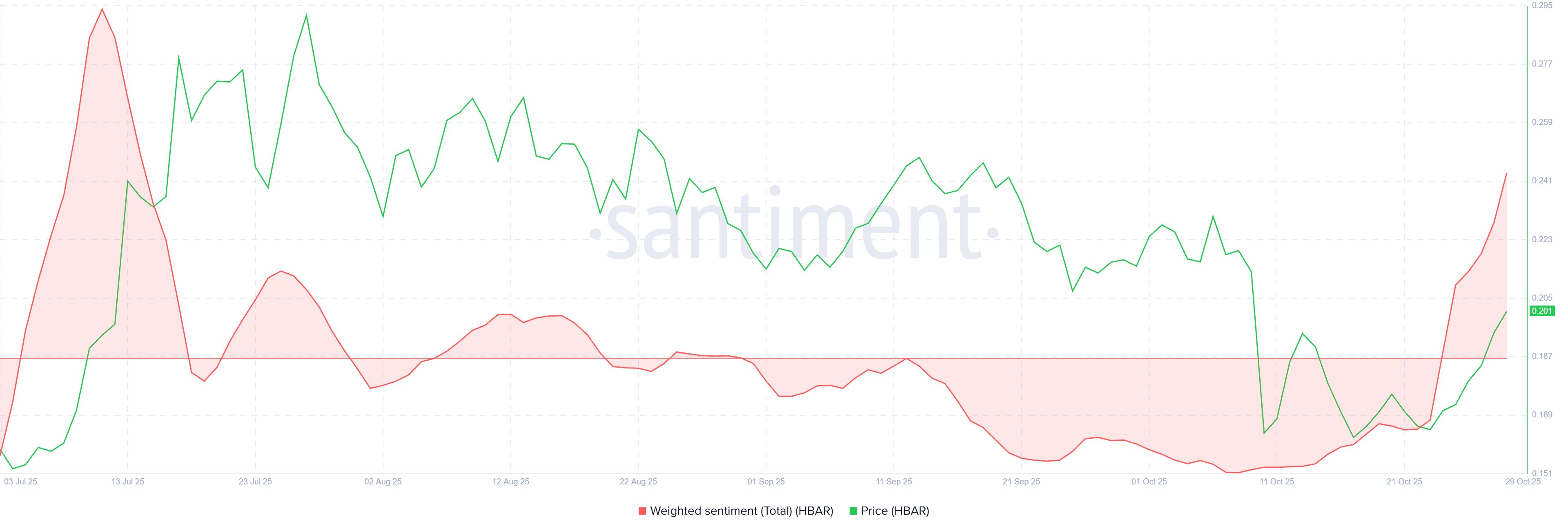

The weighted sentiment for HBAR has seen a sharp spike in recent days, reflecting rising investor optimism. This increase in positive sentiment coincides with the launch of Canary Capital’s spot HBAR exchange-traded fund (ETF), which began trading earlier this week.

The ETF’s debut has significantly amplified social discussions around the token, fueling bullish expectations in the short term. However, history suggests that sudden spikes in investor enthusiasm can be double-edged.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Weighted Sentiment. Source:

HBAR Weighted Sentiment. Source:

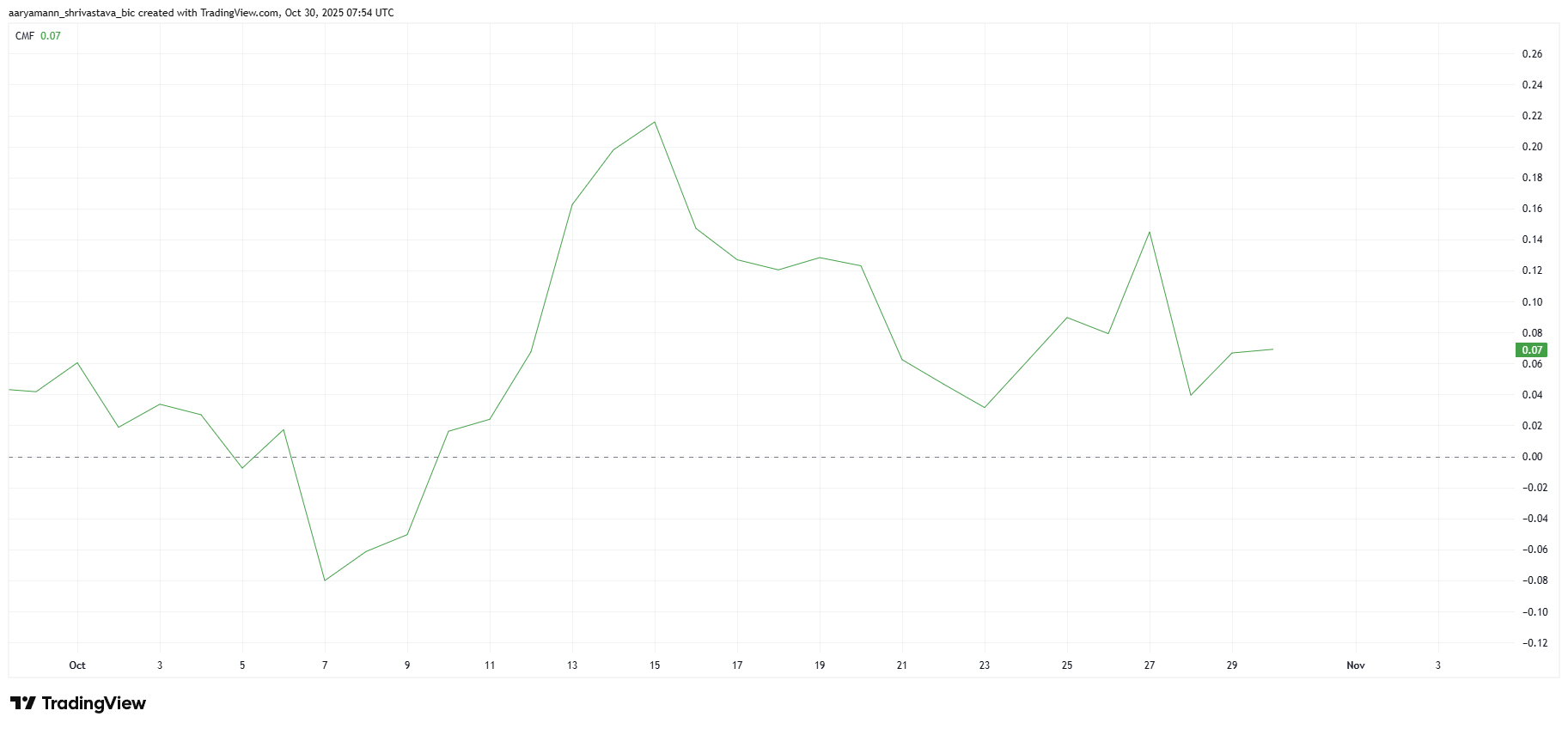

From a macro perspective, the Chaikin Money Flow (CMF) indicator paints a more cautious picture. Despite the price rally, CMF data shows no corresponding surge in inflows, suggesting that the bullish momentum is not backed by substantial capital movement.

Low inflows paired with heightened network activity often indicate an overheated asset. This imbalance tends to precede short-term reversals as traders take profits and market liquidity tightens. Unless new capital enters the market soon, HBAR’s upward trend could struggle to maintain its current pace.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Reclaims $0.200

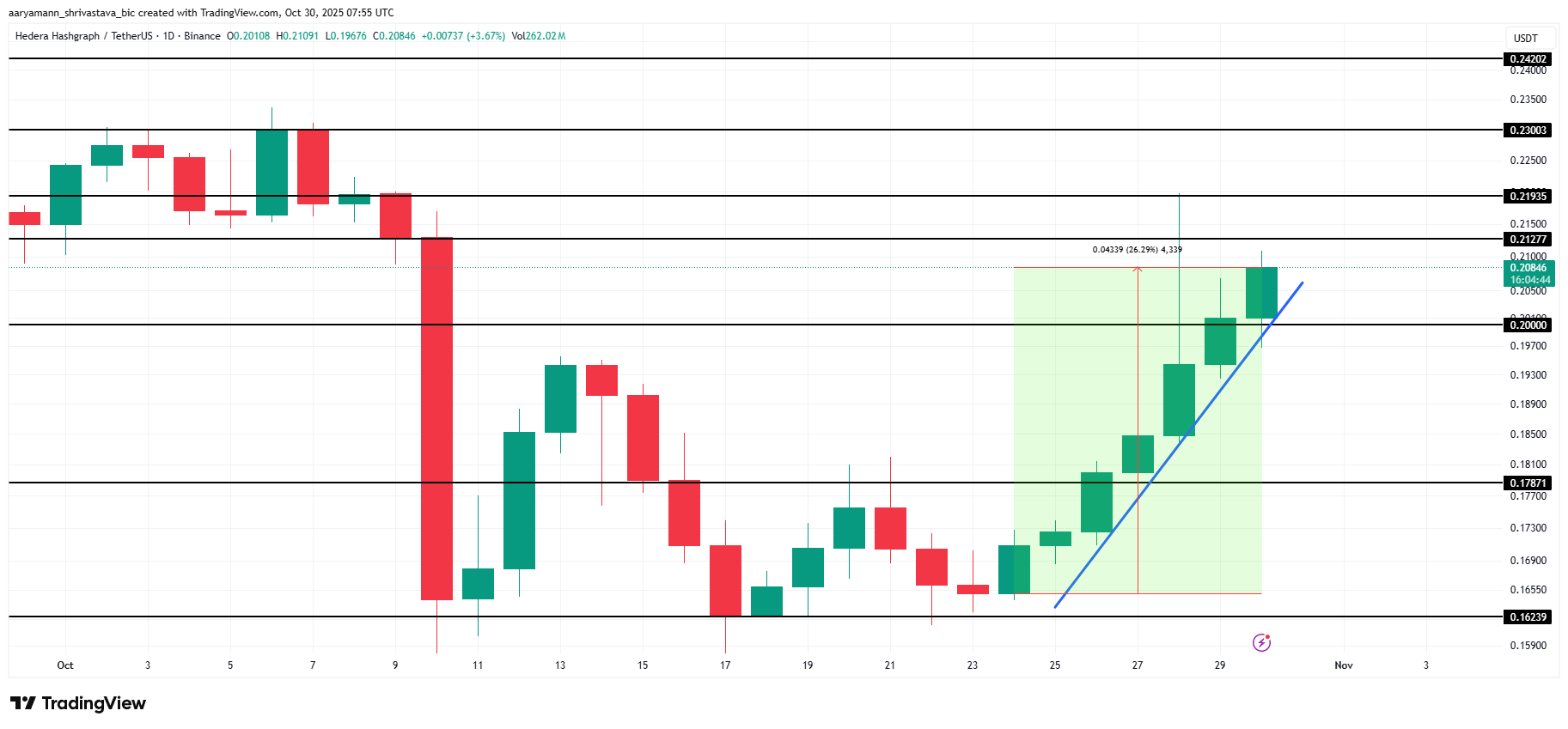

At the time of writing, HBAR trades at $0.2048 after a 26% rise this week, testing resistance near $0.212. The strong uptrend positions the token just below a key breakout zone that could determine its next direction.

If investors begin taking profits without a fresh wave of inflows, HBAR could lose support at $0.200 and decline toward $0.178. Such a move would reflect cooling momentum and renewed caution among traders.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

Alternatively, if the rally gains support from increased inflows driven by the spot ETF, HBAR could extend its rise past $0.217 and aim for $0.23. Sustaining this level would signal a continuation of the bullish trend and renewed investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As Nvidia enters the $5 trillion era, why is crypto still stuck between "cats, dogs, and frogs"?

The article points out that the cryptocurrency industry needs to break away from marginalization and become part of the mainstream financial system, achieving long-term development through technological innovation and integration with the real economy. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

Avery Ching: Systems Thinker

Ching initially focused on building systems to analyze how billions of people connect on social media, and later shifted to developing systems that could change the way trillions of dollars flow through the global economy.

Shared power banks in South Korea can now mine on-chain

The Korean DePIN project Piggycell recently launched its TGE and was listed on Binance Alpha.