Trump's crypto mentor places a $653 million bitcoin bet—why isn't Wall Street buying it?

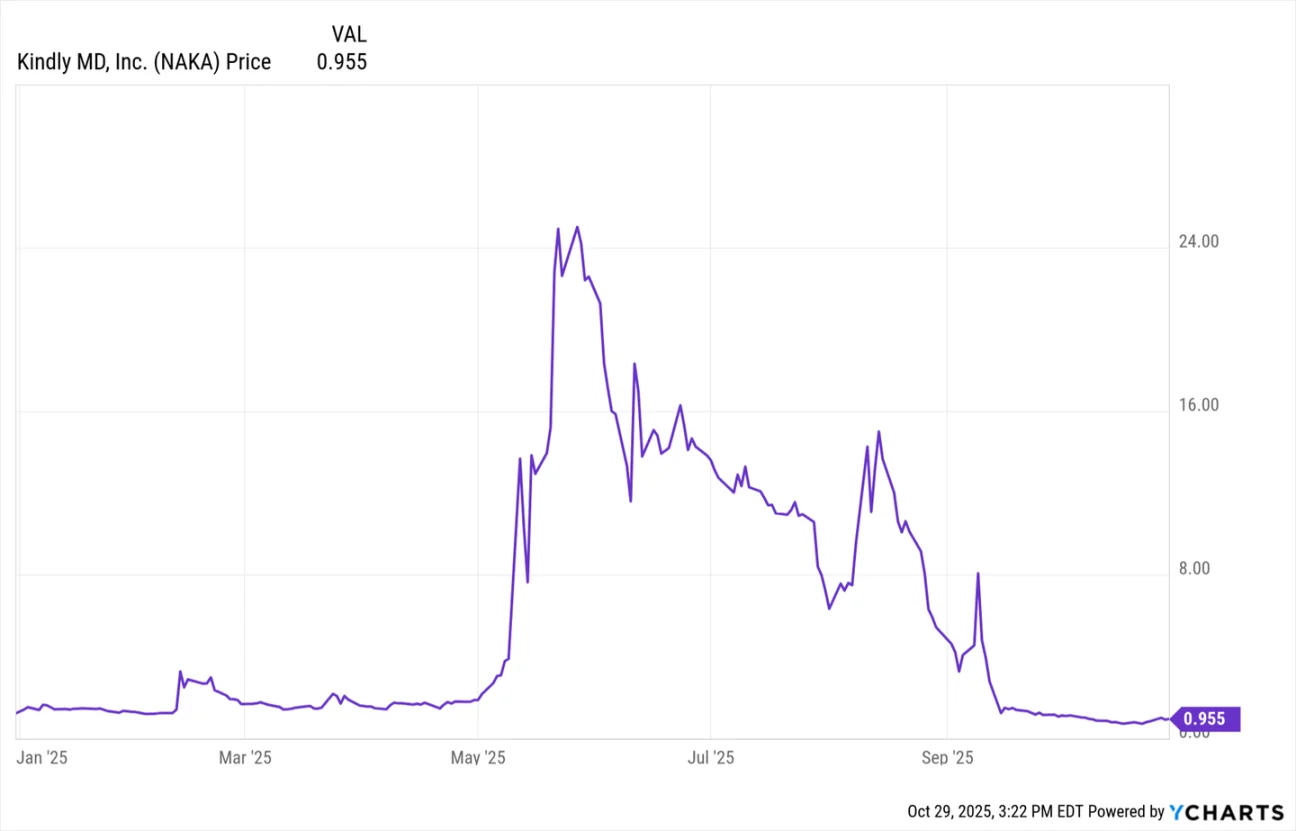

The stock price of this Bitcoin treasury company has plummeted from $25 to $0.92 in six months.

The stock price of this bitcoin treasury company plummeted from $25 to $0.92 in six months.

Written by: Nina Bambysheva, Forbes

Translated by: Luffy, Foresight News

In the words of David Bailey, the past six months have been nothing short of a “Saving Private Ryan-level brutal battle.” The 35-year-old CEO of Nakamoto Holdings—a digital treasury company he founded to manage corporate bitcoin reserves—has witnessed his boldest bet yet: a merger with Utah-based small-cap public healthcare company KindlyMD, which has gone from initial triumph to a current trial.

“I’ve been busy getting beaten up in the stock market,” he said. The company’s stock price has plummeted from $25 to $0.92 in just six months.

Bailey is not your typical Nasdaq-listed executive. He is better known as the CEO of Bitcoin Magazine, organizer of the world’s largest bitcoin conference, and a key figure in shifting Donald Trump’s attitude toward crypto. “Our goal,” he says, “is to become the number one bitcoin company in the world.”

In May of this year, Utah-based KindlyMD—a publicly traded medical clinic operator with $2.7 million in annual revenue, offering both traditional and alternative therapies—announced a reverse merger with Bailey’s Nakamoto Holdings, aiming to transform into a bitcoin holding company. The merged company is listed on Nasdaq under the ticker NAKA and currently holds about $653 million worth of bitcoin.

Wall Street is not optimistic about Bailey’s plan. After peaking at nearly $35 in May, the company’s stock traded below $1 for most of October, representing a 98% discount to the net asset value of its 5,765 bitcoins on the balance sheet.

It turns out that Nakamoto Holdings has become a victim of its own financing strategy. To raise funds for crypto purchases, the company completed a series of public market private equity (PIPE) deals totaling about $563 million. These deals issued hundreds of millions of new shares to private investors at steep discounts, severely diluting existing shareholders. In September, a large number of PIPE shares became tradable, prompting investors to cash out and lock in profits, triggering a stock price collapse. Bailey’s letter to shareholders urging short-term speculators to exit the stock only added fuel to the fire.

“Those investors who are just here to trade are actually a very expensive source of capital for us,” Bailey said. “I know some people don’t agree with this view, but what we need are long-term partners whose interests are aligned with ours. For us, this is an all-or-nothing gamble.”

In fact, Bailey says, he will soon merge his other businesses—including Bitcoin Magazine, the parent company of the bitcoin conference and consulting business BTC Inc., as well as UTXO Management, which owns hedge fund 210k Capital and venture capital firm 2140—into KindlyMD. Forbes estimates these entities could add up to $200 million in value to the bitcoin treasury company, while also increasing Bailey’s ownership stake (currently 3%).

Bailey did not comment on Forbes’ numbers, but said the cash generated by these profitable businesses will help KindlyMD buy more bitcoin. According to sources, 210k Capital alone has quietly grown its assets under management from about $100 million in January to $400 million, a fourfold increase.

This emerging financier’s logic is simple: Michael Saylor holds over 600,000 bitcoins and doesn’t have or need much operating business. Other players must have differentiated strategies to prove their value.

“We need to do things that create value,” Bailey said. “Operating real businesses is one way to do that.”

Although KindlyMD is headquartered in Salt Lake City, Utah, Bailey mainly works from his home in Guaynabo, Puerto Rico. On video calls, he is often seen sitting in front of a giant painting depicting a bank engulfed in flames. The work, titled “Burning Bank,” is by crypto artist Cypherpunk Now and is one of Bailey’s hundreds of collectibles.

“Whenever I have meetings with bankers, I make sure this painting is in the background,” he said with a laugh. For someone who wants to build his own bank, the scene couldn’t be more fitting.

Bailey grew up on a farm in Fayetteville, Tennessee, about an hour south of Nashville. He developed a strong interest in money and markets early on. In 2009, he entered the University of Alabama to study economics, finance, and mathematics, aspiring to become an investment banker.

“I used to be a huge fan of Warren Buffett and attended every Berkshire Hathaway shareholder meeting in college. I never thought I’d buy bitcoin—it was totally out of character for me at the time,” he recalled.

In 2012, a friend sent him an article about bitcoin, and everything began to change. Bailey initially thought bitcoin was a scam but couldn’t prove it. In November of that year, when bitcoin was trading between $10 and $12, he made his first investment.

In 2014, a year after graduation, Bailey joined Bitcoin Magazine, an early publication focused on the emerging cryptocurrency, co-founded by Vitalik Buterin, who later created Ethereum. Shortly after, Bailey and his college friend Tyler Evans acquired the magazine through their jointly founded BTC Inc.

To expand the brand’s influence, the two launched the Bitcoin Conference in 2019. This festival-like event has now become the “Coachella of crypto,” making Bailey one of the most influential bitcoin evangelists. Last year’s conference in Nashville attracted 35,000 believers, investors, and politicians, including then-presidential candidate Donald Trump.

Bailey said his connection with Trump began with a conversation in Puerto Rico in 2024: how to get the president interested in bitcoin. “Paul Manafort was the initial gatekeeper who helped us get into his circle,” he said. Soon, Bailey’s team was allowed to pitch in Trump Tower. The core message was simple: bitcoin voters would play a key role in the presidential election. Trump, always the dealmaker, agreed to meet—if Bailey and his friends could bring votes and enthusiasm, the crypto industry would get a voice.

“Trump turns everything into a season of The Apprentice; you’re always auditioning,” he added. “‘Okay, you want to be the bitcoin advisor? I’ll bring in three more people to compete for the spot.’” Bailey ultimately prevailed, joining with industry leaders to raise over $100 million for Trump’s campaign, including $21 million at the Nashville conference alone. At that event, Trump’s famous pledge—to make America the global capital of crypto—became widely known.

“He was very uncertain at first, but the cheers from the audience changed his attitude. As he was leaving, he said, ‘These bitcoin people like me, they’re my people,’” Bailey recalled. He now serves as an informal advisor to the president. In his view, Trump simply realized that crypto was being treated differently from every other asset class (after the election, Trump has made hundreds of millions from crypto). Bailey believes the current goal is to create a level playing field, and the bigger vision is to make the U.S. the most bitcoin-friendly country in the world.

Bailey claims that in his 13-year career, he has invested in over 100 bitcoin-related companies, with the best performers—Metaplanet and Smarter Web—turning millions of dollars into hundredfold returns. He says the returns are not just financial; good ideas get copied. “If thousands of bitcoin companies thrive, we win.”

This Buffett-inspired long-term vision is now driving KindlyMD’s development. Bailey envisions building it into a large holding company with profitable, independently operated subsidiaries. For him, this is not just an investment strategy but a replay of monetary history. His so-called “bitcoin standard” echoes the evolution of gold: bullion dealers became bullion banks, which then evolved into central and investment banks. He believes today’s bitcoin treasury companies are the bullion dealers of the digital age, moving toward a new kind of bank.

KindlyMD is driving this transformation. The company has invested in other bitcoin holding companies, namely Japan’s Metaplanet and the Netherlands’ Treasury B.V. “Imagine nurturing an ETF,” Bailey explained. “That’s exactly what we’re doing—nurturing these actively managed ETFs in the form of corporate stock on a global scale.” Of course, like other newly established crypto treasury companies, Bailey’s entry into public markets has sidestepped the scrutiny of the U.S. Securities and Exchange Commission (SEC) over ETFs and IPOs.

Despite KindlyMD’s lackluster “debut” on Wall Street, Bailey isn’t too concerned. “The best thing about bitcoin is that it’s very forgiving—you can make mistakes in your career and then start over,” Bailey said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The New York Times: The Untold Stories Behind Trump’s Embrace of Crypto

MSCI Index Exclusion Could Force Crypto Treasury Firms To Sell $15 Billion In Assets

XRP and HBAR Are Now Institution-Safe Assets? Here’s the Latest

XRP Price: 850% Upside or 50% Crash? Experts Share Mixed Opinions