Bitcoin Updates Today: Bitcoin's October Downturn Reveals Contrasting Trends in Crypto While BNB Surges

- Bitcoin fell 5.5% in October, its first monthly decline since 2018, driven by Fed policy uncertainty, ETF outflows, and dormant wallet activity. - BNB Chain surged amid memecoin frenzy, with BNB price rising 6.6%, contrasting Bitcoin's struggles and highlighting crypto market divergence. - Technical analysis identified $105,000–$103,800 support and $126,000–$128,000 resistance, while institutional Bitcoin ETFs attracted $3.5B inflows, holding 12% of total supply. - Fed's 0.25% rate cut and Bitcoin-to-gol

October ended with Bitcoin posting a rare monthly loss, its first negative October in seven years, as reported by a

The selloff was intensified by movements from previously inactive wallets. In October, a

While Bitcoin’s October performance drew scrutiny,

Technical indicators pointed to a possible recovery for Bitcoin. On October 30, BTC/USD was trading at $111,328 following a 25-basis-point rate reduction, with major resistance at $126,000–$128,000 and support at $105,400–$103,800, as highlighted in a

The anticipated 0.25% rate cut by the Fed in October added further complexity to the market outlook. With inflation cooling and the U.S. Dollar Index dropping below 99, Bitcoin’s appeal as a safeguard against currency depreciation grew, according to the Investing.com analysis. Meanwhile, the so-called “hard money trade” persisted, with the Bitcoin-to-gold ratio rebounding to pre-tariff levels and institutional demand helping to stabilize prices, the report said.

The October market review highlighted the industry’s evolution. While Bitcoin’s monthly loss pointed to structural changes, BNB’s rally showcased speculative enthusiasm in certain areas. For investors, the month was a reminder of the crypto market’s dual nature—balancing sensitivity to macroeconomic factors with volatility driven by retail speculation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

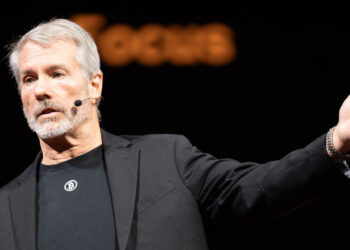

Michael Saylor Says Strategy Won’t Pursue Bitcoin Treasury Acquisitions For Now

DeFi Fees Hit $20 Billion in 2025 as On-chain Applications Drive Explosive Growth

Ripple USD Gains Traction Among Global NGOs for Real-Time Humanitarian Aid

From $0.20 to $110,000: Bitcoin’s 17-Year Journey Since the Whitepaper