Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.

Powell's Remarks Shake the Market, Says December Rate Cut Is Not a Foregone Conclusion

On October 30, Federal Reserve Chairman Jerome Powell stated at a press conference that the rate cuts in September and today were risk-management cuts, but the future may not be the same. In his opening remarks, he made the most important statement: "There were very different views within the Committee during this meeting on what action to take in December. Further lowering the policy rate at the December meeting is not a foregone conclusion." Subsequently, the market's pricing probability for a Fed rate cut in December quickly dropped from 92% to 70%, risk assets fell across the board, and U.S. Treasury yields and the U.S. Dollar Index (DXY) surged.

Fed Mouthpiece: FOMC Does Not Fully Endorse Market Pricing for December Rate Cut

On October 30, "Fed mouthpiece" Nick Timiraos wrote that Powell's press conference indicated that the FOMC as a whole does not agree with the market's previous high pricing for a December rate cut. Powell stated that there are significant differences in views on what action to take in December. He emphasized that a December rate cut "should not be seen as a done deal. In fact, far from it." This goes beyond their usual disclaimer that "policy is not on a preset course," and is clearly an effort to regain some policy flexibility to avoid being forced into a specific action. What if there is no government data to help clarify the economic situation? Powell pointed out that this means there is "a very high degree of uncertainty, which could be a reason for caution."

Powell: If No New Information Emerges, There Is Reason to Slow the Pace of Rate Cuts

On October 30, Federal Reserve Chairman Powell said: If no new information is obtained and economic conditions appear unchanged, there will be reason to slow the pace of rate cuts. He hopes that by December, more comprehensive data will be available. The lack of data during a government shutdown may indicate that policy adjustments should be slowed. It is uncertain how long the debate over slowing rate cuts in December will last.

Crypto Market Seeks Support Amid Uncertainty Over Fed Rate Cut Expectations

On October 30, following the FOMC meeting last night, Powell's hawkish remarks indicated significant uncertainty regarding a December rate cut. Affected by this news, the crypto market chose to decline in search of support. According to market data, Bitcoin briefly fell below the $110,000 mark this morning and is currently quoted at $110,370 (UTC+8), with a 24-hour drop of 1.02%; Ethereum briefly fell to $3,820 (UTC+8), now quoted at $3,910 (UTC+8), with a 24-hour drop of 1.04%; SOL briefly fell below $190 (UTC+8), now quoted at $194.7 (UTC+8), with a 24-hour drop of 0.99%.

Bitwise's Solana ETF Surpasses $70 Million in Volume on Second Day

On October 30, according to The Block, the first U.S. spot Solana ETF—Bitwise Solana Staking ETF (ticker BSOL)—set the highest trading volume record among nearly 850 newly listed ETFs this year on its first day, and performed even more strongly on its second trading day. BSOL's trading volume on Wednesday reached $72.4 million (UTC+8), up from the first day's record of $56 million (UTC+8). Bloomberg Senior ETF Analyst Eric Balchunas posted on X: "A $72 million (UTC+8) trading volume is very impressive and a good sign." He also noted that the Canary Litecoin ETF (LTCC) and Canary HBAR ETF (HBR) had trading volumes roughly similar to Tuesday, at about $8 million (UTC+8) and $1 million (UTC+8), respectively. Balchunas said these numbers are quite impressive and pointed out that most ETFs see a decline in trading volume after the initial hype of the first day. In addition, Grayscale launched its Solana Staking ETF (GSOL), with a trading volume of about $4 million (UTC+8). Balchunas commented: "Solid performance, but clearly not as strong as BSOL. Just being listed one day later actually makes a huge difference and makes competition much harder." The REX Osprey Solana Staking ETF (SSK) also attracted about $18 million (UTC+8) in funds on Wednesday.

glassnode: If Bitcoin Fails to Hold Above $113,000, It Could Drop to $88,000

On October 30, glassnode published a market view stating that the on-chain market structure continues to reflect a phase of adjustment and reorganization. Bitcoin's failure to hold the cost basis of short-term holders highlights its weakening momentum and continued selling pressure from both short-term and long-term investors. The high degree of decentralization among long-term holders and the persistently high CEX transfer volumes indicate that market demand is nearing saturation, suggesting that the market may need a longer period of consolidation to rebuild confidence. Until long-term holders start accumulating again, Bitcoin's upside potential may remain limited. The market continues to struggle above the short-term holder cost basis (around $113,000 (UTC+8)), which is a key battleground for bulls and bears. If it fails to regain this level, it could further fall to the actual price of active investors (around $88,000 (UTC+8)). Notably, this analysis accurately predicted the impact of the Fed's unexpected actions on Bitcoin: "The current calm in the market is conditional and temporarily stable, but if the Fed's actions deviate from expectations, this calm will become fragile."

Powell: December Rate Cut Is Not a Foregone Conclusion, Committee Is Divided, Job Market Still Cooling, Short-Term Inflation Pressure Remains (Full Text Attached)

Powell stated that short-term inflation pressure remains, employment faces downside risks, and the current situation is quite challenging. The committee remains divided on whether to cut rates again in December, and a rate cut is not a foregone conclusion. Some FOMC members believe it is time to pause. Powell said that higher tariffs are pushing up prices in certain categories of goods, leading to overall inflation rising.

Bitcoin on the Eve of a Year-End Surge: ETF Drains Liquidity, Rate Cuts Ignite, Altcoins Ready to Double

The cryptocurrency market showed signs of recovery in October 2025, with investor sentiment shifting from cautious to cautiously optimistic. Net capital inflows turned positive, institutional participation increased, and the regulatory environment improved. Significant capital inflows were seen in Bitcoin spot ETFs, and the approval of altcoin ETFs injected new liquidity into the market. On the macro level, expectations for Fed rate cuts are rising, and the global policy environment is becoming more favorable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Avery Ching: Systems Thinker

Ching initially focused on building systems to analyze how billions of people connect on social media, and later shifted to developing systems that could change the way trillions of dollars flow through the global economy.

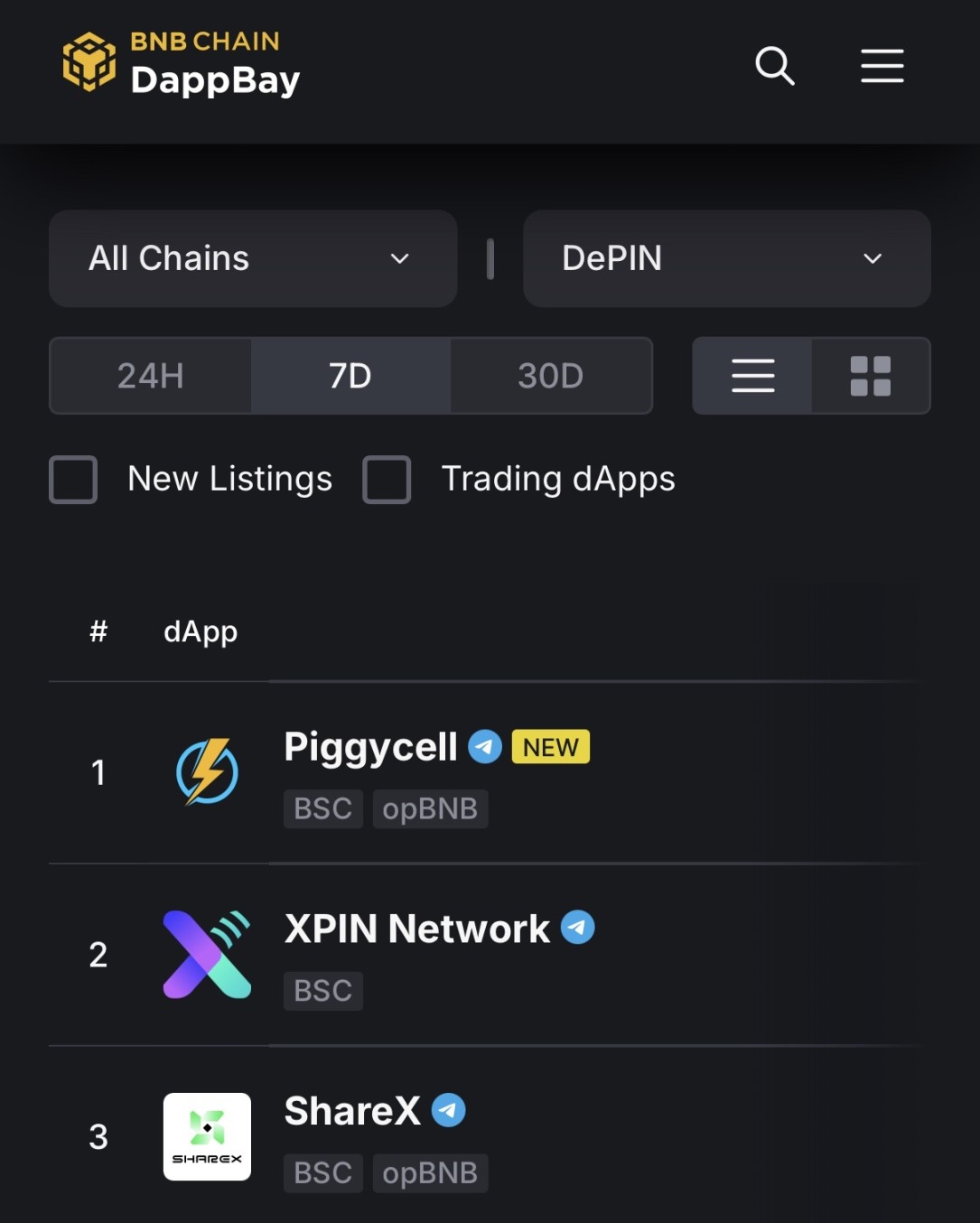

Shared power banks in South Korea can now mine on-chain

The Korean DePIN project Piggycell recently launched its TGE and was listed on Binance Alpha.

Crypto Projects Ignite Interest with Strategic Buyback Programs

In Brief ETHFI employs a buyback strategy to stabilize and increase its token value. Strategic buybacks aim to reduce market surplus and bolster investor confidence. The initiative reflects proactive market management in a volatile crypto environment.