Buybacks Can't Save DeFi

2025 will not be an easy year for DeFi project teams, but they have indeed learned a trick from Wall Street: expressing confidence through buybacks.

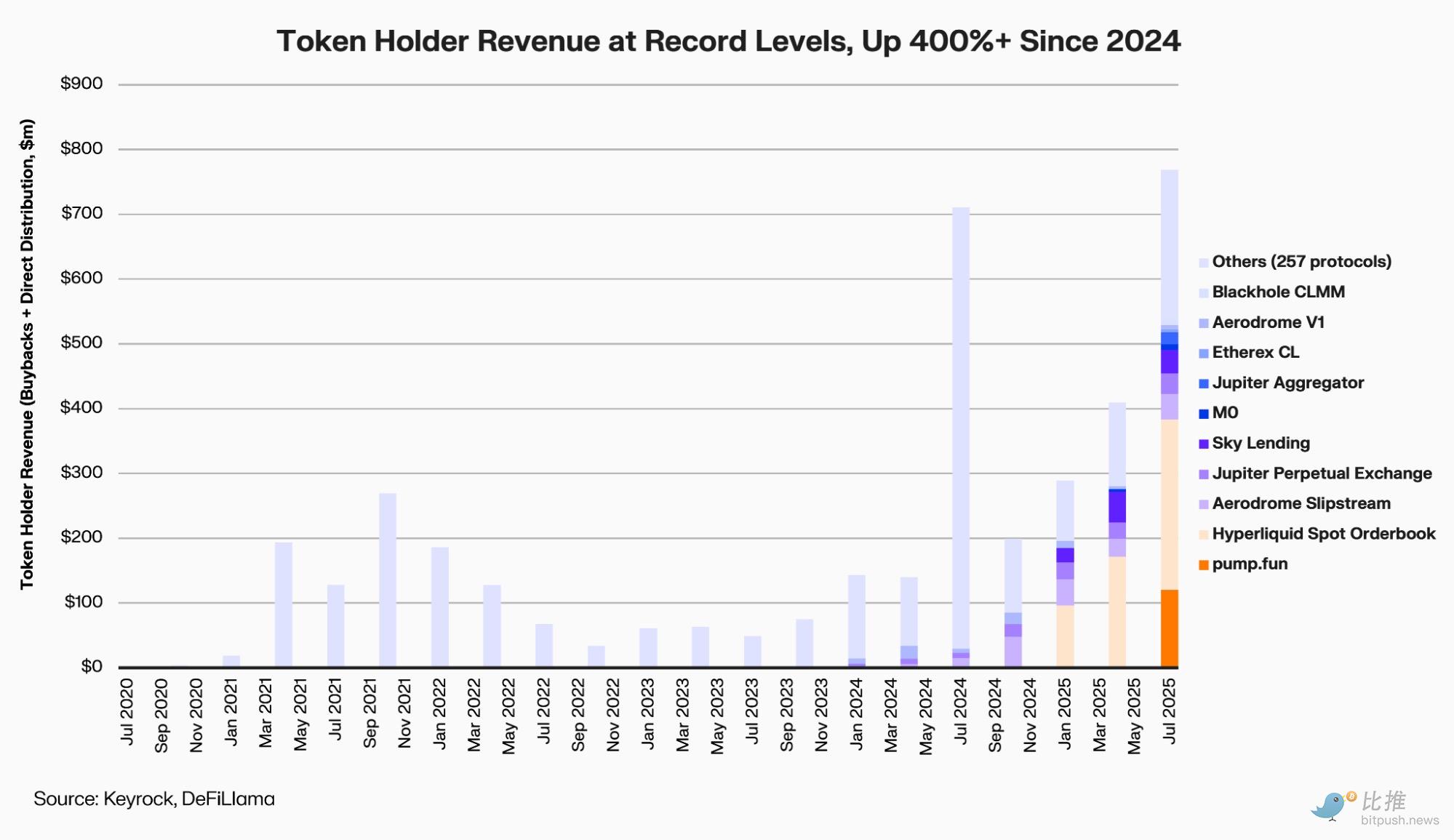

According to a report by crypto market maker Keyrock, the top 12 DeFi protocols spent about $800 million on buybacks and dividends in 2025, a 400% increase from early 2024.

Report analyst Amir Hajian wrote: “Just as listed companies use buybacks to signal long-term commitment, DeFi teams also hope to prove through this that they are profitable, have cash flow, and have a future.”

But in a market lacking liquidity and with low risk appetite, are these actions to “reward token holders” a return to value, or just burning money in vain?

Who’s in the buyback wave?

This round of buybacks started at the beginning of the year with Aave and MakerDAO, and continued with PancakeSwap, Synthetix, Hyperliquid andEther.fi—covering almost all the major DeFi tracks.

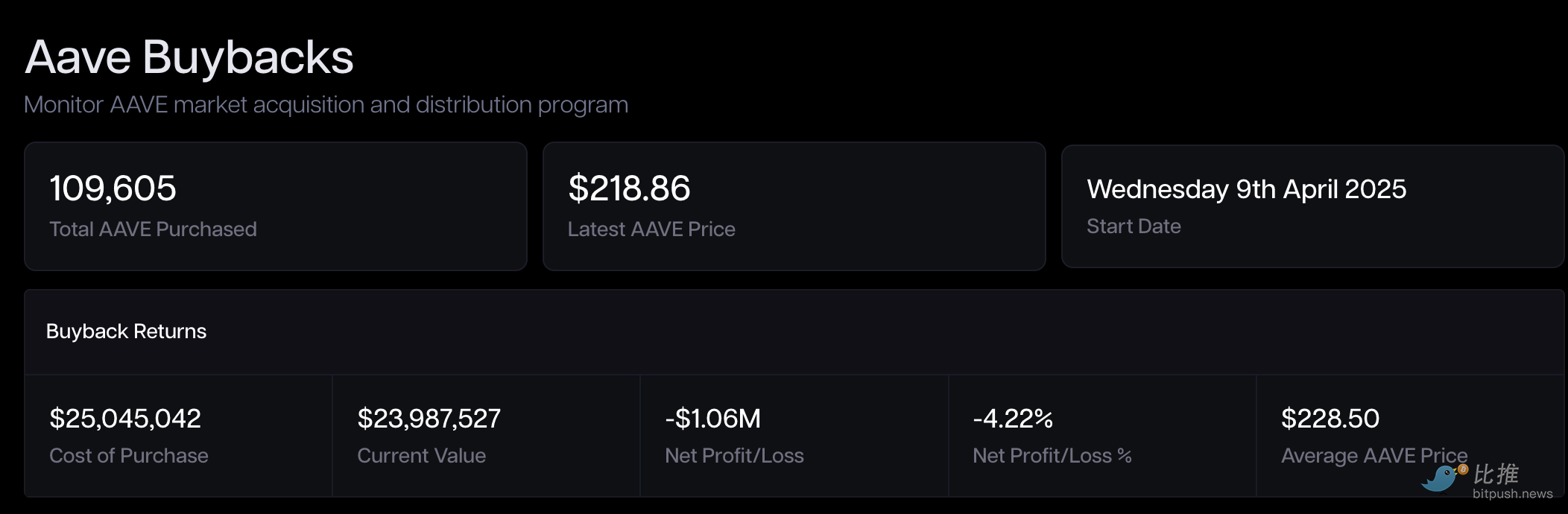

Aave (AAVE) was one of the earliest leading projects to launch systematic buybacks.

Since April 2025, Aave DAO has used protocol revenue to buy back about $1 million worth of AAVE every week, and in October discussed “normalizing” the mechanism, with an annualized budget of up to $50 million.

On the day the proposal was approved, AAVE briefly rose 13%, but after a six-month pilot, the book profit was negative.

MakerDAO (MKR) launched the Smart Burn Engine in 2023, using DAI surplus to regularly buy back and burn MKR. In the first week after the mechanism went live, MKR rebounded 28%, and was hailed as a model for “returning cash flow to token holders.”

However, a year later, the market presents a paradox of “confidence restored, valuation lagging.”

Despite strong fundamentals (MakerDAO continuously increases DAI reserve yields through real world assets, RWA), the price of MKR (as of the end of October 2025, fluctuating around $1,800) is still only about one-third of its 2021 bull market all-time high (about $6,292).

Ethereum liquid staking protocol Ether.fi (ETHFI) has recently proposed a plan that is undoubtedly the most high-profile “big move” of late. The DAO authorized up to $50 million to buy back ETHFI in batches below $3, using a Snapshot quick vote, with the goal of “stabilizing the token price and restoring confidence.”

However, the market is also wary: if the funds mainly come from treasury reserves rather than sustainable income, such “price-supporting buybacks” will inevitably run out of steam.

PancakeSwap (CAKE) chose the most programmatic path. Its “Buyback & Burn” mechanism has been integrated into the token model, with net inflation data disclosed monthly. In April 2025, CAKE’s net supply shrank by 0.61%, entering a sustained deflationary state.

But the price still hovers just above $2, far below the $44 high of 2021—the supply improvement brings stability, not a premium.

Synthetix (SNX) and GMX are also using protocol fees to buy back and burn tokens.

Synthetix wrote the buyback module into its 2024 version update, while GMX automatically allocates part of trading fees to the buyback pool.

Both achieved a 30% to 40% rebound during the 2024 buyback peak, but when stablecoin pegs were under pressure and fees declined, both suspended buybacks and redirected funds to risk reserves.

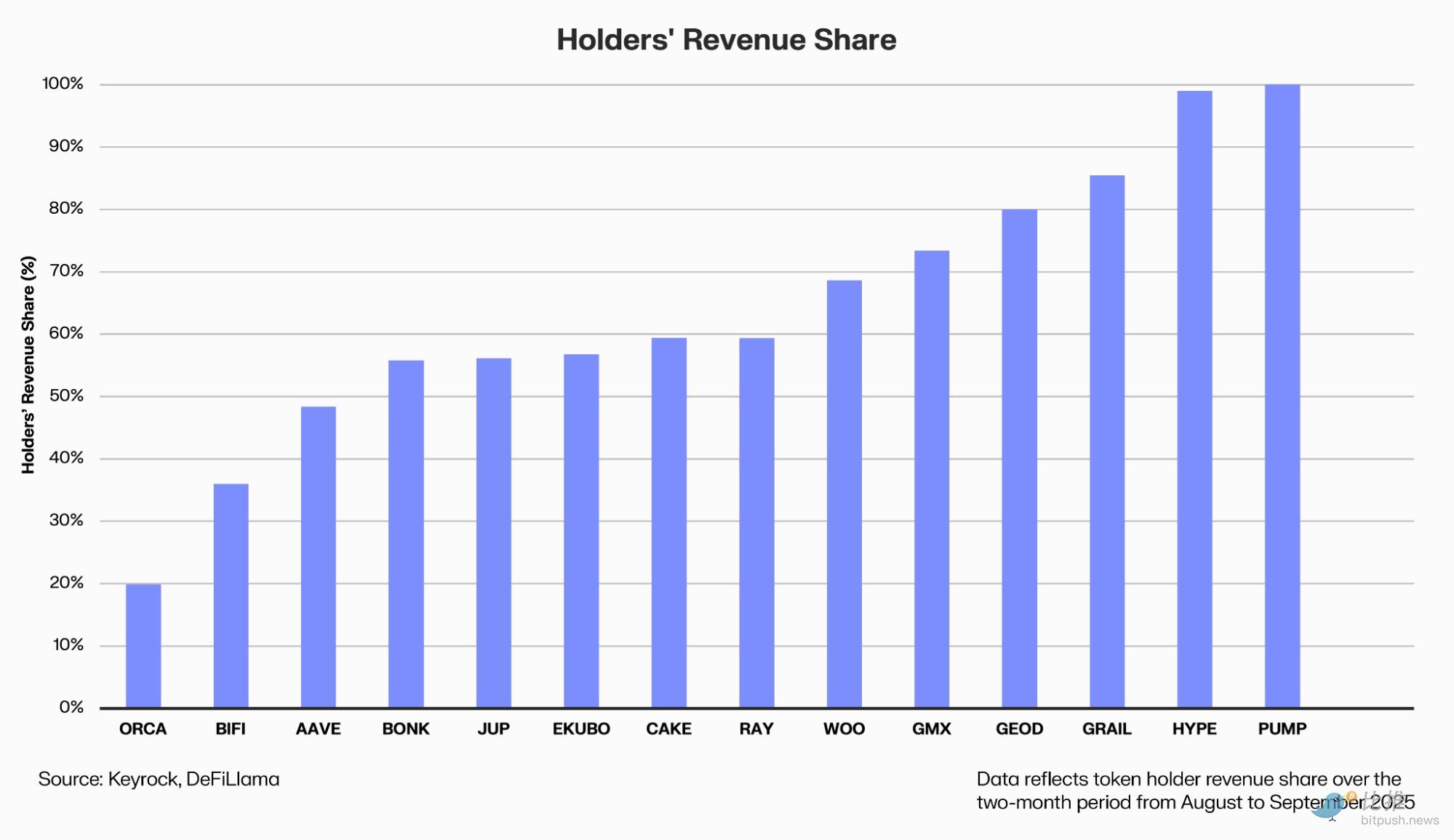

The real “exceptional winner” is the perpetual contract platform Hyperliquid (HYPE).

It treats buybacks as part of its business narrative: a portion of protocol revenue is automatically allocated to secondary market buy orders.

According to Dune data, Hyperliquid invested a total of $645 million in the past year, accounting for 46% of the entire industry, and its HYPE token has risen 500% since its launch in November 2024.

But HYPE’s success is not just due to buy orders, but also to revenue and user growth—daily trading volume has tripled in a year.

Why do buybacks often “fail”?

From the perspective of traditional financial logic, buybacks are highly sought after mainly for three reasons:

First, they promise to increase value per share. The protocol uses real money to buy back and burn tokens, reducing circulation and meaning each token will enjoy a higher share of future earnings.

Second, they convey governance confidence. Willingness to initiate buybacks shows the protocol has profitability, financial leeway, and governance efficiency. This is seen as an important sign of DeFi moving from “burning money for subsidies” to “operating for dividends.”

Third, they create scarcity expectations. If combined with mechanisms such as token locking and reduced issuance, buybacks can create a deflationary effect on the supply side, optimizing the token economic model.

However, theoretical perfection does not equal practical feasibility.

First, timing is often counterproductive. Most DAOs are generous with buybacks in bull markets but cut funding in bear markets, resulting in the awkward situation of “buying high, waiting low,” which runs counter to the original intention of value investing.

There are also concerns about funding sources. Many projects use treasury reserves rather than sustainable profits, so once income declines, buybacks become unsustainable “putting on a brave face.”

There is also the opportunity cost. Every dollar used for buybacks is a dollar less for product iteration and ecosystem development. Market maker Keyrock warned in October: “Excessive buybacks may be one of the least efficient ways to allocate capital.”

Even if buybacks are executed, their effect is easily diluted by ongoing unlocks and new token issuance. When supply-side pressure does not ease, limited buybacks are just a drop in the bucket.

Messari researcher Sunny Shi pointed out:

“We have not found that the market will continuously raise valuations because of buybacks; prices are still determined by growth and narrative.”

In addition, the macro liquidity structure of the entire DeFi market has changed. Although total value locked (TVL) has rebounded strongly to a three-year high (about $160 billion), there is still a gap compared to the historical peak of the 2021 bull market (about $180 billion). More importantly, although protocol revenue and capital utilization are high, secondary market trading volume and the inflow of speculative hot money still need time to fully return to the “frenzied” state of the previous cycle.

In a tight funding environment, even the most generous buybacks can hardly offset the structural problem of insufficient demand.

Confidence can be bought back for a moment, but only real capital inflows and growth cycles can allow DeFi to “regenerate” itself again.

Author: OXStill

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Spot ETF Set for Nov 13 Launch as SEC Delay Clause Removed

Quick Take Summary is AI generated, newsroom reviewed. Canary Funds removed the "delaying amendment" clause from its XRP spot ETF S-1 filing. This move uses Section 8(a) of the Securities Act, setting an auto-effective date of November 13. The ETF is planned to trade on Nasdaq and will use Gemini and BitGo as digital asset custodians. The strategy mirrors recent auto-effective launches of Solana, Litecoin, and Hedera ETFs.References CANARY REMOVES SEC DELAY CLAUSE — $XRP SPOT ETF NOW ON TRACK FOR NOVEMBER

'Dino' cryptos to soak up institutional funds bound for altcoins: Analyst

Price predictions 10/31: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, BCH

Bitcoin and Ethereum Options Worth $16 Billion Set to Expire, Could Trigger Market Turbulence

Traders Anticipate Market Swings as $13.5 Billion in Bitcoin and $2.5 Billion in Ethereum Options Approach Expiration Date