Under brutal harvesting, who is looking forward to the next COAI?

From MYX to COAI, the so-called myths of tenfold or hundredfold returns are nothing more than a quicker exit route under the spotlight of Binance Alpha.

Author: zhou, ChainCatcher

Since September, the crypto world has witnessed a series of ruthless "harvesting" dramas. From MYX, AIA to COAI, whales and project teams have joined forces to use high levels of control and manipulation to sweep away retail investors' funds. Despite such obvious signs of harvesting, a large number of users in the market are still hoping for the next "100x coin," afraid of missing out on the chance to get rich overnight.

The Evolution of the "Harvesting Template" from MYX to COAI

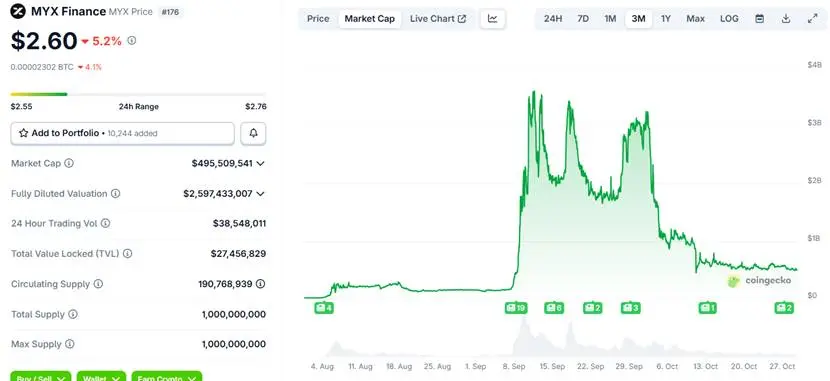

This scene began with MYX.Finance, a decentralized derivatives exchange based on the Arbitrum chain. Its token MYX was listed on Binance Alpha in early September, with an initial market cap of about 100 millions USD and relatively flat trading volume. In early September, MYX suddenly surged, with its market cap quickly climbing above 3 billions USD, then entering a high-level oscillation phase, accompanied by daily "needle-like spikes" and pullbacks. Funding rates turned negative, and the top ten addresses held over 95% of the supply. According to coinglass data, on September 18, MYX rose 298.18% in a single day, with an intraday amplitude of 317.11%. Short positions were liquidated for 52.09 millions USD, and long positions for 10.51 millions USD. In early October, the price entered a waterfall decline. Although there were brief rebounds, the price soon continued to fall. Since then, MYX has continued to decline and is now stabilized at around 500 millions USD in market cap.

Soon after, the first wave of copycat projects DeAgentAI (AIA) quickly emerged, attracting market attention with its AI agent narrative. In early October, its price once increased more than tenfold (UTC+8), then repeated the MYX playbook, harvesting retail investors through multiple surges and crashes, with a holding concentration as high as 97%. If AIA was a lightweight copy of the MYX template, then ChainOpera (COAI) took this model to the extreme.

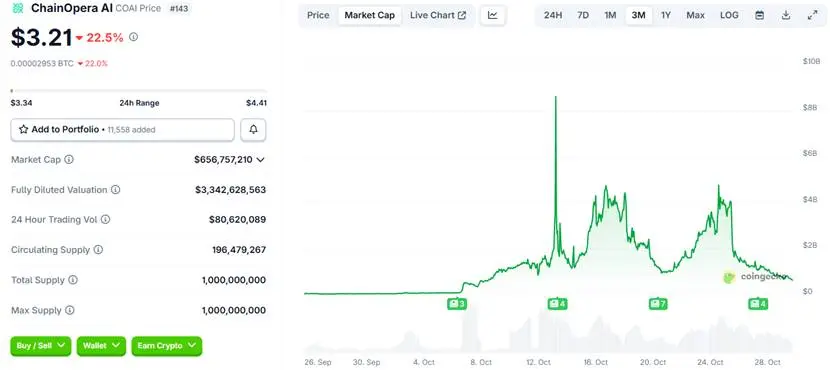

On September 25, COAI was listed on Binance Alpha and contract platforms, with an initial market cap of only 15 millions USD. Within a few weeks, it surged hundreds of times, with the market cap peaking above 8 billions USD. The price then fluctuated violently between 5 and 25 USD (UTC+8). Such dramatic ups and downs and halving-style shakeouts made it one of the most eye-catching "monster coins" of the year. Several traders pointed out that the top ten holders of COAI controlled 96.5%-97% of the circulating supply. Whales lured retail investors by pumping the price (such as the 81% surge on October 15 (UTC+8)), then dumped (such as the 58% crash on October 25 (UTC+8)), leaving retail investors with almost no way to respond.

It is worth noting that newly listed tokens are often dominated by project teams, institutional investors, or market makers (MMs) at the initial issuance, resulting in high concentration (top 10 addresses typically hold 30%-60%). For Alpha new coins, the top 10 addresses usually hold 50%-80%, while 95% is considered extremely concentrated.

From MYX to COAI, the manipulation tactics of whales have become increasingly sophisticated: first, they hype up hot topics, then use highly concentrated chips and control advantages to easily manipulate prices, and finally use contracts to amplify capital effects for high-level exits. If retail investors pile into shorts, whales can not only earn funding rates but also use liquidated funds to pump the price, further consolidating their control.

FOMO-Driven "Control Is Justice"

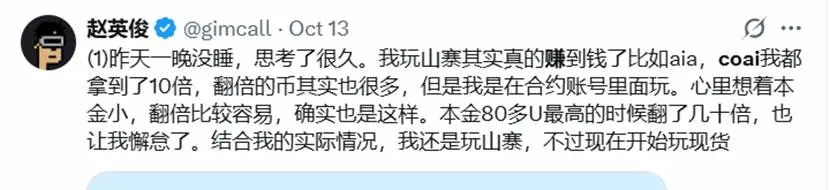

Recently, many users on X have posted screenshots flaunting their short-term gains, with survivor bias masking the massive losses from liquidations, creating an illusion of low expectations and high returns.

The community's attitude has also changed: from initially criticizing MYX as a "three-nothing project" (no code maintenance, no buyback commitment, no community foundation) and questioning the legitimacy of its multi-billion market cap, to now, with some investors swept up by FOMO sentiment, gradually accepting the idea that "control is justice," dreaming that the story of overnight wealth will happen to them.

Crypto investor @huahuayjy stated that the emergence of MYX is epoch-making for the crypto world. It has forcefully broken the ceiling for altcoins, making market makers and project teams realize the potential for huge profits from pumping. Subsequent imitators may drive a mini bull market for altcoins. However, opposing views argue that a true altcoin season depends on overall liquidity easing and new capital inflows, not just a few projects playing musical chairs. Others believe that the MYX model may signal the end of the bull market, making it harder for small projects to break out.

In addition, KOL sanyi.eth reflected that after losing money shorting MYX, he has actively avoided monster coins. COAI rose from 0.3 USD to 61 USD (UTC+8) and then retraced to 18 USD (UTC+8). Although the project previously raised about 17 millions USD and is positioned in the AI sector, its fundamentals are not weak. However, compared to its valuation, market sentiment is clearly overheated. Retail investors participating in such highly volatile coins usually end up being liquidated or paying high fees.

When a large number of retail investors are still flocking to MYX and COAI, it shows that the pursuit of fairness in the market has gradually given way to the pursuit of speculative gains. In other words, as long as they can still bet on contracts, many people don't care whether it's the project team and market makers pulling the strings behind the scenes.

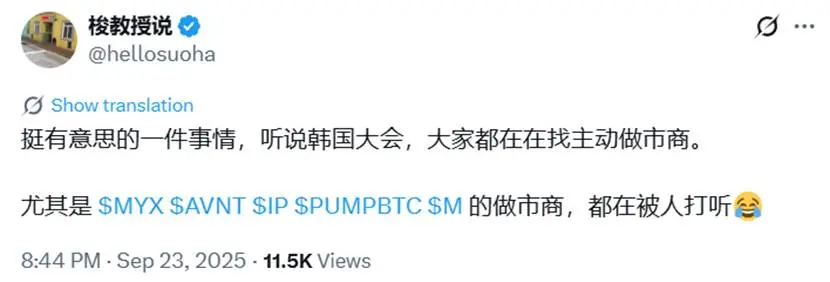

It is worth mentioning that, according to X user @hellosuoha, at last month's KBW 2025 conference in Seoul, South Korea, the trading depth of projects such as MYX, AVNT, and IP attracted attention. The market makers behind them have become key contacts for potential token-issuing project teams.

Similar models are being frantically replicated, and more MYX-style projects may emerge in the future. In this ecosystem, retail investors addicted to FOMO will only face more frequent liquidation lines.

Similar models are being frantically replicated, and more MYX-style projects may emerge in the future. In this ecosystem, retail investors addicted to FOMO will only face more frequent liquidation lines.

Does the Alpha Narrative Amplify the Harvest?

Essentially, the huge volatility of these coins after listing is partly due to direct manipulation by whales and project teams; on the other hand, the Alpha platform narrative accelerates retail entry, providing whales with a broader "hunting ground" and evolving into a standardized script that is faster to replicate and more ruthless in exit.

This may also reveal one of Binance Alpha's design intentions: to attract speculators with its low circulation and high volatility. After all, there will always be people willing to pay for volatility—some come for airdrops, some stay for short-term profits, and ultimately, some pay the price in volatility.

In addition to MYX, AIA, and COAI, which are highly controlled coins, many other chaotic phenomena have emerged on the Alpha platform: some projects go to zero or crash immediately after listing, others are involved in false narratives or code plagiarism. Overall, the platform's motivation to attract speculative funds far outweighs its motivation to incubate projects.

From another perspective, the emergence of Alpha is not inherently evil. It is simply a high-volatility experimental ground focused on early-stage new products. But when narrative, structure, and human nature combine, volatility becomes a harvesting machine. According to coinmarketcap data, Binance Alpha's 24-hour trading volume exceeds 8 billions USD (UTC+8), far surpassing many small and medium-sized crypto exchanges. This shows that such "barbaric growth" is not accidental, but the result of the combined effect of capital and traffic.

Conclusion

On one side, whales and project teams use the high volatility of the Alpha platform to create a green exit channel, while on the other, retail investors are still obsessed with the fantasy of the next "100x coin." Greed and fear are intertwined—human nature has always been this way. Instead of blindly chasing the next COAI, it's better to consider where you stand in this game.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

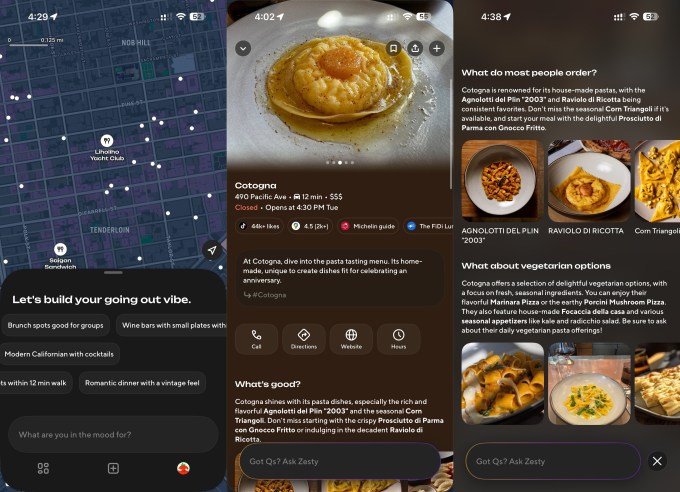

DoorDash rolls out Zesty, an AI social app for discovering new restaurants

Ethereum price plunges below $3,000, liquidations surge, volatility intensifies