Crypto entrepreneurs can get rich without issuing tokens—who is paying for the bubble?

The founder laughed, while investors panicked.

The founders are laughing, while investors are panicking.

Written by: Jeff John Roberts, Forbes

Translated by: Saoirse, Foresight News

Stories like this are often told in the startup world: founders toil for years, working tirelessly, and finally become multimillionaires when their company goes public or gets acquired. Such tales of wealth are also common in the cryptocurrency sector, except that the path to massive gains is often much shorter here.

Take a typical example: Bam Azizi founded the crypto payments company Mesh in 2020. This year, the company completed a Series B funding round, raising $82 million (with an additional round a few months later, bringing the total to $130 million). Normally, funds from Series A or B rounds are almost entirely used for business expansion. But in this case, at least $20 million from the round went directly into Azizi’s personal pocket.

This gain came from a “secondary equity sale”—that is, investors purchased shares held by the founder or other early participants. Such transactions mean that when a startup announces a funding round, the actual amount the company receives is often less than the headline figure; more importantly, the founder doesn’t have to wait years to cash out their shares, but can achieve financial freedom overnight.

This isn’t necessarily a bad thing. In response to comments about Azizi’s “unexpected windfall,” a Mesh spokesperson pointed to the company’s recent impressive achievements—including a partnership with PayPal and the launch of an AI wallet—to demonstrate the company’s healthy operations. Nevertheless, founders cashing out early through secondary equity sales (a common phenomenon in the current crypto bull market) means that some founders accumulate massive wealth before their company has truly proven its value—or may never do so. This raises questions: does such cashing out distort entrepreneurial incentives? And is the prevalent “get rich quick” culture in crypto reasonable?

A $7.3 Million Property Complex in Los Angeles

Mesh founder Azizi is not the only one to “secure profits early” in the current booming crypto market. This bull run began last year, during which bitcoin prices soared from $45,000 to $125,000, keeping the industry red-hot.

In mid-2024, crypto social platform Farcaster completed a remarkable Series A round—raising $150 million, led by venture capital firm Paradigm. Notably, at least $15 million of this $150 million was used to acquire secondary shares held by founder Dan Romero. Romero, an early employee of crypto giant Coinbase, held equity before the company went public and has never been shy about his wealth. In an interview with Architectural Digest, he revealed he was spending heavily to renovate a property in Venice Beach—a complex of four buildings worth $7.3 million, which Architectural Digest likened to “a small Italian village.”

However, while the property renovation is going smoothly, Farcaster’s development has been less than ideal. Despite a promising start, reports indicate the startup had fewer than 5,000 daily active users last year and is now far behind competitors like Zora. Romero has repeatedly declined to comment on Farcaster’s performance or his sale of secondary shares.

Although Farcaster raised $135 million ($150 million minus the $15 million cashed out by the founder), its predicament is not unique. In the crypto sector and the broader venture capital industry, investors are well aware that the probability of a startup failing is much higher than that of becoming an industry giant.

Omer Goldberg is another crypto founder who profited from the secondary equity sale boom. According to a venture capitalist involved in the deal, earlier this year his blockchain security company Chaos Labs completed a $55 million Series A round, with $15 million going directly to Goldberg personally. Chaos Labs is backed by PayPal Ventures and has become an important voice in blockchain security, but neither Goldberg nor Chaos Labs responded to requests for comment.

Venture capitalists and a crypto founder interviewed by Fortune said that Azizi, Romero, and Goldberg are just the tip of the iceberg among recent beneficiaries of secondary equity sales. For the sake of maintaining industry relationships, these sources all requested anonymity.

Investors point out that driven by the crypto market’s heat, secondary equity sales (which also occur in other hot startup sectors like AI) are on the rise. Venture firms such as Paradigm, Andreessen Horowitz, and Haun Ventures are all scrambling to participate in such deals.

In this context, if a VC agrees to let founders cash out some of their illiquid shares, they can secure lead investor status in a funding round or ensure they have “a seat at the table” in the deal. The typical model is: one or more VCs buy founder shares during a funding round and hold them long-term, hoping to sell at a higher valuation in the future. In some cases, early employees also get a chance to sell shares; but in others, news of the founder’s cash-out is kept completely secret from employees.

For investors, secondary equity sales carry significant risks: they receive common stock, which comes with far fewer rights than the preferred shares typical in funding rounds. Meanwhile, the crypto industry has a long history of “overpromising and underdelivering,” and secondary equity sales have sparked debate: how much reward should early founders receive? Do such deals affect a startup’s future from the outset?

Crypto Founders Are “Different”

For those who have observed the crypto industry for a long time, scenes of founders amassing huge wealth during bull markets may seem familiar. In 2016, the ICO boom swept the industry, with numerous projects raising tens or even hundreds of millions of dollars by selling digital tokens to VCs and the public.

These projects typically promised to “pioneer revolutionary new uses for blockchain” or “surpass Ethereum to become the world’s computer”—claiming that as the project attracted more users, the token’s value would soar. Looking back now, most of these projects have “vanished without a trace.” Some founders still appear at various crypto industry conferences, but others have disappeared completely.

A venture capitalist recalls that investors at the time tried to restrain founders’ behavior through “governance tokens.” In theory, holders of governance tokens had the right to vote on the project’s direction, but in practice, this restraint was almost meaningless.

“They’re called ‘governance tokens’ in name, but in reality, they don’t govern anything,” the VC said helplessly.

By the next crypto bull market in 2021, startup fundraising models began to resemble traditional Silicon Valley models—VCs received equity (though token sales via warrants remained a common part of VC deals). In some cases, founders also cashed out early through secondary equity sales, just like today.

Payments company MoonPay is a typical example: in a $555 million funding round, the executive team cashed out $150 million. Two years later, the deal caused a stir—media investigations revealed that just before the crypto market crashed in early 2022, MoonPay’s CEO spent nearly $40 million on a mansion in Miami.

NFT platform OpenSea had a similar situation. This once high-profile startup raised over $425 million in multiple rounds, with a large portion flowing into the founding management team’s pockets via secondary equity sales. However, by 2023, NFT popularity had plummeted and was almost ignored, and OpenSea announced a new strategy this month.

“You’re Building a Cult of Personality”

Given the crypto industry’s turbulent history, it’s natural to wonder: why don’t VCs require founders to accept more traditional incentive mechanisms? As one VC put it, under traditional mechanisms, founders can get enough money in Series B or C rounds to relieve life pressures like mortgages, but to get “massive returns,” they have to wait until the company goes public or is acquired.

Derek Colla, a partner at law firm Cooley LLP who has helped design many crypto industry deals, says the rules in crypto are “different.” He points out that compared to other startup sectors, crypto companies are “asset-light”—meaning that funds that might have gone to buying chips or hardware can now be distributed directly to founders.

Colla adds that the crypto industry relies heavily on “influencer marketing,” and there are plenty of people willing to “throw money at” founders. “Essentially, you’re building a cult of personality,” he commented.

Glen Anderson, CEO of Rainmaker Securities, a company specializing in secondary equity sales, believes the core reason founders can cash out early is simple—“they have the leverage.” “Whether it’s AI or crypto, many fields are in a hype cycle,” Anderson said. “In this market environment, as long as you tell a good story, you can sell at a high price.”

Anderson also said that founders selling shares doesn’t mean they’ve lost faith in the company’s future. But an unavoidable question is: if the company a founder is trying to build might “amount to nothing,” are they morally entitled to eight-figure wealth?

Lawyer Colla believes that such cash-outs don’t dampen founders’ entrepreneurial passion. He gave the example of MoonPay’s founder, who was criticized by the media for buying a mansion, but the company is still thriving today; and Farcaster’s struggles aren’t because founder Romero “isn’t working hard enough”—Colla said Romero “works harder than anyone.”

However, Colla also admits that the very best entrepreneurs usually choose to hold onto their shares long-term—they believe that by the time the company goes public, the shares will be worth far more than they are now. “The truly top founders won’t choose to sell shares on the secondary market,” he said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

It’s Over: 3 Reasons Why a Crypto Crash Is Happening

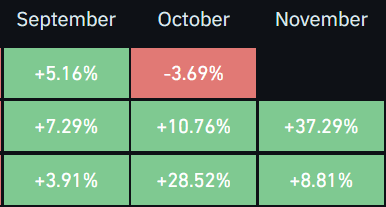

Crypto Market Performance: Why November Could Be the Next Big Month

Cardano Price Ready to Bounce as it Nears Support with Bullish Fundamentals

The Fog After the Plunge: Macro Liquidity Bottoms Out vs. Market Sentiment Reversal

Overall, the current market is in a volatile phase in the late stage of the bull cycle, with sentiment leaning pessimistic but liquidity not yet exhausted. If macro liquidity improves, the crypto market may continue its upward cycle; if liquidity remains constrained, it could accelerate the transition into the early stage of a bear market.