Key Notes

- Experts estimate quantum computers capable of breaking Bitcoin encryption could emerge within 5-10 years based on recent IBM and Google advances.

- Dormant Satoshi-era coins totaling 1.72 million BTC in outdated address formats face highest risk from quantum algorithm attacks.

- Bitcoin community remains divided on whether to burn vulnerable coins or migrate them, with proposed quantum-resistant solutions creating major scaling issues.

The Human Rights Foundation published a report on Oct. 31, 2025, warning that cryptographically relevant quantum computers pose a significant threat to Bitcoin BTC $109 556 24h volatility: 1.6% Market cap: $2.18 T Vol. 24h: $60.96 B security. The report states that 6.51 million BTC are vulnerable to quantum attacks within the next five years.

The vulnerable supply includes 1.72 million BTC in early Pay-to-Public-Key addresses, according to the report . These coins, valued at approximately $188 billion, are considered dormant and include an estimated 1.1 million BTC attributed to Satoshi Nakamoto. An additional 4.49 million BTC remain vulnerable, though active owners could migrate these funds to quantum-secure address types.

Timeline and Technical Threats

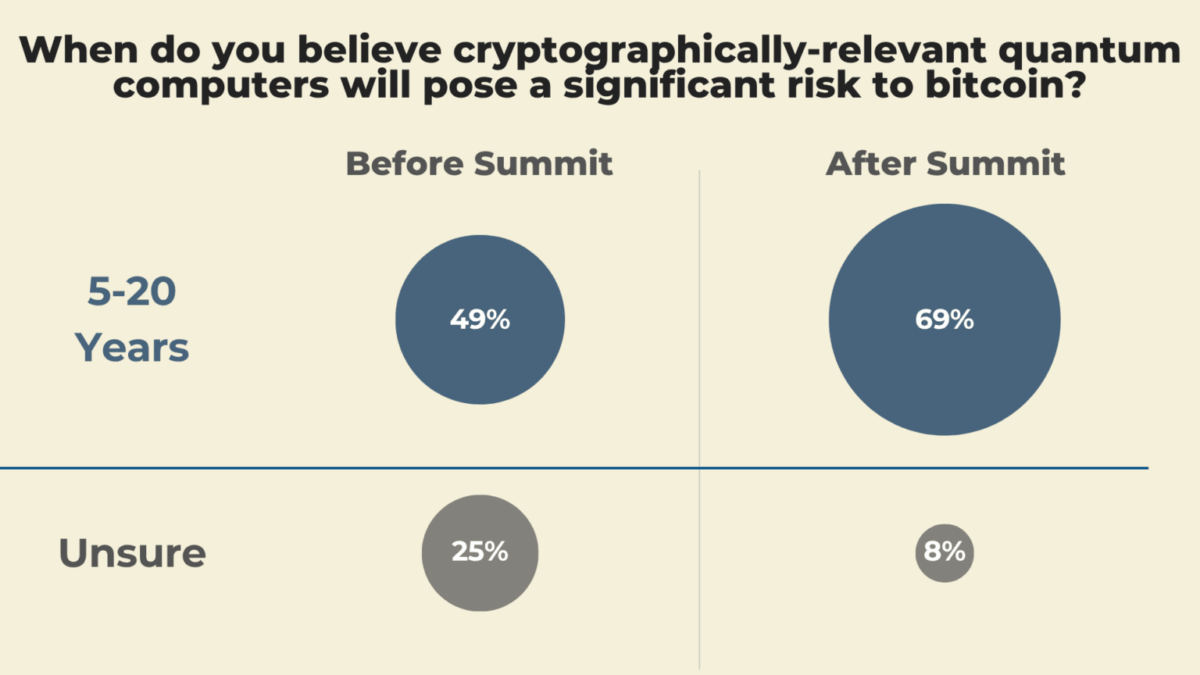

Eighty experts at the July 2025 Presidio Bitcoin Quantum Summit assessed that quantum computers capable of breaking Bitcoin’s encryption could emerge within 5-10 years. Market analyst Charles Edwards’ 2026 quantum threat warning aligns with the urgency expressed at the summit. Recent hardware advances from IBM, including a 120-qubit system, and Google’s 105-qubit Willow chip add material urgency to the threat assessment.

Presidio Bitcoin Survey | Source: Presidio Bitcoin

Quantum computers running Shor’s algorithm could execute long-range attacks on addresses with exposed public keys, including P2PK formats and reused addresses. Short-range attacks targeting new transactions during their brief exposure window also present risks to Bitcoin’s security model.

Community Debate Over Dormant Coins

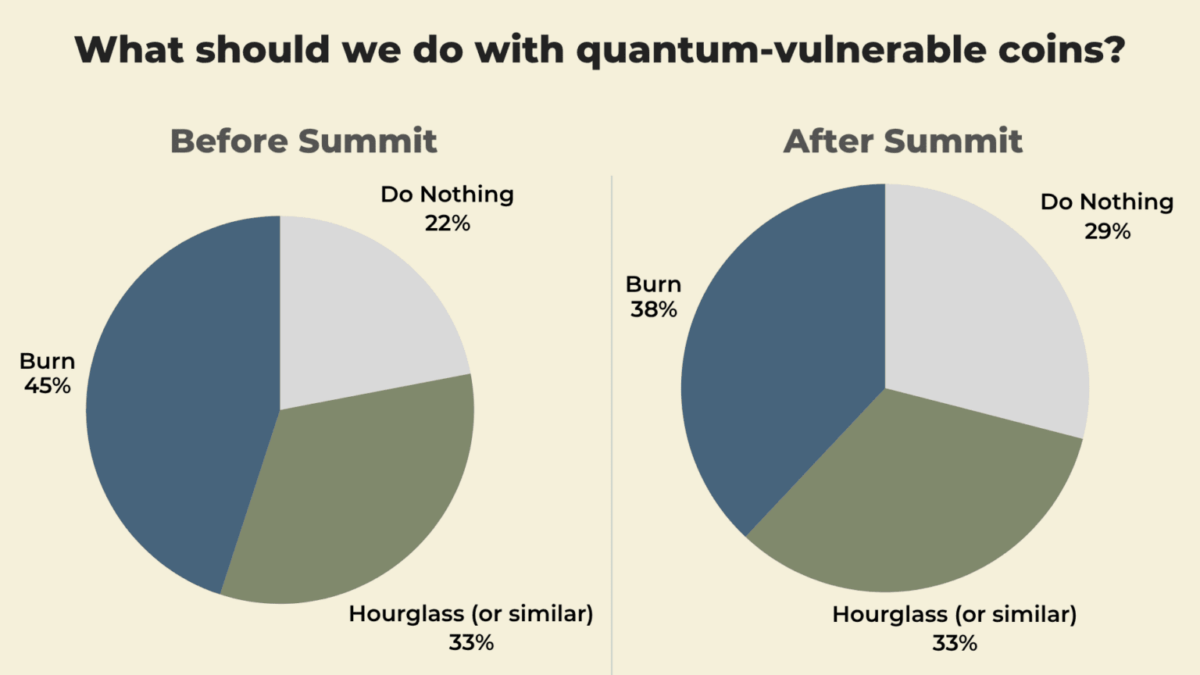

The report highlights a “burn or steal” dilemma dividing the Bitcoin community over how to handle the vulnerable Satoshi-era funds and other dormant coins in P2PK addresses. The Presidio Summit confirmed that no consensus has been reached on whether these coins should be destroyed or left vulnerable to potential theft by quantum attackers.

Presidio Bitcoin Survey | Source: Presidio Bitcoin

Multiple quantum-resistant signature schemes have been proposed, including lattice-based and hash-based approaches. However, these solutions are 10 to 38 times larger than current signatures, creating significant blockchain scaling challenges. The summit surfaced competing approaches, including SPHINCS+, Lifeboat, and BIP360 proposals, but participants did not converge on a single roadmap.

Experts reached consensus on one immediate action item: eliminating address reuse, particularly by exchanges and custodians. The summit emphasized that institutional custody solutions must adopt better operational practices to reduce vulnerability before quantum computers arrive.

next