Crypto Hacks Fall 85% In October 2025 – But How?

Most crypto hack losses in October 2025 stemmed from major security incidents at Garden Finance, Typus Finance, and Abracadabra.

The cryptocurrency market experienced a rare moment of relief in October, as the total value lost to hacks and exploits reached its lowest level of the year.

Data from blockchain security firm PeckShield shows that only $18.18 million was stolen across 15 separate incidents. This represents a steep 85.7% decline from the $127.06 million recorded in September.

Crypto Hacks Hit Year-Low Even as New Risks Emerge

The largest incidents of the month occurred at Garden Finance, Typus Finance, and Abracadabra, which collectively accounted for $16.2 million of the total stolen funds.

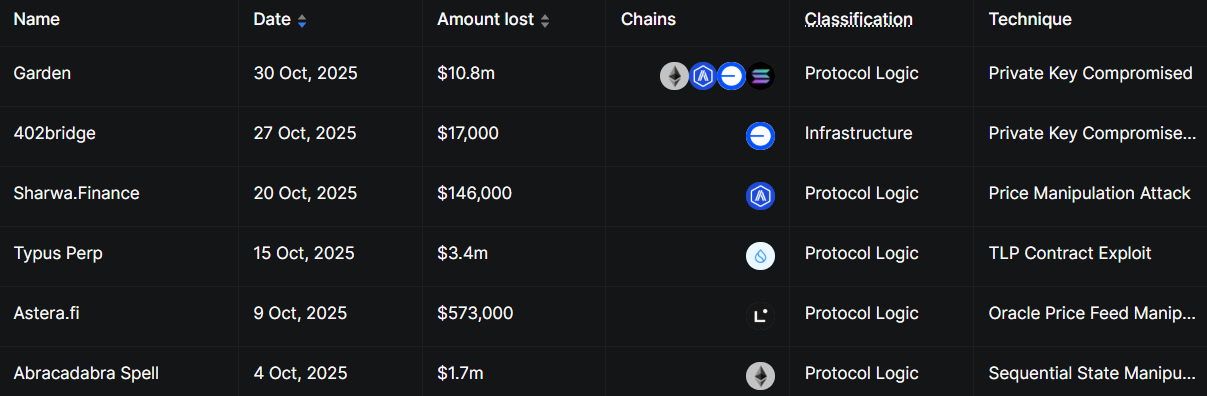

Top Crypto DeFi Hacks in October 2025. Source:

Top Crypto DeFi Hacks in October 2025. Source:

Garden Finance, a Bitcoin peer-to-peer protocol, disclosed on October 30 that it had been exploited for more than $10 million after one of its solvers was compromised.

The breach, which affected only the solver’s own inventory, pushed October’s loss figures higher in the final hours of the month.

Without the Garden Finance incident, total losses would have hovered near $7.18 million — the lowest single-month value since early 2023.

Typus Finance, a yield platform built on Sui, suffered an oracle manipulation attack on October 15. The exploit drained roughly $3.4 million from its liquidity pools.

Investigators later traced the attack to a flaw in one of its TLP contracts, which caused the project’s native token to drop by about 35%.

Around the same time, DeFi lending platform Abracadabra endured its third exploit since launch. The attack resulted in roughly $1.8 million in MIM stablecoin losses after hackers bypassed solvency checks through a smart contract vulnerability.

While October’s modest loss figures suggest improved protocol security, cybersecurity experts warn that the threat landscape continues to evolve.

Earlier this month, BeInCrypto reported that state-sponsored groups, particularly North Korea-linked hackers, are experimenting with embedding malicious code directly into blockchain networks. This emerging tactic could bypass traditional security layers and create new risks for decentralized systems.

Essentially, this emerging phase of blockchain-focused cyberwarfare highlights a sobering reality that while DeFi protocols strengthen their defenses, threat actors continue to evolve at the same pace.

So, the industry’s best month of 2025 may therefore mark a temporary reprieve rather than the start of lasting safety.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Pi Coin Faces Critical $0.29 Threshold—Will It Recover or Is This a Temporary Surge?

- Pi Coin's 26% surge to $0.2610 triggered a golden EMA crossover, signaling short-term bullish momentum despite weak institutional buying indicators. - Fibonacci support at $0.20-$0.22 and a bullish engulfing candle suggest potential for a $0.29 retest, but bearish divergences in RSI/MFI persist. - A $0.29 breakout could validate a falling wedge reversal toward $0.37, while breakdown below $0.20 risks exposing $0.15 support amid 36.8% three-month losses. - Rising Smart Money Index and retail participation

JP Morgan CEO Reverses Stance on Cryptocurrency

Trader’s 100% Win Rate Influences BTC, ETH, SOL Moves

From Ethereum Misses to La Culex Wins: A Next 1000x Crypto Presale Deep Dive