Bitcoin Stays Flat Despite Historic US–China Trade Deal Announcement

Despite the US-China breakthrough, Bitcoin showed little reaction, rising less than 1% as selling pressure from long-term holders persisted.

The United States and China have taken a major step toward easing trade tensions, agreeing to suspend several tariffs that have rattled global markets this year.

Yet, despite the diplomatic breakthrough, Bitcoin’s price has not mirrored the optimism expected from such a deal.

US-China Reach Historic Agreement

On November 1, the White House announced that President Donald Trump and Chinese President Xi Jinping had reached a trade and economic agreement. The deal was finalized during meetings held in the Republic of Korea.

Under the deal, China will suspend new export controls on rare earth elements and grant general licenses for their shipment. Beijing also pledged to curb fentanyl exports to the United States and pause all retaliatory tariffs imposed since March 4.

In return, Washington will reduce tariffs on Chinese goods by 10% and extend existing tariff exemptions through November 2026.

“[This is] a massive victory that safeguards US economic strength and national security while putting American workers, farmers, and families first,” The White House stated.

The Kobeissi Letter, a macroeconomic research firm, described the accord as the most substantial thaw in US–China trade relations in years, noting its potential to ease global supply-chain strain.

Bitcoin Shrugs Off Diplomatic Optimism

Yet financial markets are showing little enthusiasm to the news.

Bitcoin, which often reacts to geopolitical and macroeconomic signals, recorded a modest gain of less than 1% in the past 24 hours. It was trading at $110,785 at press time.

Indeed, the muted response contrasts sharply with the volatility recorded in October. At the time, Trump’s announcement of new retaliatory tariffs sparked a $20 billion liquidation wave across crypto markets.

Meanwhile, industry analysts say the muted price response this time reflects deeper structural shifts in Bitcoin ownership rather than a loss of macro sensitivity.

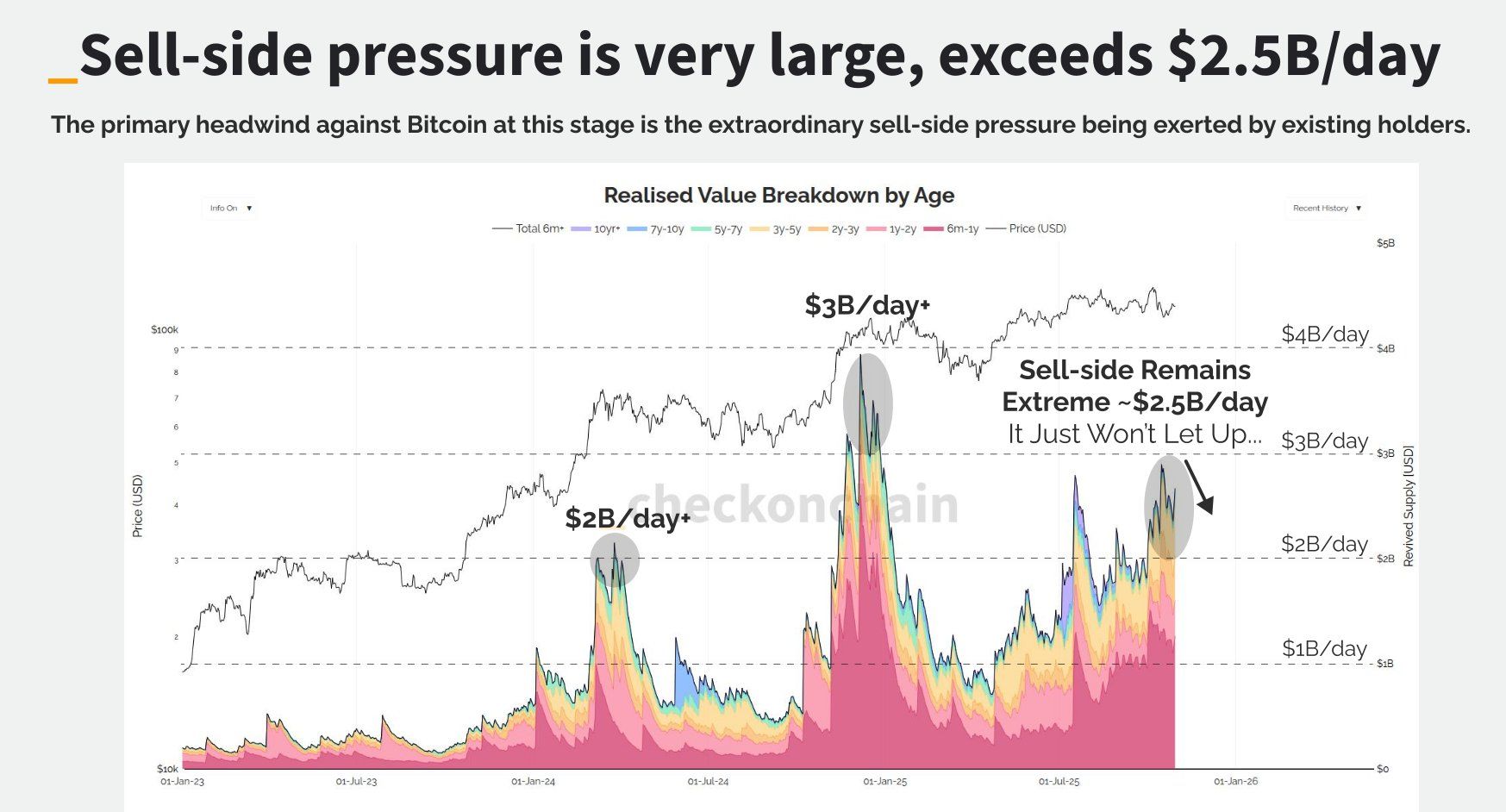

James Check, a Bitcoin on-chain analyst, observed that older holders are offloading coins at an accelerated rate in comparison to previous cycles.

He noted that Bitcoin’s sell-side pressure remains intense, with the average age of coins being sold now around 100 days. This represents a sharp rise from the 30-day average seen in the previous period.

Bitcoin Selling Pressure. Source:

Bitcoin Selling Pressure. Source:

This shift, he explained, signals a transition in which long-term holders are offloading their positions to patient, deep-pocketed newcomers entering the market.

“We are watching a changing of the guard, from the OGs who rode the early risky waves, into the new pool of TradFi buyers who like calmer waters,” Check explained.

Despite the short-term price weakness, experts maintain that Bitcoin’s long-term fundamentals remain intact. The current rotation, they argue, marks a natural evolution of the asset’s maturity — where seasoned traders exit and traditional finance begins to take hold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

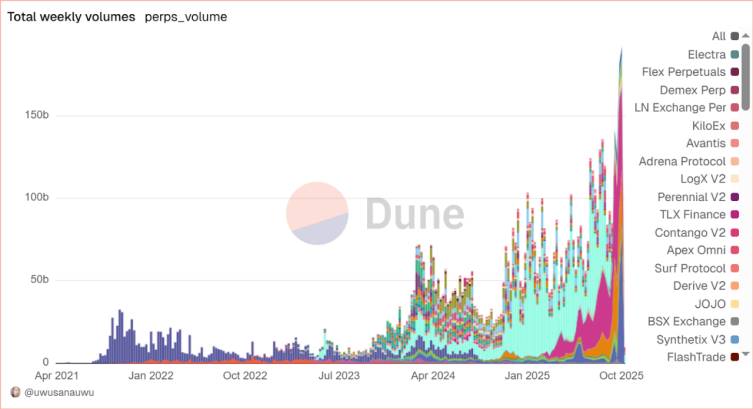

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.