Web3’s Future Focuses on Real Economic Utility

- Yi He prioritizes real utility in Web3.

- Venionaire supports economic activity over speculation.

- Bitcoin ETFs increase interest in sector utility.

Web3’s future centers on practical applications rather than speculative hype. Key players like Binance emphasize creating real value, while institutional backing, including Bitcoin ETFs, enhances adoption—shifting focus to utility-driven growth and infrastructure advancements.

Yi He of Binance emphasizes Web3’s future on real economic activity rather than hype, aligning with efforts from Venionaire Capital.

The transition to Web3 highlights a shift toward practical utility, moving beyond hype-driven cycles .

BTC, ETH, and altcoins benefit from increased institutional focus.

Binance’s leadership underlines Web3’s shift to real economic activity . Yi He stresses user-focused value creation, supported by Venionaire’s investment in practical Web3 applications. These actions reflect a broader trend of prioritizing functionality over speculation.

Shifts in Web3 result in enhanced real-world applications affecting Bitcoin, Ethereum, and other major cryptocurrencies. With fresh institutional interest, sectors like Layer-2 scaling and tokenization see significant growth, supported by data showing rising Total Value Locked (TVL).

The industrial shift to Web3 places greater trust in projects like Uniswap and cross-chain bridges , ensuring long-term economic stability. Ethereum’s role in these developments remains critical, as evidenced by increased developer and institutional commitment.

The focus on real utility over speculation transforms Web3, with Layer-2 and real-world asset tokenization drawing keen attention. Binance and Venionaire Capital are pivotal in developing infrastructure that benefits traditional finance and decentralized systems. Regulatory and technological advancements support a seamless Web3 integration, fostering ongoing mainstream acceptance.

“It’s not about which version of the web you’re in—it’s about whether you’re creating real value for users.” – Yi He, Co-founder, Binance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

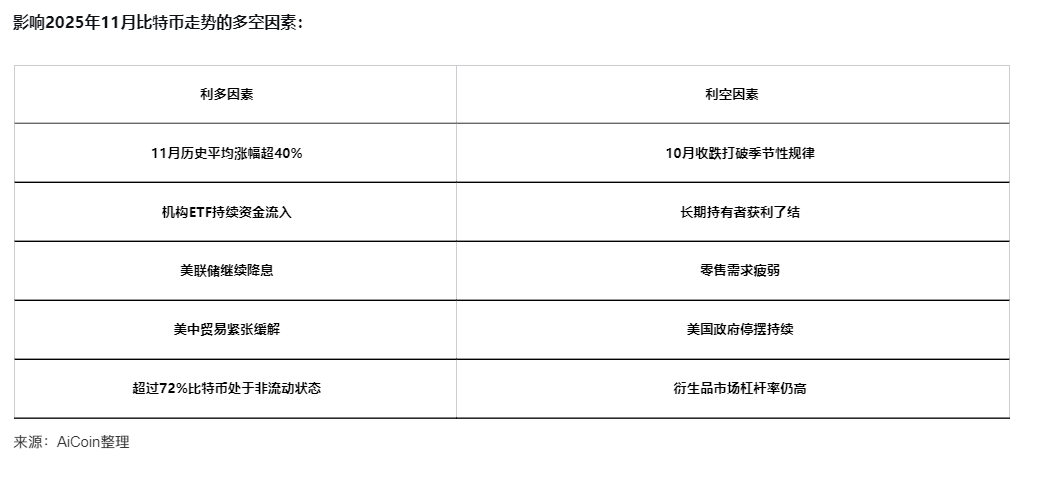

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle