Spot XRP ETFs May Arrive in Near Future

Nate Geraci, one of the most authoritative exchange-traded fund analysts, has stated that he expects the first XRP ETFs to launch within the next two weeks.

As reported by U.Today, Canary Capital recently submitted an updated S-1 filing for its spot Solana ETF.

In the meantime, Bitwise's fourth S‑1 amendment has added a 0.34% fee as well as an NYSE listing. This, according to various analysts, also indicates that the XRP is on the verge of going live.

The list of other firms that are vying to launch XRP ETFs includes Grayscale Investments, 21Shares, WisdomTree, CoinShares, and, of course, financial giant Franklin Templeton.

Notably, both BlackRock and Fidelity decided to remain on the sidelines of the race despite the latter filing for a similar Solana-based product.

The REX/Osprey XRP product, which has already surpassed $100 million in assets under management, claims to provide spot exposure to the token, but it does not hold just the underlying asset like the funds that are on the verge of launching in the US.

"Final nail in the coffin"

Geraci is convinced that the launch of the traditional spot XRP ETF will be "the final nail in the coffin" for anti-crypto regulators.

He recalled that the SEC had open litigation against Ripple up until several months ago.

As reported by U.Today, Ripple dropped its cross-appeal in July, and the two parties then filed a joint dismissal of their appeals in August. The closure of the case was then finalized by the United States Court of Appeals for the Second Circuit during the same month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

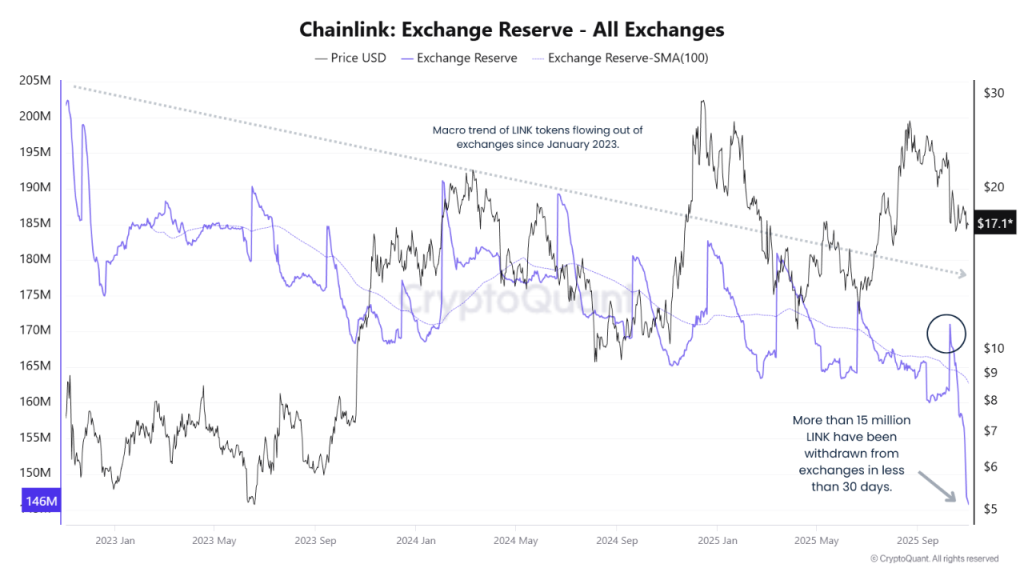

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including