Dogecoin News Today: Contrasting Paths in Crypto: ADA and DOGE Face Challenges While BlockDAG's Presale Gains Momentum

- Cardano (ADA) confirms a "death cross" on hourly charts, dropping below $0.60 after large holders sold 100M ADA, intensifying bearish pressure. - Dogecoin (DOGE) consolidates near $0.18 support, with DeFi growth (5.10% 24h TVL rise) and technical indicators suggesting potential for $0.25-$0.33 gains if support holds. - BlockDAG's $435M presale surges, attracting 312K holders and institutional backing, with a planned $0.05 Feb 2026 listing positioning it as a "Layer-1 breakout" candidate. - Divergent cryp

Cardano (ADA), currently ranked as the tenth-largest cryptocurrency, is experiencing renewed downward momentum after a "death cross" appeared on its hourly chart, indicating stronger short-term selling pressure. ADA has dropped for four straight days, sliding from a weekly peak of $0.693 to below $0.60. Experts point to significant profit-taking by major investors, who offloaded 100 million

At the same time,

The differing paths of these assets highlight broader trends in the market. While ADA and DOGE face technical and macroeconomic headwinds, there remains strong demand for high-growth speculative plays in the crypto space. Observers suggest that DOGE's DeFi developments and ADA's on-chain metrics will be key for short-term direction, while upcoming blockchain projects could bring new liquidity factors in early 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

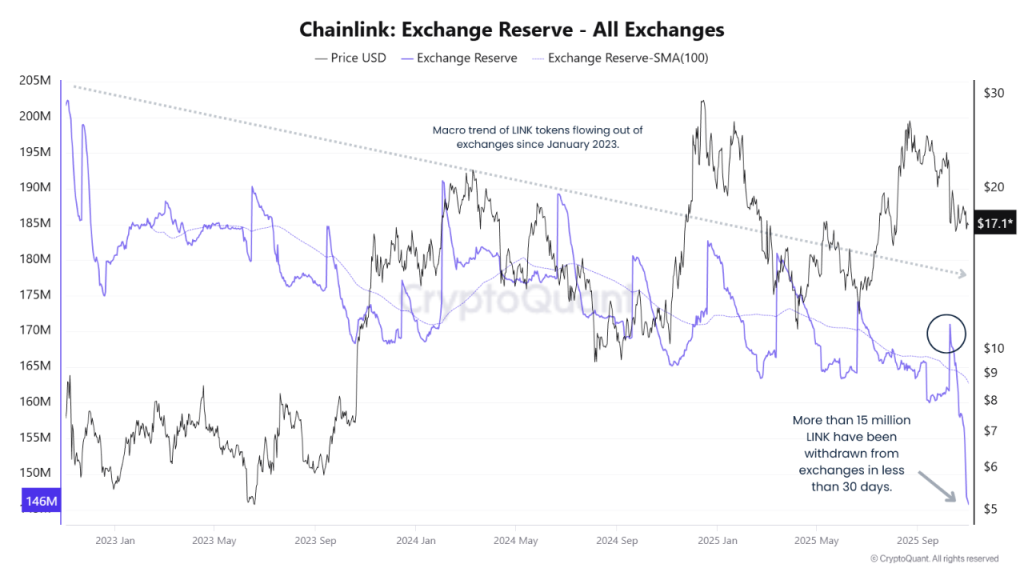

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including