Balancer Hack Drains Over $110M from DeFi Pools, Here's What Happened

Balancer ( $BAL ) suffered a massive exploit draining over $110 million from its liquidity pools. The attack, initially estimated at $70–88 million, was later confirmed to be far more severe.

Balancer’s official account acknowledged the exploit hours after reports surfaced, confirming that their v2 pools were affected and that internal teams were investigating with “high priority.” The announcement came only after widespread panic and a sharp selloff in both DeFi tokens and Bitcoin, which fell below $108,000.

Balancer Hack: What Happened

According to early data from CoinDesk , the exploit targeted multiple liquidity pools — including WETH, osETH, and wstETH — draining an estimated $70M to $88M within hours.

Shortly after, on-chain analysts such as Lookonchain reported that the stolen amount had surged past $116 million, suggesting the attacker continued siphoning funds even as Balancer began mitigation efforts.

The project has not disclosed the precise vulnerability yet but stated:

“We’re aware of a potential exploit impacting Balancer v2 pools. Our engineering and security teams are investigating with high priority.”

Market Reaction: DeFi Fear and Bitcoin Selloff

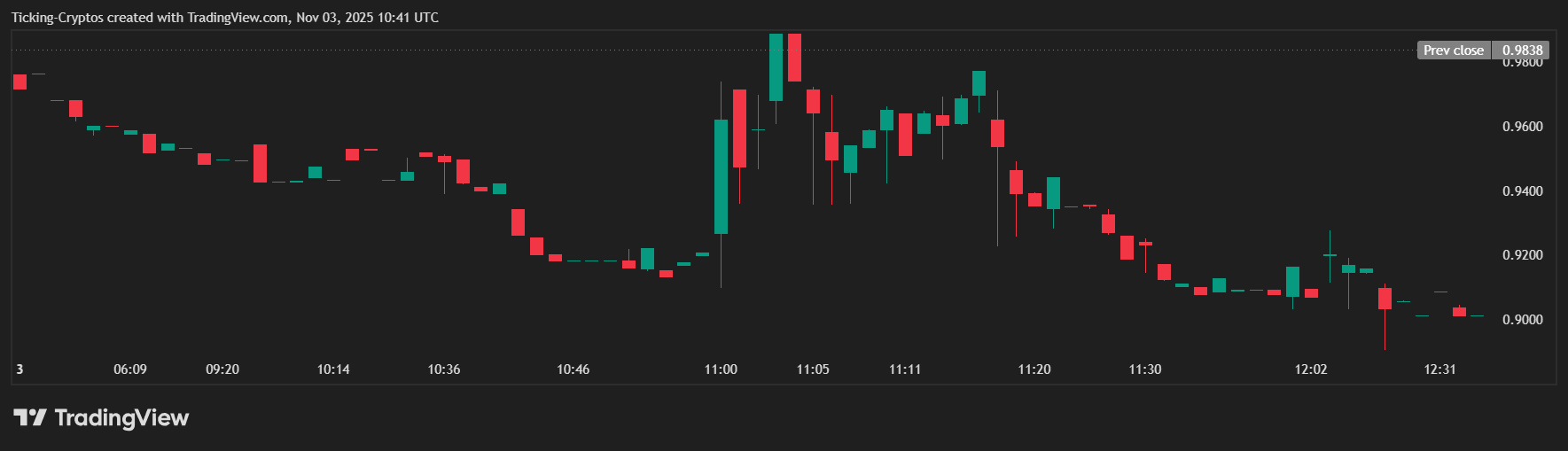

The exploit’s impact was immediate. The Balancer ($BAL) token dropped over 10% intraday, trading near $0.90 — a steep fall from its previous close around $0.98.

The broader crypto market also felt the shockwave. Reports indicate that traders rushed to de-risk their DeFi exposure, leading to additional sell pressure on $Ethereum, $Solana, and $BNB.

At the same time, Bitcoin ($BTC) defended the $107K support level amid heavy volatility. Analysts noted that Bitcoin’s resilience might be linked to traders exiting altcoins and rotating into BTC as a temporary safe haven.

BAL Token Price Analysis

According to the attached chart, BAL/USD shows a sharp downward candle pattern consistent with panic selling.

- Current BAL Price: $0.90

- 24h Change: -10.6%

- Previous Close: $0.9838

- Support Zone: $0.88 – $0.90

- Resistance Zone: $0.95 – $1.00

If panic continues, BAL could test the $0.80 level, though a stabilization near $0.90 might signal a short-term bottom, especially if Balancer issues a detailed recovery plan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Introducing FlipAI Agents: Data Science in Your Pocket

Whale Shorting of ASTER Reaches $11.9 Million Profit

SOL Rallies on ETF Hype, TON Faces Pressure, & BlockDAG’s $435M+ Presale Inspires Market Confidence

The ZKsync praised by Vitalik had already developed the fastest zkVM.

In terms of a single GPU, Airbender not only has the fastest verification speed but also the lowest cost.