Is the Web3 industry entering a "new era of compliance"? Are we pursuing the wrong kind of "mass adoption"?

As traditional financial institutions are actively promoting the large-scale adoption of blockchain technology, should the Web3 industry also reconsider its own development direction?

As traditional financial institutions are actively driving the large-scale application of blockchain technology, should the Web3 industry also reconsider its own development direction?

Written by: Spinach Spinach

Recently, the industry has been abuzz with discussions about Ethereum FUD. Not long ago, there was a three-hour-long Space discussion on Twitter titled "What’s Going on with Ethereum?" I participated throughout and heard many brilliant perspectives. From the game between Ethereum and Layer2, to ideological, organizational, and historical lessons, I gained a comprehensive understanding of the current dilemmas facing Ethereum and the industry, and felt everyone’s deep love and harsh criticism for Ethereum.

During the Space, I was already brewing some thoughts internally, but I was very hesitant to share them because I knew my views differed significantly from most Web3 natives and I feared backlash (being well aware of the toxic atmosphere in the industry). So I didn’t speak up at the time, but later decided to stand up and share my perspective, attempting to offer a new angle from the application layer—often discussed but rarely deeply examined—to observe the challenges facing Ethereum and the entire industry. Although this view may not be mainstream, I believe only through rational and honest discussion can the industry move toward a healthier direction.

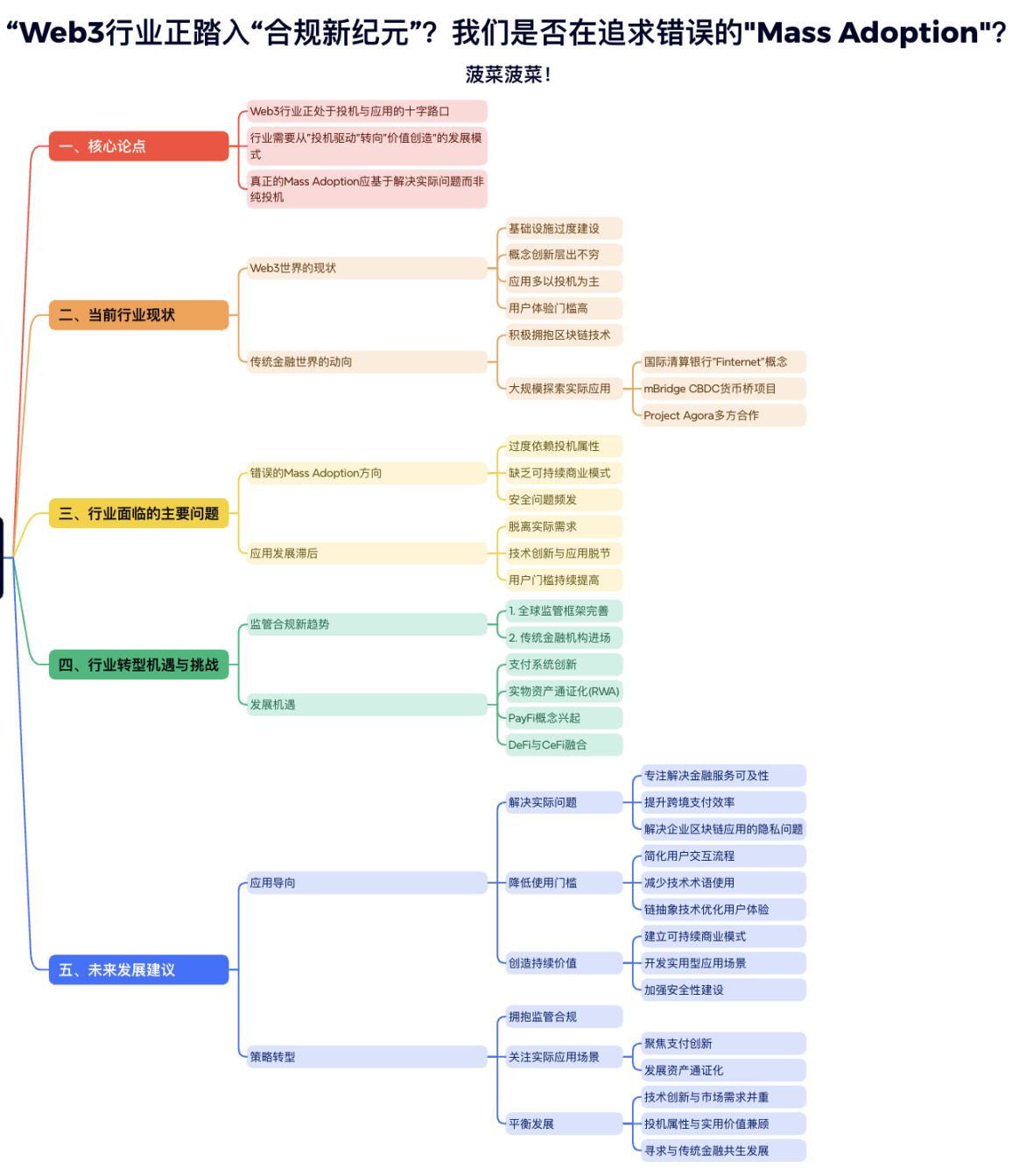

The article is quite long, so I’ve prepared an AI summary for those who don’t want to read the full text.

Background

Before sharing my views, let me introduce my current work background. Many followers may have noticed that my output frequency has dropped significantly over the past long period, and I rarely comment on the industry anymore.

This is because, over the past year, as a founding member of the Singaporean FinTech startup Ample FinTech, I have been deeply involved in project collaborations with three national central banks on tokenization and cross-border payments. This experience has shifted my mindset and focus beyond the pure Web3 circle, directing my attention to the strategic moves of global central banks and traditional financial institutions.

During this period, I began spending a lot of time researching blockchain and tokenization reports and papers published by traditional forces, understanding the projects they are working on, while also keeping an eye on industry trends on Twitter and communicating with friends to stay updated on Web3 developments. By simultaneously following the application development trajectories of both the Web3 circle and the traditional financial system, I have been able to build a more comprehensive cognitive framework between the two dimensions, giving me a different perspective on the industry’s future.

Fragmented Parallel Worlds

This dual perspective, being in both worlds at once, has made me increasingly aware of the disconnect in atmosphere and development paths between the two fields. In the Web3 world, the common complaint is: more and more technical infrastructure is emerging, new concepts and terms are endlessly created, complexity is deliberately manufactured, raising the bar for understanding, and ultimately, most efforts are aimed at impressing Vitalik and exchanges. After TGE, projects almost always become "ghost towns." Who really cares about actual utility?

Recently, the focus of discussion has shifted to questioning Vitalik and the Ethereum Foundation. More and more voices are complaining: Vitalik and the Foundation seem overly obsessed with "technical theorizing" and "idealistic pursuits," investing massive energy into technical details while showing little interest in users’ real needs and commercial exploration. This tendency has sparked widespread concern within the industry.

During the Space, Mr. Meng Yan (@myanTokenGeek), drawing on the historical experience of internet development, pointed out sharply: this development path that is detached from consumers and the market is unsustainable. If Ethereum continues its "technology-first" approach, such concerns are not unfounded.

However, when we look outside the crypto circle, we see a completely different picture: traditional financial forces and governments worldwide are significantly changing their attitudes toward Web3 technology. Not only do they see blockchain and tokenization as crucial upgrades to existing payment and financial systems, but they are also proactively exploring transformation paths. This shift is certainly due to recognition of new technologies, but more deeply, it may stem from sensing the disruption and threat Web3 technology poses to the existing order.

In 2024, a milestone turning point appeared: the Bank for International Settlements (BIS), known as the "central bank of central banks," officially proposed the concept of "Finternet" (Financial Internet).

This move is highly significant—it positions tokenization and blockchain technology as the next-generation paradigm for the human financial and monetary system, instantly causing a sensation in the traditional financial world and becoming one of the most talked-about topics.

This is not just the introduction of a new concept, but a major endorsement of blockchain and tokenization technology by the traditional financial sector. Its impact spread rapidly: major global financial institutions and central banks accelerated their efforts, engaging in unprecedented exploration in building tokenization infrastructure, asset digitization, and payment applications.

Behind these major initiatives is not a hasty decision by the BIS, but a strategic choice based on years of in-depth research. I spent a lot of time tracing and studying the BIS’s decision-making trajectory and discovered a gradual development pattern: as early as 2018, the BIS began systematically researching Web3 technology and has since published dozens of highly professional research papers.

In 2019, the BIS took a key step—establishing the BIS Innovation Hub to systematically conduct blockchain and tokenization experimental projects. This series of in-depth research and practice led them to realize an important fact: behind blockchain technology and tokenization lies enormous potential to reshape the global financial landscape.

Among the BIS’s many experimental projects, the most iconic is mBridge—a CBDC cross-border payment bridge jointly launched in 2019 by the BIS Hong Kong Innovation Hub, the People’s Bank of China, the Hong Kong Monetary Authority, the Bank of Thailand, and the Central Bank of the UAE. Technically, mBridge is essentially a public permissioned chain based on EVM, operated by the central banks of participating countries as nodes, supporting direct cross-border settlement of central bank digital currencies (CBDCs) on-chain.

However, history is always full of dramatic twists. In the current complex geopolitical landscape, especially after the outbreak of the Russia-Ukraine conflict, this project—originally intended to improve cross-border payment efficiency—unexpectedly became an important tool for BRICS countries to circumvent SWIFT international sanctions.

This situation forced the BIS to withdraw from the mBridge project at this stage. Recently, Russia has even launched the BRICS Pay international payment settlement system based on blockchain technology, pushing blockchain to the forefront of geopolitical competition.

Another major BIS initiative is the launch of the largest public-private partnership project in blockchain history—Project Agora. This project brings together an unprecedented lineup: seven major central banks (the Federal Reserve, the Bank of France representing the EU, the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, and the Bank of England), as well as more than 40 global financial giants including SWIFT, VISA, MasterCard, and HSBC.

Such large-scale cross-border collaboration has a surprisingly clear goal: to use blockchain technology and smart contracts to build a globally unified ledger system while maintaining the existing financial order, thereby optimizing the current financial and monetary system. This move itself is a strong signal: the momentum of blockchain technology is unstoppable, traditional financial forces have shifted from watching to fully embracing it, and are actively promoting its application in real-world scenarios.

In contrast, the Web3 industry, while chanting the slogan of Mass Adoption every day, is actually obsessed with hyping meme coins and indulging in the short-term attention economy. This stark contrast prompts deep reflection: as traditional financial institutions are actively driving the large-scale application of blockchain technology, should the Web3 industry also reconsider its own development direction?

Mass Adoption: Casino or Application?

In this fragmented development landscape, we must consider a fundamental question: "What is true Mass Adoption?" Although this term frequently appears in Web3 discussions, it seems everyone has a significantly different understanding of it.

Looking back at the so-called "hit projects" in Web3 over the past few years, an intriguing pattern emerges: those projects claiming to achieve "Mass Adoption" are essentially speculative games disguised as innovation. Whether it’s the endless stream of MEME coins, the "P2E" model under the GameFi banner (such as the once-popular running shoe project), or SocialFi projects touting social innovation (like http://Friend.tech), upon closer inspection, they are all carefully packaged "digital casinos." While these projects attract a large influx of users in the short term, they do not truly address users’ real needs and pain points.

If Mass Adoption simply means getting more people to participate in speculation and drive up token prices, then this "Adoption" is merely a zero-sum game concentrating wealth among a few, and its unsustainability is obvious.

I have personally witnessed too many cases of friends outside the circle losing everything after entering the crypto space, with very few actually profiting. This phenomenon is also confirmed by recent data: a recent on-chain data analyst’s research shows that on the http://pump.fun platform, only 3% of users made more than $1,000 in profit. Behind this cold statistic lies the reality that profiting from coin speculation is a game for the very few.

Even more worrying is that the entire industry has become a hotbed for hackers, phishing, and scams. It’s common to see news on Twitter about some whale losing heavily to Permit phishing. Not to mention ordinary retail investors—according to the latest FBI report, in 2023 alone, Americans suffered over $5.6 billions in crypto scam losses, and shockingly, victims over 60 years old accounted for 50% of the total. The interests of many ordinary investors simply cannot be protected in this "dark forest."

Speculation and increasingly severe hacking have made the industry environment worse and worse, prompting us to reflect: are we chasing the wrong direction for "Mass Adoption"? In the frenzy of speculation, are we ignoring the creation of truly sustainable value?

To be clear, I am not completely denying the speculative nature of Web3. After all, most participants enter this field seeking investment returns, and this profit-driven motivation is understandable; speculation will continue to exist. However, Web3 should not—and cannot—stop at being a global casino. It needs to develop truly sustainable and valuable application scenarios.

Among these, payments and finance are undoubtedly the application areas with the greatest potential for Web3 technology to land. This has already become a consensus among traditional financial forces, national governments, and the market: we see traditional financial forces exploring various innovative applications on a large scale, including payment system innovation, real-world asset tokenization (RWA), integration of DeFi and traditional finance, and the emerging PayFi concept. These active explorations and practices clearly point to the most urgent needs of the current market.

In my humble opinion, for Ethereum or the industry, the core issue may not be whether the technical direction is correct, but whether we truly understand what constitutes a valuable application. When we focus excessively on technological innovation but ignore market demand; when we are obsessed with creating concepts but stray from real scenarios—is this really the right development direction?

This line of thinking leads to a deeper concern: if we continue down this path, could it be that the traditional financial system or SWIFT network we once aspired to disrupt will instead become the main force driving the true large-scale adoption of blockchain? Furthermore, could we see a situation where public permissioned blockchain systems led by traditional financial forces and governments dominate most real-world application scenarios, while public chains are marginalized as niche "speculation playgrounds"?

While the Web3 industry’s attention is still focused on Ethereum "challengers" like Solana, it seems no one is paying attention to the fact that traditional financial forces have already sounded the charge. In the face of this upheaval, should Ethereum or the entire industry be thinking not only about current development strategies, but also about how to position themselves and articulate their value proposition in the coming wave of industry compliance? Perhaps this is the real test facing the industry.

After observing these trends, I have the following thoughts on the path to truly healthy and sustainable Mass Adoption for the industry:

The first priority is solving real problems: Whether infrastructure or applications, we should be grounded in real needs and focus on addressing genuine pain points. For example, many ordinary people and SMEs around the world still have difficulty accessing financial services; for example, privacy issues for enterprises using blockchain, etc. The value of technological innovation must ultimately be reflected in solving real problems.

Secondly, lowering the threshold for use: The ultimate goal of technology is to serve users, not create barriers. The endless stream of terms and complex concepts in today’s Web3 world actually hinders true adoption to some extent. We need to make technology more accessible, such as using (Based Chain Abstraction) to solve user experience issues.

Third, creating sustainable value: Healthy industry development must be built on sustainable business models, not over-reliance on speculation. Only projects that truly create value can survive the test of the market in the long term, such as Web3 payments, PayFi, and RWA, etc.

The importance of technological innovation is beyond doubt, but we must also recognize: applications are the primary productive force. Without real applications as a foundation, no matter how much infrastructure or how advanced the technology, it is ultimately just a castle in the air.

The Turning Point for Web3 Application Mass Adoption Has Arrived

Looking back at history, attempts to combine blockchain with the real world have never ceased, but often failed to materialize due to untimely conditions, regulatory restrictions, or technical bottlenecks. However, the current situation presents an unprecedented opportunity: technical infrastructure is maturing, traditional financial forces are actively embracing innovation and exploring real applications, and regulatory frameworks around the world are gradually improving. All these signs indicate that the next few years may become a key turning point for Web3 applications to achieve large-scale adoption.

At this critical juncture, regulatory compliance is both the biggest challenge and the greatest opportunity. More and more signals show that the Web3 industry is gradually moving from its initial "wild era" into a "new era of compliance." This shift not only means a more regulated market environment, but also heralds the beginning of truly sustainable development.

This shift is reflected on multiple levels:

1. Regulatory frameworks are becoming more complete

- Hong Kong has launched a comprehensive Virtual Asset Service Provider (VASP) regulatory regime

- The EU’s MiCA Act has been officially implemented

- The US FIT21 Act passed the House of Representatives in 2024

- Japan amended the Payment Services Act to provide a clear definition for crypto assets

2. Standardized participation by traditional financial institutions

- Large asset management institutions such as BlackRock have launched Bitcoin and Ethereum ETFs

- Traditional banks have begun providing custody services for crypto companies and launching tokenized bank deposits

- Mainstream payment companies have launched compliant stablecoins

- Investment banks have set up digital asset trading departments

3. Compliance upgrades of infrastructure

- More exchanges are proactively applying for compliance licenses

- Widespread adoption of KYC/AML solutions

- The rise of compliant stablecoins

- Application of privacy computing technology in compliant scenarios

- Launch of central bank-level blockchains (CBDC currency bridge mBridge, Singapore Global Layer 1, BIS Project Agora, etc.)

4. Regulatory pressure on Web3 and project compliance transformation

- The largest decentralized stablecoin project MakerDAO is transforming to Sky to embrace compliance

- The FBI is conducting phishing enforcement against MeMe project market makers

- DeFi projects are beginning to introduce KYC/AML mechanisms

In this trend, we are seeing:

- More traditional financial institutions entering the Web3 field through acquisitions or partnerships

- Traditional financial forces continuously gaining pricing power over Bitcoin through BTC ETFs

- A new generation of compliant Web3 applications rising rapidly

- The entire industry gradually establishing order under regulatory pressure, with fewer overnight riches opportunities

- Stablecoin use cases shifting from speculation to substantive uses such as international trade

There is no doubt that the future main battleground for blockchain technology will focus on several key areas: payment system innovation, real-world asset tokenization (RWA), the emerging PayFi concept, and the deep integration of DeFi and traditional finance (CeFi). This reality brings an unavoidable proposition: if the industry is to achieve breakthrough development in real applications, it must directly engage with regulators and traditional financial institutions. This is not a multiple-choice question, but a necessary path for development.

The reality is that regulation always sits at the top of the industry ecosystem. This is not only an objective fact, but also an iron law repeatedly validated over more than a decade of crypto industry development. Almost every major industry turning point is closely related to regulatory policy.

Therefore, we need to seriously consider several fundamental questions: Should we embrace regulation and seek a symbiotic path with the existing financial system, or stick to the "decentralization" ideal and continue to linger in regulatory gray areas? Should we pursue a purely "casino-style" Mass Adoption, repeating the speculation-driven path of the past decade, or strive to create real, sustainable value and truly realize the revolutionary potential of blockchain technology?

Currently, the Ethereum ecosystem faces a significant structural imbalance: on one hand, there is ever-increasing infrastructure and endless technological innovation; on the other, application ecosystem development is relatively lagging. In this contrast, Ethereum faces a dual challenge: it must contend with the strong performance and user experience offensive from up-and-coming public chains like Solana, and also be wary of the encroachment of compliant public permissioned chains laid out by traditional financial forces in the real application market.

Even more challenging, Ethereum must simultaneously face competitive pressure from two directions: on one side, public chains like Solana are capturing more market share and user attention in the meme market thanks to their performance advantages; on the other, public permissioned chains led by traditional financial institutions are leveraging their natural compliance advantages and massive user bases to gradually lay out real-world application scenarios such as payments and asset tokenization, and are likely to gain a first-mover advantage in these key areas in the future.

How to seek breakthroughs under this double squeeze, maintaining technological innovation without losing market competitiveness—these are the key challenges Ethereum must face head-on in its quest for a breakthrough.

The above views are only my personal perspective, offered as a humble contribution, in hopes of sparking more constructive thinking and discussion within the industry. As industry participants, we should all contribute to promoting Web3 toward a healthier and more valuable direction.

Due to my personal cognitive limitations, I welcome everyone to engage in friendly discussion and jointly explore the future direction of the industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.

Solana ETF attracts 200 millions in its first week; as Wall Street battles intensify, Western Union announces a strategic bet

The approval of the Solana ETF is not an end point, but the starting gun for a new era.