BasePerp To Enable Creation of Perpetual Futures Markets on Base

November 3, 2025 – Singapore, Singapore

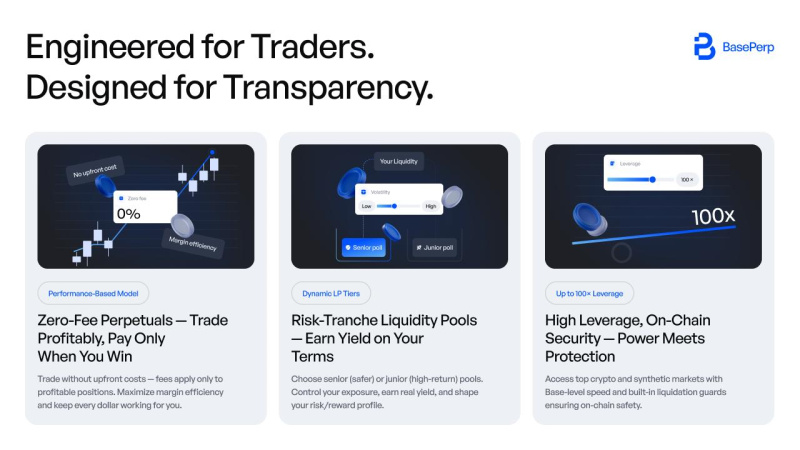

BasePerp has announced the launch of the first native perpetual DEX (decentralized exchange) built on the Base blockchain.

The platform is designed to deliver high-performance derivatives trading within one of the fastest-growing ecosystems in 2025, combining scalability, security and deep liquidity to support both retail and institutional participants.

Perpetual DEXs have become the main narrative in 2025, driving substantial liquidity growth and increased institutional participation across major blockchain networks.

New-generation perpetual trading platforms illustrate how the derivatives market can enhance ecosystem adoption and TVL (total value locked) through greater speed, liquidity depth and diverse trading options.

The perpetual futures market now represents a dominant liquidity driver in the crypto sector, attracting institutional capital, market makers and high-frequency traders.

Strong perpetual markets enhance a blockchain’s financial relevance, often surpassing spot trading and yield-farming activity in both scale and engagement.

Perpetual DEXs he new frontier of DeFi power

The perpetual futures market now represents a dominant liquidity driver in crypto.

Platforms across the sector have proved that perpetual derivatives can outpace spot market growth, bringing attention from institutional capital, market makers and high-frequency traders.

The success of perpetual DEXs causes the growth of deep liquidity pools and new high-volume DeFi ecosystems.

The explosive growth of next-gen perp DEXs proves that institutional capital and funds participate in high-performance trading infrastructures.

Derivatives traders and LP users influence TVL growth and the development of DeFi systems.

Strong perpetual markets make a chain financially relevant, outperforming spot trading and yield-farming activity.

BasePerp he first perpetual DEX launching on Base blockchain

Base has become one of the fastest-growing ecosystems by this year, overtaking Optimism in TVL, and continues to show strong user and developer interest.

Recent network inflation spikes and massive user migration can boost the chain’s rapidly increasing usage.

BasePerp , with its release, can become a cornerstone of perpetual trading for Base investors and traders. It can boost TVL to $100 billion and 25 million users, according to analyst data.

Reports indicate over 25,000 developers are building on Base, and BasePerp can become a driver that will enter the entire Base ecosystem, encouraging DeFi protocols and accumulating migration from networks where perpetual trading is already saturated.

Perpetual DEXs already dominate volume metrics, and BasePerp has strong upside potential. It can leverage the Base infrastructure and offer fresh liquidity options, scaling derivative capital inflow.

About

Based on Base’s scalability and security, BasePerp is positioned to become the first native perpetual DEX on Base, offering high-performance trading.

Attracting the interest of retailers and institutional investors, it has the potential to become a fundamental component of the Base ecosystem, boosting the DeFi market and liquidity.

Website

Contact

Mark , BasePerp

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Update: SEC Sets November 2025 as Pivotal Deadline for Dogecoin ETF Approval

- Bitwise files a fast-track SEC 8(a) ETF application for Dogecoin , targeting November 2025 approval if regulators remain silent. - The move reflects growing institutional demand for crypto exposure amid regulatory uncertainty and a competitive ETF landscape. - Grayscale's DOJE ETF and rivals' XRP/Dogecoin products highlight intensified competition, with $24M+ in early trading volumes. - Analysts project 300% DOGE price gains if resistance breaks, while SEC's crypto-friendly leadership and legal battles w

Ethereum Updates Today: SharpLink Moves ETH—A Bid for Stability or Signs of Major Overhaul?

- SharpLink Gaming transferred $14M ETH to OKX ahead of Q3 earnings amid crypto market declines. - The move highlights challenges for crypto-holding firms as ETH drops 25% in 30 days and stocks like SBET fall 4.28%. - Institutional investors increasingly use ETH staking for yield, contrasting Bitcoin-focused strategies lacking comparable returns. - CertiK emphasizes treasury management integrity as spot crypto ETFs shift focus to secure asset handling amid governance scrutiny.

Tesla’s $1 Trillion Musk Deal: Strategic Move to Keep CEO or Example of Excessive Corporate Power?

- Tesla shareholders approved a $1 trillion compensation package for Elon Musk, tied to aggressive targets like $8.5 trillion valuation and 20 million vehicle deliveries. - Critics call the package excessive, while Tesla defends it as critical to retain Musk amid his SpaceX, xAI, and Trump administration commitments. - The Texas-based approval bypasses Delaware's strict governance rules, sparking debates over "race to the bottom" in corporate accountability. - Skeptics question feasibility of targets, with

The Quantum Computing Hype Cycle and What It Means for the Valuation of Cybersecurity Stocks

- Quantum computing threatens RSA/ECC encryption by 2025, accelerating post-quantum cryptography (PQC) adoption and investment in quantum-safe firms. - NIST's 2030 PQC standards and "harvest now, decrypt later" strategies force urgent infrastructure upgrades, with governments stockpiling sensitive data. - SEALSQ leads the quantum-safe sector with $220M liquidity, $17.5M 2025 revenue guidance, and PQC-embedded semiconductors for IoT/automotive sectors. - High-risk plays like BTQ (blockchain PQC) and pre-rev