StakeWise Recovers $21M in Balancer Hack Funds— Can This Boost ETH Price?

StakeWise successfully recovered $20.7 million in osETH and osGNO tokens following the $120 million Balancer V2 exploit. The funds will be returned to victims, confirming partial recovery.

Ethereum staking protocol StakeWise announced that it has successfully recovered a substantial portion of osETH and osGNO tokens stolen in the Balancer V2 hack.

The attackers executed a sophisticated price manipulation attack on Balancer over several hours on Monday. The attack primarily targeted ETH-related liquidity tokens, with total confirmed losses estimated to exceed $120 million.

Attack Targets Balancer V2 ‘Stable’ Pools

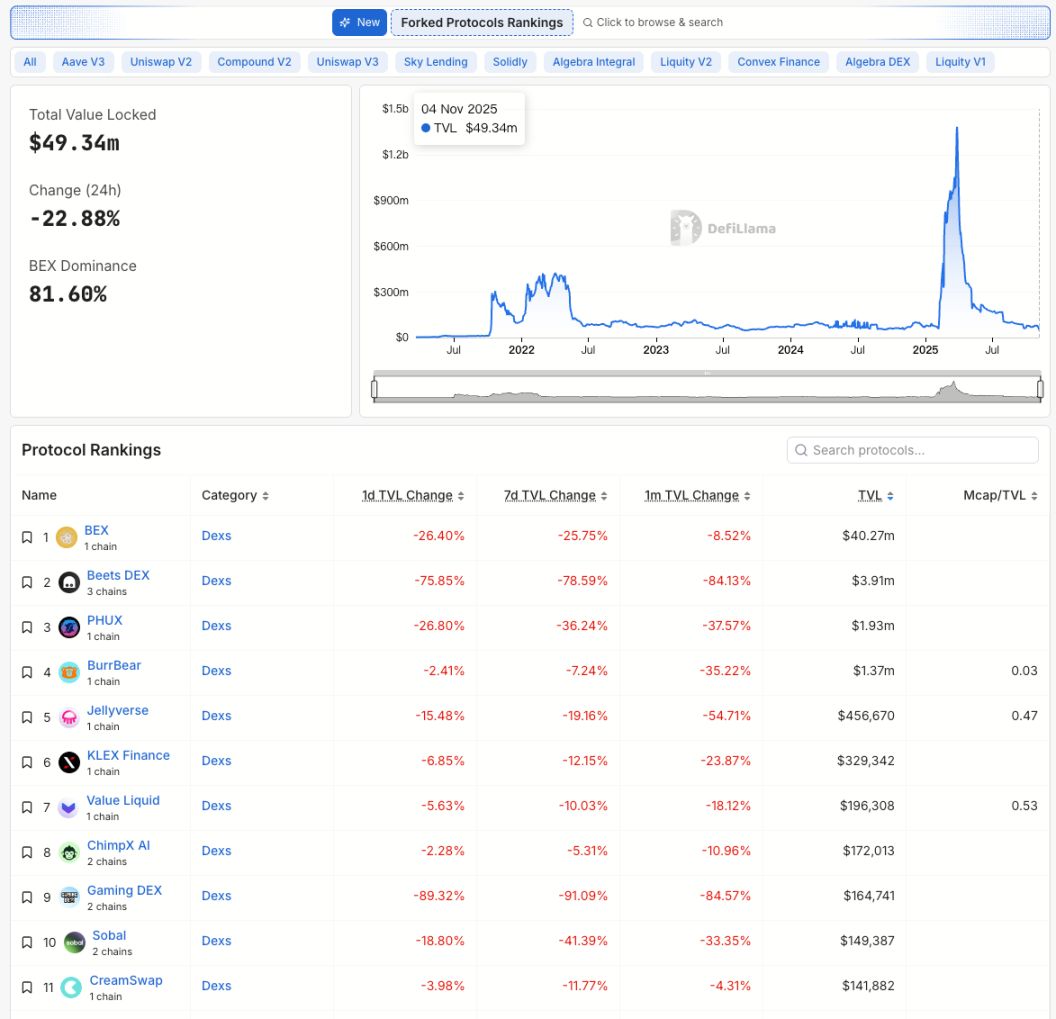

StakeWise said that the exploit affected instances and forked versions of the V2 contract active across all chains. The firm noted that the “stable” pools suffered the most severe impact.

Using an emergency multisig transaction, StakeWise recovered 5,041 osETH ($19 million) and 13,495 osGNO ($1.7 million) from the Balancer hackers. The recovered tokens represent 73.5% of the stolen osETH and 100% of the osGNO, and the funds are slated to be returned to the victims.

TL:DR StakeWise smart contracts, including osETH and osGNO, are not affected by the unfortunate Balancer V2 exploit. pic.twitter.com/XKO8rze7mU

— StakeWise (@stakewise_io) November 3, 2025

Recovery Boosts ETH Sentiment

The Balancer exploit had an adverse ripple effect on several crypto prices. The majority of tokens were ETH-related, so Ethereum suffered tough hits. According to CoinGecko data, the Ethereum price dropped over 8% on Monday.

Investors and traders now question whether StakeWise’s announcement will accelerate ETH’s recovery. Optimistic prediction dictates that the possibility of large quantities of stolen tokens being dumped onto the open market for cash has significantly reduced. As of Tuesday morning in Asia, the ETH price was trading around the $3,640 mark, up 1.1% from Monday.

StakeWise Protocol Remains Secure

StakeWise emphasized that its smart contracts and the osETH token were safe. Furthermore, the osETH–Aave ETH liquidity pool—an incentivized pool managed by the StakeWise DAO—remained unaffected because it utilized the newer Balancer V3 version, which was immune to the specific exploit.

StakeWise warned that osETH liquidity would temporarily decrease as liquidity providers withdraw funds from the affected pool for security reasons. This mass withdrawal may temporarily cause large market sales of osETH to trade below the protocol’s fixed osETH exchange rate.

Nonetheless, since the core StakeWise protocol remains uncompromised, users can still safely burn osETH at the internal exchange rate and proceed with the ETH unstaking process.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.