Is Pi Coin Preparing for a 47% Rally? This Pattern Says It Might Be

Pi Coin (PI) has slipped 5.3% in the past 24 hours, but a cup-and-handle pattern suggests a potential 47% upside. Strengthening money flows and a gradual recovery in buying momentum could make Pi one of the few altcoins to watch for a breakout this month.

Pi Coin (PI) is down 5.3% in the past 24 hours, erasing most of its seven-day gains. The token continues to trade sideways inside a broader downtrend. However, a bullish setup may be forming on the chart.

This formation hints at the potential for a strong upside move, but only if key resistance levels are cleared soon.

Cup and Handle Pattern Hints at a 47% Upside

A cup and handle is a bullish continuation pattern that looks like a rounded “U” (the cup) followed by a smaller downward channel (the handle). The pattern for Pi Coin is clearly visible, and the neckline — which connects the two cup rims — is slightly sloping upward.

An upward-sloping neckline signals growing buyer confidence. It means that the right rim of the cup is forming higher than the left, showing that each rebound is happening at higher prices — a subtle sign of strengthening demand.

Biullish PI Price Pattern:

TradingView

Biullish PI Price Pattern:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

There’s one long wick below the cup (on October 10) that might seem to break the formation. However, that wick was a one-off seller flush. It quickly reversed within the same Pi Coin candle and was never revisited. So, it’s excluded from the cup base, as it represents a liquidity spike rather than a structural low.

Per the pattern, the vertical distance from the bottom of the cup to the neckline projects a 47% potential upside from the breakout level.

Money Flows Show Early Signs of Recovery

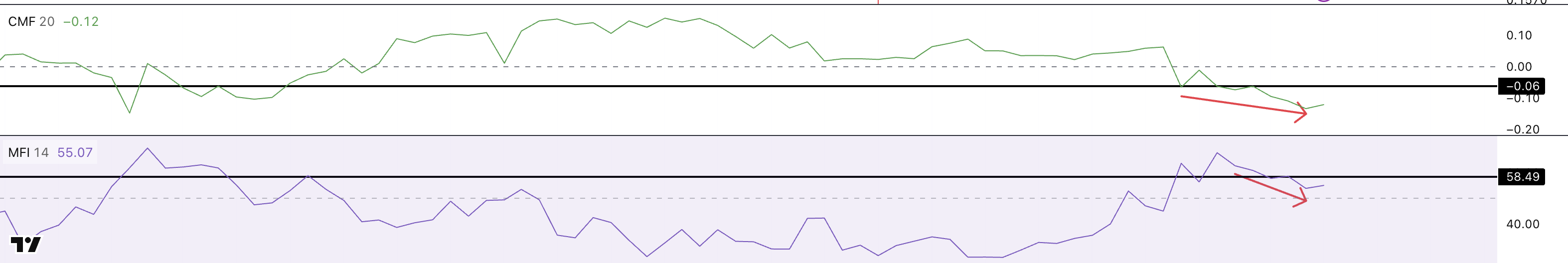

Two key Pi Coin indicators are now supporting this structure: the Chaikin Money Flow (CMF) and the Money Flow Index (MFI).

CMF measures how much capital is entering or leaving a token, especially from big wallets. It dropped below zero on October 26 and has been forming lower lows, suggesting selling pressure and the subsequent handle-specific consolidation.

However, over the last few days, CMF has been curling up from –0.12 toward –0.06, indicating that outflows are slowing and that buying activity may be returning.

Similarly, MFI, which tracks both price and trading volume to gauge buying pressure, is rising after falling from 58.49 earlier. A move back above 58 would confirm renewed retail accumulation.

Money Flows Can Improve Bullishness:

TradingView

Money Flows Can Improve Bullishness:

TradingView

If CMF crosses above –0.06 and MFI climbs above 58.49, it could trigger a handle breakout — the early stage of a larger bullish move. For a confirmed breakout above the cup neckline, CMF needs to push above zero, which would mark clear big money inflow dominance.

Key Pi Coin Price Levels To Watch For Upside (Or Downside)

PI’s first hurdle is the handle breakout zone near $0.24. A daily close above it could lift the price toward $0.27 and then $0.29, which marks the next resistance cluster.

The neckline breakout and the start of the full cup-and-handle move would occur above $0.33. Clearing that could open the path to $0.37 and $0.39.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

On the downside, $0.21 is the key invalidation level. A daily close below that would weaken the bullish setup.

A drop below $0.19 would invalidate the cup pattern completely. Moreover, it would likely trigger new lows, suggesting that the handle has extended beyond its valid range.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report November 4, 2025

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

XRP price flashes classic ‘hidden bullish divergence.’ Is $5 still in play?

Bitcoin falls under $101K: Analysts say BTC is ‘underpriced’ based on fundamentals

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"