The recent pullback of BTC may appear to be driven by sentiment on the surface, but if you’ve been watching the actions of major players, you’ll notice—funds started moving well before the price reversed. In particular, Coinbase and Kraken, the two “US market indicators,” sent very clear signals: one aggressively dumped with market orders, while the other slowly suppressed with limit orders, working together seamlessly.

1. Kraken Leads the Attack

▪ First Signal: Night of November 1 to Daytime November 2

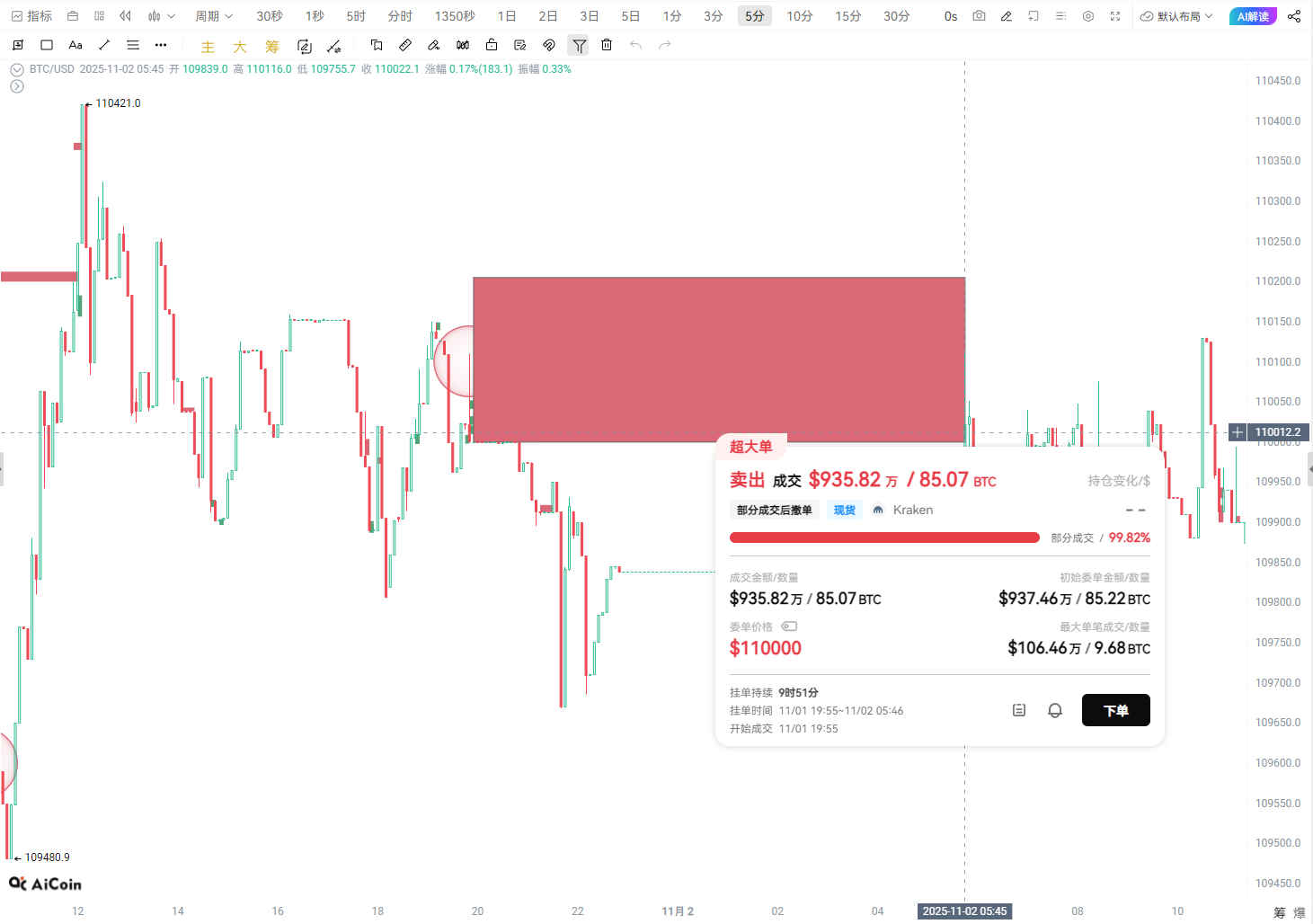

According to the PRO “Major Order Tracking” indicator (which monitors major limit orders), Kraken was the first to show unusual activity:

1. A limit sell order of $9.358 million was placed at $110,000.

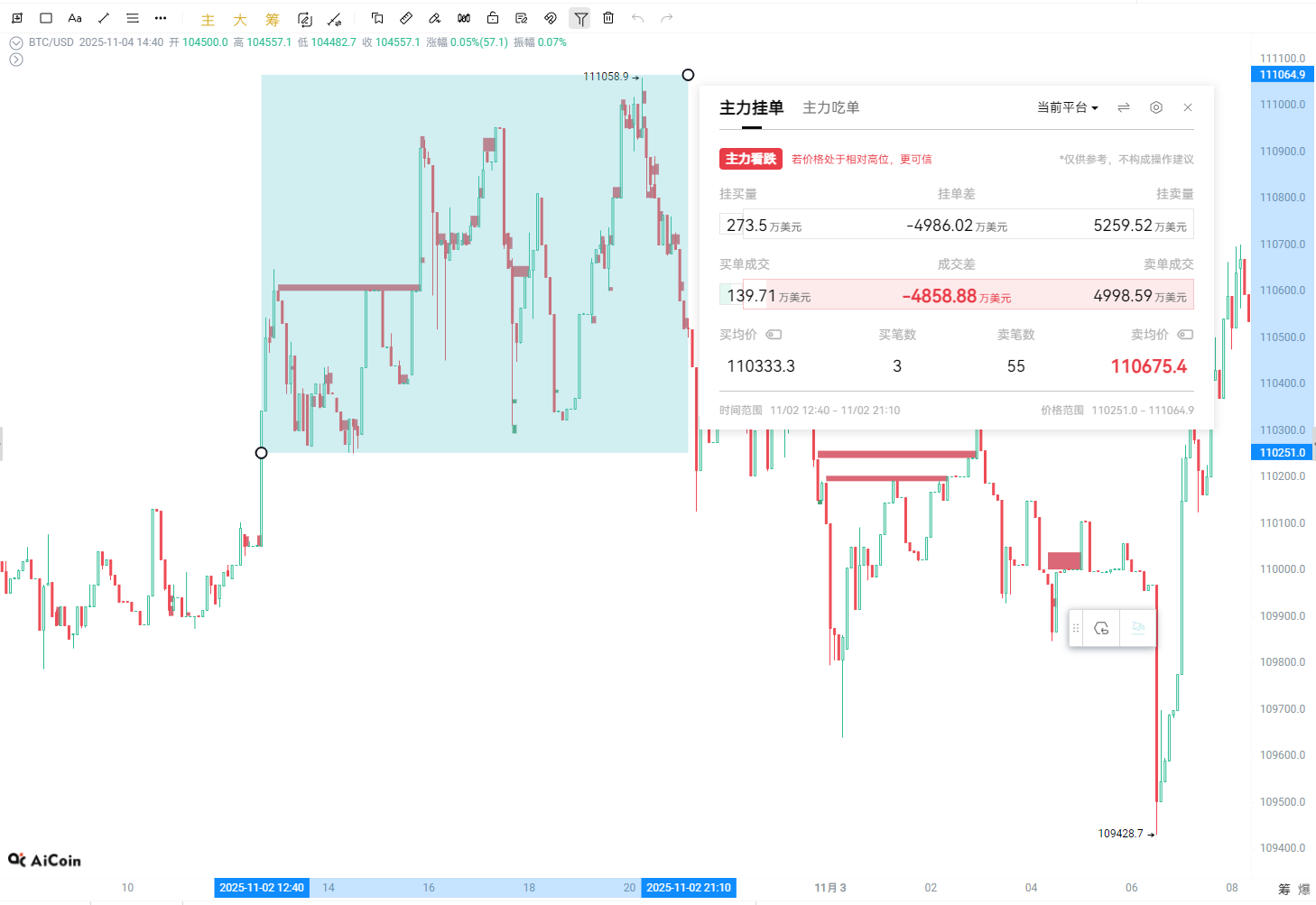

2. Immediately after, within the $110,200 - $111,050 range, 55 dense limit sell orders appeared within a few hours, totaling nearly $50 million.

Interpretation: Such dense, large limit sell orders near key price levels usually mean that the major players are not in a rush to dump instantly, but are instead setting up a solid “sell wall.” They’re telling you: “Want to rebound? Get past me first.” This is a classic “price suppression” move, aiming to curb upward momentum and create room for a subsequent drop. The “Major Order Tracking” indicator here gives us a core signal: heavy sell pressure above, making a breakout extremely difficult—bulls should be cautious.

2. Coinbase Major Players Dump with Market Orders

▪ Second Signal: Afternoon of November 2 & Early Morning of November 3

According to the PRO “Major Trades” indicator (tracking major market executions), Coinbase’s unusual activity stands out:

November 2, 13:34, market sell of $7.15 million, average sell price $110,457.51.

November 3, 00:03, market sell of $8.98 million, average sell price $110,110.

Interpretation: Market selling is a completely different logic from Kraken’s limit selling. This is a cost-ignoring, speed-prioritizing dump, aiming to instantly break through market liquidity and trigger panic and cascading stop-losses. Indeed, the second large order directly caused Coinbase’s price to wick down to $108,800.

This generated a golden signal understood only by PRO users: Coinbase wicks down alone, while Binance/OKX did not follow. Based on past performance, such US market-specific wicks usually mean the market will retest this wick low. The “Major Trades” indicator here signals: major players are taking the initiative, downward momentum is confirmed, and based on cross-market price differences, an excellent “target level” is given—108,800.

3. Long-Short Battle and Position Rotation

Major players are not a monolith; there are handovers and absorption during the decline.

▪ Third Signal: The “Battlefield” at Noon on November 3

“Major Order Tracking” shows: Kraken once again placed a massive $110 million limit sell order near $107,500. This indicates that major players believe there is still selling pressure here, continuing to suppress the rebound.

But the “Major Trades” indicator shows: almost simultaneously, there was a $102 million market buy order absorbing the sell-off.

Interpretation: The market is telling us: there are major players selling, and there are major players buying; some funds are suppressing, while others are supporting. The repeated oscillations at this level are perfectly explained. The PRO tools let us see the “long-short battle” behind the decline, rather than just a simple one-sided sell-off.

4. Major Players Closing the Net

The closed loop of major player operations is “sell high, buy low,” and the PRO indicators let us clearly see the “buy low” step.

▪ Fourth Signal: Early Morning of November 4

When the price fell as expected to around $106,500, the “Major Trades” indicator once again captured a $5.88 million market buy order on Coinbase.

Interpretation: This is a classic major player move. At the top, they use “limit order suppression + market order dumping” to push the price down, then at relatively low levels, they use “market buy orders” to refill their positions. The entire operation chain is clearly displayed before us through the two AiCoin PRO indicators.

Special Note: During the Asian session, multiple market sell orders appeared on Binance BTC spot, and a large market sell order worth over $6 million appeared near $105,000 on Coinbase BTC. Major player activity has not ended yet, so it is recommended to continue tracking with PRO tools.

5. PRO Practical Application Guide

After reviewing, let’s summarize how to use AiCoin PRO for daily decision-making:

1. Spotting Trend Initiation: “Major Order Tracking” leads, “Major Trades Indicator” confirms.

▪ When dense limit sell orders appear at a key price level (such as previous highs or round numbers), be alert that this could be the prelude to a decline.

▪ When there are consecutive large market sell orders, it means downward momentum has started, so consider reducing positions or following the trend.

2. Watching Key Levels: Focus on “cross-market price differences” and “limit buy walls.”

▪ When Coinbase or other US markets wick down alone, it’s often a signal that the price will be tested.

▪ If a huge limit buy order (such as Binance’s $111 million long order) appears during a decline at a certain level, that level is recognized by major players as a short-term bottom area and is an important support reference.

3. Reading Major Player Intentions: Combine both indicators to judge the phase.

▪ Accumulation of limit sell orders + market sell-off = Major players are actively shorting, avoid.

▪ Market sell-off + market buy-in = Major players may be trading in waves, watch for bottom signals.

▪ Huge limit long orders at low levels = Major player defense appears, consider building positions in batches.

Finally: There are countless technical indicators, but those that directly reveal the movements of major funds are king. These two core functions of AiCoin PRO lay the cards of the major players on the table for you. This review shows us that declines don’t happen suddenly—they are orchestrated step by step by the major players. As long as we use the right tools and understand their operational language, we can transform from passive victims into smart traders who follow the major players and profit.