Zcash (ZEC) extended gains over the last 24 hours, rising about 21.8% to roughly $475 by press time.

The move came as Bitcoin eased, yet ZEC pushed higher and outperformed the broader market.

Zcash ZEC 24h Price Surge. Source: CoinMarketCap

Zcash ZEC 24h Price Surge. Source: CoinMarketCap

Through the previous afternoon, ZEC hovered near $380, then began a steady advance. Momentum improved overnight, with brief pauses that held above prior pivot levels.

By morning, buyers pressed toward a session peak just under $498. Intraday swings remained orderly.

Each dip found support above earlier floors, keeping a sequence of higher lows intact. As a result, price stayed in the upper end of today’s range for most of the session.

Liquidity clustered near round numbers. The chart shows offers building around the $500 area, which capped the day’s high. Conversely, demand appeared between $460 and $440 during pullbacks.

ZEC’s relative strength stood out. While major tokens tracked Bitcoin’s decline, ZEC diverged and added double-digit gains.

That placed it near rank #17 by market value during the session. Into the late afternoon, the market continued to test the upper band.

A decisive move above $500 would open fresh territory. However, failure there could keep price rotating inside the $460–$500 zone in the near term.

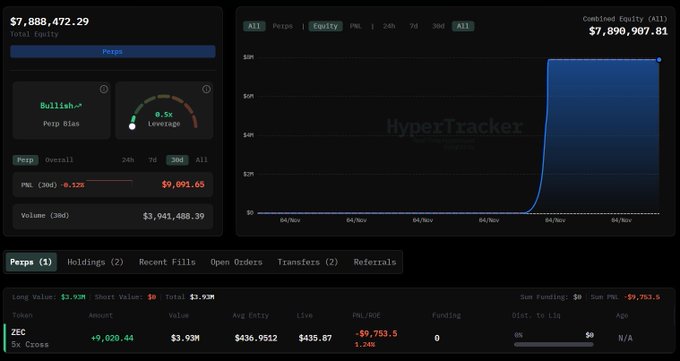

Big ZEC leverage bet hits Hyperliquid

A newly created account deposited $7.9 million USDC on Hyperliquid and immediately opened a 5x long on Zcash (ZEC), according to crypto.news.

The position appeared alongside ZEC’s sharp 24-hour rally, signaling fresh leveraged interest during heightened volatility.

ZEC 5x Long $7.9M Deposit. Source X

ZEC 5x Long $7.9M Deposit. Source X

Soon after the deposit, the account sized into the long and left no other active perp positions visible.

Meanwhile, ZEC continued to trade near the session highs, keeping the risk tightly tied to intraday swings around the $500 area.

The wallet’s first action on the venue was this single ZEC trade. Consequently, its PnL now hinges on short-term momentum and funding dynamics as liquidity clusters around round-number levels.

ZEC intraday path: pullback to support, retest, then push toward 546

ZEC trades near $473 with the 30-minute 50-EMA around $439. The tape shows a strong impulsive leg from the $380 area, then a stair-step advance with higher lows.

Taking the historical move into account, the structure favors a brief reset before the next leg.

Zcash ZECUSDT 30 Minute Breakout Path. Source: TradingView

Zcash ZECUSDT 30 Minute Breakout Path. Source: TradingView

First, price likely fades to the demand band at $446–$450. That zone aligns with prior breakout shelves and sits above the EMA trendline, which kept the uptrend intact during earlier dips.

If bids defend that area, momentum can rotate back to the $472–$477 supply line for a clean retest.

Next, sustained acceptance above $477 opens the upper magnet around $546. The level marks the measured objective drawn on the chart and matches historical offer concentration from prior cycles.

A firm break and hold above $477 would let buyers probe $505–$515 first, then stretch toward $540–$546.

Finally, after tagging the $540–$546 target, price likely pauses and consolidates between roughly $520 and $546 as intraday RSI cools from the low-60s.

The path invalidates on a decisive close below $439, which would shift focus back to $420–$425 support.

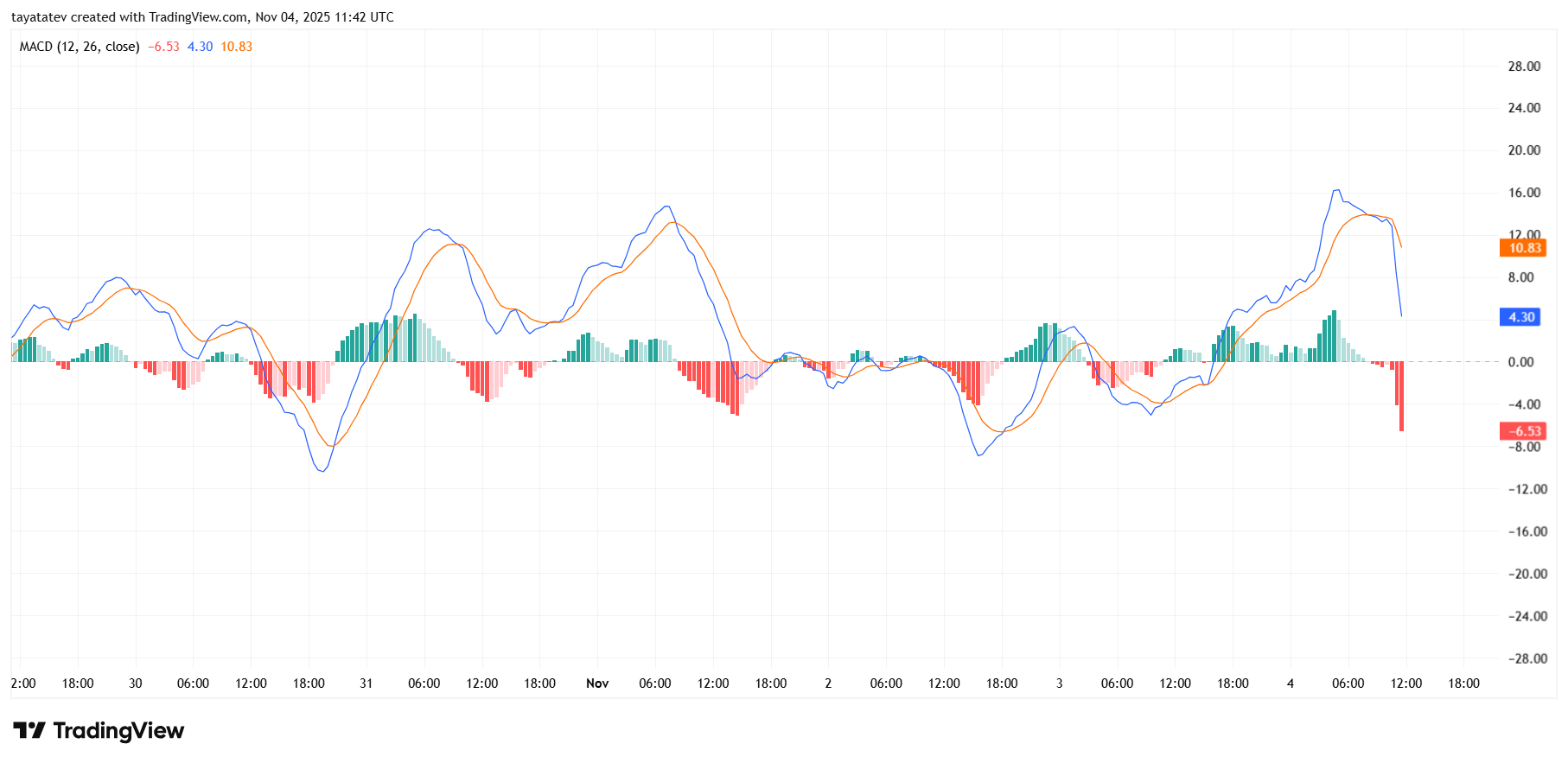

ZEC 30-min MACD signals a momentum cool-off before the next test

ZEC’s 30-minute MACD just flipped bearish. The MACD line (≈4.3) now sits below the signal line (≈10.8), and the histogram printed a deeper red bar (≈-6.5).

This crossover follows a strong positive run-up, so momentum is cooling as intraday longs take profit.

Zcash ZECUSDT 30-Minute MACD. Source: TradingView

Zcash ZECUSDT 30-Minute MACD. Source: TradingView

In the near term, expanding negative histogram bars often precede a pullback toward trend support.

Therefore, price has room to fade into the $446–$450 demand band mapped by the prior breakout shelf.

If the histogram starts contracting and the MACD curls back toward the signal, buyers can attempt a fresh push to reclaim $472–$477.

However, if the histogram continues to widen below zero and the MACD makes a lower low, downside pressure can extend toward the 50-EMA cluster near $439.

A bullish reset requires the MACD to recapture the signal and shift the histogram back above zero, which would put $505–$515 back in play.

Editor at Kriptoworld

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 4, 2025 • 🕓 Last updated: November 4, 2025