Can BlackRock's Bitcoin ETF prevent a Bitcoin crash?

Bitcoin has fallen below $105,000, despite BlackRock launching a new Bitcoin ETF in Australia. Can institutional adoption prevent Bitcoin from dropping below $100,000?

Despite major positive news, Bitcoin has fallen below $105,000—even as BlackRock announced it would expand its Bitcoin ETF to Australia, marking the debut of its crypto investment product on a new continent.

Despite continued institutional adoption, the market still faces intense volatility, massive liquidations, and concerns that Bitcoin could soon fall below $100,000.

BlackRock Expands Bitcoin ETF to Australia

BlackRock's upcoming iShares Bitcoin ETF (IBIT) is set to list on the Australian Securities Exchange (ASX) in mid-November 2025.

After dominating the US market, this marks the asset manager’s next move into the Asia-Pacific region—offering local investors a regulated entry point to Bitcoin investment.

This milestone is expected to deepen global liquidity and enhance Bitcoin’s legitimacy among institutional investors.

However, the timing is unfortunate: as news of the ETF spread, Bitcoin’s price continued to fall, indicating that broader market sentiment remains cautious.

Bitcoin Falls Below $105,000, Liquidations Reach $1.3 Billion

According to market data shared by Ash Crypto, over $1.3 billion in leveraged long and short positions were liquidated within 24 hours—with Bitcoin ($378 million) and Ethereum ($333 million) suffering the largest losses.

This large-scale deleveraging event intensified the decline, forcing more traders to close positions and accelerating Bitcoin’s slide to $104,742.

The next key support level is near $100,000—a psychological and technical threshold.

If this level is breached, analysts warn that further declines to $95,000–$97,000 could follow.

Polymarket Shows 52% Probability of Bitcoin Falling Below $100,000

Prediction platform Polymarket currently assigns a 52% probability that Bitcoin will fall below $100,000 this month—the highest reading in months.

This surge in bearish sentiment reflects traders’ fear and hedging as volatility spikes.

It also highlights a growing belief that institutional news alone may not be enough to offset macro pressures and deleveraging.

Can Institutional Adoption Save Bitcoin?

While the launch of BlackRock’s ETF is undoubtedly bullish in the long term, its short-term impact on price is limited.

Institutional capital inflows are slow, while retail traders often “sell the news.”

Nevertheless, each new ETF expansion strengthens Bitcoin’s status as a legitimate global trading asset.

If BlackRock’s Australian ETF inspires similar launches in Asia, it could attract new liquidity, potentially stabilizing the market above $100,000.

But until these inflows materialize, macro uncertainty, the Federal Reserve’s cautious stance, and risk-off sentiment may continue to pressure prices.

Market Outlook—Crash or Consolidation?

| BlackRock Bitcoin ETF (Australia) | Institutional Expansion | Long-term Bullish |

| $1.3 Billion in Liquidations | Leverage Reset | Short-term Bearish |

| Bitcoin Below $105,000 | Technical Break | Neutral to Bearish |

| Polymarket 52% Crash Probability | Sentiment Indicator | Bearish |

| Macro & Fed Uncertainty | Risk Pressure | Bearish |

| Institutional Demand | Supports Bottom | Bullish |

In the coming weeks, Bitcoin may fluctuate between $100,000 and $110,000, with sharp volatility on both sides.

If it falls below $100,000, panic selling could be triggered, while a rebound above $110,000 may signal a return of confidence driven by ETF-related optimism.

Conclusion

BlackRock’s ETF expansion into Australia marks a new chapter in institutional adoption of Bitcoin, extending its influence to new continents and investor bases.

But with leverage still high and traders fearful, the question remains: Can institutional capital arrive quickly enough to prevent Bitcoin from falling below $100,000 ?

For now, the odds are even—fundamentals are strong, but the short-term storm is not yet over.

$BTC, $ETH

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

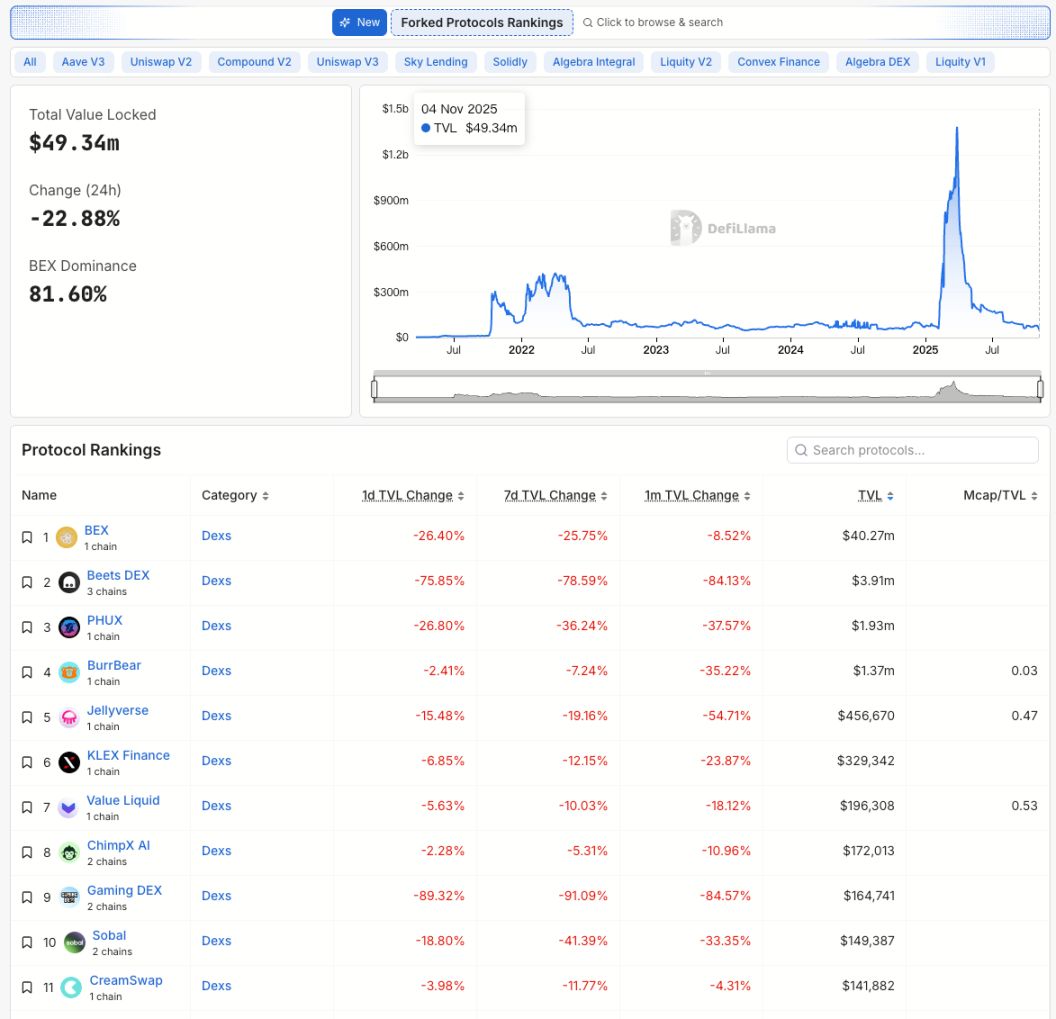

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.