The cryptocurrency trading craze in South Korea is fading—where is the capital flowing now?

Author: Liam, TechFlow by Deep Tide

Original Title: Here’s a Ghost Story: Even Koreans Are No Longer Trading Crypto

If we were to choose the world’s most enthusiastic crypto traders, Koreans would definitely make the list.

Korea has always been one of the most fervent countries for cryptocurrencies globally. The market even coined a term: “Kimchi Premium,” where Korean traders once paid up to 10% more for bitcoin than the global average.

But by 2025, the tide has turned.

The trading volume on Korea’s largest crypto exchange, Upbit, has dropped 80% compared to the same period last year. The activity of bitcoin-KRW trading pairs is far less than in previous years. In contrast, the Korean stock market is booming, with the KOSPI index surging over 70% this year, continuously hitting record highs.

On Kakao Talk and Naver forums, retail investors who once discussed altcoins daily are now talking about “AI semiconductor concept stocks.”

The crypto ghost story has arrived—even Koreans are no longer trading crypto.

Trading Volume Halved, Koreans No Longer Trading Crypto

In recent years, Korea has always been a battleground for the global crypto market.

For exchanges and project teams, this is a place with high-net-worth quality clients. To put it more bluntly, Koreans have often been the main buyers of altcoins at the top.

Media and film often feature stories of Koreans trading crypto overnight, getting rich, and then liquidated.

So, when someone tells you that retail investors in this “nation of crypto traders” are no longer trading, you might find it absurd.

But the data doesn’t lie.

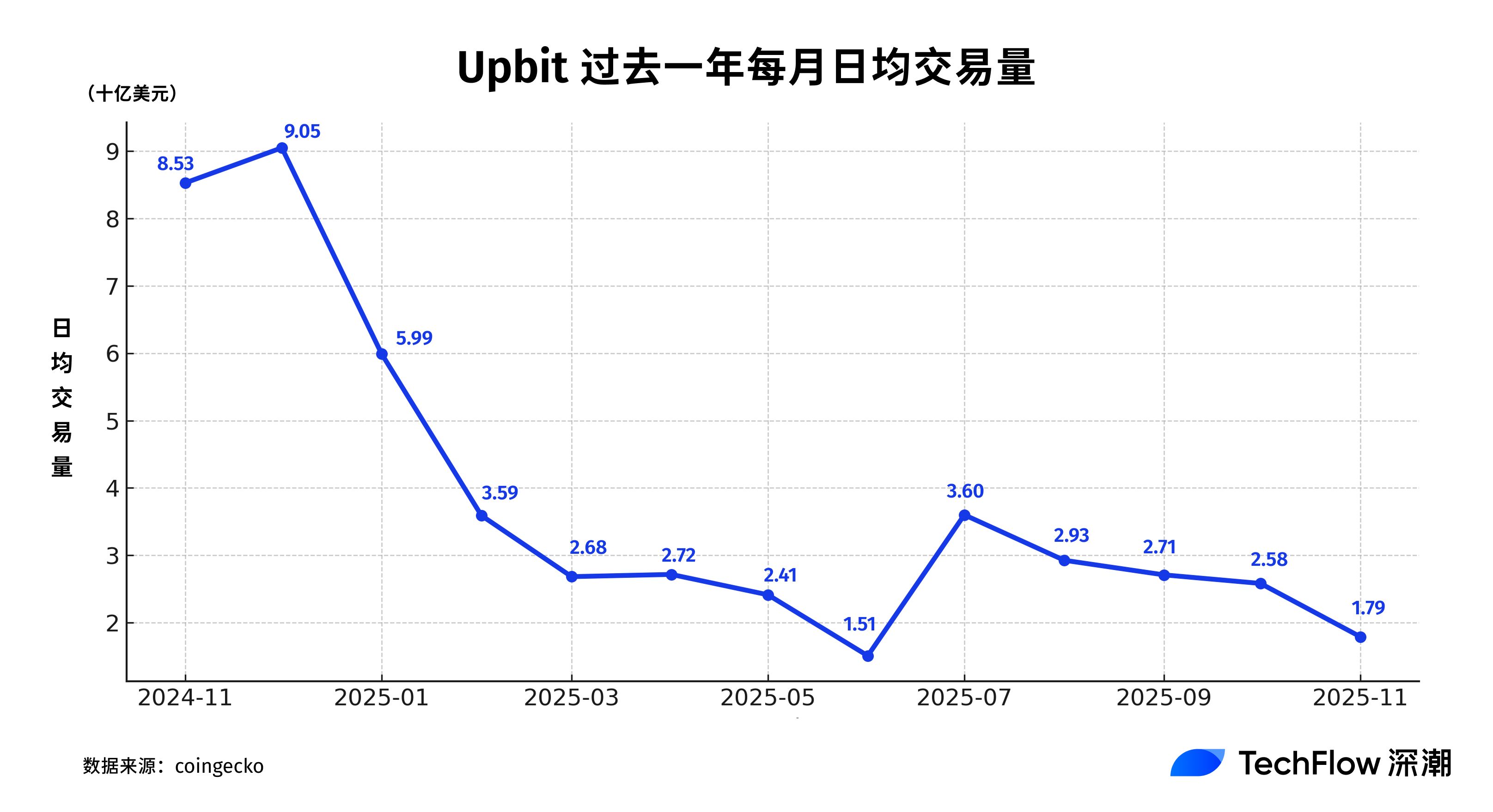

The trading volume on Korea’s largest exchange, Upbit, has collapsed.

In November 2025, Upbit’s average daily trading volume was only $1.78 billion, a sharp drop of 80% compared to $9 billion in December 2024, and has declined for four consecutive months.

Upbit’s historical peak occurred on December 3, 2024, the night of Korea’s martial law, when daily trading volume reached $27.45 billion, ten times the usual amount.

But that night of frenzy became the peak, and the market quickly cooled off, with trading volume plummeting.

More notably, the volatility of trading volume has also significantly decreased.

During the frenzy at the end of 2024, daily trading volume often fluctuated violently between $5 billion and $27 billion; but after entering 2025, most of the time, trading volume stabilized in the $2 billion to $4 billion range, with much narrower fluctuations.

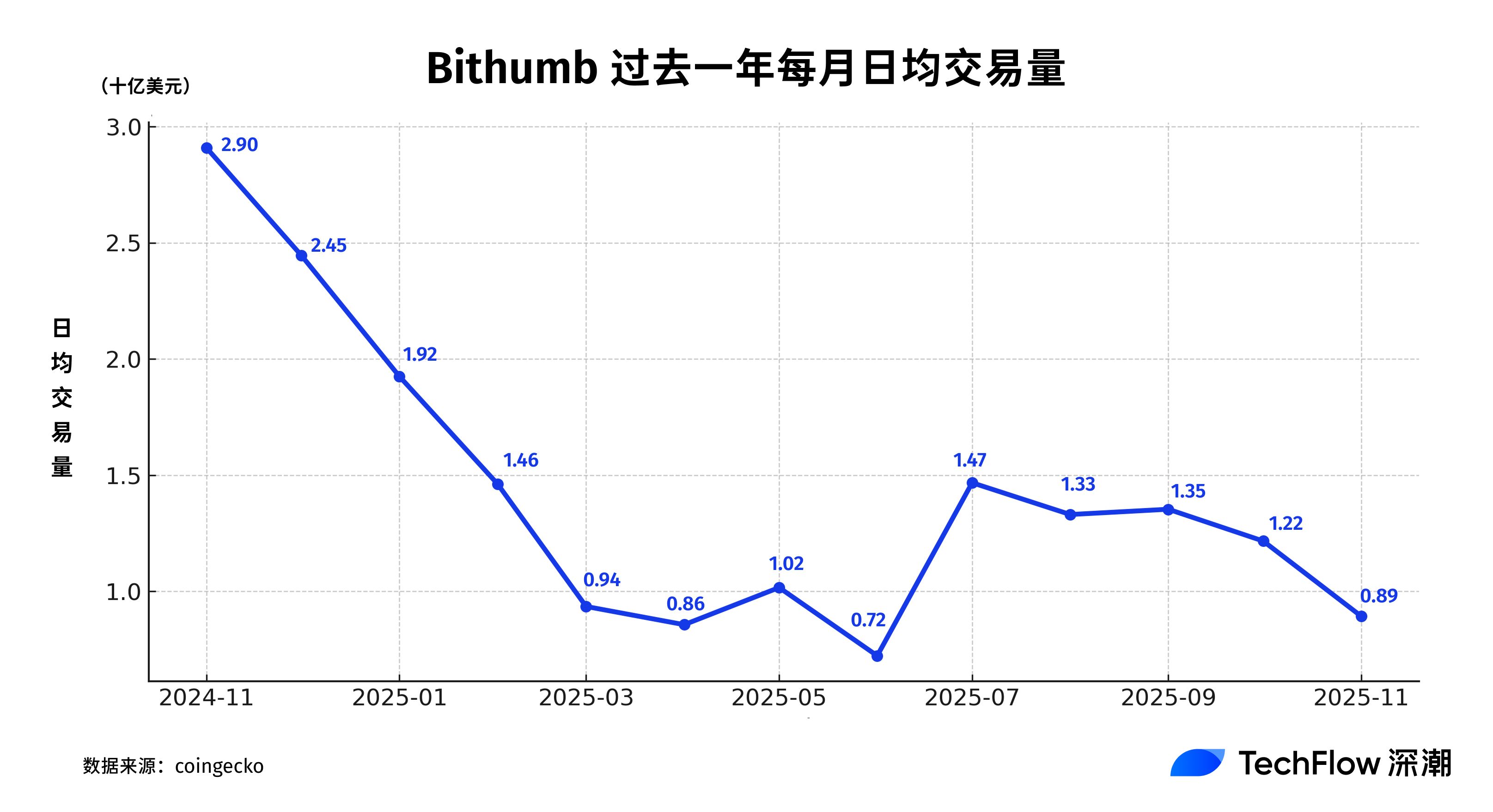

Korea’s second-largest exchange, Bithumb, has faced a similar fate.

At the end of 2024 (December), Bithumb’s average daily trading volume was about $2.45 billion. By November 2025, it had dropped to around $890 million, a total decline of about 69%, with nearly two-thirds of its liquidity lost.

The two largest local exchanges in Korea (Upbit and Bithumb) both fell into a “liquidity recession” during the same period, which not only means a cooling of trading but also a comprehensive retreat of Korean retail investor sentiment.

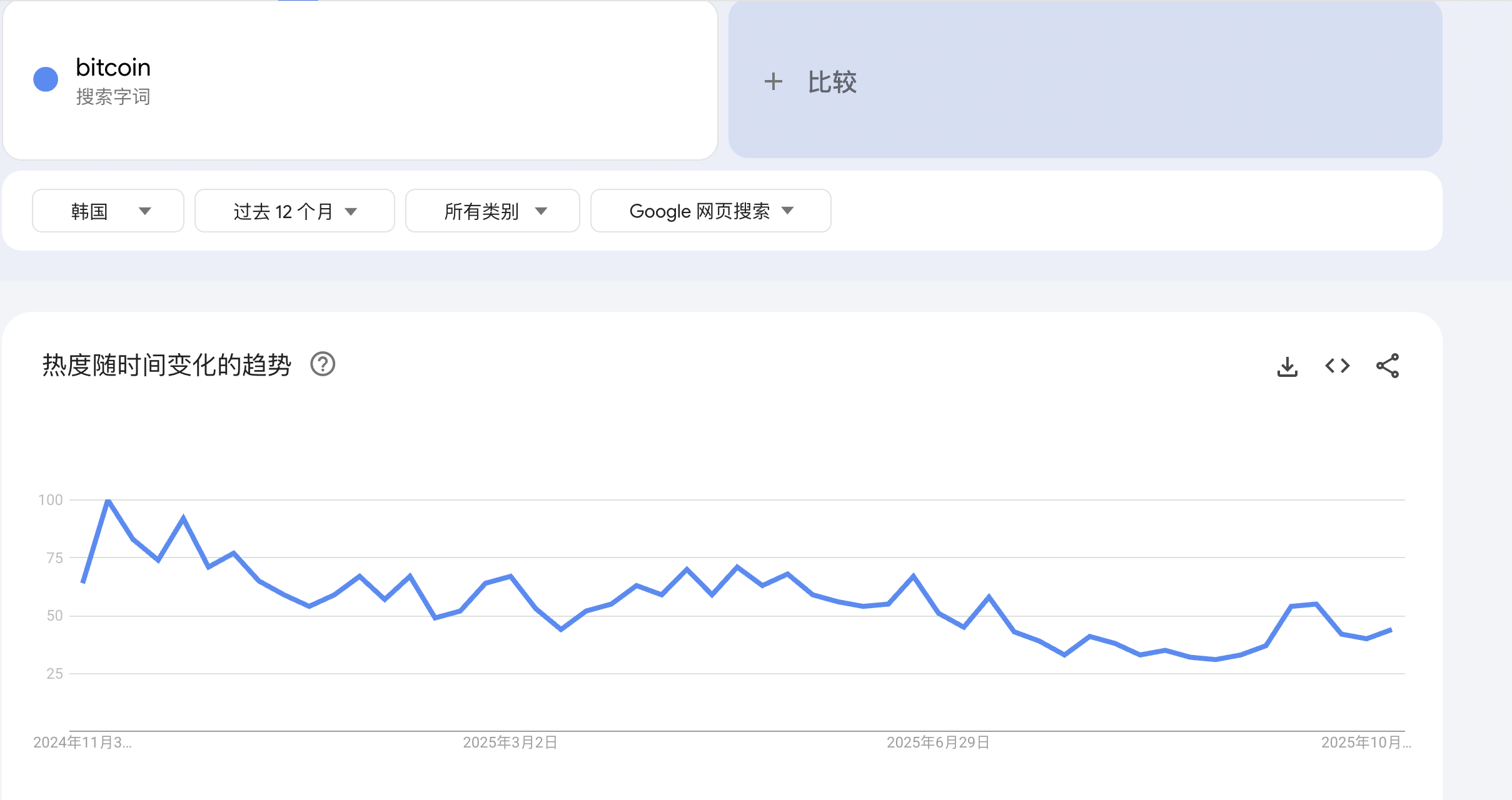

Search data confirms this. In Korea’s Google search trends, the latest search index for bitcoin is 44, down 66% from the peak of 100 at the end of 2024.

Korean Stocks Go Wild

So, where did Koreans’ money go? The answer: the stock market.

This year, the Korean stock market can be described as the reincarnation of bitcoin’s 2017 bull market—an epic bull run.

In just the past October, Korea’s benchmark KOSPI index hit intraday record highs 17 times, broke through the 4,200-point mark, and rose nearly 21% in October alone—the best single month since 2001.

Since the beginning of the year, the KOSPI index has soared more than 72%, leading all major asset classes.

In October, KOSPI’s average daily turnover reached 16.6 trillion KRW (about $11.5 billion), with a single-day high of 18.9 trillion KRW, up 44% from September, causing brokerage apps to lag.

And that’s just the index—individual stocks are even crazier.

Samsung Electronics has doubled since the start of the year; memory giant SK Hynix’s stock price rose 70% this quarter and has surged 240% since the start of the year. The two companies’ combined daily turnover is 4.59 trillion KRW, accounting for 28% of the entire market.

The market is so hot that even the exchange couldn’t stand it. On Monday night, the Korean exchange issued an “investment caution” notice for SK Hynix stock due to its rapid rise, causing SK Hynix’s stock price to plunge on Tuesday.

AI Becomes a “National Faith”

Once, the Korean stock market was stagnant, barely rising for over a decade. Local media frequently talked it down, saying “there’s no future for the Korean stock market,” which led many Korean investors to trade crypto or invest in US stocks. Why did the Korean stock market turn around in 2025?

This round of the Korean stock market’s surge may look like “retail investors going crazy,” but the logic behind it is exceptionally clear:

Global AI boom + policy push + domestic capital returning home.

Everyone knows that the spark for this rally comes from AI.

ChatGPT ignited the second season of the global tech bubble, and Korea happens to sit at the “ammunition depot” of the industrial chain.

Korea is the global leader in memory chips. SK Hynix and Samsung Electronics almost monopolize the high-bandwidth memory (HBM) market, which is the most critical material for training large AI models.

This means that whenever Nvidia or AMD’s GPU shipments increase, Korean companies’ profit curves soar in tandem.

At the end of October, SK Hynix released its financial report: third-quarter revenue of $17.1 billion, operating profit of $8 billion, a 62% year-on-year increase, both hitting record highs.

More crucially, SK Hynix has already locked in customer demand for all DRAM and NAND capacity through 2026—supply can’t meet demand.

So Koreans have realized:

AI is America’s narrative, but the money is being made in Korea.

If Nvidia is the soul of US stocks, Korean retail investors have found their faith in SK Hynix.

From crypto to stocks, they’re still chasing that “tenfold dream,” but buying Samsung or SK also lets them wear the crown of “patriot.”

Also, don’t ignore a key background: the Korean government is working hard to rescue the stock market.

For a long time, Korean stocks have suffered from the so-called “Korea Discount.”

Family conglomerate monopolies, chaotic corporate governance, low shareholder returns… all led to Korean companies being generally undervalued. Even Samsung Electronics has long traded below global peers, and after SK Hynix’s 240% surge, its PE is still only 14.

After President Yoon Suk-yeol took office, he launched a reform plan known as the “Korean version of the shareholder value revolution”:

Promote higher dividends and stock buybacks by companies;

Crack down on cross-shareholding by conglomerates;

Lower capital gains tax and encourage pension funds and retail investors to increase domestic allocations.

This reform has been called by the media a “national action to eliminate the Korea Discount.”

As a result, overseas capital began to return, and local institutions and retail investors also rushed to “buy domestic stocks.”

Of course, another reality is that there’s nowhere else for the money to go.

Korea’s real estate market has cooled during the high interest rate cycle, US stocks are highly valued, and in crypto, they can only passively take over.

Investors need a new gambling table, and the stock market just happens to provide a legitimate casino.

According to data from the Bank of Korea, in the first half of this year, more than 5 million new securities accounts were opened by local retail investors, and brokerage app downloads have surged.

The speed of this capital inflow into KOSPI is even faster than the retail rush into crypto in 2021.

At the same time, Korean pension and insurance funds are also increasing their holdings in local tech stocks.

From the state to institutions to retail investors, everyone is rushing into the stock market. You could even say this is a “nationwide bull market.”

Speculation Never Sleeps

Unlike the crypto market, which relies on “sentiment” to pump prices, this Korean stock market “bull” at least has some performance support.

But one thing must be acknowledged in the end:

This stock market bull run is, in essence, still a nationwide “emotional resonance.”

Koreans haven’t changed—they’ve just switched gambling tables. Not only do they gamble, but they also leverage up.

According to Bloomberg, Korean retail investors are significantly increasing leverage, with margin loan balances doubling in five years. They are pouring into high-leverage and inverse ETFs.

According to Gelonghui data, in 2025, Korean retail leverage funds account for 28.7% of total positions, up 9% from last year; holdings in 3x leveraged products rose from 5.1% to 12.8%; leverage usage among 25–35-year-olds is 41.2%.

This generation of retail investors comes with an “all-in gene.”

However, as Korean retail investors collectively rush into the stock market, a new question arises:

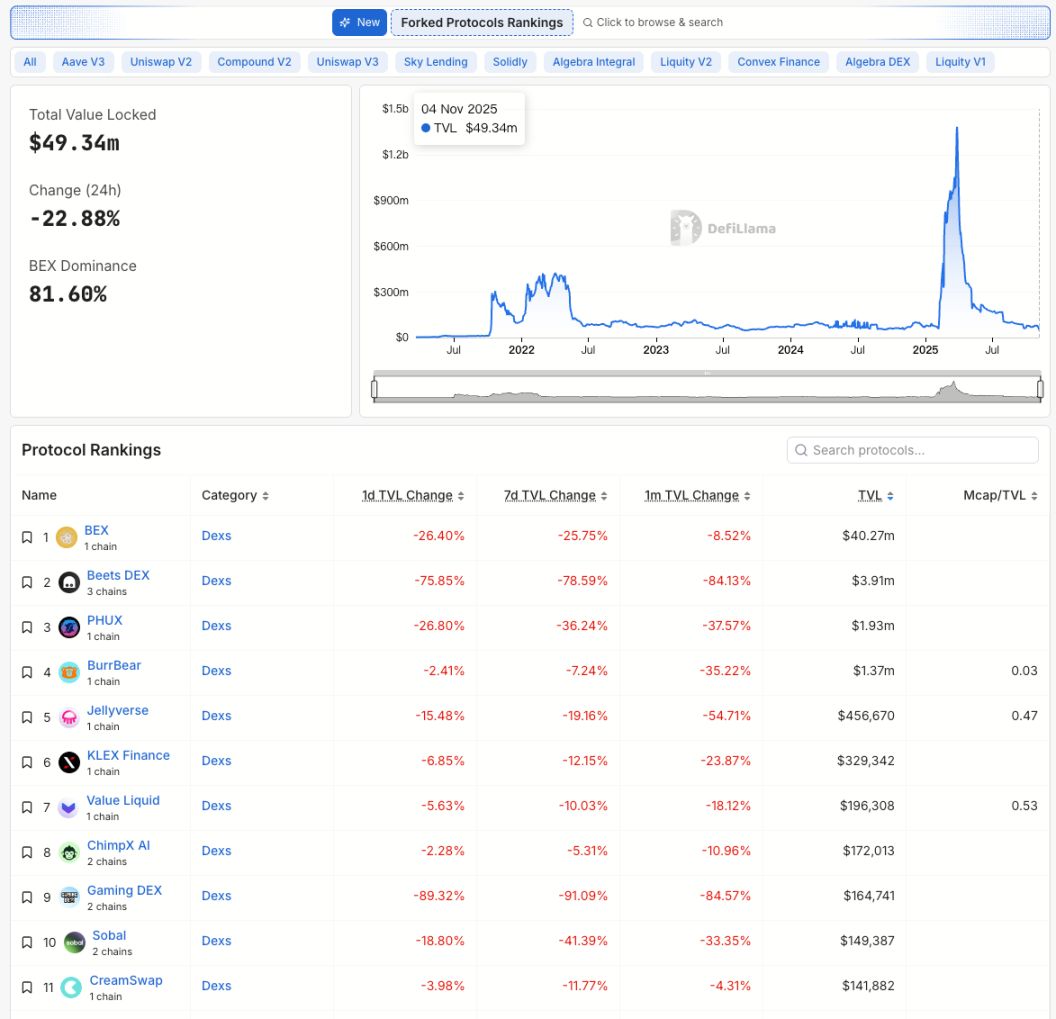

“If Koreans are no longer trading crypto, who will buy the altcoins?”

In recent years, the Korean market has often been the last buyer of altcoins.

From Dogecoin to PEPE, from LUNA to XRP, in almost every crazy bull market, you could see the presence of Korean retail investors.

They represent the “ultimate sentiment indicator” of the global crypto market. As long as Koreans are still buying, the bubble hasn’t peaked.

But now, with trading volumes on Upbit and Bithumb both plummeting, the crypto world has lost its last believers—and its biggest fuel source.

Altcoins, with no one left to buy.

Perhaps we’ll have to wait until the global AI stock market fever fades, or until the crypto world can tell a compelling enough story again.

Then, the sleeping gamblers will be awakened and return to the blockchain to place their bets once more.

After all, the gamblers are always there—they’ve just changed casinos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.