Arthur Hayes: A Detailed Analysis of U.S. Debt, Money Printing, and the Future Trend of Bitcoin

Author: Arthur Hayes

Original Title: Hallelujah

Compiled and Translated by: BitpushNews

For ease of reading, the translation has been edited and organized from the original content.

Introduction: Political Incentives and the Inevitability of Debt

Praise to Satoshi Nakamoto, the existence of time and the law of compound interest, independent of individual identity.

Even for governments, there are only two ways to pay expenses: using savings (taxes) or issuing debt. For governments, savings are equivalent to taxes. As is well known, taxes are unpopular with the public, but spending money is very popular. Therefore, when distributing benefits to civilians and the elite, politicians prefer to issue debt. Politicians always tend to borrow from the future to ensure re-election in the present, because when the bill comes due, they are likely no longer in office.

If, due to officials' incentive mechanisms, all governments are "hard-coded" to prefer issuing debt over raising taxes to distribute benefits, then the next key question is: How do buyers of US Treasuries finance these purchases? Do they use their own savings/equity, or do they finance through borrowing?

Answering these questions, especially in the context of "Pax Americana," is crucial for predicting future US dollar monetary creation. If the marginal buyers of US Treasuries are financing their purchases, then we can observe who is providing them with loans. Once we know the identity of these debt financiers, we can determine whether they are creating money ex nihilo for lending, or using their own equity. If, after answering all the questions, we find that the financiers of Treasuries are creating money in the process of lending, then we can draw the following conclusion:

Government-issued debt will increase the money supply.

If this assertion holds, then we can estimate the upper limit of credit that financiers can issue (assuming there is a limit).

These questions are important because my argument is: If government borrowing continues to grow as predicted by TBTF Banks, the US Treasury, and the Congressional Budget Office, then the Federal Reserve's balance sheet will also grow. If the Fed's balance sheet grows, that is bullish for US dollar liquidity, which will ultimately push up the price of bitcoin and other cryptocurrencies.

Next, we will answer these questions one by one and evaluate this logical puzzle.

Q&A Section

Will US President Trump finance the deficit through tax cuts?

No. He and the "red camp" Republicans have recently extended the 2017 tax cuts.

Is the US Treasury borrowing to cover the federal deficit, and will it continue to do so in the future?

Yes.

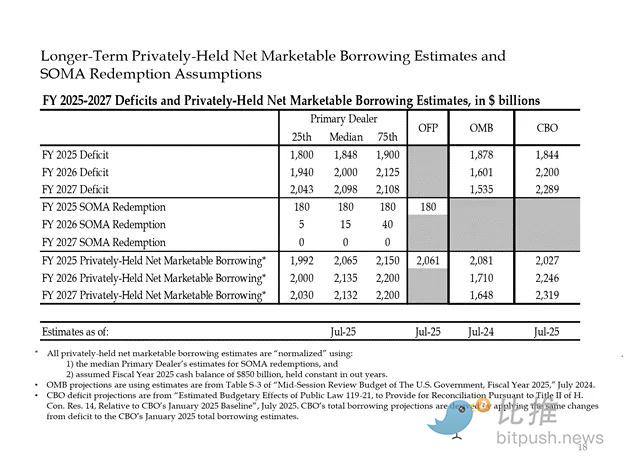

Below are estimates from major bankers and US government agencies. As shown, they predict a deficit of about $2 trillion, financed by $2 trillion in borrowing.

Given that the answers to the first two questions are both "yes," then:

Annual federal deficit = Annual Treasury issuance

Next, we will analyze the main buyers of Treasuries and how they finance their purchases step by step.

The "Waste" That Devours Debt

-

Foreign Central Banks

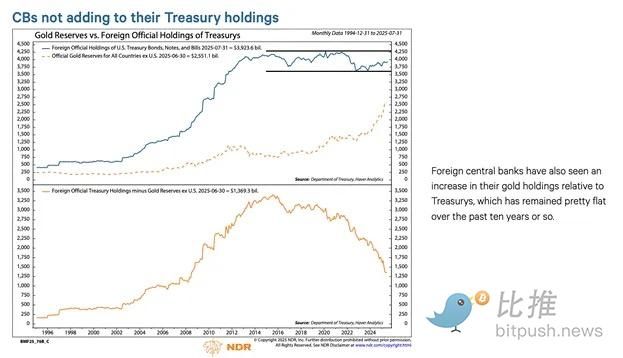

If "Pax Americana" is willing to seize the funds of Russia (a nuclear power and the world's largest commodity exporter), then any foreign holder of US Treasuries cannot ensure safety. Foreign central bank reserve managers are aware of the risk of expropriation, and they would rather buy gold than US Treasuries. Therefore, since Russia's invasion of Ukraine in February 2022, the price of gold has truly soared.

2. US Private Sector

According to the US Bureau of Labor Statistics, the personal savings rate in 2024 is 4.6%. In the same year, the US federal deficit accounts for 6% of GDP. Given that the deficit is larger than the savings rate, the private sector cannot be the marginal buyer of Treasuries.

3. Commercial Banks

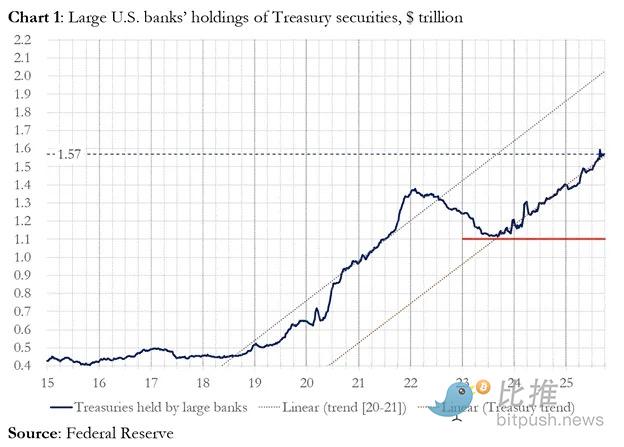

Are the four major money center commercial banks buying large amounts of Treasuries? The answer is no.

In fiscal year 2025, these four major money center banks purchased about $300 billion worth of Treasuries. In the same fiscal year, the Treasury issued $1.992 trillion in Treasuries. While these buyers are undoubtedly important, they are not the ultimate marginal buyers.

4. Relative Value (RV) Hedge Funds

RV funds are the marginal buyers of Treasuries, as acknowledged in a recent Federal Reserve document.

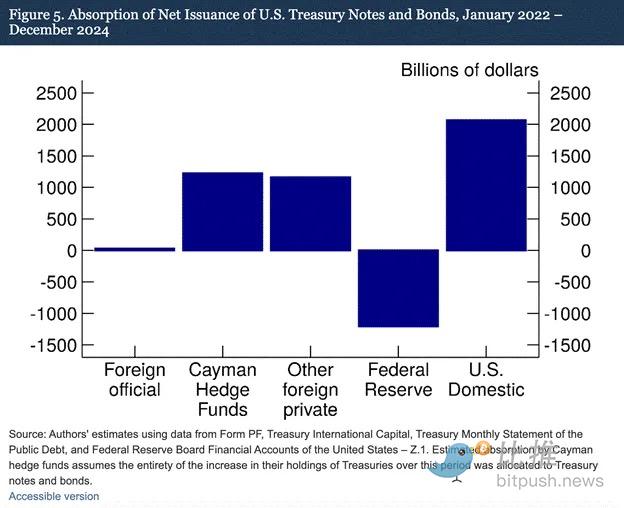

Our findings indicate that Cayman Islands hedge funds are increasingly becoming the marginal foreign buyers of US Treasuries and bonds. As shown in Figure 5, from January 2022 to December 2024—a period during which the Federal Reserve reduced its balance sheet by allowing maturing Treasuries to roll off its portfolio—Cayman Islands hedge funds made net purchases of $1.2 trillion in Treasuries. Assuming these purchases were all Treasuries and bonds, they absorbed 37% of the net issuance of Treasuries and bonds, almost equal to the total purchases by all other foreign investors combined.

RV funds' trading model:

-

Buy spot Treasuries

-

Sell corresponding Treasury futures contracts

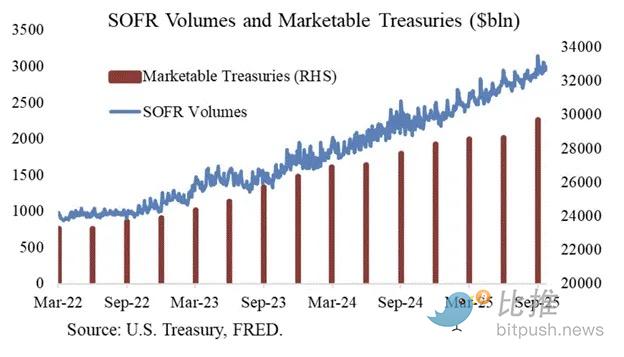

Thanks to Joseph Wang for the chart. SOFR trading volume is a proxy for the scale of RV fund participation in the Treasury market. As you can see, the growth in debt burden corresponds to the growth in SOFR trading volume. This indicates that RV funds are the marginal buyers of Treasuries.

RV funds engage in this trade to earn the tiny price difference between the two instruments. Since this spread is very small (measured in basis points; 1 basis point = 0.01%), the only way to make money is to finance the purchase of Treasuries.

This leads us to the most important part of this article: understanding the Fed's next move—how do RV funds finance their Treasury purchases?

Part Four: Repo Market, Stealth QE, and Dollar Creation

RV funds finance their Treasury purchases through repurchase agreements (repo). In a seamless transaction, RV funds use the purchased Treasury securities as collateral to borrow overnight cash, then use the borrowed cash to settle the Treasury purchase. If cash is abundant, repo rates will trade at or just below the Fed funds upper bound. Why?

How the Fed Manipulates Short-Term Rates

The Fed has two policy rates: the upper bound of the federal funds rate (Upper Fed Funds) and the lower bound (Lower Fed Funds); currently 4.00% and 3.75%, respectively. To force actual short-term rates (SOFR, the Secured Overnight Financing Rate) to stay within this range, the Fed uses the following tools (ordered from lowest to highest rate):

-

Overnight Reverse Repo Facility (RRP): Money market funds (MMF) and commercial banks deposit cash here overnight and earn interest paid by the Fed. Reward rate: Fed funds lower bound.

-

Interest on Reserve Balances (IORB): Commercial banks earn interest on excess reserves held at the Fed. Reward rate: between the upper and lower bounds.

-

Standing Repo Facility (SRF): When cash is tight, commercial banks and other financial institutions can pledge eligible securities (mainly Treasuries) and receive cash from the Fed. Essentially, the Fed prints money in exchange for collateral. Reward rate: Fed funds upper bound.

The relationship among the three:

Fed funds lower bound = RRP < IORB < SRF = Fed funds upper bound

SOFR (Secured Overnight Financing Rate) is the Fed's target rate, representing a composite rate of various repo transactions. If SOFR trades above the Fed funds upper bound, it means the system is short on cash, which will cause big problems. Once cash is tight, SOFR will soar, and the highly leveraged fiat financial system will stop functioning. This is because if marginal liquidity buyers and sellers cannot roll their liabilities at predictable rates near the Fed funds rate, they will suffer huge losses and stop providing liquidity to the system. No one will buy Treasuries because they cannot obtain cheap leverage, causing the US government to be unable to finance itself at affordable costs.

Exit of Marginal Cash Providers

What causes SOFR to trade above the upper bound? We need to look at the marginal cash providers in the repo market: money market funds (MMF) and commercial banks.

-

Exit of Money Market Funds (MMF): MMFs aim to earn short-term interest with minimal credit risk. Previously, MMFs would withdraw funds from the RRP and move them to the repo market because RRP < SOFR. But now, since short-term T-bills offer attractive yields, MMFs are withdrawing funds from the RRP and lending to the US government instead. RRP balances have dropped to zero, and MMFs have essentially exited as cash providers in the repo market.

-

Commercial Bank Constraints: Banks are willing to provide reserves to the repo market because IORB < SOFR. However, banks' ability to provide cash depends on whether they have sufficient reserves. Since the Fed began quantitative tightening (QT) in early 2022, banks' reserves have decreased by hundreds of billions of dollars. Once balance sheet capacity shrinks, banks are forced to charge higher rates to provide cash.

Since 2022, both MMFs and banks, the two marginal cash providers, have had less cash to supply to the repo market. At some point, neither is willing or able to provide cash at rates below or equal to the Fed funds upper bound.

Meanwhile, demand for cash is rising. This is because former President Biden and now Trump continue to spend heavily, requiring more Treasuries to be issued. The marginal buyers of Treasuries, RV funds, must finance these purchases in the repo market. If they cannot obtain daily funds at rates below or just below the Fed funds upper bound, they will stop buying Treasuries, and the US government will be unable to finance itself at affordable rates.

Activation of SRF and Stealth Quantitative Easing (Stealth QE)

Because a similar situation occurred in 2019, the Fed established the SRF (Standing Repo Facility). As long as acceptable collateral is provided, the Fed can provide unlimited cash at the SRF rate (i.e., the Fed funds upper bound). Therefore, RV funds can be confident that no matter how tight cash gets, they can always obtain funding at the worst case—the Fed funds upper bound.

If the SRF balance is above zero, we know the Fed is using printed money to cash the checks written by politicians.

Treasury issuance = Increase in US dollar supply

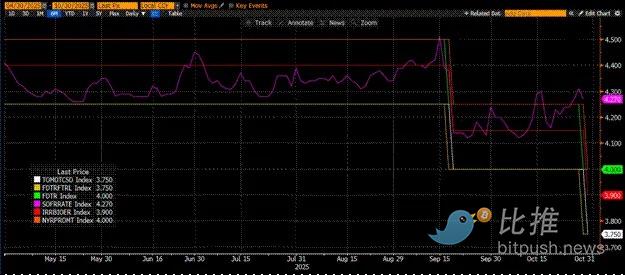

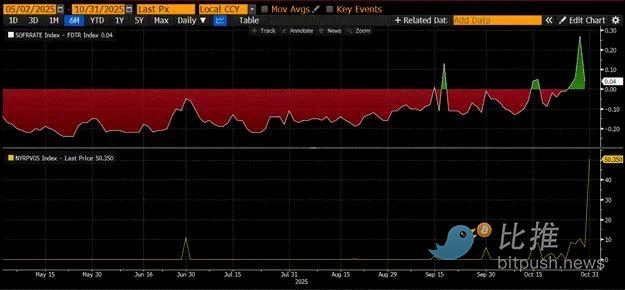

The chart above (top panel) shows the difference between (SOFR – Fed funds upper bound). When this difference approaches zero or is positive, cash is tight. During these periods, the SRF (bottom panel, in billions of dollars) is used in a non-trivial way. Using the SRF allows borrowers to avoid paying higher, less manipulated SOFR rates.

Stealth Quantitative Easing (Stealth QE): The Fed has two ways to ensure there is enough cash in the system: the first is by buying bank securities to create bank reserves, i.e., quantitative easing (QE). The second is by freely lending to the repo market through the SRF.

QE is now a "dirty word," and the public generally associates it with money printing and inflation. To avoid being blamed for causing inflation, the Fed will strive to claim its policy is not QE. This means the SRF will become the main channel for money printing to flow into the global financial system, rather than creating more bank reserves through QE.

This can only buy some time. But ultimately, the exponential expansion of Treasury issuance will force repeated use of the SRF. Remember, Treasury Secretary Buffalo Bill Bessent not only needs to issue $2 trillion annually to fund the government, but also needs to issue trillions more to roll over maturing debt.

Stealth QE is about to begin. Although I don't know the exact timing, if current money market conditions persist and Treasuries pile up, the SRF balance as the lender of last resort will have to grow. As the SRF balance grows, the global supply of fiat US dollars will also expand. This phenomenon will reignite the bitcoin bull market.

Part Five: Current Market Stagnation and Opportunity

Before stealth QE begins, we must control capital. The market is expected to remain volatile, especially before the US government shutdown ends.

Currently, the Treasury is borrowing money through debt auctions (negative for US dollar liquidity), but has not yet spent the money (positive for US dollar liquidity). The Treasury General Account (TGA) balance is about $150 billion higher than the $850 billion target, and this extra liquidity will only be released into the market after the government reopens. This liquidity drain is one of the reasons for the current weakness in the crypto market.

Given that the four-year anniversary of bitcoin's 2021 all-time high is approaching, many will mistakenly interpret this period of market weakness and fatigue as the top and sell their holdings. Of course, that's assuming they weren't "deaded" in the altcoin crash a few weeks ago.

But this is a mistake. The logic of the US dollar money market does not lie. This corner of the market is shrouded in obscure terminology, but once you translate these terms into "printing money" or "destroying money," it's easy to know how to follow the trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

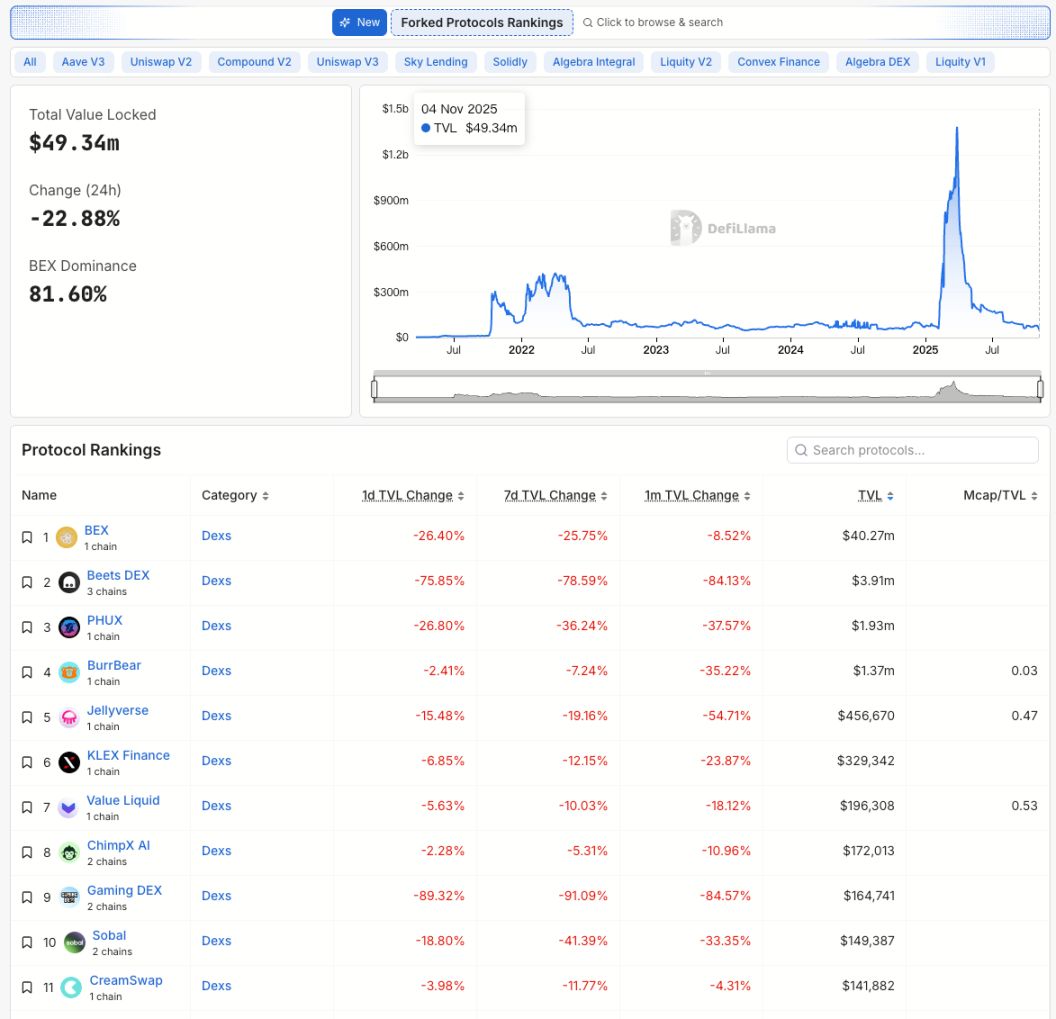

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.