Key takeaways

- BAL is down 12% in the last 24 hours and has dropped below $0.9.

- The coin could retest the April 8 low of $0.739 if the bearish trend persists.

BAL sinks below $0.85 following Balancer hack

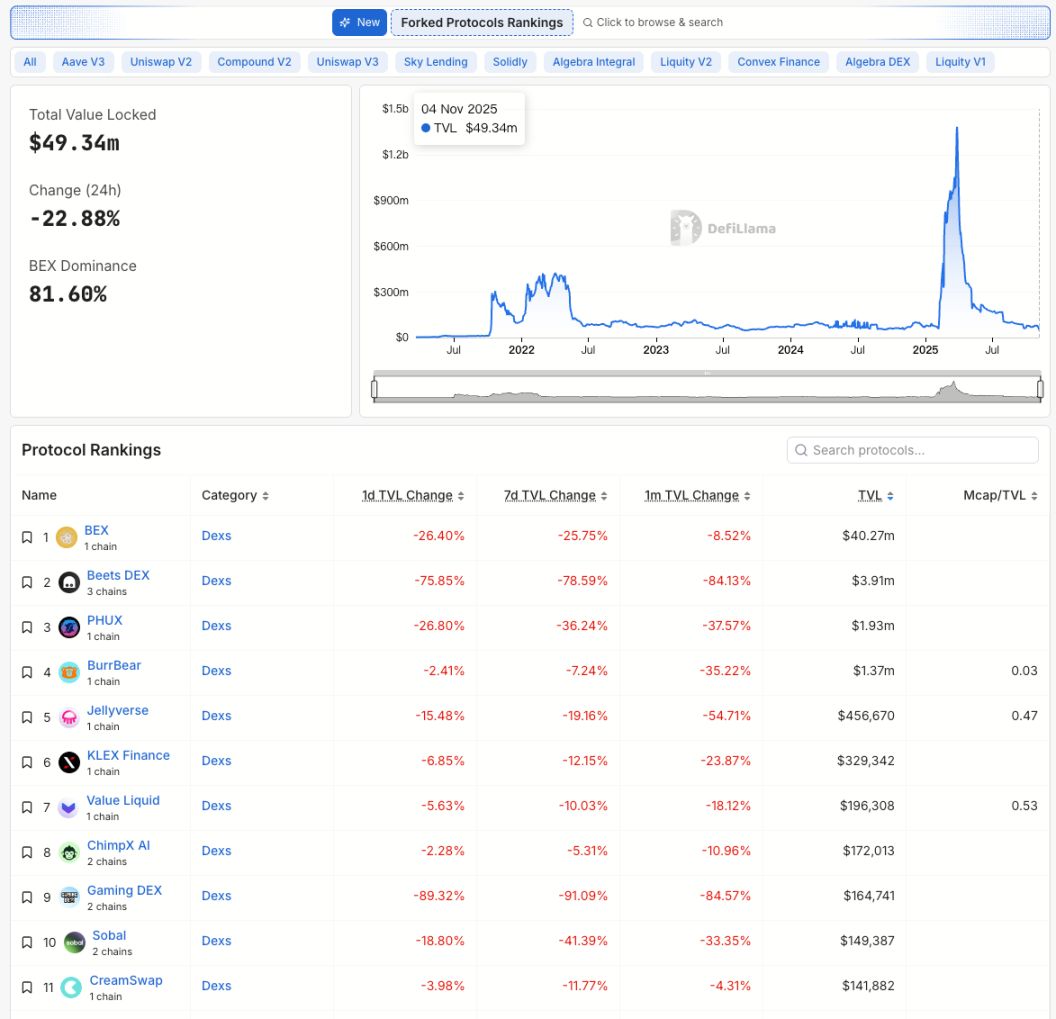

BAL, the native coin of the Balancer platform, has lost 5% of its value in the last 24 hours, making it one of the worst performers in the market. The bearish trend comes after Balancer, a DeFi protocol, suffered a major exploit on Monday, losing roughly $110 million in digital assets.

According to reports, the stolen funds include osETH, WETH, and wstETH. The attacker drained 6,850 osETH, 6,590 WETH, and 4,260 wstETH from the Balancer platform. The security tool Decurity revealed that the hack occurred due to a faulty access control in its “manageUserBalance” function.

manageUserBalance in @Balancer has a faulty access check

In _validateUserBalanceOp it checks msg.sender against user supplied op.sender. It allows to execute UserBalanceOpKind.WITHDRAW_INTERNAL (kind = 1) https://t.co/UBUdD8RGsa pic.twitter.com/KlaYPv56bf

— Defimon Alerts (@DefimonAlerts) November 3, 2025

The vulnerability allowed the attacker to trigger internal balance withdrawals from Balancer’s smart contracts without proper permissions.

BAL could slip below $0.8 if the selloff continues

BAL has lost 12% of its value since the report of the hack on Monday, with the coin losing a crucial daily support level at $0.915. The BAL/USD 4-hour chart has switched bearish and inefficient following the swift selloff recorded by the pair.

The technical indicators are also bearish, suggesting heavy selling pressure. The RSI on the daily chart reads 43, below the neutral 50 and in a bearish zone. The MACD lines also crossed over into the negative zone over the weekend, suggesting a bearish bias.

After dropping below the $0.9150 support, the bulls would need to defend the next major resistance level at $0.735. This support level has held since April 8, and failure to defend this could trigger a yearly low for BAL.

However, if BAL recovers from this selloff, it will need to push above the support-turned-resistance level of $0.9150 over the next few hours or days. This would allow it to push above $1.0 psychological level once again.