Kiln Integrates Chainlink CRE and ACE to Launch Institutional-Grade On-Chain Yield Products

Quick Breakdown

- Kiln integrates Chainlink CRE and ACE to build compliant, automated on-chain yield products tailored for institutional investors.

- CRE enables decentralized execution of vault operations, NAV publishing, and cross-chain settlement without centralized intermediaries.

- ACE embeds compliance directly into DeFi workflows, allowing institutions to enforce access controls, identity verification, and audit-ready policies.

Institutional staking platform Kiln has integrated the Chainlink Runtime Environment (CRE) and Automated Compliance Engine (ACE) to power its next generation of on-chain yield products. The move strengthens Kiln’s ability to offer compliant, transparent, and automated yield infrastructure across multiple blockchains.

. @Kiln_finance , an institutional-grade onchain asset and yield management platform with over $16B in delegated staked assets, has integrated the Chainlink Runtime Environment (CRE) and is integrating the Automated Compliance Engine (ACE). https://t.co/COH1ZXuFVl

With CRE live… pic.twitter.com/aoeHcT6XQU

— Chainlink (@chainlink) November 3, 2025

Initially launching on Base, Kiln plans to extend support to Ethereum, BNB Chain, Optimism, Arbitrum, and Polygon as it scales operations for institutional clients managing digital asset portfolios.

Powering institutional yield with chainlink infrastructure

The integration of Chainlink’s CRE allows Kiln to orchestrate vault operations across blockchains within a secure, decentralized compute environment. This enables automated, tamper-resistant execution without centralized intermediaries, a key requirement for large institutions operating in the regulated DeFi space.

With CRE, Kiln can execute yield strategies, publish on-chain Net Asset Values (NAVs), and automate settlement workflows through Chainlink’s consensus-secured network. Institutions such as Swift, UBS, and Aave already utilize CRE for interoperable, data-connected on-chain processes — underscoring its growing relevance in the tokenized financial ecosystem.

Embedding compliance in permissioned DeFi

Chainlink’s ACE complements CRE by embedding compliance enforcement directly into blockchain workflows. The framework allows Kiln to define and execute policy controls such as allowlists, transaction limits, and identity-based access using cryptographic proofs and audit-ready logs.

This infrastructure supports reusable digital credentials aligned with standards like LEI/vLEI, ONCHAINID, and DIDs, ensuring that DeFi vaults meet institutional-grade compliance without sacrificing transparency or decentralization .

According to Kiln CEO Laszlo Szabo, the integration represents a blueprint for “secure, permissioned DeFi that scales across ecosystems,” providing banks, custodians, and asset managers with the infrastructure needed for compliant yield generation.

In a parallel development, MYX Finance has integrated the Chainlink Data Standard to enhance its permissionless perpetual trading platform, introducing real-time, verifiable market data across all EVM-compatible blockchains. The upgrade represents a major step in bridging institutional-grade precision with DeFi transparency, strengthening confidence in decentralized trading infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

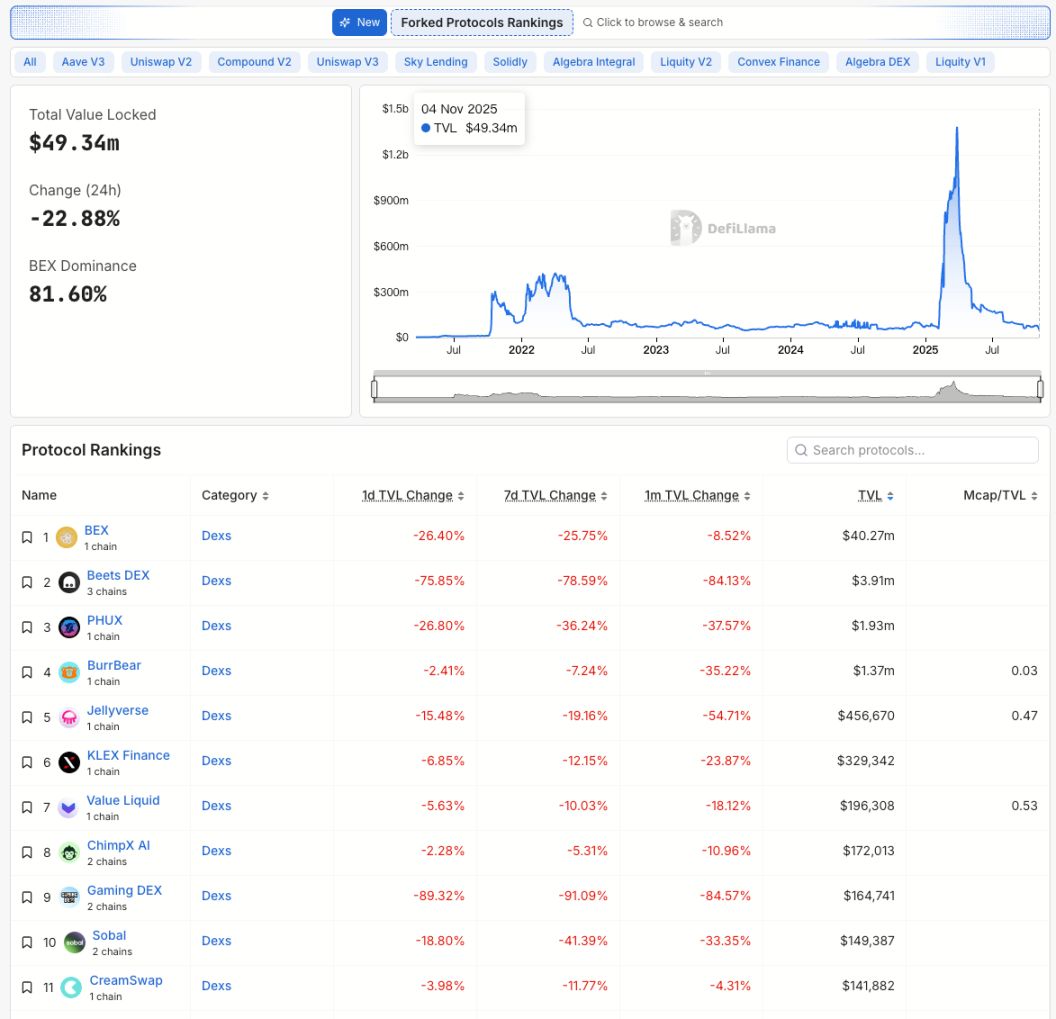

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Berachain: All funds stolen due to the vulnerability have been recovered.

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.