SEC crypto treasury probe frozen by shutdown, but subpoenas could fly soon after government reopens

Quick Take As the U.S. enters its second month of being shut down after Congress could not reach a deal on funding, former SEC lawyers spoke with The Block about what could happen next with a probe involving digital asset treasury strategies. Whether or not subpoenas are eventually sent out will depend on how the companies respond to the initial inquiry. President Trump’s ties to crypto treasuries have helped make the SEC probe a “touchy subject,” argues one legal advocate.

What's shaping up to be the longest government shutdown in U.S. history most likely brought to a halt the Securities and Exchange Commission's inquiry into whether publicly listed crypto treasuries committed any acts that could be construed as insider trading.

But once the government reopens, multiple former SEC lawyers say the regulatory agency will almost certainly restart their probe, which could possibly result in the regulator issuing subpoenas within as little as one to two months should the inquiry escalate into full-blown investigations.

"If the trading is suspicious and there's a strong relationship between a corporate insider — who had material, nonpublic information — and an individual that traded on that information, that may be enough for a subpoena," David Chase, a former SEC enforcement lawyer who now works as a defense attorney, told The Block.

In late September, roughly a week before the U.S. government shutdown began, The Wall Street Journal reported that both the SEC and the Financial Industry Regulatory Authority (FINRA) contacted multiple publicly listed companies, which earlier this year adopted new business strategies of purchasing crypto, with questions about irregular patterns of trading volume and share price movements that may have occurred days before crucial corporate information was made public.

SEC officials specifically warned companies about potential violations of Regulation Fair Disclosure, according to WSJ. The regulation strictly prohibits public companies from disclosing material, nonpublic information to people who might use the intel to inform stock trading decisions.

"The SEC and FINRA don't start off necessarily saying this is an insider trading case," Howard Fischer, a former senior trial counsel at the SEC, told The Block. "They say: 'Let's take a look at this because it looks like before the information was released to the general public, about the adoption of a digital asset treasury strategy, there was anomalous trading in the equities of this company.'"

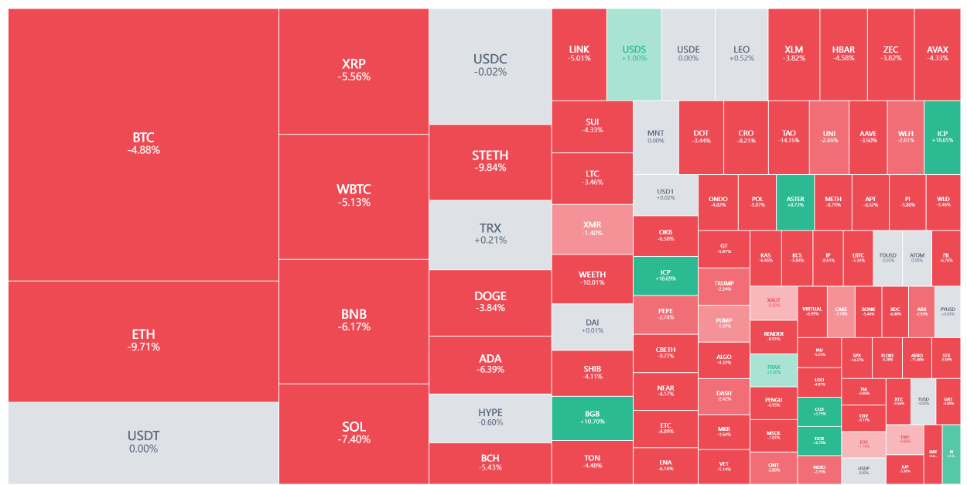

Besides Bitcoin and Ethereum digital asset treasuries (DATs), the two most popular cryptocurrencies among treasuries, several publicly traded companies have also decided to accumulate large quantities of different altcoins. So far, billions of dollars have been invested in DATs.

SEC probe frozen with skeleton crew

For now, neither the SEC nor FINRA is saying anything. FINRA, which is a self-regulatory organization that writes and enforces rules for registered brokers, is fully up and running during the government shutdown. SROs are not part of the federal government and are funded by regulated members, according to the regulator . FINRA declined to comment when asked about the probe.

In the SEC's case, with less than 10% of its staff currently working, the agency's inquiry into crypto treasuries is most likely on ice, as most employees who work on investigations have likely been furloughed.

During the shutdown, which began on Oct. 1, the SEC is working off an agency plan, a spokesperson told The Block. The SEC can respond to emergencies related to either the safety of human life or the protection of property.

Most people expect the stalemate between Republicans and Democrats will eventually end and the U.S. government will be allowed to reopen, with people returning to work. At the SEC, that likely means lawyers, accountants, and other individuals who specialize in investigations picking up where they left off before the shutdown.

Responses to SEC letters important

Whether or not subpoenas are eventually sent out once the government reopens will depend a lot on how different parties, who received letters, choose to respond to regulators, according to former SEC lawyers. The agency could also send out voluntary information requests, which Fischer said is happening more now than under the previous Biden administration.

Voluntary information requests are where the SEC asks for documents during an investigation. Although the requests are not legally enforceable, if the contacted parties decline, that response can trigger a subpoena.

Kris Swiatek, a partner at Seward Kissel LLP, where he specializes in digital assets, told The Block that how companies respond to initial inquiries will play a major role in whether or not the SEC pursues further action and issues subpoenas.

"Every public issuer, and any parties that are related to them in terms of the deals that were struck, will be viewed in its own light at the end of the day," said Swiatek.

Chase said the SEC will want to establish a timeline. "They send what's called a chronology letter, basically who knew what and when at the company in terms of the material, nonpublic information," he said.

And as to who could be facing insider trading allegations?

"It could be insiders at the company. It could be people outside the company. It could be people who are approached to finance these transactions. There's a whole host of people who they could be looking at," said Fischer.

Responses and subpoenas aside, at least one former SEC lawyer said the existing data could be enough to jumpstart a proper investigation.

"If this was a real insider trading investigation that they wanted to pursue, they could make a lot of headway just based on the market information," one former SEC lawyer told The Block.

Fischer said although it's unclear exactly what regulators are looking at, they are likely analyzing market activity.

"If you look at a chart of average daily volume before they announce this kind of activity, there's a huge spike … so clearly someone knew what was going to happen or predicted it based on other information and purchased the securities in anticipation of that market move," he said.

Chase said if subpoenas are issued, the SEC will likely ask to see phone, email, text, and social media communications. Then, after testimonies are taken, the SEC would probably determine whether there is enough evidence to move forward with recommending charges and issuing a Wells notice. That notice is a form of communication from SEC staff that lets a firm know that the agency's staff may recommend an enforcement action against them.

Crypto treasuries a 'risk area'

While the DAT phenomenon is a recent one, the SEC scrutinizing crypto companies and individuals who work in crypto is nothing new. In 2023, the SEC charged Terraform Labs and Do Kwon with securities fraud. Coinbase and Binance have also been targeted. The SEC ended up settling with Terraform and later dismissed the cases against Coinbase and Binance . The SEC also brought a lawsuit against crypto-project Unicoin for allegedly offering fraud rights certificates to investors of its cryptocurrency and common stock. That lawsuit is still ongoing.

Since President Trump took office, however, the U.S. government's, including the SEC's, treatment of crypto organizations has been markedly different, with digital asset executives celebrating the seemingly pro-crypto administration.

"Regulators have been certainly warming up to crypto under this new administration," said Swiatek, adding that this SEC probe could end up being the first instance of the agency questioning the behavior of companies operating in the digital assets space during Trump's second term.

"This is sort of one of the first new signs of 'Look, there's something happening here that we need to look into.' That's an interesting dynamic," he said.

David Namdar, who is CEO of the Nasdaq-listed crypto treasury BNB Network , which owns over $450 million in BNB tokens, seems to think some people in crypto need to become accustomed to a new, and more regulated form, of doing business.

"As the digital asset and venture worlds intersect more with public markets, there’s a learning curve about how material information must be controlled," he told The Block. "One issue in certain deals in the sector has been what people describe as information leakage, related to situations where bad actors have shared pieces of information related to a potential transaction, leading to market chatter about pending transactions before official filings."

Namdar said that to the best of his knowledge, BNB Network, which is officially named CEA Industries Inc., is "not among the companies subject to in-depth inquiries from the SEC or FINRA."

'Touchy subject' given Trump ties to DATs

One legal advocate for a major crypto venture capital firm warned that the digital asset treasury boom could end up being a considerable "risk area" for the digital assets industry if DATs take on too much debt to buy crypto. But the advocate also said there's a worry among some monitoring the situation that the SEC looking into DATs might reveal irregular activity within an organization tied to the Trump family.

"On the DATs, there is some fear about the Trump family," the person said, adding that the policing of DATs is a "touchy subject" due to the president's close ties to crypto treasuries.

While there is no proof that the Trumps have done anything wrong or that the SEC is looking into any companies with ties to the president, Trump is connected to more than one DAT, including Nasdaq-listed ALT5 Sigma Corporation, which holds a reserve of WLFI tokens, the native cryptocurrency of World Liberty Financial, which is a Trump-backed DeFi project. Trump-owned Trump Media Technology Group Corp., the company behind Truth Social, also adopted a crypto treasury strategy . Trump Media is also listed on the Nasdaq.

ALT5 Sigma and Trump Media didn't immediately respond to a request for comment.

The advocate, however, is encouraged that the SEC is trying to get to the bottom of whether or not wrongdoing occurred, regardless of how crypto-friendly Trump's government has been.

"This is what the SEC should be doing. You want them actually focused on nascent areas where there's a burst of activity and some questionable, inter-person trading," they said. "This is what we would want out of the SEC if we want crypto to work well."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CZ Discusses the Memecoin Craze, Hyperliquid, and Offers Advice to Entrepreneurs

CZ's life after stepping down, reflections, and deep insights into the future of crypto.

Privacy coins surge against the trend—is this a fleeting moment or the dawn of a new era?

The whale myth has collapsed! No one can beat the market forever!

Still dare to play with DeFi? This feeling is all too familiar...