I. Project Introduction

Momentum is a global financial operating system built on the Sui blockchain, aiming to provide efficient and scalable DeFi infrastructure for the tokenization era. Its flagship product, Momentum DEX, adopts a Concentrated Liquidity Market Maker (CLMM) model, deeply optimized for the Move language ecosystem, supporting refined capital deployment and liquidity management. Since the Beta launch on March 31, 2025, Momentum has rapidly developed into the core liquidity hub of the Sui ecosystem. The platform uses a ve(3,3) governance model to convert users into active and incentive-aligned community members, while supporting multi-chain interaction, greatly reducing transaction fees (up to 80%), and significantly improving liquidity provider returns.

Momentum’s greatest technological innovation lies in its CLMM-based architecture, which is significantly superior to traditional Uniswap v3-style DEXs by achieving higher capital efficiency through concentrated liquidity allocation. The platform integrates automated yield vaults, RWA asset tokenization, Launchpad, and other modules, forming a unified financial operating system rather than being limited to a basic trading tool. The token economic model uses MMT as the core governance and incentive token, integrating the ve(3,3) model and establishing a long-term incentive loop through locking and participation rights. As of October 25, 2025, Momentum has attracted more than 2.1 million users, with $600 million in TVL and total trading volume of $26 billion, demonstrating strong user growth and ecosystem influence.

II. Project Highlights

Core position in the Sui ecosystem and market performance: Momentum positions itself as the mainstream decentralized exchange (DEX) and liquidity engine of the Sui ecosystem, undertaking roles such as liquidity aggregation, capital efficiency optimization, and ecosystem project incubation. Since its Beta launch, TVL has remained healthy (from $357M to $600M), daily trading volume exceeds $100M, cumulative trading volume has surpassed $23–25 billion, and protocol fees have exceeded $15 million. It accounts for 24%–43% of Sui DeFi’s total liquidity, with trading volume/TVL ratios ranking at the top of the Sui ecosystem, becoming one of its central liquidity protocols.

ve(3,3) governance and incentive economic model: The core governance mechanism adopts the ve(3,3) model, similar to veCRV. Users obtain $veMMT voting rights by locking $MMT, with longer lock-up periods resulting in higher voting weights. Users can participate in incentive pool distribution, platform governance, and protocol fee sharing. This model creates a long-term “trust loop,” effectively encouraging LPs and users to hold long-term positions and actively participate, significantly suppressing liquidity outflow and short-term “farm-and-dump” behavior.

Full-function DeFi infrastructure suite: In addition to being an efficient DEX, Momentum also integrates various core DeFi components, including the main DEX platform, secure multisig management (MSafe), Smart Vaults (automated yield vaults), and more. These Vaults are built by a professional team and feature automated rebalancing, compounding, leverage, and looping strategies to reduce user operational complexity. The Launchpad (TGL) is designed for high-quality projects, supporting strategic allocation and anti-speculation mechanisms to further contribute to Sui ecosystem growth.

Cross-chain and RWA asset expansion to connect Web3 with traditional finance: Momentum is committed to building cross-chain financial infrastructure with protocols like Wormhole, enabling multi-chain expansion and supporting seamless transfer of various asset classes, including tokens, equities, and real estate. It is actively expanding into RWA tokenization, promoting deep integration between crypto assets and traditional financial markets, expanding global liquidity and compliance of digital assets, and ultimately building a bridge between Web3 and the real economy to broaden the coverage of DeFi assets.

III. Market Cap Outlook

As a representative ve(3,3) governance-based CLMM DEX in the Sui ecosystem, Momentum has formed clear network effects and an ecosystem foundation. Currently, Momentum has over 2.1 million users, $600 million in TVL, and over $26 billion in cumulative trading volume. As the DeFi narrative gains momentum, Momentum is expected to remain the preferred liquidity infrastructure protocol on the Sui chain. On November 4, MMT was listed on Bitget and other major exchanges, closing at 0.394 USDT within 15 minutes of listing, with a peak price of $4.229 and a maximum increase of over 973%. MMT’s current circulating market capitalization has reached $410 million.

IV. Token Economics

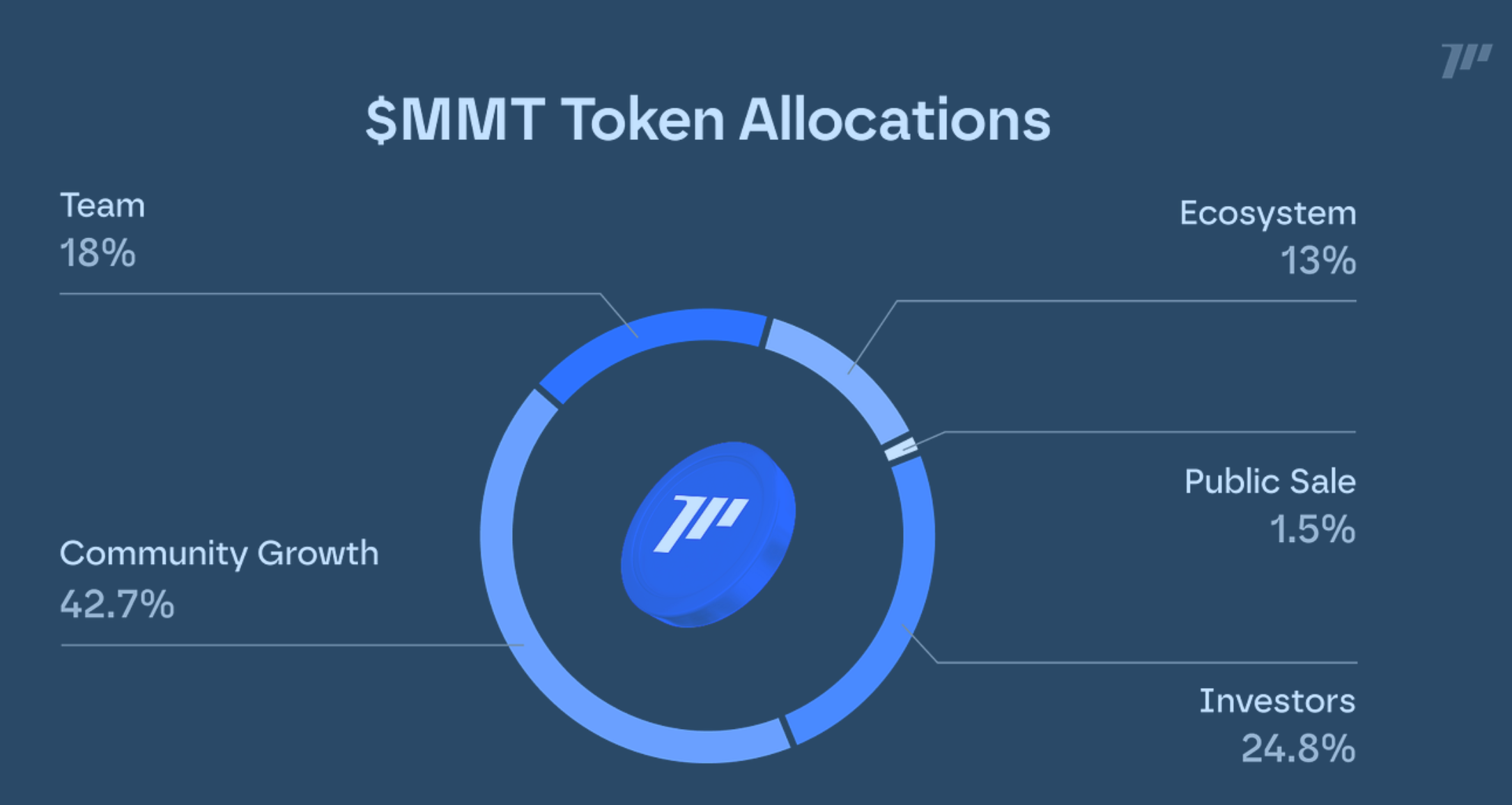

Total Token Supply The total supply of MMT is 1 billion tokens, with an initial circulating supply of approximately 175 million (17.54% of total supply). Token allocation and vesting mechanisms:

Community Growth: 42.72% (9.91% unlocked at TGE, the remainder linearly released over 60 months)

Institutions: 24.78% (0% unlocked at TGE, 12-month lockup, remainder released linearly over 48 months)

Team: 18% (0% unlocked at TGE, 48-month lockup)

Ecosystem: 13% (9% unlocked at TGE, the remainder released linearly over 24 months)

Public Sale: 1.5% (fully unlocked at TGE)

Token

Use Cases:

Governance voting: Lock $MMT into $veMMT to participate in protocol voting, fee sharing, and liquidity incentive allocation

Liquidity incentives: Rewards for LPs and liquidity protection

Revenue sharing: veMMT holders receive protocol fee dividends

Ecosystem expansion: Supports project incubation (TGL), cross-chain aggregation, and RWA trading

Other use cases: Supports automated vault compounding, and serves as a trading pair asset after TGE

IV. Funding Information

Momentum Finance has raised a total of $10 million, backed by multiple top Web3 and DeFi investors. Major investors include Coinbase Ventures, DNA Fund, and several leading crypto VCs, along with ecosystem support from Circle and Aptos.

V. Risk Warnings

Approximately 20.41% of tokens unlock within the first month of TGE. If ecosystem user growth and TVL are insufficient, or if the market experiences sharp volatility, there may be profit-taking from early investors, creating potential sell-pressure and price fluctuations.

The ve(3,3) model relies heavily on community participation and lock-ups. If the DeFi market weakens and user activity decreases, governance efficiency and incentive distribution may be affected, leading to declining liquidity stability or model underperformance.

VI.Official Links

Disclaimer: This report is AI-generated, with human verification of information only. It does not constitute any investment advice.