155 Million ASTER Whale Accumulation Brings Price Back To $1

Whale accumulation of 155 million Aster tokens has reignited investor confidence, pushing ASTER back above $1 and signaling the potential start of a fresh recovery phase.

Aster (ASTER) has experienced a turbulent few weeks, marked by a sharp decline followed by a short-lived recovery. Despite the volatility, the altcoin has managed to hold above the $1.00 threshold, a level that investors appear determined to defend.

Recent on-chain data shows that this stability is being reinforced by strong whale accumulation, which could help the token regain lost ground.

Aster Investors Back Recovery

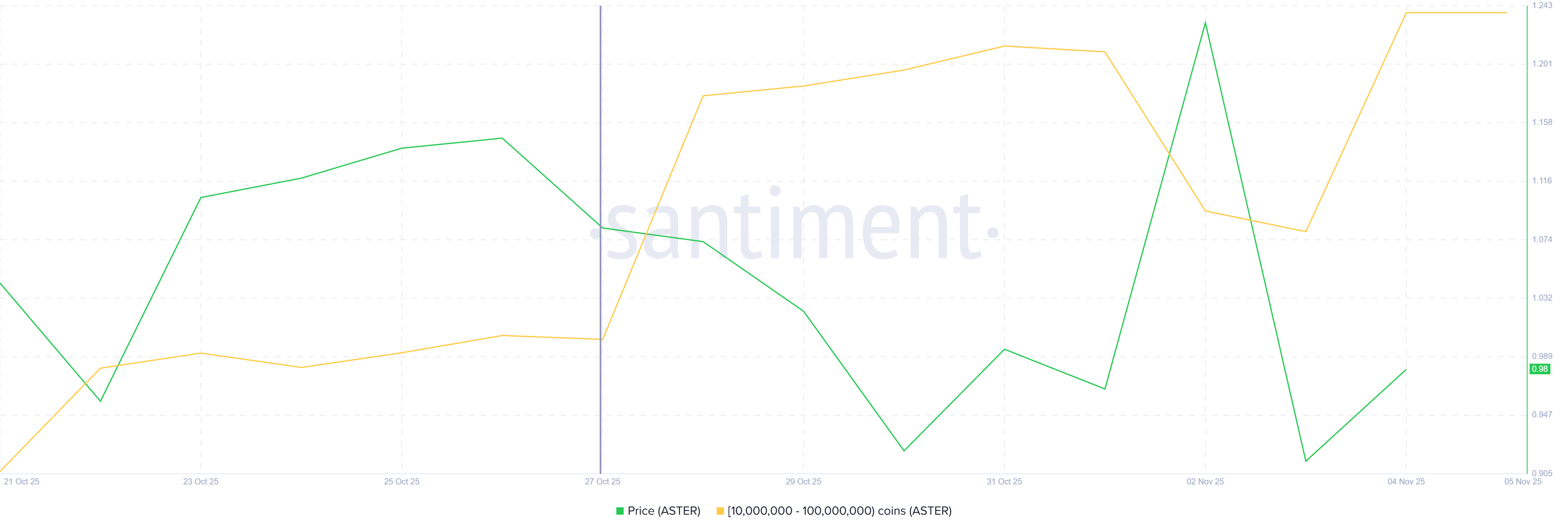

Whale investors have become a key driving force behind Aster’s recovery. Wallets holding between 10 million and 100 million ASTER tokens have significantly increased their holdings over the past week. In total, these large investors purchased more than 154 million ASTER, worth approximately $155 million, signaling renewed institutional confidence in the asset.

This accumulation suggests that whales view current price levels as an attractive entry point. Their growing support, especially during a period of uncertainty, reinforces bullish sentiment among smaller investors.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Aster Whale Holding. Source:

Aster Whale Holding. Source:

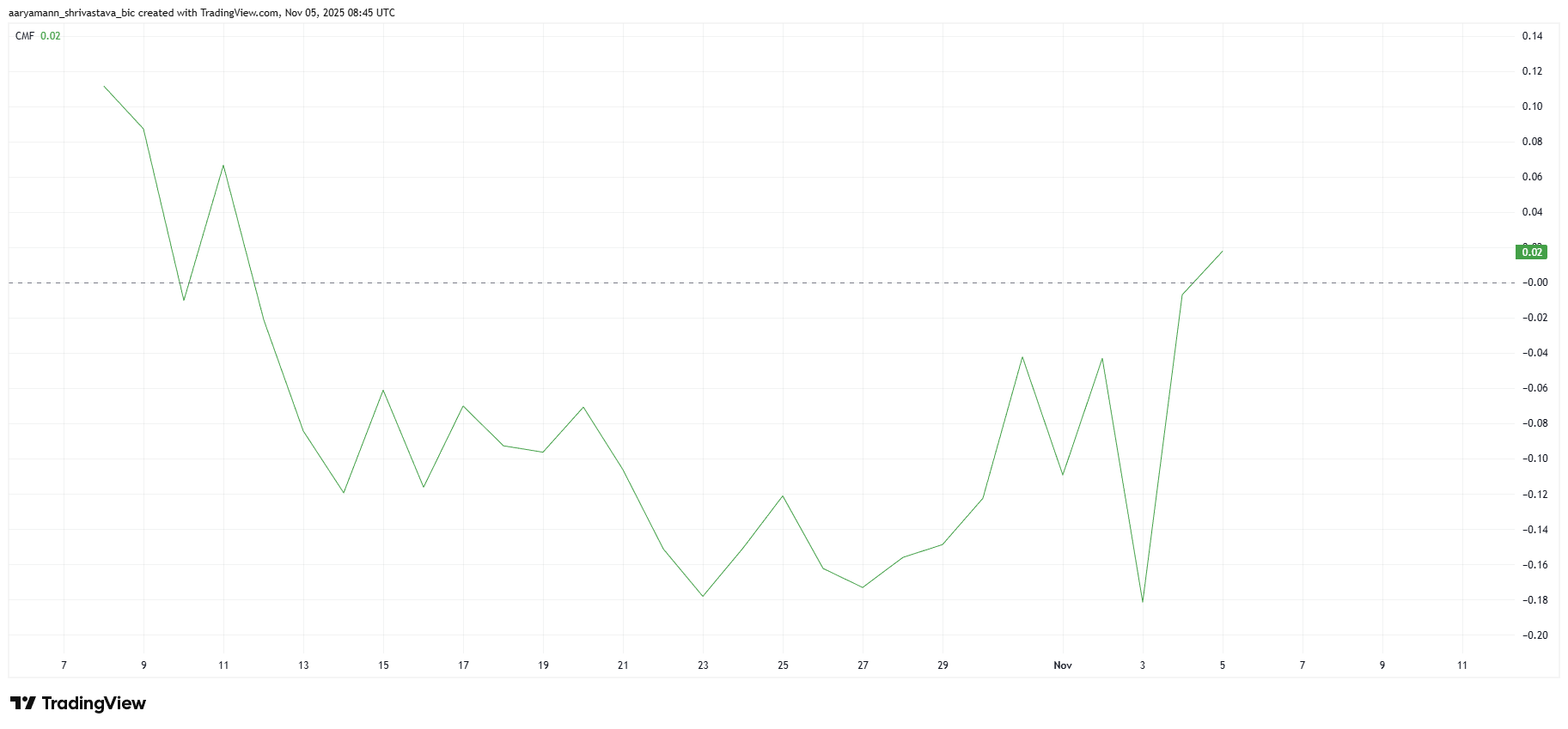

Beyond whale behavior, broader market indicators also suggest improving momentum for Aster. The Chaikin Money Flow (CMF) indicator highlights consistent inflows, signaling that capital from all investor groups is moving back into ASTER. This increase in buying pressure supports the notion that the asset may be entering an accumulation phase.

It marks the first time in four weeks that ASTER’s CMF has entered a sustained positive zone, a sign that demand could be reignited across the market. The growing optimism among investors may drive further price appreciation.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Needs To Find A Way

At the time of writing, ASTER is trading at $1.01, holding just above the crucial $1.00 support level. This resilience amid broader market skepticism provides a stable base for potential growth in the near term.

If the buying momentum continues, Aster’s price could rise toward $1.15 and potentially $1.25. Such a move would likely attract additional inflows, helping extend the rally.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if investor sentiment weakens and selling pressure builds, ASTER could slip below $0.95 and test lower supports at $0.88 or $0.80. This would invalidate the bullish outlook and delay any sustained recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind Polymarket’s $2 billion splurge: The New York Stock Exchange’s self-rescue campaign

The New York Stock Exchange's self-rescue movement essentially redefines the business model of traditional exchanges. With the IPO market shrinking, trading volumes declining, and data services experiencing sluggish growth, traditional exchanges can no longer rely solely on their conventional profit models to maintain competitiveness.

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.