Key Market Insights for November 5th, how much did you miss out on?

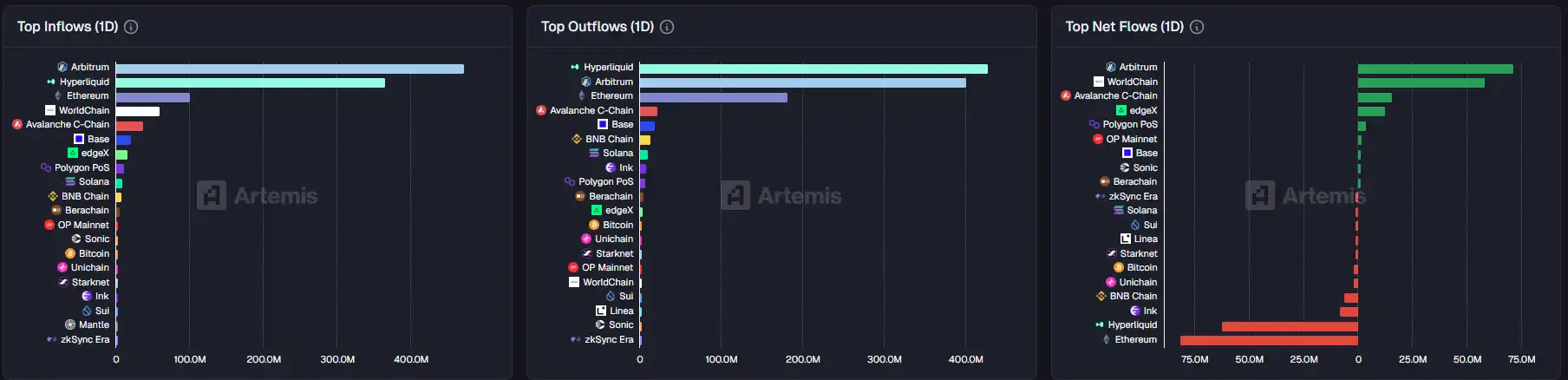

1. On-chain Funds: $71.4M USD flowed into Arbitrum today; $81.3M USD flowed out of Ethereum 2. Largest Price Swings: $MMT, $XUSD 3. Top News: GIGGLE keeps rising, breaking through $143 in a short time, with a 24-hour surge expanding to 178%

Featured News

1. GIGGLE Continues Surge with a Short-Term Breakthrough to $143, 24-hour Gain Expands to 178%

2. MMT Surges Briefly Touching $1.5

3. Bitcoin Rebounds Breakthrough $102,000, 24-hour Loss Narrows to 4.7%

4. U.S. Government Enters 36th Day of "Shutdown," Setting a New Record for the Longest Ever

5. Nansen Data Reveals Top 100 Binance Smart Chain Addresses Increased Holdings by 714% in the Past 30 Days

Trending Topics

Source: Overheard on CT, Kaito

Here is the translation of the original content:

[PEPE]

Today, discussions around PEPE mainly focused on significant market activities and notable purchases. A new Chinese whale has been actively acquiring Plush Pepe NFTs, spending millions of dollars to support the floor, while another noteworthy purchase was Plush Pepe #1442, transacted at a price of 9718 TON. Additionally, a clever whale who previously profited from PEPE made a substantial investment in ASTER. Despite the overall bearish sentiment in the crypto market, PEPE remains a hot topic due to these high-profile transactions.

[STREAM]

STREAM Finance took center stage today due to a major loss caused by an external fund manager, resulting in $93 million losses, leading to deposit and withdrawal freezes and a drop in the value of its stablecoin xUSD. This event has raised concerns about the wider DeFi ecosystem's exposure to STREAM's financial troubles, with other protocols (such as Morpho, Euler, and Silo) potentially at risk of contagion. This situation sparked debates on the importance of risk management practices and operational transparency in DeFi.

[MORPHO]

Today, the discussion around MORPHO mainly focused on the aftermath of the Stream Finance crash, leading to a strict scrutiny of the Curator model used by Morpho. This event highlighted the risks associated with high-yield vaults and the importance of risk management in DeFi. Despite the negative sentiment, some tweets defended Morpho's isolated market model, emphasizing that it prevented a wider spread. The discussion also involved the need for Curators to have better transparency and accountability, as well as the potential for DeFi to responsibly scale.

[LINK]

Today, Chainlink (LINK) garnered attention due to several significant announcements and developments. The launch of Chainlink's Chainlink Runtime Environment (CRE) and Chainlink Confidential Computing was highlighted as a key innovation enabling private smart contracts and enhancing on-chain finance. UBS successfully executed the first on-chain tokenized fund redemption using Chainlink's Digital Transfer Agent, marking a milestone in blockchain infrastructure. Additionally, Tradeweb partnered with Chainlink to on-chain publish U.S. Treasury data through DataLink, further advancing institutional tokenization efforts. Despite these positive developments, there are concerns about a Chainlink oracle failure leading to a $1 million vulnerability in the Moonwell protocol.

[MOMENTUM]

Momentum (MMT) received significant attention today as it was listed on several major exchanges, including Binance, Bybit, and OKX. The token's launch was marked by various trading opportunities, airdrop distributions, and investor protection features. The community is excited about the project's potential, with discussions highlighting its innovative DeFi mechanisms such as the ve(3,3) model and strategic partnerships. The token's performance, trading incentives, and future growth prospects are key topics driving the discussion around MMT.

Featured Articles

1. "Wall Street Continues to Sell Off, How Much Further Will Bitcoin Drop?"

In the first week of November, the sentiment in the crypto market was very bearish. Bitcoin has plummeted to a new low below the "10.11" crash, failing to hold the $100,000 mark and even dropping below $99,000, hitting a six-month low, while Ethereum fell to a low of $3,000. The total 24-hour liquidation amount exceeded $2 billion, with long positions losing $1.63 billion and short positions being liquidated for $400 million.

2.《Why Does the Bitcoin Price Surge When the US Government Shuts Down?》

The US government shutdown has officially entered its record-breaking 36th day. In the past two days, the global financial markets have tumbled. The Nasdaq, Bitcoin, tech stocks, Nikkei Index, and even safe-haven assets such as US Treasuries and gold have not been spared. As market panic spreads, Washington politicians continue to bicker over the budget. Is there a connection between the US government shutdown and the global financial market downturn? The answer is emerging.

On-chain Data

On-chain Fund Flow Data for the Week of November 5

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Washington fueled the Bitcoin bubble, Peter Schiff says

Arthur Hayes, Bitwise exec still bullish as Bitcoin falls under $100K

Bitcoin price 21% dip ‘normal’ as accumulator wallets buy 50K BTC in day

How token burns affect price, and when they don’t