A $500 billion valuation giant is emerging

With a valuation comparable to OpenAI and surpassing SpaceX and ByteDance, Tether has attracted significant attention.

With a valuation on par with OpenAI, surpassing SpaceX and ByteDance, Tether has attracted significant attention.

Written by: Liu Guohui

Editor: Guan Xueqing

Source: Miaotou APP

Stablecoins are overtaking fiat currencies, becoming the choice for many people in Argentina.

Local residents purchase USDT not to profit from further crypto asset investments like those in the crypto community, but to indirectly hold US dollars through holding the token, thereby hedging against wealth erosion caused by depreciation of the local currency. In some local consumption scenarios, such as coffee shops, USDT and other stablecoin payments have also started to be accepted.

This is because, even with diligent governance, Argentina under President Milei has only seen its annual inflation rate drop from 211.4% in 2023 to 43.5% by mid-2025, which is still at a high level.

Now, people in many countries across Africa, South America, and elsewhere are widely using stablecoins.

Among these, besides the need to maintain wealth stability, people in these countries are also using stablecoins for cross-border payments. Based on blockchain technology, not only are transactions settled quickly, but the costs are also much lower than traditional banking cross-border transfers.

In Argentina, about two-thirds of cryptocurrencies purchased through exchanges are stablecoins pegged to the US dollar, with the main one being USDT issued by Tether.

The global reach of USDT should not be underestimated.

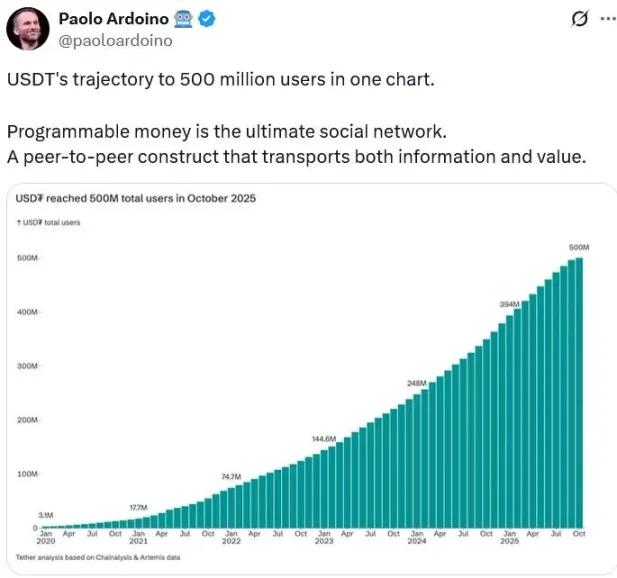

On October 22, Tether CEO Paolo Ardoino stated that the number of its "real users" has exceeded 500 million, which is about 6.25% of the global population.

Such a massive user base has pushed USDT's issuance scale to over $180 billions.

At the same time, as the world's largest stablecoin issuer, Tether's net profit in 2024 has reached $13 billions, surpassing even some of the world's largest banks in profitability.

Its valuation is even more astonishing.

According to Bloomberg, investment bank Cantor Fitzgerald, controlled by the Lutnick family (with the current US Secretary of Commerce), is pitching Tether Holdings to investors, planning to raise $15 billions at a target valuation of $500 billions. Japan's SoftBank Group and Cathie Wood's Ark Invest are in talks to participate.

What does a $500 billions valuation mean? AI giant OpenAI recently completed a share transfer deal worth about $6.6 billions, bringing its valuation to $500 billions. ByteDance, which is not yet listed, is currently valued at around $330 billions. Elon Musk's SpaceX was valued at $350 billions at the end of last year.

With a valuation on par with OpenAI and surpassing SpaceX and ByteDance, Tether has become a focal point. Why can a company focused on stablecoins, facing an uncertain regulatory environment, achieve such a high valuation?

The Troubles of New Money

Before understanding Tether, let's look at some recent anecdotes about the company.

As the world's largest stablecoin company, Tether has continued to increase its holdings in the renowned Italian football club Juventus on the secondary market this year, now holding 11.5% and becoming the second-largest shareholder. The reason for investing in Juventus is likely because both Tether's current chairman and CEO are from northern Italy, within Juventus' traditional sphere of influence.

For nearly a century, Juventus has been owned by the Italian Agnelli family. The current family head, John Elkann, serves as chairman of Stellantis Group and Exor Group. Stellantis is the world's fourth-largest automaker, with brands such as Fiat, Maserati, and Peugeot Citroën. Exor Group owns assets like Ferrari and Juventus, representing classic "old money."

Besides holding shares, Tether has recently been quite active in Juventus' corporate governance.

In October 2025, Tether officially nominated two candidates for Juventus' board of directors, proposing amendments to the club's charter to allow minority shareholder representatives to join the board and its key committees.

The demands of new money were ignored by old money, as Juventus' board completely rejected Tether's proposals regarding capital increases, board composition, and participation in internal committees.

The battle between new and old money may continue in the future and is sure to be exciting.

The current situation for old money is not optimistic. In 2024, Stellantis Group's net revenue was €156.9 billions, down 17% year-on-year; net profit was €5.5 billions, a 70% year-on-year plunge. Its current total market value is only $30 billions. Meanwhile, Tether, a crypto giant, is expected to achieve a net profit of $15 billions in 2025, with its valuation possibly climbing to $500 billions.

Why does old money with a $30 billions market cap look down on new money valued at $500 billions?

Besides the desire for control, it should also be noted that although old money finds it hard to make money, the industry is mature and holds a status that new money cannot reach. During the Club World Cup held in the US this summer, Juventus was the only team invited to the White House to meet Trump. Even top clubs like Real Madrid and Manchester City, who currently perform better than Juventus, do not have this status, simply because John Elkann is a friend of Trump.

As for Tether, last year it sold shares at a low price to investment bank Cantor Fitzgerald to get close to Lutnick, who was then on Trump's team and later became Secretary of Commerce.

Tether's business requires political protection. This round of fundraising, despite not lacking funds, may also be to bring in people with more resources and influence.

This reflects Tether's current state: the business is highly profitable but has not yet gained mainstream recognition and urgently needs to establish a social status that matches its high profitability and valuation.

The Rise of Top "New Money"

How did Tether become the industry leader in such an important emerging sector?

Tether Chairman Giancarlo Devasini and CEO Paolo Ardoino are both Italian. Giancarlo rarely appears in public, while CEO Ardoino now acts as an evangelist, frequently communicating with the outside world through media and social networks. Neither were the earliest developers of USDT; both started in the crypto world by running crypto asset exchanges.

In 2012, Giancarlo Devasini invested in the exchange Bitfinex and gradually took over operations. Ardoino was responsible for technical development at Bitfinex. At that time, bitcoin was just emerging, and its price was extremely volatile. Especially in 2014, the crypto world experienced the collapse of Mt.Gox, then the largest exchange, due to a massive bitcoin loss from a hack, causing the bitcoin price to drop from over $1,000 to $200.

Against the backdrop of huge price fluctuations, three American developers—Brock Pierce, Reeve Collins, and Craig Sellars—launched the Realcoin project, issuing a cryptocurrency pegged 1:1 to the US dollar to achieve price stability and serve as a medium of exchange in the digital asset field. Realcoin was later renamed Tether, meaning "to tie," pegged to the US dollar, with the token named USDT, making it one of the earliest stablecoins.

At the time, due to low recognition of cryptocurrencies, Bitfinex often faced terminated partnerships with banks, making fiat deposit channels a major problem for the exchange.

Bitfinex executives took over the Tether project, registered a company in the British Virgin Islands, and operated it, trading on Bitfinex and other exchanges. Customers could exchange fiat for USDT at a 1:1 ratio and then trade bitcoin and other crypto assets, eliminating the need for multiple bank channels and simplifying the trading process, thus becoming a bridge between crypto assets and fiat currencies.

However, the significant growth in USDT users has only occurred in recent years.

According to Tether's data, there were only about 3 million users in 2020, growing to 500 million in just over five years. For the first five years, it remained a relatively niche asset, mainly due to limited use cases. In the early years, USDT was primarily used for crypto asset trading.

Growth in Tether user base

During those years, the overall crypto market was still in its early stages, and national policies toward crypto assets were not as friendly as they are now. The user base was small, market depth insufficient, and demand for stablecoins relatively limited. Moreover, the stablecoin sector lacked clear regulatory frameworks, making investors and institutions cautious about stablecoin development.

CEO Paolo Ardoino has also stated that despite years of blockchain industry development, user experience remains poor because attention was focused on the wrong things—only on our own "ecosystem," which mainly consisted of geeks and those with time to learn new things.

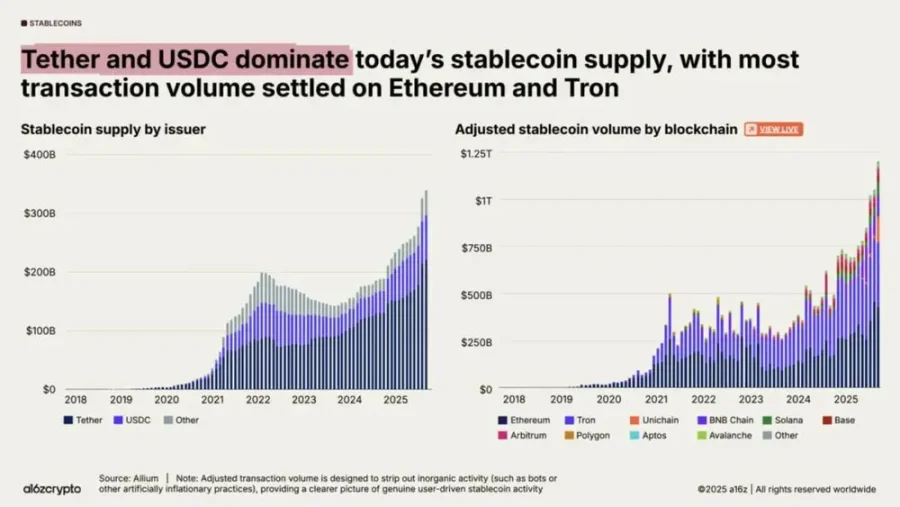

Growth in stablecoin issuance and transaction volume

USDT and the entire stablecoin market saw a surge in scale after 2019, as the convenience of using USDT for cross-border payments was gradually discovered by many users. In addition, the DeFi ecosystem accelerated during this period, with the prosperity of lending, crypto trading, derivatives, and asset management.

After 2023, RWA (Real World Assets) became a mainstream narrative in blockchain, further increasing demand for stablecoins. Both USDT issuance and transaction volume grew rapidly, boosting Tether's customer base and profitability.

Why Is It Worth $500 Billion?

In short, Tether has much in common with Chinese internet companies.

Tether dares to seek a $500 billions valuation from the capital markets, based on two factors: first, the stablecoin industry's growth prospects are widely favored by institutions; second, Tether's high market share and unique competitiveness in the stablecoin sector.

Although Tether launched USDT in 2014, its scale did not grow significantly in the early years. In 2019, the stablecoin market was about $5 billions. Now, the market generally expects the scale to multiply several times.

US Treasury Secretary Bessant believes that by 2028, the stablecoin market will exceed $2 trillions, or even more. Bernstein predicts that in the next decade, stablecoin supply will grow to about $4 trillions.

The most direct supporting factor behind this is the gradual improvement of regulatory frameworks, with major financial centers introducing targeted regulations. The US passed the GENIUS Act, Hong Kong implemented the Stablecoin Ordinance, and the EU's MiCA regulation took effect, establishing licensing systems. These regulatory measures have cleared obstacles for large-scale institutional capital inflows, pushing stablecoins from a gray area into mainstream finance.

In terms of specific demand, besides the huge scale of cross-border payments, the RWA tokenization wave is also emerging, with tokenized stocks, bonds, and other traditional assets achieving uninterrupted trading and settlement through stablecoins. Institutions predict that by 2030, RWA-related stablecoin demand will account for 25%-40% of the market.

There is also a clear risk-hedging demand in emerging markets. In economies with structurally weak currencies, such as Argentina, Turkey, and Nigeria, inflation and currency depreciation create organic demand for US dollars. Surveys show that among the primary reasons for using stablecoins in emerging markets, "saving in US dollars" and "converting local currency to US dollars" account for 47% and 39%, respectively, making stablecoins a "digital safe-haven asset" for residents to protect wealth and avoid local currency depreciation.

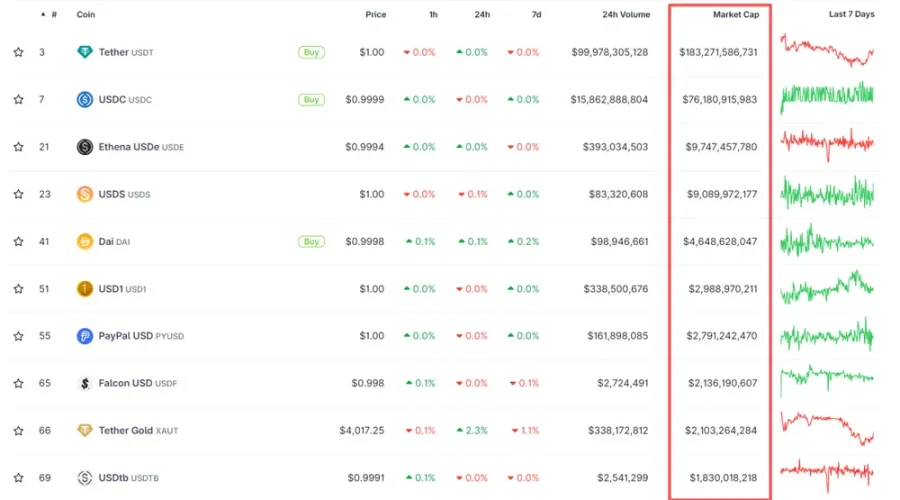

In the stablecoin world, Tether has the highest market share. According to coingecko, as of October 29, the total stablecoin market cap was $311.6 billions, with USDT in circulation worth about $183.3 billions, accounting for about 59% of the stablecoin market. Circle's USDC has a market cap of about $76.2 billions, or 24%, ranking second.

Tether leads by a wide margin.

Market cap and trading of major stablecoins

Like Tether, Circle is a centralized stablecoin issuer, with tokens pegged 1:1 to the US dollar. Other stablecoins are mainly algorithmic and less mature. Circle is Tether's main competitor.

Circle is characterized by its honesty and compliance, actively cooperating with regulators and traditional financial institutions as the "good kid."

Founded in 2013, Circle was initially a bitcoin payment company, using bitcoin as a backend network. When users wanted to transfer funds, they could buy bitcoin for a short period to move funds to related bank accounts. However, due to bitcoin's price volatility, Circle shifted to stablecoins in 2018. For customer acquisition, Circle partnered with US-compliant exchange Coinbase and shared half its profits with Coinbase. On the investment side, BlackRock manages over 90% of its US dollar reserves through its money market fund.

In terms of licensing, Circle has obtained Money Transmitter Licenses (MTL) in 46 US states and relevant licenses in the UK, France, and Singapore. It implements daily disclosures and monthly audits of US dollar reserves, making every effort to ensure compliance.

To achieve regulatory compliance, stablecoin institutions must conduct proper customer identification (KYC) to prevent illegal activities such as money laundering and illicit trades, which incurs significant compliance costs.

To reduce compliance costs, Circle mainly focuses on institutional clients. If it were to serve a large number of retail users while ensuring KYC compliance, the costs and benefits would be hard to balance.

In 2016, Circle received $60 million in Series D funding, with Chinese institutions such as Baidu, CICC Alpha, Everbright Investment, Wanxiang, and CreditEase participating. At that time, Circle wanted to enter the Chinese market and established Circle China. Circle founder Jeremy Allaire stated that Circle would operate under China's regulatory framework and would not launch products without government approval, distinguishing it from other tech companies. This also highlights Circle's compliance-oriented nature.

Compared to Circle's cautious approach, Tether's long-term dominance in the stablecoin sector is more due to its aggressive growth.

Tether did not spend excessive time on licensing and compliance management but instead targeted emerging markets with more urgent needs, laying out channels and service networks.

Tether is not registered in the US; it was initially registered in the British Virgin Islands and moved its registration to El Salvador in early 2025 to take advantage of crypto-friendly policies.

Its customer base mainly targets emerging markets in Asia, Africa, and Latin America. These markets often face two dilemmas: high costs and cumbersome processes for cross-border payments, increasing pressure on locals; and severe inflation and currency depreciation due to monetary policy or political instability. USDT's low-cost, efficient cross-border payments and US dollar peg directly address these pain points.

According to CEO Paolo Ardoino, the financial systems in developed countries are already highly efficient, with almost no barriers to daily transfers. But in some developing countries, financial system efficiency may be only 5%, and many people cannot even open bank accounts. Stablecoins, through blockchain technology, can raise financial efficiency in these regions to 60% or 70%.

The distribution channel network Tether has built is a key factor in its success.

To reach a broad customer base, unlike Circle and Coinbase's deep integration, Tether has established deep business relationships with mainstream exchanges. Due to team background, Tether was initially deeply tied to Bitfinex. Later, exchanges like Poloniex and Binance expanded USDT/crypto trading pairs, creating a "exchange-stablecoin" ecosystem. USDT became the first stablecoin to circulate across major exchanges, occupying the "crypto dollar" entry point.

Later, even with the emergence of more compliant USDC, many platforms still defaulted to USDT as the trading and settlement unit. It is widely used in crypto trading, DeFi applications, and cross-border payments, with both corporate and individual users recognizing its value stability, further boosting its liquidity.

USDT's daily trading volume on major crypto exchanges (such as Binance, Huobi, etc.) is huge, often accounting for a high proportion of total crypto trading volume. As a primary trading pair (such as BTC/USDT, ETH/USDT), it provides an efficient trading medium, reducing friction and slippage.

The greater the liquidity, the harder it is to replace, forming a classic network effect.

Additionally, USDT is issued on multiple mainstream blockchains, such as Ethereum, Tron, BNB Chain, Solana, Avalanche, etc. For example, on the Tron network, USDT as a TRC-20 token contract has become the most widely used stablecoin.

Latest data shows that in early 2025, Tron and Ethereum together account for about 90% of USDT's total circulation, with Tron at about 50% and Ethereum at about 40%.

This creates a mutually dependent relationship between USDT and public chains. In the public chain ecosystem, stablecoins play a key liquidity role, facilitating the exchange and circulation of various assets. Public chains have large user bases and rich application ecosystems, and USDT issued on public chains can leverage their influence and user base for promotion. For example, Ethereum has a large number of DeFi applications attracting many users, and USDT and other stablecoins issued and circulated on Ethereum can be widely used by these users.

In terms of cross-chain liquidity, USDT supports multiple blockchains (such as Ethereum, Tron, Solana, etc.), enabling rapid transfers across chains globally, with fees lower than traditional bank cross-border payment systems.

On the other hand, to expand business in emerging markets and developing countries, Tether has made specialized channel arrangements for these markets.

Paolo once said that when Tether enters a new country, it does not directly seek cooperation with the largest local bank like its competitors. Instead, it goes deep into the streets, conducting grassroots education and promotion, visiting door-to-door, and seeking local partners who share their philosophy, starting from the grassroots to promote their products. This bottom-up approach has always been their method.

This makes Tether somewhat resemble Chinese internet companies, going to the countryside, high-frequency ground promotion, and staking out territory.

Tether has invested in more than 100 companies worldwide, using these companies to build a broad distribution network.

For example, its investment in Kenyan digital currency payment service provider Kotani Pay leverages local business resources and strengths to strengthen payment network construction in Africa. Tether has established numerous physical touchpoints in Africa, Central America, and South America. Globally, Tether has millions of physical touchpoints, from convenience store networks, phone recharge points, and newsstands in Central America to rural markets in Africa. Tether directly engages with these entities to distribute and promote USDT, which is one of their key success factors.

There are also innovative projects, such as Tether's solar-powered self-service kiosk project in Africa, which has completed 500 pilots, providing electricity to residents lacking power. Users subscribe for $3 USDT per month, with about 500,000 users and 10 million battery replacements so far. Tether plans to expand the number of kiosks to 10,000 by 2026 and 100,000 by 2030, expecting to cover about 30 million households and an average of 120 million people in Africa, enabling them to use USDT for daily transactions.

Paolo believes that this innovative distribution channel and deep penetration into emerging markets are key to Tether's leading position in the stablecoin sector.

Tether's cooperation with Tron has also promoted USDT's expansion in the third world. Tron, founded by Justin Sun, launched lower USDT transaction fees to compete with Ethereum, reducing transaction costs for emerging market users and forming Tron's main revenue source.

Of course, Tether's rapid development in emerging markets is not only due to its own channel layout but also closely related to the problems of these countries themselves.

For example, Africa and Latin America are highly dependent on US dollar stablecoins (mainly USDT), with USDT accounting for the vast majority of local trading volume in exchanges and cross-border remittance scenarios.

In high-inflation, currency-depreciating countries like Venezuela and Argentina, USDT is widely used for value preservation, payments, and daily settlements, with high actual usage rates, merchant acceptance, and active on- and off-exchange channels. In Venezuela, many merchants, universities, and companies use USDT in daily transactions.

Why Is Tether the World-Class "Crypto Dollar"?

Fiat currency is a matter of national economic sovereignty, and every government is reluctant to cede power on this issue. Yet USDT is widely used in many countries, becoming a tool for local people to pay, fight inflation, and hedge against currency depreciation. Many companies may want to do this, but why has only Tether succeeded?

In June 2019, Meta's predecessor Facebook released the Libra white paper, launching the sensational Libra project, which planned to issue stablecoins pegged to the US dollar, British pound, euro, and yen, establishing a simple global currency and financial infrastructure to provide low-cost cross-border payment services. The project was overseen by the Libra Association, whose members included Visa, Mastercard, PayPal, Uber, and 27 other well-known companies.

Facebook had an astonishing 5 billion global users and 3.5 billion daily active users. With such a user base and many partners, the probability of success should have far exceeded Tether's. However, the project faced massive regulatory resistance from the US and European countries. After several iterations and concessions to regulators, it still failed. In early 2022, the project was sold for $200 million, officially declaring its failure.

Why did Tether survive while Libra died?

The key is that the two essentially represent a clash of two stablecoin models: Tether is "grassroots market-driven, regulatory ambiguity," while Libra is "top-down design, overexposed compliance."

Libra's original intention was to create a "super-sovereign currency" backed by a basket of currencies, which essentially challenged central banks. Countries immediately became alert: why should a US tech company issue a global currency? This ambition to "replace national currency systems" put it under political siege from day one. Central banks and regulators worldwide unanimously opposed it, forcing the project to be constantly "downgraded."

Libra tried to be fully compliant and globally applicable, but global financial regulation is highly fragmented, with each country having its own anti-money laundering, capital control, and foreign exchange licensing requirements. As a result, Facebook had to negotiate, explain, and modify the structure with dozens of regulators, trapping the project in a "compliance quagmire."

Moreover, once launched, Libra would have required Facebook to bear bank-level regulatory responsibility, which is almost impossible for a tech company.

Additionally, Facebook's own reputation was a drag. Facebook was widely accused of abusing privacy and data. When it announced plans to "issue a global currency," the public and governments worldwide worried it would use consumer data to control the financial system. This brand trust crisis intensified political and public pressure.

Tether's success, on the other hand, is a victory of "pragmatism + gray area."

Tether started from a small ecosystem, did not challenge sovereignty, and never tried to "replace currency systems." It simply met an urgent need in the crypto world—a dollar token that could be exchanged at any time with low volatility. It focused on exchanges, OTC, cross-chain settlement, and other marginal but fast-growing areas, so regulators initially did not see it as a systemic risk.

After gaining some growth, Tether used regulatory ambiguity for flexibility, registering offshore (such as in the British Virgin Islands) and operating on the edge of global financial regulation, allowing rapid iteration and free expansion without waiting for approval from each country.

It did not need to "get permission first," but rather "do it first and adjust later." Tether was not a top-down "system project" but directly responded to the most practical market needs, including cross-exchange arbitrage, OTC remittance, DeFi liquidity pools, and serving as a dollar substitute in emerging markets (such as Turkey and Argentina). It started from real pain points, not ideology.

Libra wanted to change the world before starting, while Tether grew the market step by step. In finance, this often determines survival.

This also explains why the more compliant Circle has never matched Tether in scale.

Although Circle's stablecoin appeared four years later, it has the potential of developed markets like Europe and the US, but its scale still lags far behind Tether, mainly because so much time and effort was spent on compliance, inevitably slowing its development.

Can Tether Maintain Its Competitive Advantage?

In the short and medium term, Tether still has a good chance of maintaining market leadership, but the regulatory, trust, and competitive threats it faces are real and could change the landscape in the coming years.

In the past, the key to the stablecoin business was who dared to take bigger risks and move faster, building up "market share" before regulation arrived. Tether excelled in this regard. But as stablecoins become mainstream and regulatory frameworks are established, the elements of competition are quietly changing.

The core competitive elements in the stablecoin market may total five or six. In the future, the core competition will be "who can make people feel safe storing their money there." Regulation, transparency, liquidity, ecosystem, and brand all revolve around this core, each relating to "trust."

Among these, regulatory compliance is increasingly likely to become the hardest competitive barrier.

Whether a company can "legally survive," obtain regulatory recognition in more countries or regions, partner with licensed institutions, or even gain bank account support, will determine who wins more real payment and institutional clients. USDC is following this path—transparent, compliant, slower but steady. Tether grew aggressively early on but is now catching up in this area.

Besides gaining regulatory trust, user trust is also essential. This involves the safety and transparency of reserves. Users care not only about payment convenience but also: "If I hold USDT now and want to exchange it for US dollars, is there real reserve backing it?"

Therefore, the ability to provide timely, third-party verifiable reserve reports will be an important competitive strength. Circle (USDC) publishes monthly audit reports, audited by one of the Big Four firms. Tether is also working to improve, but its transparency still lags far behind Circle. As a result, many question whether Tether has sufficient US dollar reserves and whether it over-issues USDT.

In terms of liquidity and network effects, this is Tether's forte and inherent advantage, which will likely continue. USDT is deeply deployed on almost every exchange and major chain, making it the default "crypto dollar" option and forming an inertia moat. So even if people know it carries regulatory risks, it is not easy to replace immediately. Additionally, Circle cannot catch up with Tether's channel layout in emerging markets in the short term.

On the technical side, future competition may focus on compatibility and cross-chain capabilities—whether stablecoins can move seamlessly between Ethereum, Tron, Solana, Layer 2, etc. Whoever has the most stable cross-chain solution, lowest fees, and highest security will win the favor of users and developers in the DeFi ecosystem.

Tether's products have wide coverage and mature cross-chain deployment. USDT is deeply deployed on multiple chains (such as Tron, Ethereum, etc.), making it widely usable in the crypto ecosystem. Circle is also working on cross-chain interoperability standards and is expected to be highly competitive in the future.

In terms of ecosystem cooperation and use cases, Tether has an advantage. Stablecoins are not just trading tools but also bridges for payments, storage, and settlement. Whoever can connect to traditional finance (such as Visa, PayPal, bank APIs) or become a daily payment method in emerging markets (like Latin America and Africa) will gain real influence. Circle needs to improve its relative disadvantage in this area.

In terms of brand, Tether's long-term leadership and extensive layout in emerging markets have created strong user awareness, but its lack of compliance is a concern for many. If Circle's compliance card can be played in multiple markets, it will have great opportunities in the future.

Considering these core factors, the most likely scenario is that Tether will continue to lead in the short and medium term, but its market share will decline slightly.

This is because channel building, network effects, and existing liquidity can help Tether withstand short-term shocks. But as regulation tightens and more compliant competitors—including Circle and potentially banks and financial institutions issuing stablecoins in the future—gradually build up stablecoin scale in certain markets (especially the US and EU), they will capture users and market share. The result is that Tether remains number one, but its market share is compressed.

Tether is aware of this predicament, which is why it has taken many recent actions, including deepening ties with Cantor Fitzgerald, the investment bank under current US Secretary of Commerce Lutnick, investing most of its US dollar reserves with Cantor Fitzgerald; the CEO frequently communicating with the public on social media; launching compliant stablecoins in the US; and acquiring Juventus stock and seeking board seats—all moves to align more closely with the mainstream world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Government Shutdown, Market Strike? The Plunge Behind Bitcoin's Crash

Three things that must happen for Bitcoin to avoid bear market

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.