What Altcoins Whales Are Buying After the Early November Crypto Crash?

The early-November crypto crash shook the market, but whales are quietly turning it into an opportunity. On-chain data shows large holders accumulating Aster, Bio Protocol, and Syrup — three altcoins showing bullish divergences, OBV and CMF breakouts, and clear recovery setups that could define the next leg once broader sentiment stabilizes.

The early-November crypto crash caught the market off guard, contradicting expectations of a strong, bullish month. Between November 4 and 5, sharp pullbacks across major tokens disrupted sentiment and erased short-term gains. Even so, altcoins that whales are buying continue to stand out.

On-chain data shows large holders quietly accumulating tokens that display breakout structures, early divergences, and stronger technical setups. All are signs that big money may already be positioning for the next leg of recovery with or without retail participation.

Aster (ASTER)

The first altcoin that whales are buying after the early-November crash is Aster (ASTER), a BNB Chain project focused on decentralized trading. In the past 24 hours, Aster whales have increased their holdings by 12.58%, now owning 43.62 million ASTER.

This means whales added roughly 4.9 million tokens, worth about $5.46 million at the current price. Interestingly, exchange balances rose by 0.72%, showing that while whales are quietly accumulating, some retail or early investors are likely taking profits — a pattern often seen when whales are buying altcoins during early recovery phases.

ASTER Whales:

Nansen

ASTER Whales:

Nansen

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the technical front, ASTER continues to trade inside a falling wedge. It is a pattern that usually signals a potential bullish reversal as price compresses. The token’s sharp drop on November 4 was followed by a clear bullish divergence on the Relative Strength Index (RSI). It is a momentum indicator that compares recent gains and losses to identify whether an asset is overbought or oversold.

Between October 10 and November 3, ASTER’s price made a lower low while RSI formed a higher low, hinting that selling pressure is easing. Since then, the ASTER price has been moving up steadily.

If this momentum continues, a breakout above $1.28, followed by $1.53 — approximately 36.8% higher from current levels — would confirm the move and open a potential path toward $2.21. That would mean a wedge breakout and turn the ASTER price structure completely bullish.

ASTER Price Analysis:

TradingView

ASTER Price Analysis:

TradingView

However, the key support remains at $0.93, and if that fails, Aster could revisit $0.81 or lower if broader market conditions weaken further.

Bio Protocol (BIO)

The next altcoin that whales are buying after the early-November crash is Bio Protocol (BIO), a decentralized science (DeSci) project built on Ethereum. Despite being down 44.2% in the past month, the token has traded flat over the past 24 hours — suggesting that the sharp sell-off might be stabilizing.

In the last day, Bio Protocol whales have increased their holdings by 87.07%, now holding 1.89 million BIO. That means they’ve added about 880,000 tokens. Mega whales — the top 100 addresses — also expanded their holdings by 0.07%, now sitting at 2.98 billion BIO, adding another 2.09 million tokens. Together, whales and mega whales picked up nearly 2.97 million BIO, valued at close to $226,000 — showing quiet but clear accumulation at lower levels.

BIO Protocol Whales:

Nansen

BIO Protocol Whales:

Nansen

The technical setup supports this accumulation phase. The On-Balance Volume (OBV) indicator, which measures cumulative buying and selling by adding volume on up days and subtracting it on down days, has been forming a downward trendline since late September.

Between September 21 and October 27, OBV formed a series of lower highs, creating a clear resistance slope. On November 2, BIO’s OBV briefly broke above that line, leading to a price uptick between October 31 and November 2. Although the move failed initially, a new breakout attempt has begun, marked by a green daily candle.

BIO Price Analysis:

TradingView

BIO Price Analysis:

TradingView

If this OBV breakout sustains, the first resistance to watch lies near $0.097, which aligns with the 50% Fibonacci retracement. A close above that could open the path toward $0.12 and $0.16, confirming bullishness. However, if BIO loses $0.066, it would fall back under its OBV trendline — signaling renewed weakness. That could make the bears’ eye new BIO price lows.

Syrup (SYRUP)

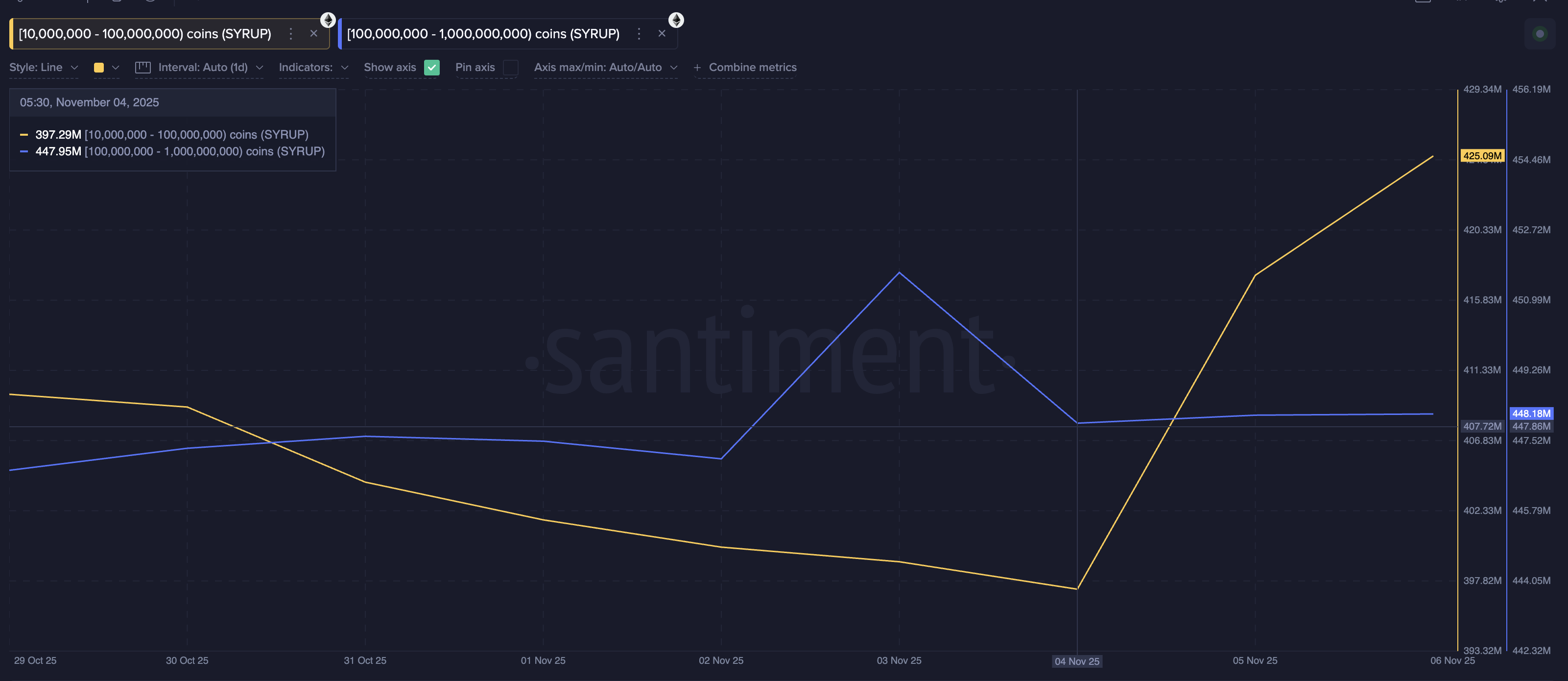

The third altcoin that whales are buying is Syrup (SYRUP). It is a DeFi token that powers Maple Finance’s staking and lending platform. Whale accumulation in Syrup has accelerated notably since November 4, immediately following the market-wide pullback.

Two whale cohorts have been leading this move. The larger group, holding between 100 million and 1 billion SYRUP, has increased its balance from 447.95 million to 448.18 million SYRUP. That meant adding around 230,000 tokens in just two days. Meanwhile, smaller whale addresses holding 10 million to 100 million SYRUP have made a much stronger push. They raised their collective holdings from 397.29 million to 425.09 million SYRUP — an increase of about 27.8 million tokens.

SYRUP Whales:

Nansen

SYRUP Whales:

Nansen

Together, both cohorts have added nearly 28 million SYRUP (worth $11.50 million), reflecting clear confidence returning among large holders.

This aggressive accumulation aligns with key technical signals. Between August 25 and November 4, the RSI (Relative Strength Index) on the daily chart formed a bullish divergence. The price made lower lows while RSI formed higher lows, often an early sign of trend reversal.

Adding to that, the Chaikin Money Flow (CMF), which tracks whether capital is flowing into or out of an asset, has just broken marginally above its downward trendline drawn from October 14. This suggests fresh inflows from large wallets, further validating the whale-led accumulation.

SYRUP Price Analysis:

TradingView

SYRUP Price Analysis:

TradingView

The next confirmation for SYRUP’s recovery would be if the CMF moves above zero, which would validate sustained buying momentum. On the price front, the first major resistance lies near $0.46, about 13% above current levels of $0.41. A close above it could push SYRUP toward $0.53 and beyond. On the downside, strong support sits at $0.36, and if that fails, the token could retest $0.31 or lower.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin faces ‘insane’ sell wall above $105K as stocks eye tariff ruling

Privacy coins surge 80%: Why Zcash and Dash are back in the spotlight

TRUMP memecoin price may increase 70% by end of 2025

[English Long Tweet] Privacy Manifesto: How Zero-Knowledge Technology is Reshaping the Internet