Key Market Intelligence for November 6: How Much Did You Miss?

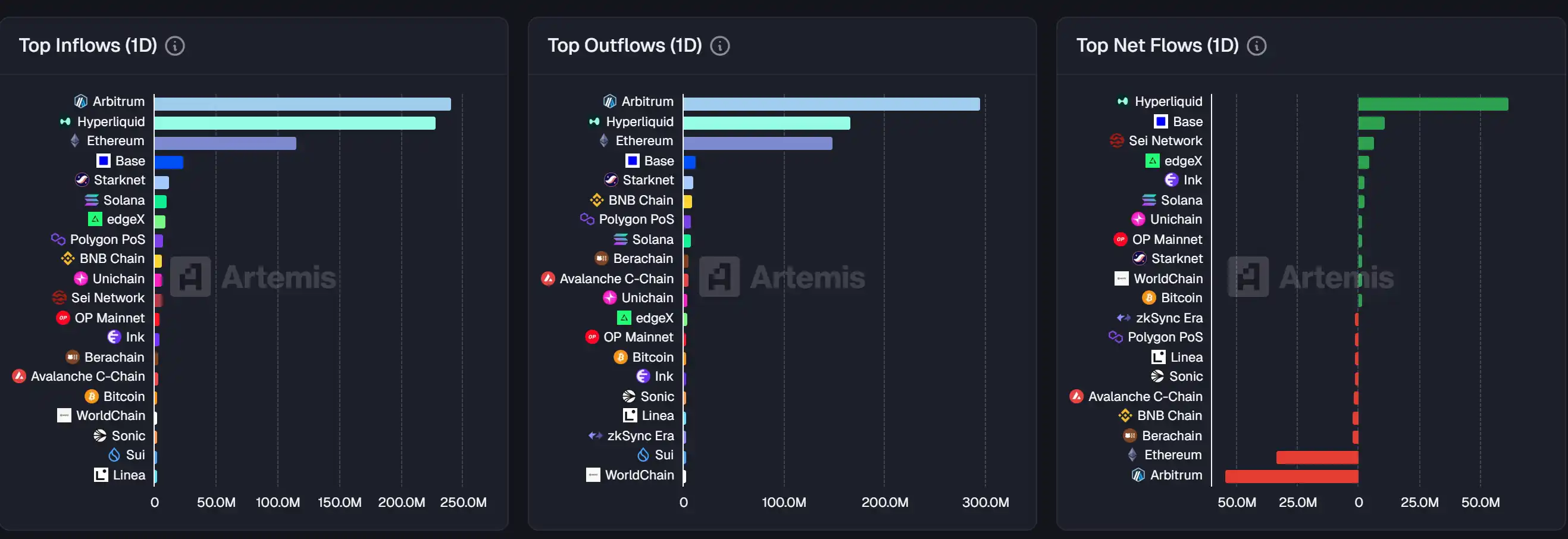

1. On-chain funds: $61.9M flowed into Hyperliquid today; $54.4M flowed out of Arbitrum. 2. Largest price changes: $SAPIEN, $MMT. 3. Top news: ZEC surpassed $500, marking a 575% increase since Naval’s call.

Selected News

1. ZEC breaks through $500, up 575% since Naval's call

2. Trump says he hopes to make the United States a "Bitcoin superpower"

3. MON pre-market trading price briefly surpasses $0.06, up 10.3% in 24 hours

4. BNB Chain ecosystem tokens rebound sharply, GIGGLE and Binance Life rank high in market cap

5. Since the public buyback, ASTER has accumulated 25.5 million ASTER tokens repurchased, with an average daily buyback of about 2.76 million tokens

Trending Topics

Source: Overheard on CT, Kaito

The following is the Chinese translation of the original content:

[PIPWORLD]

Today, PIPWORLD has attracted attention for being listed on the KaitoAI leaderboard, having built the world's first AI-driven trading ecosystem. Users can create, train, and deploy PiP World agent clusters on any decentralized exchange (DEX) and blockchain. The project is likened to an "AI hedge fund playground," and the leaderboard tracking user activity is now officially live. The addition of well-known figures such as former Kraken executive Saad Naja has added credibility, and the platform's potential to revolutionize AI trading is highly anticipated, with many investors expressing interest in its innovative model.

[MEMEMAX]

Today's discussion around MEMEMAX focused on its integration with Kaito and the ongoing MaxPack event (which rewards on-chain trading). Users are actively participating in trading to obtain higher-value packs, and some have reported substantial rewards. The community is also discussing the potential and future development of the MEMEMAX platform, including its onboarding process and fee structure. The high return potential and the platform's strategic partnerships are the core reasons for the market's enthusiasm.

[MEGAETH]

Today's discussion on MEGAETH mainly revolved around the public allocation strategy and process transparency. The team was praised for detailing the allocation method, including a scoring system based on on-chain activity, social interaction, and MEGAETH-exclusive signals. Community reactions were mixed: some users celebrated being selected for the core community list, while others expressed disappointment at not being chosen. Discussions also touched on MEGAETH's potential as a leading crypto application platform, with some users expressing strong confidence in its future development.

[MONAD]

The core discussion around MONAD today centered on the upcoming mainnet launch and accompanying airdrop event scheduled for November 24. This news has sparked strong excitement and anticipation in the crypto community, with multiple tweets focusing on the mainnet launch, airdrop details, and support from major platforms and wallets. The market is also focusing on Monad's strategic partnerships, ecosystem development, and comparative analysis with other blockchain projects.

[INTUITION]

INTUITION, trading under the code $TRUST, drew significant attention today due to its mainnet launch and subsequent listings on major exchanges such as Binance, KuCoin, and Kraken. The project focuses on decentralizing information and turning data into assets, with its airdrop event and staking opportunities receiving positive market feedback. The community is actively engaging with the project, celebrating its potential to revolutionize the knowledge economy through decentralized trust and reputation systems.

Featured Articles

1. "Market Volatility Intensifies: Why Bitcoin Still Has a Chance to Reach $200,000 in Q4?"

This article was first published on October 27, 2025. On November 6, Tiger Research published again, stating that despite increased market volatility, the $200,000 target price remains unchanged. The article details the reasons behind this view.

2. "Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point"

In November 2025, the crypto market is at a structural turning point. The total market cap has fallen, and the fear index has dropped, corresponding to a mid-term turnover and value allocation zone. The main risks are regulatory uncertainty, on-chain complexity and multi-chain fragmentation, information asymmetry, and emotional overreaction. The next 12 months will be a "structural bull" rather than a full bull market, with the key being mechanism design, distribution efficiency, and attention management. Early distribution and execution loops should be prioritized, with disciplined allocation around long-term themes such as AI×Crypto and DAT.

On-chain Data

On-chain capital flows for the week of November 6

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin holds above $100,000, but for how long?

Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Bitcoin ‘$68K too low’ versus gold says JPMorgan as BTC, stocks dip again

$100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ debate