The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

For retail investors keen on chasing popular stocks, overnight US stocks experienced their worst trading day since April.

On Tuesday, a combination of Palantir's earnings report, bearish bets from well-known short sellers, and turmoil in the cryptocurrency market led to a fierce sell-off of previously favored stocks and assets among retail investors. All three major US stock indexes fell, with the Nasdaq plunging over 2%.

According to the index tracking retail-heavy stocks by Goldman Sachs, the index plummeted 3.6% that day, about three times the decline of the S&P 500, marking the largest single-day drop since April 10.

At the opening of the US stock market on Tuesday, retail investors' trading enthusiasm did not immediately subside. According to data compiled by JPMorgan, as of 11 a.m. New York time on Tuesday, retail investors were still net buyers of stocks and ETFs worth $560 million.

This may be one of the reasons why the market rebounded briefly in early trading and the S&P 500 narrowed its losses, but the rally did not last, and the market soon turned downward again. Melissa Armo, CEO of the trader education platform Stock Swoosh, described Tuesday's US stock market performance as follows:

When people start to panic and sell, this is what happens.

Poor Earnings and "Big Short" Entry

Specifically, two major events directly triggered the sell-off of retail-favored stocks. First, Palantir's earnings report raised concerns about its growth prospects.

According to Jinse Finance, Palantir's earnings report showed an excellent third quarter, but the market questioned the sustainability of its high valuation. This "darling" of retail investors, which soared more than 150% this year, suffered a sharp decline yesterday, closing down nearly 8% and remaining weak after hours.

Secondly, legendary investor Michael Burry's regulatory filing became the last straw that broke the camel's back.

According to a 13F regulatory filing, Michael Burry, the hedge fund manager made famous by the movie "The Big Short," established bearish positions on Palantir and chip giant Nvidia in the previous quarter.

Just a few days ago, Burry had issued a warning to retail investors about the market being overheated. The disclosure of his short positions undoubtedly confirmed his bearish stance and quickly intensified market panic.

Crypto Market Turmoil Intensifies Sell-off

In addition to the direct impact on the stock market, turmoil in the cryptocurrency sector also increased pressure on retail investors and dragged down crypto-related stocks.

According to Jinse Finance, bitcoin prices accelerated their decline, falling below the $100,000 mark for the first time since June, briefly dropping to around $99,932 and breaking below the 200-day moving average, marking the second-largest single-day drop of the year. Ethereum, the second-largest by market capitalization, also plunged more than 10%, falling to around $3,225.

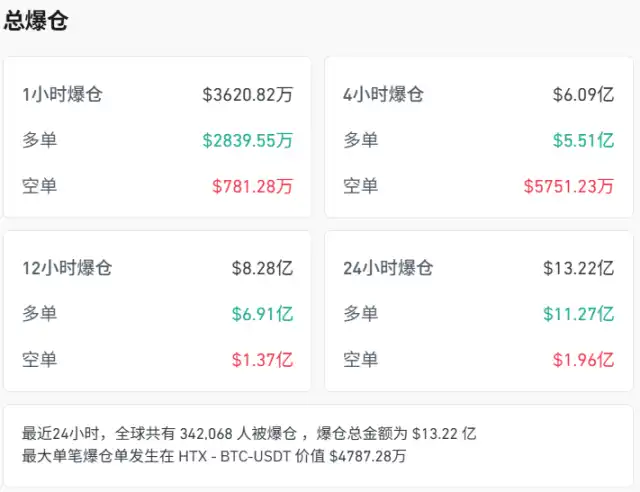

According to coinglass statistics, in the past 24 hours, 342,000 people were liquidated across the network, with the liquidation amount exceeding $1.3 billion, of which long positions accounted for 85% of the losses.

This crypto market decline is not far removed from the historic liquidity crisis three weeks ago, when a violent market shock forced the liquidation of billions of dollars in leveraged crypto positions.

Looking ahead, market sentiment remains tense. Melissa Armo said she is preparing for another possible round of declines on Wednesday. She advised:

If traders can withstand some pain, they can start preparing a potential stock buy list. If not, then I suggest selling.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Bitcoin ‘$68K too low’ versus gold says JPMorgan as BTC, stocks dip again

$100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ debate

Bitcoin bulls retreat as spot BTC ETF outflows deepen and macro fears grow