Key Notes

- Wood's revised projection still anticipates 1,100% growth for Bitcoin over the next five years despite the reduction.

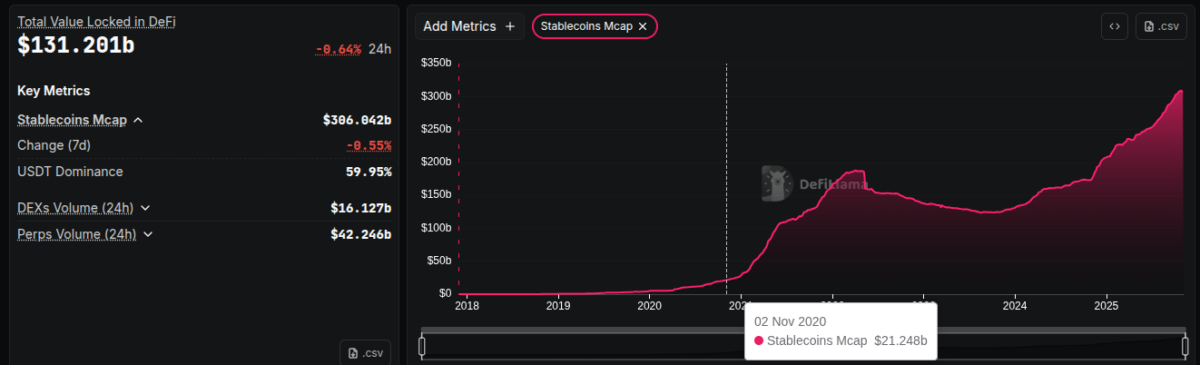

- Stablecoin market capitalization has reached $306 billion, outpacing Bitcoin's growth by 2.14 times since 2020.

- Major tech companies including Google and Cloudflare have launched stablecoin-integrated platforms for payments and AI transactions.

Cathie Wood , CEO of Ark Invest, has reduced her bullish price forecast on Bitcoin BTC $101 638 24h volatility: 2.5% Market cap: $2.03 T Vol. 24h: $62.01 B from $1.5 million to $1.2 million per coin. The five-year price prediction change has sparked commentaries on X, with some people questioning its relevance considering it is a 20% reduction for a more than 1,000% increase forecast.

Ark’s CEO adjusted her forecast during a live show at CNBC’s “Squawk Box” on November 6, making the case that stablecoins have overtaken part of the role she once expected Bitcoin to play, scaling faster than expected. Moreover, Cathie Wood mentioned the growth of stablecoin’s appeal in developing countries, particularly across emerging markets, serving as digital dollars for payments and savings.

“Given what’s happening to stablecoins,” she said, “we could take maybe $300,000 off of that bullish case,” referencing the $1.5 million target in Ark Invest’s 2030 bull case for Bitcoin published in ARK’s Big Ideas 2025 report in February 2025.

With Bitcoin currently trading slightly above the $100,000 mark, Ark’s bull case projects a 1,100% growth, up to $1.2 million per BTC in five years—or a 220% surge per year. For comparison, Bitcoin is up 630% since its opening price on November 1, 2020, trading at $13,800 per coin.

Bitcoin (BTC) five-year price chart, as of November 6, 2025 | Source: TradingView

Stablecoin Growth

Notably, the stablecoin market cap is currently at an all-time high above $306 billion, registering exponential growth in the past five years. On November 2, 2020, the market cap of this token class was at $21 billion, per DefiLlama data —representing a 1,350% growth in the same period as BTC’s 630%. Outperforming Bitcoin by 2.14 times.

Total value locked and stablecoin market cap chart, as of November 6, 2025 | Source: DefiLlama

Many companies and institutions have started to look at the stablecoin use case with more optimism and a sense of opportunity lately. Big names have started making moves into this demand, as Coinspeaker reported earlier this year. In September, Google launched an AI payments platform with stablecoin support, in partnership with Coinbase and over 60 major organizations. Meanwhile, Cloudflare unveiled NET Dollar , a USD-backed stablecoin designed for AI agents to conduct automated transactions.

Nevertheless, Wood continues to see Bitcoin as the “digital gold” and a solid asset to hedge against fiat currencies, which dollar-pegged stablecoins are limited at.