Media Literacy as a Key Strategy: Strengthening Institutional Resilience in the Era of Digitalization

- Media literacy education is critical for institutional resilience, with Ukraine's 95.3% disinformation detection rate highlighting its strategic value in hybrid warfare contexts. - The EU's policy integration and 2025 studies show media literacy drives informed financial decisions, reshaping trust dynamics in tech/media sectors. - Tech giants like Meta and Google are prioritizing algorithmic transparency and AI fact-checking to maintain user trust amid shifting ad revenue models. - Investors should focus

As misinformation outpaces the spread of facts, teaching media literacy has become essential for strengthening institutions. Whether in Ukrainian universities affected by conflict or within Silicon Valley’s algorithm-driven landscape, the skill to distinguish reality from falsehood has shifted from a specialized ability to a vital necessity. For those investing in technology, media, or public trust, this evolution marks a fundamental change in assessing the sustainability of these sectors.

Building Resilience: Media Literacy as a Shield

Recent research highlights the significant impact of media literacy initiatives. In Ukraine, journalism students who completed courses such as Media Literacy: Technologies and Practical Application achieved a 95.3% success rate in identifying false information and an 88.4% rate in verifying questionable content. These results go beyond academia—they indicate a society better prepared to withstand manipulation, especially in hybrid warfare scenarios. This kind of resilience is now being embedded into policies and educational systems worldwide, with the European Union making media literacy a core part of its public agenda.

The financial consequences are considerable. A 2025 report by Prof. Sonam Chawla and Dr. Kiran demonstrated that media literacy is linked to smarter financial choices and greater digital access. As people become more critical in their consumption, their buying habits and confidence in institutions evolve. This shift affects multiple industries: technology firms dependent on advertising must cater to users who expect openness, while media outlets are increasingly pressured to focus on trustworthiness rather than sensationalism.

Technology and Media: Steering Through the Misinformation Landscape

The technology industry, especially social media companies, stands at the forefront of this shift. Platforms like

Investors need to observe how major tech firms manage the balance between innovation and trust. For instance, Meta’s recent decision to emphasize “authentic content” over engagement numbers shows a recognition of the importance of media literacy in keeping users’ trust. Likewise, Google’s move to integrate more fact-checking into its search functions demonstrates a long-term commitment to credibility as a market differentiator.

Public Trust Stocks: Redefining Institutional Value

Trust from the public has become a tangible asset rather than just a reputational bonus. Organizations that ignore the dangers of misinformation risk both their image and their finances. Take traditional media as an example: those that weave media literacy into their editorial routines—such as The New York Times’ “The Daily” podcast, which stresses source validation—are seeing better reader loyalty and subscription rates than competitors.

The 2025 Digital Media Trends report also points to a generational gap: Gen Z and millennials are 30% more likely to believe in social media advertising compared to older age groups. This indicates that media literacy programs designed for younger users could drive growth for platforms like TikTok (owned by ByteDance) and YouTube (owned by Google). Investors should focus on companies that align their strategies with the principles valued by digitally savvy consumers: openness, responsibility, and ethical use of AI.

Key Investment Areas

- Technology Industry:

- AI and Verification Solutions: Businesses such as Factmata (now part of Google) and startups creating AI-based tools to spot misinformation are well-placed to meet the growing need for institutional robustness.

Educational Technology (EdTech): Online learning platforms like Coursera and Udemy, which offer media literacy training, may experience higher demand as educational institutions and companies emphasize such skills.

Media Industry:

- Trust-Focused News Providers: Media outlets that embed media literacy into their processes (for example, The Guardian and BBC) are expected to maintain strong trust levels and see continued subscription increases.

Social Media Networks: Platforms that openly tackle misinformation (such as Reddit with its community moderation features) could surpass rivals in both user activity and advertising income.

Public Trust Indicators:

- ESG Considerations: Investors should assess companies by factoring in “trust” as part of ESG criteria. How a platform handles misinformation may affect its ESG score and, as a result, its ability to attract investment.

Final Thoughts: Backing the Future of Truth

Media literacy has evolved from a defensive tactic to a forward-looking investment in institutional strength. For investors, this calls for a shift in evaluation methods, giving preference to organizations that reflect the priorities of a media-savvy society. As misinformation becomes a worldwide concern, the companies that will excel are those that treat truth as a core strategic resource.

As one Ukrainian journalism student put it, “Spotting fake news isn’t just about being informed—it’s about preserving freedom.” For those investing, the takeaway is unmistakable: the future will favor those who prioritize resilience alongside profitability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Analyst Says Bitcoin Needs to Hit $170k to Match Gold’s Private Investment Value

Samourai Wallet Developer Sentenced to 5 Years and Fined $250k; Can He Appeal After Clarity Act?

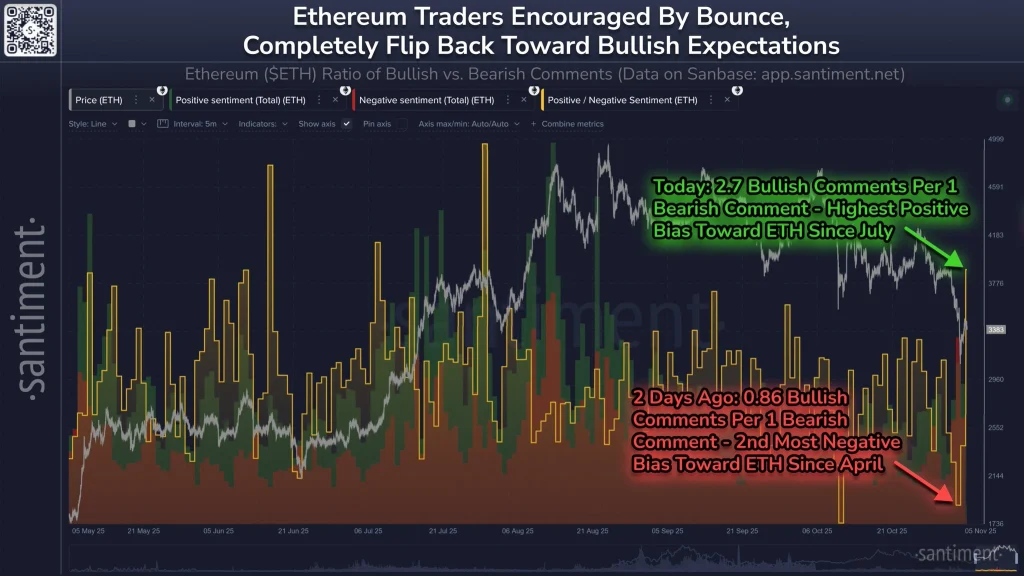

Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

Asia Morning Briefing: Bitcoin Stabilizes as Altcoins Flash Early Strength