Japan’s Digital Yen Trial Builds Blockchain Connections for International Transactions

- Japan's FSA supports a pilot project by MUFG, SMBC, and Mizuho to issue yen-backed stablecoins for cross-border payments under regulatory oversight. - JPYC launched the world's first regulated 1:1 yen-pegged stablecoin, aiming to reduce transaction costs and drive digital asset innovation. - Japan's dual-track approach combines institutional stablecoin experiments with fintech growth, addressing crypto adoption risks while promoting blockchain-driven financial modernization. - Stablecoins are seen as "me

Japan's financial regulators have made a notable move toward advancing digital currency, as the Financial Services Agency (FSA) has endorsed a pilot program in which the country’s top three banks will collaborate to issue stablecoins backed by the yen. Announced on November 7, this project brings together

Under Japanese regulations, the stablecoin will be treated as an electronic payment tool and will be jointly issued by the three banks, Mitsubishi Corporation, Progmat Inc., and

In a separate development, Tokyo-based fintech firm JPYC introduced the world’s first fully regulated yen-linked stablecoin on October 27, as reported by

The FSA’s endorsement of the major banks’ stablecoin initiative comes as digital assets gain traction in Japan’s financial industry. Market participants, including crypto exchanges such as Coincheck and SBI VC Trade, are expanding their offerings amid ongoing regulatory talks that may reduce crypto tax obligations and relax trading leverage restrictions, according to a

While both critics and investors recognize the volatility risks of cryptocurrencies, many view stablecoins as a gateway to broader adoption. Kou Okamoto, a CFO based in Tokyo who has invested in crypto since 2019, described stablecoins as offering “moderate risk and moderate returns” compared to more speculative altcoins. Additionally, SBI VC Trade saw a fivefold jump in new accounts after U.S. President Donald Trump voiced support for crypto, highlighting the global factors influencing Japan’s market.

As the FSA and industry stakeholders address regulatory and operational hurdles, Japan’s dual strategy—backing both large-scale stablecoin projects and fintech-driven innovation—positions the nation as a leading force in Asia’s digital finance sector. The results of these initiatives could transform international payments and set new standards for stablecoin use worldwide.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Vulnerabilities: Advanced Attacks Reveal Deep-Rooted Systemic Issues

- 2025 crypto hacks (Bybit $1.5B, Balancer $116M) expose systemic vulnerabilities in DeFi infrastructure and governance mechanisms. - SafeWallet rearchitected security protocols after developer workstation compromise enabled JavaScript injection attacks. - Industry adopts institutional-grade solutions like Fireblocks MPC and HUB Cyber Security's SSI integration to combat evolving threats. - Experts emphasize need for real-time transaction monitoring and standardized practices to address blind signing and k

‘Landfall’ surveillance malware exploited an undisclosed vulnerability to compromise Samsung Galaxy devices

MMT Token TGE and Its Impact on the Market: Evaluating the Trigger for Altcoin Price Fluctuations and Institutional Embrace

- MMT token's 2025 TGE sparked 1330% price surge post-Binance listing, driven by $82M oversubscribed sale and strategic exchange listings. - TVL exceeding $600M highlights DeFi innovations like YBTC.B pools and ve(3,3) tokenomics, aiming to balance liquidity with governance incentives. - Institutional adoption targets through MSafe wallets and Momentum X platform, though speculative trading risks overshadow long-term stability. - Phishing threats and name confusion with NYSE fund MMT raise volatility conce

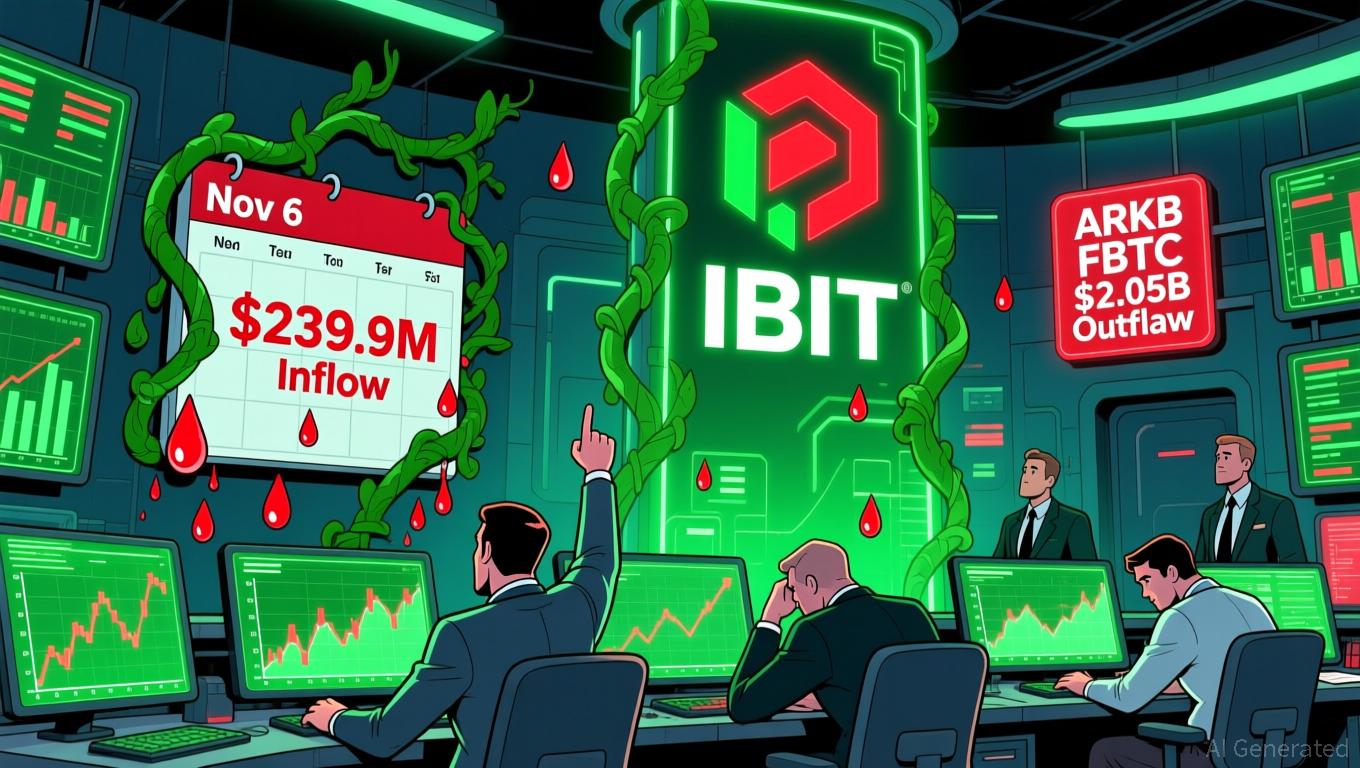

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as