EU postpones AI Act while officials balance ethical concerns with international competition

- EU delays AI Act enforcement amid U.S. pressure and tech industry pushback, proposing grace periods and postponed fines. - Key provisions face one-year compliance delay for generative AI and 2027 penalty postponement to ease corporate burdens. - Trump administration warns of retaliatory measures, prompting EU to align AI rules with transatlantic trade interests. - Critics fear weakened enforcement risks EU's ethical AI leadership, while supporters argue it preserves competitiveness. - Final decision on N

The European Union is reevaluating the schedule for rolling out its significant AI Act, with indications that crucial elements may be postponed due to increasing pressure from U.S. officials and leading tech companies. The European Commission, which launched the AI Act in April 2021 as the most comprehensive regulatory system for artificial intelligence globally, is now being urged to relax enforcement to minimize economic tensions with the U.S. and reduce compliance challenges for technology firms, according to

These potential changes, included in a "simplification package" set for a final decision on November 19, would grant generative AI companies a one-year grace period to comply and delay penalties for transparency breaches until August 2027, as reported by Cointelegraph. The AI Act, which became effective in August 2024, was intended to be phased in over a period of six to 36 months. Enforcement for high-risk AI systems—those that could seriously impact health, safety, or basic rights—was planned for August 2026, according to

This development underscores the broader conflict between the EU’s regulatory goals and the international AI environment. Former U.S. President Donald Trump has threatened countermeasures, such as withholding intelligence or military support for Ukraine, if the EU’s regulations are seen as hostile. As a result, the EU has started informal talks with the Trump administration to better align the AI Act with transatlantic trade priorities, Cointelegraph noted. At the same time, major tech companies like Meta have warned that overly strict rules could leave Europe behind in AI innovation, especially given the sector’s rapid changes.

The AI Act’s initial risk-based approach classifies AI systems from "unacceptable" to "minimal" risk, placing heavy requirements on high-risk uses like biometric monitoring and automated decisions in essential industries. Opponents of the delay argue that easing enforcement could weaken the EU’s position as a leader in ethical AI oversight, while advocates believe it helps maintain the region’s competitiveness in a market largely led by U.S. and Chinese tech giants, Cointelegraph reported.

Thomas Regnier, an official at the European Commission, confirmed that discussions are ongoing but stressed that the AI Act is still a key part of the EU’s digital agenda. "We are still reflecting," he told Cointelegraph, noting that the simplification package will be unveiled on November 19. However, the proposal still needs the backing of EU member countries and the European Parliament, creating uncertainty as the deadline approaches.

The EU’s change in direction illustrates the difficulties of fostering innovation while enforcing regulation in a fast-moving sector. Although the suggested grace period and postponed penalties are intended to lower compliance expenses, they also reflect a practical response to global technology trends. Ultimately, the result of the November 19 vote will decide whether the AI Act maintains its pioneering role or shifts toward a more adaptable model influenced by international and business interests.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

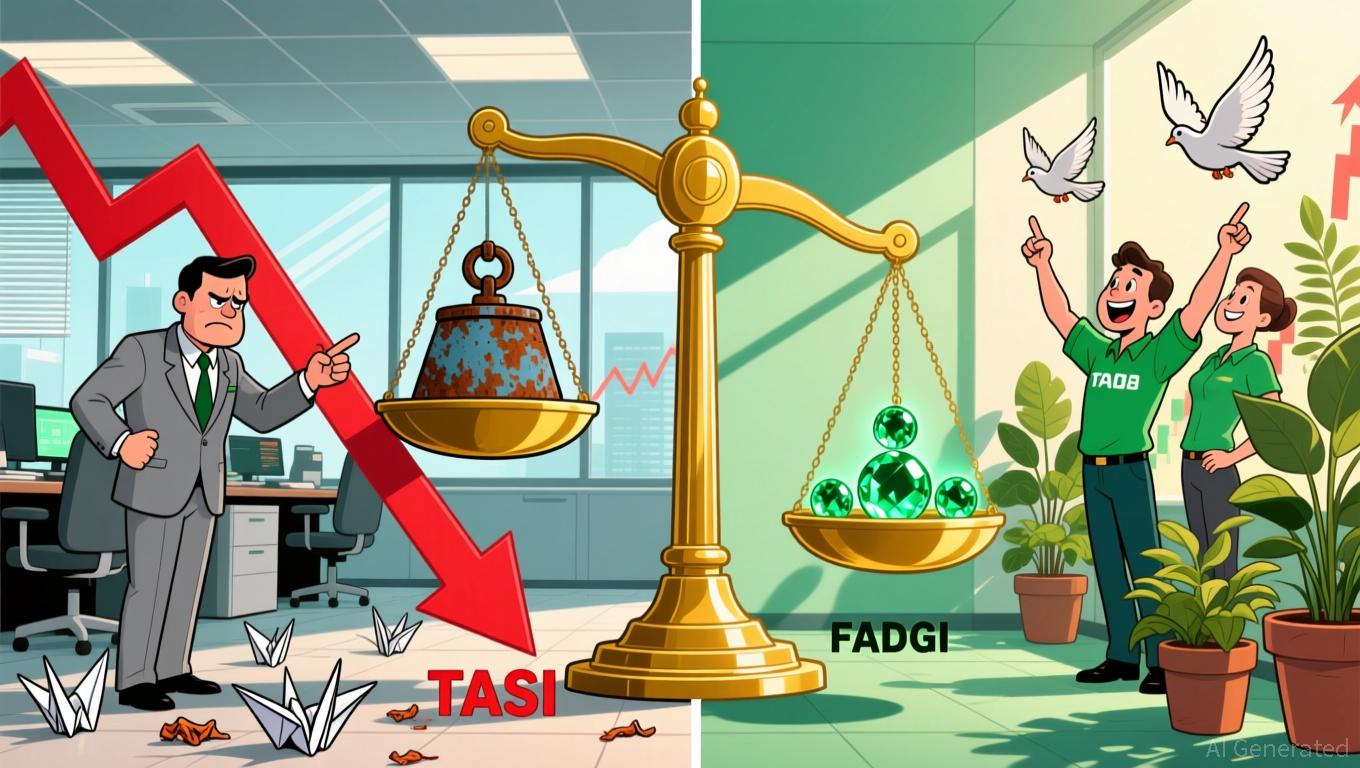

Fed's Ambiguity Causes Dollar to Weaken and Triggers Divergent Responses in Gulf Markets

- Fed policy uncertainty weakens U.S. Dollar, causing Gulf markets to react diversely as rate cut odds drop to 65% from 90%. - OPEC+'s output pause and falling oil prices amplify market anxiety, while Saudi TASI declines and Abu Dhabi FADGI rises. - U.S. Treasury Secretary Bessent demands aggressive Fed rate cuts to address housing crisis, aligning with some officials' calls for easing. - Dollar Index hits 100+ amid geopolitical fragmentation, as global investors shift capital toward Europe and Asia. - Fed

"Shattering Limits: On-Chain Cryptocurrency Now Enables Effortless Spending Worldwide Through the Visa Network"

- Tangem launched Tangem Pay, a non-custodial Visa card enabling global on-chain USDC spending via Polygon, retaining self-custody. - The service uses a dual-key security model with Rain handling compliance, operating in the U.S., Latin America, and Asia-Pacific. - It targets developing markets by reducing remittance costs and plans 2026 European launch under MiCA, aiming for 10M users by 2026. - Partnering with Paera and Rain ensures regulatory compliance, differentiating it from no-KYC alternatives like

Leverage-Induced Sell-Offs Cause Simultaneous Decline in Stocks and Cryptocurrencies

MMT Price Forecast Fluctuations in Late 2025: Effects of Macroeconomic Changes and Central Bank Decisions on Token Values

- 2025 crypto markets face instability from algorithmic stablecoin de-pegging (e.g., USDsd) and central bank policy shifts under Modern Monetary Theory (MMT). - De-pegging events trigger systemic risks, prompting stricter regulation on uncollateralized stablecoins as central banks prioritize stability over innovation. - Macroeconomic uncertainty and AI-driven cyber threats (e.g., UNC1069 malware) amplify volatility, challenging token valuations amid regulatory and geopolitical risks. - BIS advocates hybrid