Doomsday machine activated? Not so fast, this time ICP and others actually have a point

When Web3 wants to challenge the foundations of the internet, it indicates that emotions might be running high.

When Web3 tries to challenge the very foundation of the internet, it means emotions have already run high.

Written by: Eric, Foresight News

Starting from November 1, the long-silent Internet Computer (IC) token ICP began a new round of price increases. According to Bitget data, the price of ICP surged from around $2.94 to a peak of about $8.6, nearly doubling in 7 days.

With the rise of ICP, a number of Web3 storage infrastructure projects also experienced a small spring rally, with FIL, AR, STORJ and others recording notable gains since yesterday.

For "old guard" tokens like ICP and FIL, any sudden, unexplained price surge is often seen as the last liquidity extraction by major players before they exit. However, this time, the rally led by ICP is not entirely "without warning."

Internet Computer Catches the AI Express

The core reason for this round of ICP's surge is likely the Web3 AI payment narrative sparked by x402. After countless explorations, the market has found that using blockchain infrastructure and stablecoins in the AI payment sector is clearly superior to current payment solutions, and seems to be the only better option. Thus, the market's logic for selecting targets has become: "Who is more Web3?"

While various chains are searching for solutions to support x402 and gasless payments, IC, which is better suited to these needs at the underlying design level but was almost forgotten, has become "the chosen one."

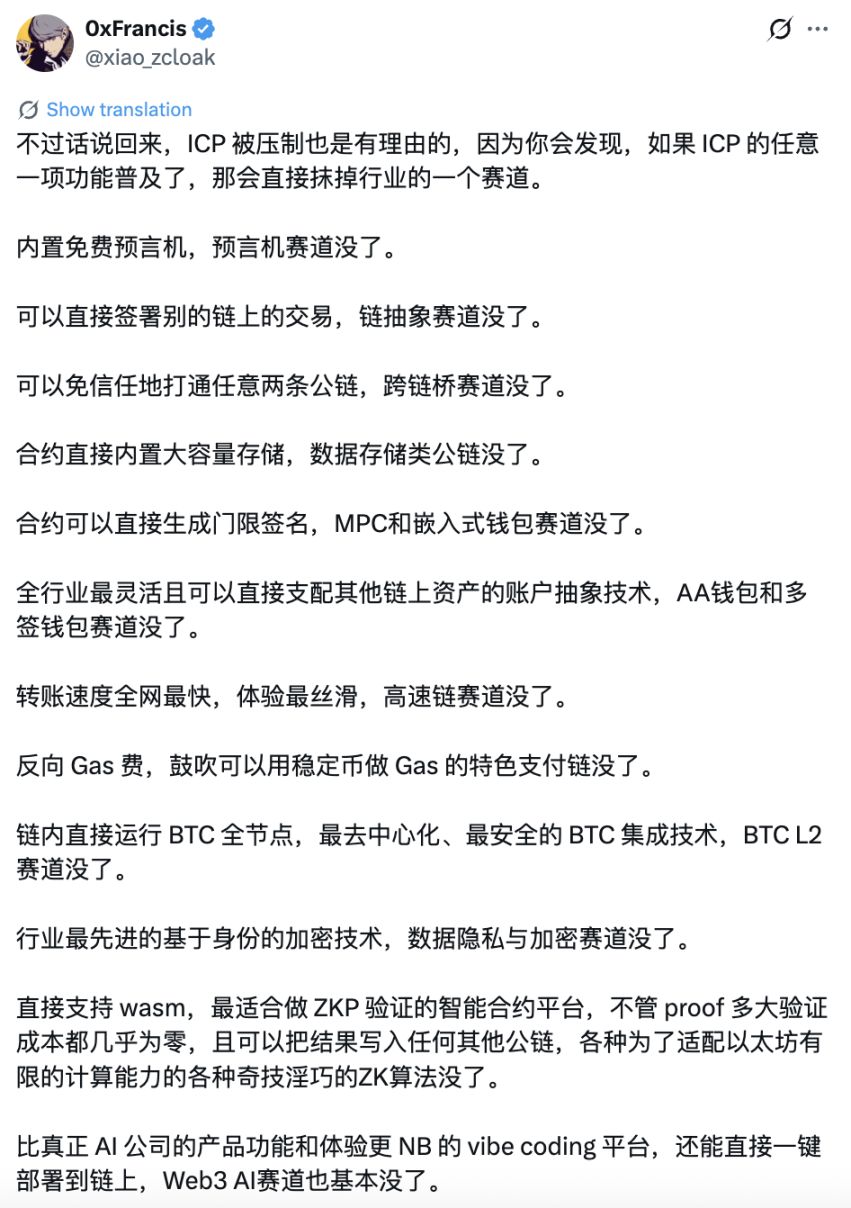

Back in 2021, IC was already considered a "too advanced" project. Strictly speaking, IC is not a pure blockchain; its architecture is more like a "new decentralized internet" that draws on blockchain data structures, and can even serve as a lower-level infrastructure layer for blockchains. As the founder of zCloak Network put it, IC basically encompasses all the so-called on-chain tracks at the underlying level: "Ethereum and other public chains are ledgers, ICP is the real world computer."

But what truly ignited the sentiment may not just be that IC is the best infrastructure for Web3+AI, but also its latest flagship product, caffeine—a product that allows users to generate DApps by chatting with AI, with no development required, and automatically deploys them on IC.

X user Haotian further fueled sentiment in the Chinese market yesterday afternoon by expressing the view that caffeine could bring more changes to AI payments.

Of course, as Haotian also mentioned, there is still some distance to go before all this becomes reality. However, after the hot investment targets of x402 and AI have already been hyped, IC, with its lower price but greater imagination, has naturally become a new hotspot for capital.

Storage Protocols Working Silently

Attributing the collective rise of storage protocol tokens to the recent brief AWS outage may be a bit far-fetched. The author believes it is more likely that the market's confidence in Web3 native infrastructure has spilled over from IC to other areas, with storage being the most obvious and high-quality sector.

Putting emotions aside, although most token prices have been lackluster, storage protocols have actually been quietly working all along.

First, as a typical case of "peaking at the start," Filecoin has actually made quite a few notable advances over the past year. In the fourth quarter of last year, Filecoin network's storage utilization rate increased from 18% to 30%. Thanks to its low-cost advantage, Filecoin's continuous improvement in usability has led many enterprises to start adopting its services.

In addition, since the beginning of this year, Filecoin has introduced new primitives for hot data (i.e., data requiring fast and frequent retrieval) called PDP (Proof of Data Possession), F3 (Filecoin Fast Finality) which shortens transaction finality from hours to seconds, the launch of EVM-compatible FVM, and the ongoing push for FWS (Filecoin Web Services) aimed at competing with traditional cloud services. All these have led to more and more real-world adoption of Filecoin.

Arweave launched Permaweb 2.0 at the end of last year, storing hot data on the mainnet and cold data in "Arweave-Lake," reducing storage costs by 38%. Since this year, Arweave has not only focused on storage but also launched the AO computing network, enabling Arweave to handle complex computing needs such as investment strategies, perfectly aligning with the Web3+AI narrative.

Two months ago, zkIPFS was launched, turning Arweave nodes into "permanent IPFS with ZKP." Solidity contracts can directly read off-chain metadata via zkCID, achieving trustless interoperability between EVM and Arweave. Overall, while optimizing storage costs, Arweave has opened up two new growth curves: high-concurrency computing with AO and Ethereum interoperability with zk tools.

StorJ itself is not closely related to blockchain, but it has always been relentless in driving adoption. Last year, StorJ acquired Valdi.ai, a company focused on GPU computing, and PetaGene, a developer of file management systems, and began supporting AI training. This year, StorJ promoted Colby Winegar, who joined StorJ in 2022, to CEO in the first half of the year, further advancing its growth strategy. In addition, StorJ optimized its tokenomics this year by introducing buybacks and staking.

When Blockchain Wants to Change the World Again…

It must be admitted that the timing of this sharp rise in tokens, including privacy coins, inevitably reminds us of the fear once instilled by the "doomsday chariots." Unlike the past, this time the chariots are supported by more self-consistent logic for the rally. Also, unlike before, the reason is no longer the project's own "progress that no one would care about unless the price rises," but rather that capital chasing hot trends has found new targets.

However, necessary risk warnings should not be omitted. The biggest risk here is that we have once again reached a point where we believe blockchain can replace certain things. In the past, every time the market developed this confident but dangerous idea, it marked the emotional peak. This time, if we look at it with a rational filter, there are indeed some differences from before, but the author believes these differences are still not strong enough to reach the level of "replacement," so we must remain cautious about the risk of emotional overload.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Universal Exchange

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

DeFi faces a potential $8 billion risk, but only $100 million has exploded so far

Interview with RaveDAO Head of Operations: Breaking Barriers with Music, Enabling Real Users to Onboard to Blockchain Seamlessly

RaveDAO is not just about organizing events; it is creating a Web3-native cultural ecosystem by integrating entertainment, technology, and community.

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”