CoinDesk 20 Performance Update: AAVE Falls 3.5% as Index Trades Lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

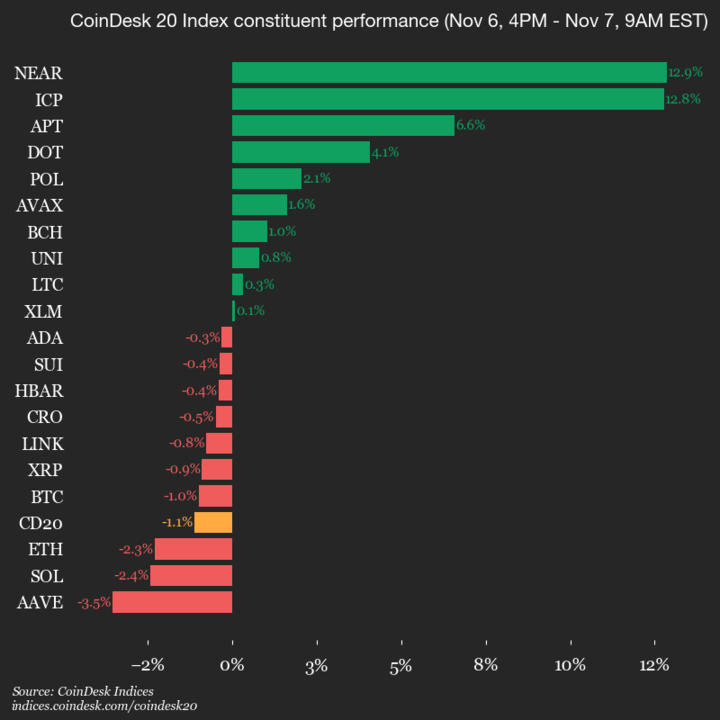

The CoinDesk 20 is currently trading at 3151.03, down 1.1% (-35.27) since 4 p.m. ET on Thursday.

Ten of 20 assets are trading higher.

Leaders: NEAR (+12.9%) and ICP (+12.8%).

Laggards: AAVE (-3.5%) and SOL (-2.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Bounces Back After $155M Short Liquidations: Is a Reversal in Sight?

Bitget Appoints Ignacio Aguirre Franco as Chief Marketing Officer to Drive Global Growth

Internet Computer's Latest Rally: Can This Upward Trend Be Maintained?

- Internet Computer (ICP) surged in 2025 amid blockchain infrastructure adoption and DeFi TVL growth, but faces sustainability questions due to volatility and security risks. - DApp engagement dropped 22.4% in Q3 2025, highlighting challenges in user retention despite infrastructure advancements like ICP's scalable "canister" smart contracts. - DeFi TVL hit $237B in Q3 2025, driven by institutional interest in stablecoins and RWAs, though ICP's direct contribution remains unclear compared to Ethereum and S

Central Bank Issues Historic Penalty: Adhering to Crypto Regulations Is Now Essential

- Ireland's Central Bank fined Coinbase Europe €21.5M for AML/CFT failures, marking its first crypto enforcement action. - Systemic flaws allowed 30M unmonitored transactions (€176B) due to software errors and governance gaps. - Regulators emphasized crypto compliance urgency, citing MiCA regulations and law enforcement collaboration risks. - Coinbase acknowledged technical errors but faced reduced penalties via early settlement under regulatory programs. - Case highlights EU's intensified crypto oversight